ECONOMICS

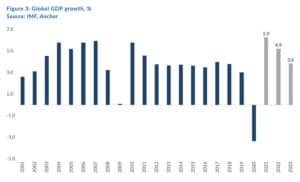

As we welcome the new year, the global economic environment remains as challenging as ever. As a small, open and commodity exporting economy, SA’s prospects are intrinsically tied to those of the global economy. Positively, the outlook for global growth generally remains robust, with the International Monetary Fund (IMF), as of October 2021, forecasting global GDP growth of 5.9% for 2021 and 4.9% in 2022, whereas 6 months ago its forecasts were 0.1-ppt lower and 0.5-ppts higher, respectively. Against this backdrop of strengthening global economic activity, trade volumes have been improving, supporting SA exports. In line with a positive global GDP growth outlook, the IMF forecasts trade growth of 10% in 2021 and 7% in 2022. However, two big markets for SA exports (China and the rest of Africa) face significant headwinds. Growth in China (which remains Africa’s single biggest customer, accounting for c. 11% of all SA exports mainly via iron ore) is projected to slow to 3% in 2H21 and 5.6% in 2022 – down from 13.1% in 1H21. Meanwhile, the recovery in economic activity across the rest of Africa looks considerably weaker than the rest of the world, thus adding further downside risks for SA GDP growth. The IMF forecasts that, after contracting by 1.7% in 2020, sub-Saharan Africa’s GDP will expand by 3.7% this year and by 3.8% in 2022.

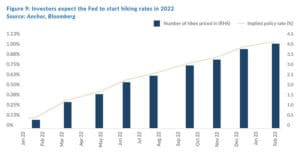

Rising global inflationary pressure remains a key spillover risk into SA via arbitrage between different markets for tradeable goods, and by a policy-induced shock to capital flows that impacts SA’s exchange rate. Worryingly, much of the world has been experiencing higher inflation due to various supply chain bottlenecks, rising demand as economies slowly reopen, and various mismatches of demand and supply. The IMF forecasts that inflation will ease for advanced economies from 2.8% this year to 2.3% next year and for emerging economies from 5.5% to 4.9%, but the risks are mounting that inflationary pressures will prove stickier-for-longer than policymakers had initially anticipated, possibly necessitating a sudden burst of aggressive tightening from key central banks globally. As expected, December’s US Fed communications confirmed that quantitative easing (QE) tapering should end by 2Q22. The potential timing of the rate-hiking cycle has moved, with the hawkish shift in the Federal Open Market Committee (FOMC) dot plot showing a median three hikes in 2022 – consequently a start in June 2022 is a strong possibility. Despite the upward revisions to inflation, risks are still viewed on the upside, but the market has already been pricing-in an early start to the cycle.

Nonetheless, the rapid spread of the Omicron variant across the globe brought more announcements about lockdowns with various levels of severity – stretching well into January for some countries. A global return to near-normal economic activity has consequently become patchy, promptly reigniting inflation fears. In SA, positively, the fourth wave of COVID-19 infections appear to have peaked without overwhelming the healthcare system. Nonetheless, high levels of unemployment remain a primary concern. The effects of COVID-19 have simply served to exacerbate SA’s labour market situation, which even pre-pandemic had one of the lowest labour absorption rates in the world. As of 3Q21, SA holds a 34.9% unemployment rate, the highest jobless rate since comparable data began in 2008, off the back of the July unrests and the still-stringent lockdown measures.

Relief measures provided by government have helped to ease the burden on some households in the formal sector of the economy, however elevated levels of financial uncertainty remain. Whilst the fourth quarter typically sees a seasonal pick-up in employment, travel bans put in place by several important SA tourist markets (albeit having since mostly been lifted), following the discovery of the Omicron variant, is likely to dampen the level of economic activity anticipated.

The release of the 3Q21 GDP negative growth rate of 1.5% led to a fairly muted market reaction, the data print within itself serves to remind us of the risks and social costs of the unrest as well as extreme inequality. At the end of the day, current economic growth rates remain insufficient to make a meaningful dent in SA’s prevailing unemployment problem. Furthermore, state-owned enterprises (SOEs) remain a drag on potential economic growth, labour markets remain rigid and investor confidence remains low. As a consequence, SA’s economic potential also remains weak in this environment. On the positive side, the steps taken by government to bring its finances under control appear plausible as tax collection remains robust and SA continues to benefit from stronger terms of trade. We continue to see a positive trade balance even though it is likely to gradually decline as commodity prices soften. Subsequently, SA bonds screen as incredibly attractive on a real yield basis, which is attracting some foreign interest. The likely three or four rate hikes in 2022 will also be supportive of the rand.

