As the South African tax year-end approaches, now is an ideal time to review your investment and tax strategies. Proper planning can enhance long-term growth, reduce tax liabilities, and support your financial goals. Key tools to consider include:

- Tax-free savings accounts (TFSAs);

- Retirement annuities (RAs);

- Capital gains tax (CGT); and

- Donations tax.

Contact an Anchor Wealth Manager regarding your investments

Tax-free savings accounts (TFSAs)

A TFSA is a highly effective yet underutilised vehicle for building long-term wealth. It offers unparalleled tax advantages, key of which is the complete exemption of all interest, dividends, and capital gains tax.

An individual can contribute up to R36,000 p.a. to a TFSA, with a lifetime limit of R500,000. While these limits might seem modest, the ability for all growth to compound tax-free can create meaningful long-term value, especially for investors who contribute consistently and avoid unnecessary withdrawals. The earlier you start contributing, the more time your money has to grow.

When compared with taxable investments, the advantage of tax-free compounding becomes increasingly significant over time, especially beyond the early years of investing.

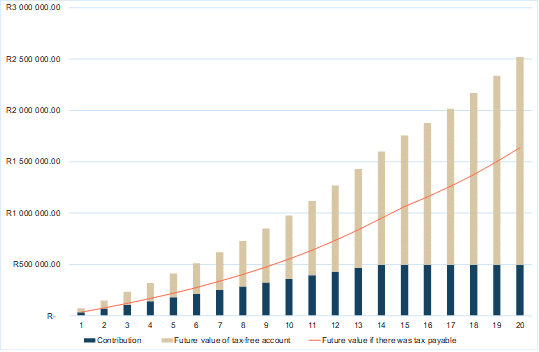

The benefits of a TFSA are best shown by way of example. Below, we have a projection of a TFSA based on the following assumptions:

An individual contributes the annual maximum of R36,000. We cease contributions when we reach the overall lifetime limit of R500,000. We assume a 10% p.a. growth rate and an inflation rate of 6% p.a. To illustrate a comparison, we take an overall 25% tax rate on returns.

Figure 1: Example of a TFSA vs a taxable investment over 20 years*

Several strategies can maximise the tax benefits of TFSAs, including:

- Contributions to a TFSA on behalf of a spouse (in South Africa, gifting money to a spouse for their TFSA contribution is exempt from donations tax).

- Opening a TFSA for children to maximise long-term compounding.

Over 20 years, tax-free compounding significantly outperforms taxable accounts, illustrating the value of starting early and contributing regularly, making a TFSA a valuable component of any diversified financial plan.

Retirement annuities (RAs)

RAs are long-term savings vehicles designed to support retirement planning, governed by the Pension Funds Act. Contributions are tax-deductible within statutory limits, and all growth within the RA (interest, dividends, and capital gains) is tax-free.

Some of the benefits include:

- Exceptional tax efficiency: Investing R120,000 p.a. over 25 years at 9% p.a. growth could result in R10.6mn in an RA vs R9.42mn in a direct investment after taxes.

Figure 2: RA vs direct investment values before and after tax*

| Investment type | Final value excluding tax payable (R) | Tax paid on interest over the term (R) | CGT (R) | Total tax payable (R) | Final value after tax (R) |

| RA | 10,600,000 | 0 | 0 | 0 | 10,600,000 |

| Direct Investment | 10,600,000 | 796,486 | 382,373 | 1,178,859 | 9,421,141 |

- Strategic flexibility: RAs offer investors the power to tailor their portfolios according to their risk appetite and retirement goals, empowering them to be in control of their retirement planning.

- Access and retirement benefits: Funds accessible from age 55, with a portion available as a lump sum and the balance used to secure retirement income. Emigrants may access funds after three years of non-residency, subject to tax.

RAs remain a cornerstone of long-term retirement planning, complementing other investments while offering disciplined growth and tax advantages, making them a critical component of a well-diversified financial strategy.

