ECONOMICS

In recent weeks, global financial markets have been preoccupied with a further repricing of expectations for ‘terminal rates’ (the peak spot where the federal funds rate is forecast to climb before being cut). Whilst headline inflation rates appear to be firmly on a downward path in most major economies, central banks across the globe remain as hawkish as ever – quelling any hope financial markets were feeling (perhaps pre-emptively) that interest rate hiking cycles were nearing their end. June, in particular, has seen a spate of surprising rate hike decisions by international central banks, adding to pressure on local markets. Following a higher-than-expected UK inflation print, as measured by the consumer price index (CPI), the Bank of England (BoE) surprised markets by hiking its key lending rate by a higher-than-expected 50 bps, taking the rate to 5% – a level not seen since April 2008. Whilst the BoE did not explicitly signal further increases, it equally did not point to ending the cycle following this latest rate hike.

Another hawkish surprise on the monetary policy front was Norway’s central bank hiking rates by 50 bps instead of 25 bps as was broadly expected. June also saw a swathe of 25-bp rate hikes by developed market (DM) central banks, notably the Swiss National Bank, the European Central Bank (ECB), the Reserve Bank of Australia and the Bank of Canada. Whilst the US Federal Reserve (Fed) decided at its June meeting to hold the policy rate steady at the current 5%-5.25% range (interrupting what had been a string of ten straight increases aimed at stomping inflation), in his recent testimony to Congress, Fed Chair Jerome Powell reiterated the Fed’s commitment to returning inflation to its 2% target, saying more rate hikes are “likely” this year. This suggests we have not yet seen the end of the advanced economies’ rate-hiking cycle. Meanwhile, monetary policy appears to be at odds with the hawkish West in China. The People’s Bank of China has cut its primary benchmark lending rates for the first time in 10 months in its latest effort to bolster growth as the world’s second-largest economy falters.

Over the weekend of 23-25 June, the world saw one of the most remarkable socio-political events in some time – what appeared to be the first coup attempt in Russia in three decades. Exactly how political events will continue to unfold in Russia (and what it means for the war in Ukraine) remains, at this point, an open-ended debate. What we are sure of at present is that whilst a formal political coup in Russia appears to have been averted (at least for now), recent events seem to point to a weakening of Putin’s traditionally authoritarian grip on power. Furthermore, one cannot deny the potential for further internal rebellions against him and his greater administration over the coming months, as these events have sorely dented his political armour. The big question for many South Africans remains – what does this mean for us, given our government’s problematic ‘friendship’ (or, in their words, ‘neutrality’) with Russia? If anything, recent events have further lowered the probability that the Russian president will attend August’s BRICS (Brazil, Russia, India, China, and SA) Summit (to be held in SA) in person. This has been a critical sticky point and source of tension between SA and the international community, considering that the International Criminal Court (ICC) has issued an international arrest warrant for Putin and SA is a signatory to the Rome Statute.

As a result, logically, Putin is unlikely to be willing to travel far from Moscow in the foreseeable future, knowing that by doing so, he may provide an opportunity for such an event to resurface. This is a widely positive development for SA as it reduces the country’s risk of being caught up in another international political whirlwind that would further isolate SA from our important trading partners. Ultimately, as a member of the BRICS grouping and a major emerging market (EM), we must seek to balance our relationships with multiple global powers. Maintaining a balanced approach and avoiding over-reliance on any single country is crucial for SA’s foreign policy independence and ability to address its domestic challenges effectively.

Aside from simmering geopolitical tensions, domestic monetary policy continues to be a major driving force in local markets. The general direction (or mix thereof) of global interest rate cycles remains a crucial factor for the SA Reserve Bank’s (SARB’s) Monetary Policy Committee (MPC) when determining local rates. With global central banks maintaining a tight grip on the current rate-hiking cycle, this may feed through to SA, which, as we know, has its own idiosyncratic economic issues. Since November 2021, the SARB has hiked rates in ten consecutive meetings, adding 475 bps in the cycle overall. Following the better-than-expected May inflation data released by Stats SA in June, local market participants have begun to feel more confident that the SARB could pause interest rate hikes at its next meeting in July. Regardless, the latest rhetoric from the SARB (and overall tone) remains hawkish. We still believe there is a strong likelihood that the SARB will continue to hike rates by another 25 bps in July and possibly pause thereafter. At the time of writing, the market is pricing in two hikes of 25 bps for the remainder of the year.