SA EQUITIES

SA equities, as represented by the FTSE/JSE Capped Swix enjoyed a stellar 2021, delivering a total return of 27.1%. While the Capped Swix, a widely adopted measure of local equity performance, only has a track record going back to December 2016 (with 2021 being its best year since inception), the previously dominant barometer of local equity performance (the FTSE/JSE All Share Index) experienced its best year dating all the way back to 2012.

Arguably, the most pleasing aspect of this return outcome was that the contributions to returns were broad-based, across most sectors – unlike the narrow market breadth experienced in other major indices. Another interesting aspect of the return outcome for the Capped Swix was that 2021 represented the first year that the Naspers/Prosus complex was a detractor (and a material one at that, with a negative 2% return) from the total return of the Capped Swix. Every other sector and subsector* contributed positively to the index’s performance. The key debate investors are now faced with is whether the strong performance can continue in the year ahead or whether those factors that drove index returns to new highs are beginning to fade as we enter a world of higher inflation and what looks to be tighter monetary conditions? While all factors are not unique to the JSE, as we have come to experience, global macro factors are playing an increasingly important role for portfolio construction on the JSE. On our numbers, we forecast a total return of 12% for the JSE in 2022 and we continue to see reasonable value across the market, with telcos the one sector in which we remain largely underweight following its recent outperformance.

As highlighted a year ago (in The Navigator – Anchor’s Strategy and Asset Allocation, 1Q21 dated 14 January 2021), the makeup of the JSE heading into 2021 made the index well placed if we were to see some outperformance of value over growth (after more than a decade of growth outperforming value). Heavy weightings to the basic materials sector and financials, in addition to relatively low valuations and earnings bases (and expectations) across many economically sensitive “domestic” stocks following years of stagnant GDP growth and a very high unemployment rate, has resulted in the ideal mix for the more valuation-sensitive investor. However, going into 2021 not many investors correctly forecast the stubbornly high inflation, particularly in the US, which has further amplified demand for rate-sensitive sectors (such as banks etc.), inflation hedges (commodities), and for those businesses with strong pricing power and the ability to pass on the increase in costs. On the flipside, these dynamics have resulted in the heavy underperformance of long duration, highly valued growth stocks – which experienced stellar gains in 2H20 – with the JSE not having any meaningful exposure to these types of businesses.

Of course, we concede that the above is an oversimplification of the dynamics at play globally – with many more nuances to each. Looking ahead to 2022, the monetary policy divergence between the US and China remains a key portfolio construction consideration for us, even as we focus inwardly on the JSE. With the Chinese set to embark on a period of monetary easing, we expect to see further support for bulk/industrial commodities in the near term, with iron ore, a key export commodity, having recovered from its recent pullback to rally by over 20% in December 2021 and thus providing further support for SA’s current account balance and the rand. In addition, we expect to see a bottoming out of Chinese equity valuations as the looser monetary policy conditions fuel demand for equities. We expect this to feed into a rerating of Tencent after a year of continuous derating in the face of a domestic regulatory reset (we have addressed our view on the Chinese tech sector at length in previous iterations of the Navigator including in an article entitled Navigating China’s regulatory reset, dated 12 October 2021).

It therefore come as no surprise that the biggest expected contributors to the total return for the JSE over the next 12 months are the diversified miners and Naspers/Prosus – with the former not necessarily due to overly high return expectations but rather moderate expectations coupled with the large weightings in the index (we are forecasting low double-digit total returns across most of the miners).

Turning inwardly to the economically sensitive “domestic” stocks, we remain cautiously optimistic despite the economic data prints setting the tone for an underwhelming growth backdrop, beset with stubbornly high unemployment and policy uncertainty (we are getting dangerously close to retiring the word “uncertainty” when describing domestic economic policy). The reason for our cautious optimism is largely due to being able to find adequate investible opportunities across the local market. Last year was the first time in many years that we believed conditions were right to get constructive on the domestic banks and we remain constructive heading into 2022, with a total return expectation in the mid-teens for the local banking sector. Higher local rates, further impairment unwinds (following a better-than-expected COVID-19 recovery), and shrewd cost management should fuel another 2 years of above-trend earnings growth. We expect the earnings momentum, coupled with undemanding valuations across the sector (with Capitec the exception from a valuation perspective) to result in an outperformance on the JSE.

