Uncertainty Around Economic Prospects

At its first meeting of 2023 on Thursday (26 January), the South African Reserve Bank (SARB) painted a bleaker picture of South Africa’s (SA’s) medium-term growth prospects amid heightened global uncertainty and concerns around the impact of loadshedding and failing state-owned enterprises (SOEs) at large. In our view, this was quite an unusual move away from only fiscal-orientated commentary on the part of the SARB. Interestingly, the SARB nevertheless appears as uncertain as financial markets at large on the direction of both the global and local economic outlook, frequently citing uncertainty to its inflation and growth forecasts.

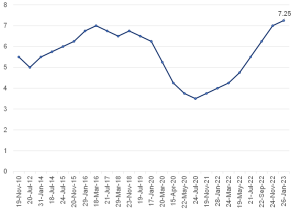

Notwithstanding the more muted Monetary Policy Committee (MPC) decision by way of a 25-bp hike (and a generally more muted outlook) to a repo rate of 7.25%, SARB Governor Lesetja Kganyago frequently underlined the importance of price stability to the greater SA economy – despite the short-term costs to local consumers. At the end of the day, for SA to achieve sustainable, long-term economic growth, price stability remains necessary, albeit not a sufficient condition.

This latest rate hike is the eighth in the current cycle, which started in November 2021 (the total adjustments to date are 375 bps). The 25-bp rate hike was broadly in line with consensus expectations, with Kganyago saying that three MPC members voted for a 25-bp hike and two for a 50-bp rate increase.

Figure 1: A history of the SARB MPC’s repo rate changes, %

At Anchor, our clients come first. Our dedicated Anchor team of investment professionals are experts in devising investment strategies and generating financial wealth for our clients by offering a broad range of local and global investment solutions and structures to build your financial portfolio. These investment solutions also include asset management, access to hedge funds, personal share portfolios, unit trusts, and pension fund products. In addition, our skillset provides our clients with access to various local and global investment solutions. Please provide your contact details here, and one of our trusted financial advisors will contact you.