Whilst SA narrowly missed a technical recession in 1Q23 (GDP grew 0.4% QoQ seasonally adjusted, after contracting by an upwardly revised 1.1% in 4Q22), local economic growth remains weak. Nonetheless, the 1Q23 economic performance clearly shows that the SA economy is adjusting to the challenges of heavy loadshedding. However, despite adapting, at the end of the day, loadshedding remains a significant obstacle to achieving substantial economic growth. Additionally, the series of interest rate hikes that began in November 2021 and intensified throughout 2022 and into 2023 are filtering through the economy and beginning to impact economic activity. Unfortunately, persistent downside risks remain, along with increased political uncertainty, which continues to hinder the growth outlook and overall sentiment. Nonetheless, there is a growing belief that our expectation of increased private-sector electricity generation capacity will gradually mitigate the impact of loadshedding on economic growth.

Overall, however, we anticipate that the near-term prospects for growth will remain lacklustre. Moving into the second half of the year, we foresee SA’s growth trajectory persistently showing weakness. The ongoing issues related to electricity supply are likely to continue as a significant limiting factor on economic activity and confidence. Moreover, the impact of elevated interest rates is expected to put a strain on household disposable incomes, thereby restricting growth in consumer spending. SA has essentially been in a stagflationary environment for a while now, with weak economic activity and a high inflationary environment. Whilst the second half of this year will likely see inflation drop back into the SARB’s target band, salary and wage increases are not expected to happen to the extent sufficient to make up for the loss in spending ability in real or nominal terms.

SA EQUITIES

The JSE, as measured by the FTSE/JSE Capped Swix Index, ended 2Q23 up 1.2%, while YTD, the index is 3.7% higher. However, in US dollar terms, the index is down 6.1% YTD and has underperformed global markets (as measured by the MSCI World Index) by approximately 22%. This underperformance should be viewed in the context of the JSE having enjoyed a particularly strong period of relative outperformance since the end of 2021. Over 2Q23, the SA All Bond Index (ALBI) dropped by 1.5%, and the rand ended the quarter 5.6% weaker. Following its strong outperformance last year, we have been defensive on JSE equities since the beginning of the year, and our caution is unchanged. However, our 12M total return projection of 12% is now slightly higher than the previously communicated 10%, which we forecast when we published The Navigator – Anchor’s Strategy and Asset Allocation, 2Q23 report, on 14 April 2023. While our return expectation of 12% has increased over the quarter, so has our return hurdle to move to an overweight position in local equities. The current restrictive interest rate environment coupled with higher forecast risk impacted by constrained local operating conditions means that on a risk-adjusted basis, local fixed income still screens more attractively on the relatives.

The JSE experienced another lacklustre quarter, impacted by both global and domestic factors. On the global front, the outcome in China was a key driver of several important factors on the JSE. More directly, Tencent is and will remain the most crucial driver of the value of index heavyweights Naspers and Prosus. As shareholders, we are pleased with the steps taken by the Naspers/Prosus complex management to simplify its cross-holding structures and effectively give longevity to the share buyback for the foreseeable future. However, actions taken to date have done most of the heavy lifting needed to reduce the high discounts to net asset value (NAV) at which the shares trade. Based on our estimates, Prosus is trading at a 35% discount to its NAV (as of 30 June), and Naspers is trading at a c. 10% discount to its stake in Prosus. These discounts have narrowed significantly over the past year, and our base case is for no further narrowing of the discount in our return forecasts. From here, the performance of Naspers and Prosus is far more reliant on the operational performance of their biggest asset, the Chinese internet platform Tencent. Earnings growth for Tencent is expected to be at a respectable mid-teens compound annual growth rate (CAGR) over the next three years – a welcome return to trend growth after a few years of re-shaping and re-organising the platform.

China’s economy is expected to grow at 5% this year (and to average 5% for the four years following that – based on internal hurdles set). China’s growth at 5% will usually be seen as a tailwind for global commodity prices and, by implication, the domestic miners on the JSE. Nevertheless, the Chinese economy seems to be trending away from focusing on infrastructure-led growth and far more on stimulating growth for the Chinese consumer. YTD, the seeming lack of urgency by China’s policymakers to produce property and infrastructure stimulus has weighed on sentiment in global commodity markets. This, coupled with the strong consensus globally that a global recession is imminent, has put further pressure across the complex of global diversified miners.

