Sub-Saharan Africa’s Funding squeeze

Like many other emerging market (EM) economies, Sub-Saharan African* (SSA) countries face a challenging global environment with sluggish global growth and tightening financial conditions. However, more specifically for the SSA region, the current boiling pot of higher global interest rates, high sovereign debt spreads, and exchange rate depreciations (amongst other factors) has created a ‘funding squeeze’ for many African economies. This challenge comes in addition to the still present policy strains stemming from the ramifications of the COVID-19 pandemic and the cost-of-living crisis amid a heightened global inflationary environment.

As a result, economic activity in the SSA region will remain subdued in 2023, with the International Monetary Fund (IMF) now predicting SSA growth at 3.6% YoY in 2023 before rebounding to 4.2% YoY in 2024. Almost four-fifths of SSA countries are projected to register a growth pickup in 2024, driven by higher private consumption and investment. There is, however, considerable heterogeneity in growth across subgroups. The growth rebound is expected to be primarily driven by IMF-defined, non-resource-intensive countries (i.e., Benin, Côte d’Ivoire, Ethiopia, Kenya, Rwanda, Senegal etc.) and other resource-intensive countries (Ghana, Namibia, South Africa etc.). The former are projected to grow by 6.2% in 2024, following 5.7% YoY growth in 2023, thus reflecting more dynamic and resilient economies and aided by the recovery in non-mining activities, including agriculture. On the other hand, growth among oil exporters is projected to decelerate to 3.1% YoY in 2024 from 3.3% in 2023, primarily because of the continued decline in crude oil prices and production slowdowns. Nigeria’s growth, for example, is forecast to decline to 3% next year.

Overall, SSA’s financing options have deteriorated significantly over the past year. The acceleration in tightening global monetary policy has led to higher interest rates worldwide. As a result, this has raised borrowing costs for SSA countries, both on domestic and international markets. Consequently, sovereign spreads for SSA have soared to roughly three times the EM average since the global interest rate tightening cycle started. In addition, higher interest rates on US treasury bonds and the search for safe assets amid global uncertainty pushed the US dollar’s effective exchange rate to a 20-year high in 2022, consequently increasing the value of dollar-denominated debt and interest payments. Together, these factors have added to the region’s external borrowing costs.

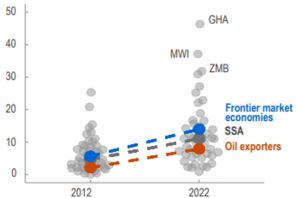

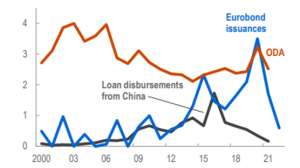

Furthermore, uncertainty and general volatility surrounding the continent have been steadily pushing higher since the onset of the global COVID-19 pandemic and Russia’s war on Ukraine. This, in turn, has led to risk repricing, disproportionately affecting SSA countries due to lower credit ratings, cutting off virtually all frontier markets from international market access since 2H22. Unsurprisingly, eurobond issuances for the SSA region declined from US$14bn in 2021 to US$6bn in 1Q22. As a result, there has been a drastic and pro-cyclical tightening of financing conditions, which has exacerbated underlying vulnerabilities. Furthermore, borrowing costs have increased significantly over the past decade, with interest payments as a share of revenue doubling over the same period. At 11% of revenues (excluding grants) for the median SSA country in 2022, interest payments are about triple those of the median advanced economy. Structural shifts behind this increase in borrowing costs include a decline in aid budgets to the region, leading some countries to turn to market-based finance, which is generally more expensive. In addition, inflows from China (an important source of financing for many SAA countries in recent years) have started to decline markedly.

Figure 1: SSA interest payments to revenue, excluding grants, % median

Source: IMF

Figure 2: SSA sources of financing, % of regional GDP

Source: IMF

This ‘financing squeeze’ comes at a difficult time for the SSA region, as it faces various elevated economic imbalances. In the wake of the COVID-19 pandemic and Russia’s war on Ukraine, macroeconomic imbalances have again risen to the forefront as a critical challenge for most African economies – pushing some close to the edge. An elevated and volatile inflationary environment is one of the key culprits – the median inflation rate in the region was c. 10% in February 2023, more than doubling since the start of the pandemic. Furthermore, aside from registering double-digit headline inflation in roughly half of the countries in the region, about 80% are also experiencing double-digit food inflation. However, positively, fuel price pressures have decelerated recently off the back of more muted international prices. This should, in turn, provide some relief for the region. According to the IMF, around half of the countries in SSA have reported a deceleration in inflation over recent months. Nevertheless, there are some resurgences along with some economies phasing out some subsidies on fuel and food prices this year (i.e., Cameroon, Ethiopia, Senegal). As a result, we believe inflation across the region will likely remain volatile for the remainder of 2023.