Outside of the banks, we remain encouraged by the opportunity set in front of us, many of which is not largely represented in big index heavy stocks, but one level below them in the mid-cap space. Last year was the first time in a while that the Anchor investment team could uncover interesting investment opportunities on the local market. Many of the companies have spent the five years prior to the pandemic on the back foot, with 2020 providing an opportunity to “reset” many of the cost bases, exit loss-making or low-return operations/geographies and consolidate overcrowded sectors. Unfortunately, many of the of the “self-help” actions taken by SA corporates have resulted in a headcount reduction and a further increase in local unemployment – which does not bode well for the long-term economic outlook of the country – but still results in a positive outcome for equity holders. Within SA, we continue to favour higher-quality, more defensive businesses and, as always, we are on the lookout for tactical opportunities during periods of dislocation, the most recent of which was the overreaction to news around the new Omicron COVID-19 strain.

*Using Anchor’s proprietary sector and subsector classifications

SA LISTED PROPERTY

We are moderately positive for another good year from JSE-listed property shares in 2022, as earnings levels and dividends become more predictable after the uncertainty brought about by the pandemic since the beginning of 2020.

The sector should pay out dividends of 7.2%, in aggregate, and sustain a two-year growth rate of 5%-10% as conditions normalise further. We project an 11% total return from JSE-listed property in 2022.

The FTSE/JSE Listed Property Index (SAPY) staged a strong recovery in 2021, with the sector returning a chart-topping 37%. However, we note it was coming off an extremely low base after a very weak performance over the preceding 3-4 years. While the listed property sector still trades at a discount (c. 12 % – based on the latest SAPY index weights) to reported net asset values (NAVs), the opportunities are very much still stock specific given, inter alia, the following: relative balance sheet strength; sector and geographic exposure (continued divergence given the outlook at a sector and geographic level); liquidity profile; and current discount to NAVs.

The SA-driven segment of the market has some recovery growth in 2022 (less rental concessions etc.), but thereafter growth will be challenged as interest rates rise and negative reversions continue. By contrast, we expect sustained c. 5% earnings growth in the offshore counters, largely driven by development profits and better underlying GDP growth, particularly in Central and Eastern Europe. The offshore exposure we have in our property fund is in aggregate trading at a 6%-7% euro yield with sustainable dividend growth, and all of this in hard currency. This should create a profile of sustained 10%-15% rand returns over the medium term, which we consider attractive in the context of global opportunities.

Another dynamic to bear in mind is that SA companies no longer, as a default, pay out 100% of their earnings as a dividend. Payout ratios vary between 75% and 100% (zero for some companies that are degearing) and hence earnings yields differ from dividend yields. This brings SA in line with global practice, where companies hold back a portion of their earnings for maintenance capex and development/growth. Previously, this was funded by additional debt, which was enabled by steadily increasing NAVs. As NAV growth has come under pressure, access to additional debt has become problematic/less desirable for certain companies.

We favour the offshore companies (MAS, Nepi Rockcastle and Lighthouse), but we also see value in some local counters and especially Growthpoint, which has recovery potential from the V&A Waterfront.

DOMESTIC BONDS

SA government bonds (SAGBs) recorded a mixed 4Q21 as the R2030 benchmark closed the year with yields that were 12.5 bpts weaker over the quarter. The resultant index level return for the All Bond Index (ALBI) was 2.9%. Over the whole curve, the belly (R186 and R2030) weakened, the long end (R2032 onwards) strengthened and the short end (currently represented solely by the R2023) firmed slightly (by 5 bpts).

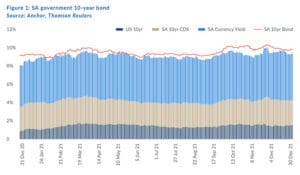

Above we track the build-up of generic SA 10-year debt, the notable factors are:

- US 10-year yields remaining stubbornly below 2% – back to pre-COVID levels.

- The SA 10-year credit default swaps (CDS) are range bound at between 250 to 300 bpts – only 10-40 bpts weaker than their pre-COVID levels.

- The currency yield is expected to be over 5% – historically, over long cycles, the rand weakens, on average, by 4% p.a.

