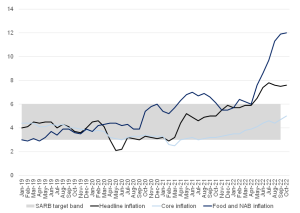

After two consecutive months of easing, South Africa’s (SA’s) annual October headline inflation rate, as measured by the consumer price index (CPI), surprised to the upside, printing at 7.6% YoY, from 7.5% YoY in September. With fuel inflation already known in advance (and thus ultimately factored in) and food inflation broadly steady in October, the upside surprise in this particular release came from core CPI. Core CPI inflation rose to 5.0% YoY in October, up from 4.7% YoY in September. Whilst the additional, out-of-cycle survey of medical health insurance turned out higher than initially forecast, the overall rise in core CPI was fairly broad-based, adding to signs that inflation is continuing to broaden beyond the energy and food price shocks and, thus, becoming more entrenched.

Figure 1: SA inflation rate, YoY % change

Source: Stats SA, Anchor

While the latest inflation print was indeed a surprise move, it is worth remembering that the October inflation print remains below the July 2022 peak of 7.8% YoY. Thus, we still expect headline CPI to continue to ease in the coming months. That being said, the path of headline inflation will remain sensitive to volatile items such as food prices, Brent crude oil prices and the exchange rate. For fuel inflation, the strong adverse base effects are still likely to dominate, and this could see fuel inflation fall into the higher single digits by March 2023 from the 30.1% YoY print in October 2022.

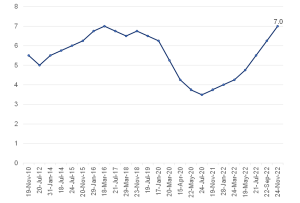

Unsurprisingly, the interruption of the downtrend in inflation from the recent peak in July served to stoke the South African Reserve Bank’s (SARB’s) inflation concerns while supporting its general approach in this rate-hiking cycle of erring on the side of caution and front-loading the interest rate hikes. Subsequently, the SARB’s Monetary Policy Committee (MPC) voted in its last meeting of 2022 to hike rates by a further 75 bpts, taking the repo rate to 7.0%. The prime lending rate has now increased to 10.5%. With this final MPC announcement for the year, the level of the repurchase rate is now above the level prevailing before the start of the COVID-19 pandemic. Notably, this latest rate hike marks the seventh hike in the current cycle, with the total adjustment being 350 bpts since this rate-hiking cycle started a year ago in November 2021.

Figure 2: History of the SARB MPC’s repo rate changes, %

Source: SARB, Anchor

Understandably, this latest interest rate hike will undoubtedly be met with some dismay by local consumers, who already have to contend with the rising cost of living coupled with the dampening effect of ongoing loadshedding on SA’s already fragile, stagnant economy. Notwithstanding encouraging indications that the general momentum in global inflationary pressure is easing and the recent striking retreat in domestic breakeven inflation, these data arguably support a persistently steep pace of rate hikes to reach the neutral rate (a key milestone for the SARB) sooner rather than later.

As the MPC regularly emphasises, the committee tends to look through the first-round effects of price shocks and focus on the second-round impacts, balancing the need to be data-dependent and forward-looking. With the latest inflation print leaning towards a more entrenched inflationary environment, the SARB will be strongly contemplating hiking to what it deems restrictive territory, thus potentially continuing to push the repo rate above the neutral rate of c. 7.25% before easing the current rate-hiking cycle.

At Anchor, our clients come first. Our dedicated Anchor team of investment professionals are experts in devising investment strategies and generating financial wealth for our clients by offering a broad range of local and global investment solutions and structures to build your financial portfolio. These investment solutions also include asset management, access to hedge funds, personal share portfolios, unit trusts, and pension fund products. In addition, our skillset provides our clients with access to various local and global investment solutions. Please provide your contact details here, and one of our trusted financial advisors will contact you.