Capital gains tax (CGT)

CGT applies to individuals, companies, and trusts on the profit made when certain assets are disposed of. It is NOT a separate tax; it is integrated with income tax, meaning that the capital gains made during a tax year are added to the taxpayer’s income.

What assets and taxpayers are impacted?

CGT applies to both tangible and intangible assets, including property, shares, business assets, and intellectual property rights or licenses. Residents are taxed on capital gains made on their worldwide assets, while non-residents are taxed only on profits from the disposal of SA immovable property and related rights. Disposals include sales, transfers, donations, or where ownership of an asset changes. Even if no actual transaction occurs, specific actions, such as expropriation or the destruction of an asset, can also be treated as disposals and trigger CGT.

How capital gains are calculated

A capital gain or loss is the difference between:

- Proceeds (amount received), and

- Base cost (purchase price plus improvements and related expenses.

Determining the base cost

Assets acquired before 1 October 2001 or after this date may use one of the following methods:

- 20% of proceeds.

- Market value on 1 October 2001.

- Time apportionment base cost (TAB).

For assets acquired after 1 October 2001, the base cost is the purchase price plus improvements.

Inclusion rates and effective tax rates

Only a portion of the capital gain is included in the taxpayer’s taxable income:

- Individuals and special trusts: 40%.

- Companies and other trusts: 80%.

This results in effective tax rates of up to:

- 18% for individuals.

- 21.6% for companies.

- 36% for trusts.

Exemptions and relief

- Annual exclusion: R40,000 for individuals (R300,000 in the year of death).

- Primary residence: First R2mn is exempt (R1mn each if jointly owned).

- Rollover relief: Involuntary disposals, transfers between spouses, and certain small-business assets.

- Clogged losses: Losses between connected persons can be used only against future gains involving the same party.

Record keeping

Record-keeping is essential to avoid being taxed on the full proceeds.

CGT is a key component of South Africa’s tax landscape. Understanding how gains are calculated, available exemptions, and compliance requirements can meaningfully improve tax outcomes and support better financial planning.

Donations tax

Natural persons are entitled to a R100,000 annual donations tax exemption per year of assessment. Any amount donated above this threshold may be subject to donations tax at 20% (for total taxable donations up to R30mn) and 25% (for amounts exceeding R30mn).

To maximise the exemption, it may be prudent to structure larger donations around the tax year-end. For example, a donation of R180,000 could be split between February and March to utilise the exemption in two separate assessment years fully.

Certain transfers are not subject to donations tax, including loans, donations between spouses, and contributions to approved public benefit organisations (PBOs). Donations to qualifying PBOs may also provide you with access to a Section 18A tax deduction, subject to SARS limits.

Individuals considering donations, particularly those as part of an estate, wealth transfer, or philanthropic planning, may benefit from tailored advice to ensure optimal structuring and compliance.

Important information

This document is provided for information purposes only, and it does not constitute financial, legal or tax advice or a solicitation to invest. All investments carry risk, and the value of investments may rise or fall, and investors may not recover the full amount invested. Past performance is not an indicator of future results. While Anchor Capital has taken care that all information provided in this material is true and correct, no representation, warranty or guarantee, express or implied, is given as to its correctness, completeness, or fitness for purpose. Anchor Capital, its directors, employees, and agents, accept no liability for any loss, damage, or expense (whether direct or consequential of any nature whatsoever) which may be suffered as a result of the use of, or reliance on, this material or which may be attributable, directly or indirectly, to the use of or reliance upon any information, links or service provided through this material.

There is no warranty of any kind, expressed or implied, regarding the information or any aspect of this service. Any warranty implied by law is hereby excluded except to the extent that such exclusion would be unlawful.

Readers should seek personalised advice from a duly licensed advisor. All investments are subject to standard FICA identity and sourceoffunds checks

© 2009-2025 Anchor Capital (Pty) Ltd. An Authorised Financial Services Provider Reg No // 2009/016295/07 | FSP # 39834