Understanding the SARB

Given its influence on monetary policy, economic indicators, financial markets, the banking sector, and overall financial stability, interest rates (using the repurchase [repo] rate) attract significant attention and discussion from policymakers, economists, investors, analysts, and the media alike. The repo rate is the interest rate at which the South African Reserve Bank (SARB) is willing to extend credit to banks. The repo rate is not to be confused with the prime rate, which is the lowest rate at which a clearing bank will lend money to its clients on overdraft – this is the rate with which the average consumer is most familiar. It is important to remember that banks are technically free to set the prime rate at their discretion. In practice, however, competition forces the various banks in South Africa (SA) to set the same prime rate – which tends to be adjusted whenever the repo rate changes.

As such, the repo rate tends to be closely analysed by most market participants for several key reasons:

1. Monetary policy:

The repo rate is a crucial tool central banks use to implement monetary policy. Central banks adjust the repo rate to influence borrowing costs in the economy, which, in turn, affects spending, investment, and inflation. Changes in the repo rate can signal shifts in the country’s monetary policy stance, such as tightening or loosening.

2. Economic indicators:

The repo rate is closely watched as an economic indicator. It reflects the cost at which banks can borrow funds from the central bank or other financial institutions, which affects the overall interest rate environment. Changes in the repo rate can provide insights into the central bank’s assessment of economic conditions, inflation expectations, and the overall health of the country’s financial system.

3. Financial markets:

The repo rate significantly impacts financial markets. It influences short-term interest rates, including interbank lending rates, money market rates, and short-term government bond yields. As a result, traders, investors, and institutions monitor changes in the repo rate to assess the attractiveness of different investments, manage their portfolios, and make informed trading decisions.

4. The banking sector:

The repo rate affects banks’ cost of funds and profitability. When the repo rate increases, borrowing costs for banks rise, which can impact lending rates for businesses and individuals. Banks also use repo agreements (repos) to manage their liquidity and obtain short-term funding. As a result, fluctuations in the repo rate can impact banks’ liquidity conditions and ability to access funds in the market.

5. Financial stability:

The repo rate is essential for maintaining financial stability. By adjusting the repo rate, central banks can influence market liquidity, manage systemic risks, and stabilise financial markets during times of stress. Moreover, monitoring and discussing the repo rate help policymakers and market participants across the board gauge these measures’ effectiveness and assess the financial system’s overall stability.

When a country’s central bank, such as the SARB in SA, meets to decide whether to hike (increase) or cut (decrease) the repo rate, the debate is primarily centred around whether said repo rate is deemed accommodative or restrictive. An accommodative repo rate is a relatively low-interest rate set by a central bank to stimulate economic activity. When the central bank wants to encourage borrowing, investment, and spending in the economy, it lowers the repo rate. Lower borrowing costs incentivise businesses and individuals to take loans, leading to increased investment, consumption, and overall economic growth. An accommodative repo rate is typically employed during an economic slowdown or a recession to support recovery. Conversely, a restrictive repo rate refers to a relatively high-interest rate set by a central bank to curb excessive economic borrowing and spending. When the central bank wants to rein in inflationary pressures, slow economic growth, or address concerns about asset price bubbles, it raises the repo rate.

Higher borrowing costs act as a deterrent, reducing borrowing and spending, which can help control inflation and prevent overheating of the economy. Restrictive repo rates are often used during periods of high inflation or when there are concerns about financial imbalances. Therefore, the choice between accommodative and restrictive repo rates depends on the prevailing economic conditions and the central bank’s policy objectives. Central banks closely monitor various indicators, such as inflation rates, employment levels, GDP growth, and financial market conditions, to determine the appropriate stance for the repo rate. It is important to note that the terminology may vary across different countries and central banks. For example, some central banks may use terms like “expansionary” or “loose” instead of “accommodative” and “contractionary” or “tight” instead of “restrictive” to describe their monetary policy stance. For our purposes, the SARB uses the terms restrictive and accommodative.

Within its current framework, the SARB targets a neutral real interest rate – the level at which the real interest rate will settle once the output gap is closed, and inflation is stable. For 2023, the SARB has deemed the neutral real rate to be 2.4%. Therefore, in the mind of the SARB, if the real repo rate is less than 2.4%, then rates are deemed accommodative. Conversely, if the real repo rate exceeds 2.4%, then rates are considered restrictive. Currently, the SARB has been relatively vocal over the fact that it will only look at ending the current rate-hiking cycle once it deems the repo rate to be restrictive. Therefore, if one is interested in forecasting the direction of interest rates within the near term, calculating the real repo rate in this context is useful. There are three fundamental methods which most market participants follow when calculating the real repo rate:

- Method (A): Nominal repo rate – one quarter ahead of expected inflation (annualised).

- Method (B): Nominal repo rate – 4Q23 expected inflation (annualised).

- Method (C): Nominal repo rate – 2023 average expected inflation.

If we consider the following inputs:

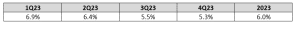

Figure 1: SARB inflation forecasts, YoY

Source: Anchor, SARB

Repo rate (as of 19 March): 7.75%

We will yield the following results following the above methodologies:

(A): 7.75%-5.5% = real repo rate of 2.25%} still accommodative

(B): 7.5%-5.3% = real repo rate of 2.45%} slightly restrictive

(C): 7.75%- 6% = real repo rate of 1.75%} accommodative

The SARB currently calculates the real repo rate using method (A). Hence, according to the SARB’s methodologies and the above calculation, rates are deemed slightly accommodative with a real repo rate of 2.25%. Therefore, there is still room for further rate hikes.

Looking ahead to the SARB’s next Monetary Policy Meeting (MPC), which takes place from 23-25 May, the market is currently pricing in a further 1% of interest rate hikes (with a 0.5% hike expected to be announced on Thursday [25 May] and the remainder at subsequent meetings) at a time when SA’s economic growth is zero or possibly even slightly negative.

Unfortunately, SA is one of the very few countries with an economy smaller than before the COVID-19 pandemic began. As a result, the SARB is walking a tightrope between raising interest rates too much and allowing inflation to rise. Regrettably, in the current environment of heightened geopolitical tensions, economic malaise and a concerningly weak currency, circumstances suggest that the SARB will have no choice but to hike rates once again. Accordingly, our baseline view is that interest rates will be hiked by 50 bps on 25 May.

At Anchor, our clients come first. Our dedicated Anchor team of investment professionals are experts in devising investment strategies and generating financial wealth for our clients by offering a broad range of local and global investment solutions and structures to build your financial portfolio. These investment solutions also include asset management, access to hedge funds, personal share portfolios, unit trusts, and pension fund products. In addition, our skillset provides our clients with access to various local and global investment solutions. Please provide your contact details here, and one of our trusted financial advisors will contact you.