In our previous Navigator report (The Navigator – Anchor’s Strategy and Asset Allocation, 4Q21 dated 11 October 2021), we again highlighted the aggressive rate-hiking cycle priced into derivatives markets. In November 2021, the SARB’s MPC announced its first rate hike of this cycle (by 25 bpts), to leave our central bank rate at 3.75%. We retain our view that further hiking is likely as we progress through 2022 and our baseline remains for 3 rate hikes this year (of 25 bpts each), with leeway for the SARB to make a +25-bpt or -25-bpt adjustment, depending on economic data releases and global factors. Current forward rate agreement (FRA) market expectations are for approximately 200 bpts of hikes in 2022. We thus see the FRA market as overly confident of a strong hiking cycle.

These rate hikes will apply pressure to domestic bonds, however given the magnitude of hiking currently assumed in the market, a slower-than-expected rate of hiking should allow bonds to tighten yields over time.

The ALBI Index at present yields 9.2%. Assuming a slower-than-expected hiking cycle and benign local and global economic factors could result in a net 2022 return for SAGBs of 9.1%. This compares with a 2021 return for the index of 8.4%.

Risks to the downside remain domestic, politically driven factors – the riots that took place in mid-2021 around former president Jacob Zuma’s imprisonment are an example of the outsized political risks that SA still faces. Given the extent of the corruption revealed at the Zondo Commission and the lack of visible progress on charging and arresting those chiefly responsible, there is the potential for further unrest and instability.

On the global front, the rate-hiking cycle expected in DMs has not yet begun to materialise. US 10-year treasury notes closed the year yielding 1.512%, which poses further downside risk to SAGBs if DMs are forced to hike at a materially more rapid pace than expected, the yields on their bonds could rise, leading to a less desirable carry trade in EM bonds – this would have a negative impact for SAGBs.

Upside potential exists if SA can insulate itself from the political instability that flared up at times last year, if corrupt individuals are brought to justice, if those state institutions that have degenerated in the past decade (such as the SA Revenue Service [SARS] and major SOEs) can begin to be placed on a positive path to recovery and if inflation in DMs slows.

THE RAND

The global economic backdrop has been shifting with an acceleration of expectations of DM rate hikes. The South African rand has been caught in the whirlwind of wildly fluctuating policy expectations as central banks have pivoted towards more rate hikes, sooner. Much of the volatility of the rand has been attributed to the strengthening US dollar, while domestic factors have taken a back seat.

Projecting the rand’s value in a year’s time is a fool’s errand. The rand vs US dollar exchange rate is one of the world’s most volatile currency pairs and trades well away from any modelled fair value for long periods. We note, however, that the rand trades within a R2.50 range to the US dollar in most 12-month periods.

With expectations of rate hikes in the US, the European Central Bank (ECB) begrudgingly being pushed into a more hawkish stance and rate hikes in SA, we expect that 2022 will be more volatile than normal and we anticipate that some wild swings in the currency might take place. This will give opportunities to take funds abroad and to take profits on US dollar positions.

We retain our purchasing power parity (PPP) based model for estimating the fair value of the rand and we have extended this out by three months since the publication of The Navigator – Anchor’s Strategy and Asset Allocation, 4Q21 report on 11 October 2021.

US inflation rates are expected to remain high for much of 2022. Our PPP-model is sensitive to the extent to which domestic inflation exceeds that of the US. Consequently, the low differential means that our expectation of long-term rand weakness is modest. Our PPP-modelled value for the rand vs US dollar at the end of the next 12 months is R14.27/US$1 (see Figure 2). We apply a R2.00 range around this to get to a fair-value range of between R13.27/US$1 and R15.27/US$1.

We note that the dollar has traditionally strengthened into the Fed’s first rate hike and thereafter given up some of its strength as we progress through the hiking cycle. If this pattern is anything to go by, then the rand may remain weak for a while before regaining some lost ground later in the year.

For practical purposes, we retain our fair value range of R14.50 to R15.00/US$1, although the rand will probably spend much of 1Q22 trading above this level. For the purposes of this document, we are basing our estimates off the top end of the range of R15.00/US$1, which implies rand strengthening of 6.2% from its R15.9921/US$1 close at the end of 2021.

GLOBAL EQUITIES

We enter 2022 with companies and markets thriving (MSCI World up 21.8% in 2021), but with COVID-19 rampant, valuations high, inflation ballooning, and interest rates set to rise – risks are elevated for share prices. We have remained positive on equities for the past 18 months and with strong GDP growth set to be sustained, many companies will continue flourishing.

The 12-month risk/return equation for global equities is becoming less attractive at the index level, and investors have to be increasingly selective in their choice of equities. While overall market performance could well be in the 0%-7.5% range, we strive to own global equities that we believe can compound at 10%-15% p.a. We believe we can still identify these after the volatile market moves in recent months.

