BHP Groups Results

BHP reported results for the six months ended 31 December 2022 on 21 February. Like several other miners that have reported results recently, lower commodity prices have weighed on earnings. As a result, BHP recorded a 16% YoY revenue drop to US$25.7bn, while its profit after tax declined 32% YoY to US$6.4bn. The company said the revenue decline was primarily driven by lower iron ore and copper prices. However, looking at production, BHP increased output nearly across the board, saying it was on track to meet its full-year production guidance.

Read more about BHP Groups’ historical iron ore exports here.

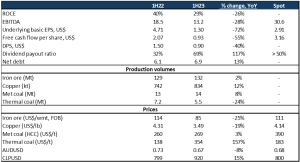

Figure 1: BHP Group overview and forecasts, in US$bn except per share

Source: BHP Group, Bloomberg, Anchor Capital

What is BHP doing with its cash?

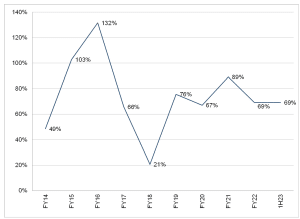

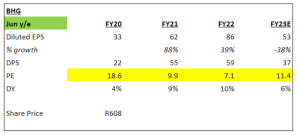

BHP’s dividend policy is to pay at least 50% of earnings in dividends. However, the payout ratio has been a lot higher than that since 2019 (see Figure 2).

Figure 2: BHP Group dividend payout ratio

Source: Bloomberg, Anchor Capital

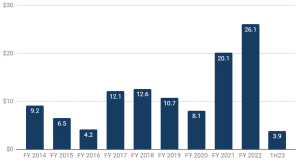

In addition to making dividend payments, BHP is acquiring OZ Minerals, a copper business, at a US$6.7bn valuation (enterprise value). This acquisition is relatively small compared to the free cash flow BHP generates (see Figure 3).

Figure 3: BHP Group free cash flow, US$bn

Source: BHP Group, Bloomberg, Anchor Captial

BHP’s net debt is US$6.9bn, near the lower end of its target range of US$5bn to US$15bn.

BHP offers low-cost iron ore exposure

Iron ore is by far the most important commodity for BHP, contributing c. 40%-50% of its total revenue (see Figure 4).

Figure 4: BHP Group revenue by commodity

Source: BHP Group

Iron ore has averaged 64% of BHP’s operating profit over the past decade (see below).

Figure 5: Iron ore as a percentage of BHP Group’s underlying EBIT

Source: BHP Group

Source: BHP Group

BHP Group Metrics

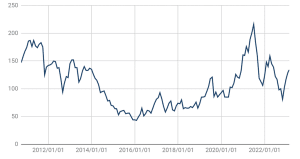

- Iron ore is currently at c. US$127/tonne (on 27 February 2023), and, in our view, the upside in the iron ore price from the current level is relatively limited based on where it is relative to its historical price following the commodities super cycle, which ended in 2015; and

- cost curve support of about US$100/tonne.

The second quarter tends to be seasonally strong for iron ore, so we may see a push higher over the short term.

Figure 6: Iron ore historical price performance, US$/tonne

Source: BHP Group

Comments:

BHP is the lowest-cost iron ore producer globally. Therefore, if iron ore prices do decline from current levels (c. US$127/tonne), it would be best placed to deal with such a decline. Moreover, given the recent moves we have seen in the iron ore price, we believe BHP’s low-cost exposure to iron ore is attractive in case we see pullbacks in the iron ore price at some point in 2023.

For FY23, we expect EPS of US$2.91, close to Bloomberg consensus analysts’ expectations of US$2.98. However, BHP’s current share price is not cheap at 11.4x FY23 EPS, but we expect it to be a relatively defensive counter vs its peers if commodity prices (iron ore in particular) come under pressure. We would therefore remain buyers of BHP.

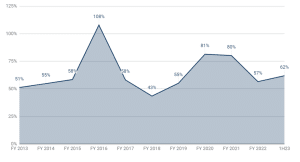

Figure 7: BHP Group earnings outlook, rand unless otherwise indicated

Source: BHP Group, Bloomberg, Anchor Capital

At Anchor, our clients come first. Our dedicated Anchor team of investment professionals are experts in devising investment strategies and generating financial wealth for our clients by offering a broad range of local and global investment solutions and structures to build your financial portfolio. These investment solutions also include asset management, access to hedge funds, personal share portfolios, unit trusts, and pension fund products. In addition, our skillset provides our clients with access to various local and global investment solutions. Please provide your contact details here, and one of our trusted financial advisors will contact you.