Unfortunately, public debt as a share of gross domestic product (GDP) also remains relatively high. SSA’s public debt ratio, at 56% of GDP in 2022, is now at levels last seen in the early 2000s. Since the pandemic, the debt increase has been driven by widening fiscal deficits because of overlapping crises, slower growth, and exchange rate depreciations. As a result, elevated public debt levels have raised concerns about debt sustainability, with 19 of the region’s 35 low-income countries already in debt distress or facing a high risk of debt distress in 2022. To make matters worse, most currencies in the region have depreciated against the US dollar in 2022. For a region highly dependent on imports that are mainly invoiced in US dollars, this adds more fuel to the inflationary fire. The currency depreciations have also contributed to higher general government debt, given that c. 40% of SSA’s total debt is external as of 2021. Although exchange rate pressures have eased since November 2022 (in some cases because significant depreciations have already taken place), they too, remain elevated and volatile.

Overall, the latest IMF projections indicate that inflation across the region will largely stay above pre-pandemic levels through 2027. Thus, policymakers across SSA will have to continue to delicately balance keeping inflation in check whilst also being mindful of the still-fragile economic recovery. It is important to note, however, that primarily external factors (such as imported food and energy or swings in the exchange rate) rather than domestic demand pressures have driven much of the inflation in the region. Positively, many of these external factors have subsided in recent months, and thus inflation is likely to follow suit. Still, because the transmission of lower international prices into domestic markets will take time, inflation is expected to remain volatile and above pre-pandemic levels over the near term.

As a result, most central banks in the region have significantly hiked policy rates since December 2021, with cumulative rate hikes naturally larger in countries with higher inflation. Interestingly, the median interest rate hike was only about 270 bps in SSA between the end of 2021 and February 2023 – lower by almost 130 bps compared with the median in EMs and developing economies outside the region. For most SSA countries, current policy rates have remained well below average over the past decade, while real short-term rates in the region are also broadly in negative territory. Angola is the only country to have cut the policy rate in early 2023, given the country’s sharp decline in headline inflation.

Overall, SSA countries face a challenging global environment with sluggish global growth and tightening global financial conditions. High inflation rates, elevated domestic interest rates, high and vulnerable debt positions, and a reduced borrowing capacity are adding to the already present constraints that make it difficult for African economies to finance their recovery. As such, policymakers and investors in SSA face another challenging year, with tighter financing conditions on top of the ongoing repercussions from various economic multi-year shocks. It is common knowledge that fiscal policy anchored in debt sustainability can help fight inflation. Thus, for most SSA economies reducing fiscal and debt sustainability risks via domestic resource mobilisation and greater spending efficiency can help cool aggregate demand and inflation. This includes measures to increase and diversify the tax base, improve tax administration (via taxpayer registration, e-filing, and e-payment of taxes), and enhance the targeting of social protection programmes (beneficiary registration and e-transfers). In addition, reforms to strengthen public investment management systems (i.e., increasing transparency in appraisal, selection, and approval of investment projects) and repurposing government spending toward high-value investments remain key.

Furthermore, accelerating debt reduction and restructuring debt is critical to shore up stability for growth. If anything, the past few years have shown that the international community needs permanent, comprehensive, and credible mechanisms to address sovereign debt crises when they occur. The G20 Common Framework for Debt Treatments (CF) is the closest said framework for debt resolution. Whilst most international financial institutions support this framework, many are calling for the process to be faster, more inclusive, and to cover all creditors. So far, four countries in the SSA region are seeking debt restructuring via the CF – Chad, Ethiopia, Zambia, and, more recently, Ghana. Chad is the only country that has negotiated an agreement with its creditors under this initiative, albeit without an actual debt reduction. Overall, leveraging concessional financing remains critical for Africa amid a challenging external environment, high debt levels, limited capacity to mobilise domestic resources and weak public investment management systems. Given the continent’s rising investment needs (including climate financing for adaptation), private and non-concessional lending will be needed to close the financing gap.

*SSA countries are Angola, Benin, Botswana, Burkina Faso, Burundi, Cameroon, Cape Verde, Central African Republic, Chad, Comoros, Congo, the Democratic Republic of the Congo, Côte d’Ivoire, Djibouti, Equatorial Guinea, Eritrea, Kingdom of Eswatini, Ethiopia, Gabon, Gambia, Ghana, Guinea, Guinea-Bissau, Kenya, Lesotho, Liberia, Madagascar, Malawi, Mali, Mauritania, Mauritius, Mayotte, Mozambique, Namibia, Niger, Nigeria, Rwanda, São Tomé and Príncipe, Senegal, Seychelles, Sierra Leone, Somalia, South Africa, South Sudan, Sudan, Tanzania, Togo, Uganda, Zambia, Zimbabwe.

At Anchor, our clients come first. Our dedicated Anchor team of investment professionals are experts in devising investment strategies and generating financial wealth for our clients by offering a broad range of local and global investment solutions and structures to build your financial portfolio. These investment solutions also include asset management, access to hedge funds, personal share portfolios, unit trusts, and pension fund products. In addition, our skillset provides our clients with access to various local and global investment solutions. Please provide your contact details here, and one of our trusted financial advisors will contact you.