It is important to note that, beneath the index level in 2021, there was a huge difference in relative performances. In 2020, growth shares were the market leaders, but many of these stars corrected in 2021 as value sectors such as energy and financials took the lead. Chinese technology (tech) shares got hammered and EMs declined 2.5% for the year. Most growth investors had a very difficult year as rampant inflation saw the US Fed indicate that interest rates would rise quicker than expected. This had a negative impact on the value of long-duration growth assets, where a higher proportion of the value is in the future, and this is being discounted at a higher rate. More than 40% of Nasdaq shares are down over 50% from their 52-week highs – a remarkable statistic in the context of the strong market conditions.

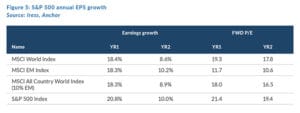

The outlook for company earnings is positive. As shown in Figure 3 below, the IMF forecasts another strong year of global GDP growth in 2022 (+4.9% YoY).

This provides a backdrop for growth and consensus earnings growth for the US S&P 500 is another 20% in 2022, following a sharp recovery in 2021 (+50% YoY) to levels 20% above the pre-COVID earnings base of 2019. Earnings are projected to return to trend growth of 8%-10% in 2023 and 2024.

Global companies are dealing with dynamics not seen in decades. Demand is surprisingly strong, with goods demand 10% higher than in 2019, but supply has been constrained by a number of factors including global logistics, labour shortages and consumer hoarding. This has seen US inflation spike to levels of around 7% and if you switch on Bloomberg TV at present this will inevitably be mentioned within five minutes. For companies with pricing power this has been very positive but for many others it is resulting in margin pressure.

This will be the most-watched factor for company earnings this year and in 2H22 it could well reverse sharply due to base effects and the resolution of supply chain issues. Chip shortages have restricted motor vehicle supply and US vehicle inventories are heading towards zero, while used car prices have risen sharply. New capacity will see this pressure being eased this year. Further risks to earnings for consumer companies are: 1) goods spending returning to trend as more household spending shifts back to travel, transport, and services, 2) higher prices being demand destructive, and 3) higher interest rates.

The impact of the conditions discussed above are very company specific and we continue to favour those companies that can compound earnings growth through economic cycles, with high returns on capital and strong pricing power. Most of the companies we own are underpinned by strong secular trends, which are usually less impacted by economic cycles. Opportunities to buy these companies at more attractive prices have arisen in recent months and more could well present themselves in the coming year.

So, earnings prospects are positive for 2022 and beyond (with some risks), but valuations reflect this in many instances. Figures 5 and 6 below show a MSCI World Index P/E of 19.3x, well above the 15-year average of 16x.

Elevated valuations could well be sustained and justified by strong earnings prospects and relatively low bond yields, but downside risk is higher than average if things do not turn out as well as projected.

EMs, by contrast, are trading at below average multiples (see Figure 7) and could well present opportunities during the year as inflation fears subside. The risk/return in beleaguered Chinese shares is starting to look very attractive.

No equity outlook commentary would be complete without a mention of the COVID-19 pandemic – ultimately this has been the driver behind the extraordinary economic conditions and share market dynamics of the past two years. Consensus is for a milder Omicron variant, but we are currently experiencing unprecedented case numbers. The world is learning to adapt, and the actions taken by governments are more important than the virus itself. However, we have learnt that the virus can continue to surprise, and this remains a key factor to watch. Many companies are still operating at levels below those of 2019 and a return to normality still presents opportunities in the likes of airlines and travel/hotel companies.

In summary, the benign behaviour of global equity indices (other than EMs) belies underlying volatilities. This has presented attractive opportunities in tech companies with secular growth stories. Value counters have outperformed as the certainty of cheap near-term earnings has been a place of safety in a world where rates are rising, and inflation is creating uncertainty. This could well persist in the short term, but we continue to invest for the long term in quality companies that can compound earnings at a high return on capital. Risks are high relative to lofty valuations, but earnings prospects still look strong. We suggest remaining invested in equity markets over the longer term and this could well be a year of very attractive investment opportunities.

GLOBAL BONDS

We enter 2022 with monetary policy at major DM central banks either tightening or with their intention to start tightening imminently having been announced. So, with maximum monetary policy accommodation largely behind us, we expect 2022 to be a year where the path of least resistance for DM rates is higher. That being said, central banks have gone out of their way to issue very clear guidance on policy tightening. With markets being forward looking, we expect that this tightening is already somewhat reflected in current rates, and we are not expecting rates to move dramatically higher unless DM central banks find themselves needing to act more aggressively than they have guided. This is only likely if the current bout of above-average inflation starts to become entrenched. This is not our base case.

