The South African Reserve Bank 50 basis point rate hike

In an unexpectedly hawkish move, and in sharp contrast to market expectations of a 25-bpt hike, the South Africa Reserve Bank (SARB) hiked the interest rate by 50 bps, taking the repo rate to 7.75%. As a result, the prime lending rate now sits at 11.25% – its highest level since 2009. The latest rate hike marks the tenth hike in the current cycle, with the total adjustment being 425 bps since the current rate-hiking cycle started in November 2021. Whilst the magnitude of the rate hike was surprising, it has taken place against the backdrop of a sharp weakening in the exchange rate since the last SARB Monetary Policy Committee (MPC) meeting was held on 26 January, with the rand weakening by 4.4% on a trade-weighted basis. Furthermore, loadshedding continues unabated, and food price inflation remains stubbornly high. Many factors that have driven local food inflation over the past year are not unique to SA. These include high global agricultural commodity prices and increased energy costs, which influence the prices of inputs such as fuel and fertiliser. While a number of these global factors are easing, as evidenced in the continued decline in the FAO’s Global Food Price Index ([FFPI], which declined for an eleventh consecutive month in February), the depreciation in SA’s exchange rate has offset much of the benefits of the decline. At the same time, persistently high levels of loadshedding have added significant costs across the agriculture and food value chain. Notably, the sharp exchange rate depreciation has prevented much of the observed decline in world food prices from transferring to SA.

Looking ahead, naturally, any significant appreciation in the coming months would have the opposite effect – easing domestic prices for agricultural commodities. However, this effect could lessen if loadshedding is maintained at lower levels. Unfortunately, the consensus is that loadshedding will likely remain at relatively high levels for the foreseeable future, which will, in turn, be a critical factor in keeping local food prices higher for longer. Furthermore, an increase in administered prices, such as electricity, due to be implemented in April 2023, could add further cost pressures that, in turn, are likely to keep food prices elevated over the coming months.

Of more concern is the SARB’s revision in its growth forecasts. For 2023, the Bank’s forecast for GDP growth is at a measly 0.2% YoY from the revised 0.3% expected in January. From there on out, the economy is expected to expand by 1.0% in 2024 and 1.1% in 2025. However, economic growth in 2023 remains particularly volatile, and risks persist. As much as loadshedding is eating away at SA’s growth, it is also inflationary. This, along with the pass-through effect of recent rand weakness, is what the SARB seems most concerned about. In addition, the real repo rate remains below the SARB’s ideal range of about 2% – the level at which the SARB believes it has adequate control over price changes in the economy.

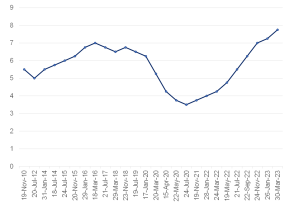

Figure 1: The history of the SARB’s repo rate changes

Source: SARB, Anchor

This latest rate hike will hit SA consumers hard. On a new home loan of R2mn at the prime lending rate, this latest increase hikes the monthly instalment by around R680. Since November 2021, monthly payments on a R2mn home loan are almost R5,500 higher due to a raft of rate hikes. With higher inflation (particularly food prices) eroding households’ real wages, big interest rate increases lowering disposable income, extreme loadshedding, an increasingly tricky socio-political environment and a generally uncertain future weighing on local consumers across the board, we hold a particularly subdued outlook for household consumption spending in 2023.

At Anchor, our clients come first. Our dedicated Anchor team of investment professionals are experts in devising investment strategies and generating financial wealth for our clients by offering a broad range of local and global investment solutions and structures to build your financial portfolio. These investment solutions also include asset management, access to hedge funds, personal share portfolios, unit trusts, and pension fund products. In addition, our skillset provides our clients with access to various local and global investment solutions. Please provide your contact details here, and one of our trusted financial advisors will contact you.