Tightening monetary policy looks set to happen in 3 stages:

- A gradual tapering of QE i.e., central banks reducing the quantum of bonds that they have been purchasing.

- Increasing short-term rates.

- Shrinking of central bank balance sheets (by allowing the bonds they have purchased to mature without being replaced).

QE has already started in the US (in November 2021) and by the end of 1Q22 we expect the US Federal Reserve (Fed) will no longer be expanding the size of its balance sheet (the Fed was purchasing US$120bn of bonds p.m. until its tapering programme started in November). The ECB is the other DM central bank which has been providing significant amounts of liquidity to global markets via its QE programme. It has guided that a large part of this accommodation (which has been running at c. EUR85bn p.m.) will be removed from the end of 1Q22 with QE dropping to EUR40bn p.m. in 2Q22, then EUR30bn p.m. in 3Q22 and EUR20bn p.m. in 4Q22.

The Fed and the ECB have both suggested that they will only start increasing policy rates after they have fully tapered QE so, for the US, higher policy rates become a possibility from 2Q22, while the ECB is unlikely to be in a position to hike rates in 2022. Derivatives markets are currently pricing in four US rate hikes in 2022, with the first rate hike most likely at the Fed’s meeting on 16 March, another hike at the meeting in June, and then the other two rate hikes in 2H22.

We think that the shrinking of major DM central bank balance sheets is unlikely to happen until well into 2023 at the earliest and so that is certainly not on our radar when forecasting where we expect yields to end the year.

The first half of 2022 is likely to be pretty uncomfortable for central banks as we expect base effects and supply chain issues to keep inflation in the US (and to a slightly lesser extent in Europe), uncomfortably high and well above their 2% target. However, we expect 2H22 to see a significant easing of those pressures and so, to the extent that the Fed and ECB can hold their nerve in 1H22, we expect them to be under significantly less pressure in 2H22, allowing them to proceed cautiously with monetary policy tightening. The net result of all of this is likely to be a somewhat volatile 1H22 for rates, with volatility subsiding into the back of the year, where we expect US 10-year government bond rates to close 2022 at 1.9%, leaving investors in US 10-year government bonds with a total return loss of 2% in 2022.

US dollar investment-grade corporate credit spreads are slightly off the lows they have traded at for much of 2021. We expect them to be able to maintain current levels during 2022, but with rates drifting slightly higher during the year, we anticipate that investors will experience a total return loss of 1% in 2022.

GLOBAL PROPERTY

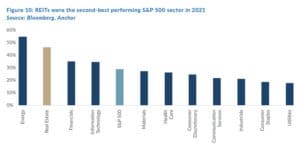

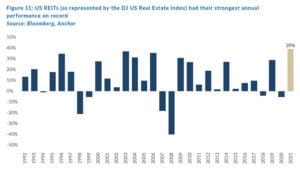

2021 was a great year for listed property stocks (real estate investment trusts [REITs]), particularly those in the US (where c. 70% of the market cap of DM REITs reside).

The Dow Jones US Real Estate Index had its best year going back to its inception 30 year ago.

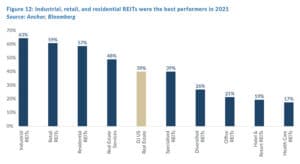

Amongst the US REIT sub-sectors, industrial, retail, and residential REITs were the star performers.

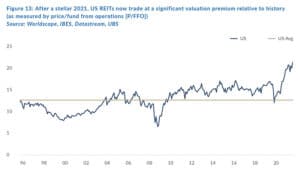

This strong rally in REIT share prices has left them with elevated valuations, which we think will be a headwind to 2022 performance.

Forward dividend yields on DM REITs have been squeezed by the rally and, even when factoring in a slightly lower yield environment relative to pre-COVID, the current forward dividend yields (c. 3.1%) are still c. 0.4% lower than pre-pandemic levels. In 2022, we expect above-average net operating income (NOI) growth for the sector in the high single-digits, particularly as some of the pandemic-impacted sectors get some relief from elevated vacancies, but we think that this is already more than factored into above-average multiples. We expect a slight unwind of elevated multiples to combine with the 3% dividend yield and the high single-digit NOI growth to result in a 5.2% total return for REIT investors in 2022.