As a quality house, it is unlikely that we would ever have large overweight positions in the basic materials sector. We are currently underweight, with the view to take up exposure should there be some policy response from China that would prompt support for global commodities. Longer term, it is hard to argue the structural appeal of certain metals, particularly those used in the energy transition space. We have read many research articles that suggest that to meet carbon emission targets on energy production, the world will need to produce far more copper, nickel, lithium and certain rare-earth elements. Even higher-grade iron ore will see an increase in demand. Those developments keep us interested in the sector; however, they are not enough to get us overly excited in the current environment.

Domestically, the year has produced another frustrating environment for JSE investors. For the most part, we have been impressed with how many SA corporates are run. As an investment team that puts equal amounts of effort into local and global equities, we have experience with meeting management teams from all over the world, and SA management teams operate at a very high standard. Unfortunately, high unemployment, high interest rates, persistent loadshedding and continued policy uncertainty have set the tone for what was an incredibly difficult 1H23 for the domestically focussed sectors on the JSE. We went into the year defensive, preferring the earnings visibility of the banks to the less-certain retailers, mobile operators and industrials. As the first half played out and earnings expectations got taken down, so did the severity of the most direct earnings impact – loadshedding. Our extremely defensive local positioning is currently being heavily scrutinised.

Making us slightly more constructive over the next 6 to 12 months is the potential for a domestic earnings recovery towards the back end of 2023, which we think could start to get priced in sometime in 3Q23 or early 4Q23. Across many sectors, the earnings base will be low, and we expect the consumer environment to be less severe than what was experienced between November 2022 and June 2023, where loadshedding was at its worst and interest rates at their highest. It is not inconceivable that domestic interest rates have peaked, making us more balanced on the banks’ earnings cycle and less negative on the local consumer. With the upcoming 2024 National and Provincial Elections, we are optimistic for a better consumer environment over the next 12 months than the previous 12 months. Still, the usual caveat applies, the economic outcomes for SA remain binary, making forecasting 12-month forward, total returns extremely difficult. We will continue to build our local equity portfolios with a quality bias, favouring those best-in-class shares in each sector which we believe will navigate the challenging environment with the least friction.

DOMESTIC BONDS

In 2Q23, SA Government Bonds (SAGBs) recorded a negative 1.53% return at an ALBI level. This follows a strong performance in 1Q23, where the index returned 3.42%.

Currently, yields across the curve have weakened, making domestic bonds more attractive. Globally and locally, a key concern remains to curtail inflation – central banks have been forthright in hiking rates even in cases of lower growth, as SA faces. With three SARB meetings remaining this year, domestically forward rate agreements (FRAs) are pricing 25-50 bps more in rate hikes for 2023, with the peak achieved by year-end.

We have for some time viewed interest rate hikes as more likely to curtail growth, which, combined with the heavy burden of elevated loadshedding stages, has seen the SARB slash its projections for SA’s 2023 growth to a mere 0.2% YoY. Additionally, SA’s growth outlook remains severely impacted by domestic political factors, with SA’s cosy relationship with Russia and ongoing loadshedding (discussed in more detail below) being the two crucial ones of late.

The decrease in loadshedding as the mid-year approached should act as a deflationary pressure over the longer term, particularly given the increased demand for electricity during winter. However, the National Energy Regulator of SA (NERSA) granted tariff increases to ESKOM, which are now implemented and will dull this recovery over the short term.

We remain cautiously optimistic for SA fixed income – nominal bonds in the belly and long end of the curve currently yield materially over 11%, floating rate notes remain attractive with the repo rate (and thus the 3-month Johannesburg Interbank Agreed Rate [JIBAR]) remaining elevated in the near term. This gives various attractive instruments for investment across the fixed-income spectrum. However, the aforementioned political risks should temper this optimism. The 12-month time horizon includes SA’s national election in 2024, which is likely to be a closer call for the ruling ANC’s popularity than any previous election in the country’s democratic history and thus has the potential of being another volatile moment.

Thus, we are currently cautiously positive duration, retaining a tilt towards the belly of the SAGB curve.

THE RAND

In 1H23, the rand weakened on the back of a stronger US dollar, risk aversion and domestic economic and political malaise. However, as the dust from this settles, we think the rand will likely trade in the R18.25-R19.00/US$1 range for the next quarter.

Projecting the rand’s value in a year’s time is a fool’s errand. This is because the rand vs US dollar exchange rate is one of the world’s most volatile currency pairs and trades well away from any modelled fair value for long periods. We note, however, that the rand trades within a R2.50 range to the US dollar in most 12-month periods.

The indicators for the rand’s fair value are continuing to turn negative. We note that the boon from high commodity export prices has subsided, eroding some currency support. Rating agencies and analysts are focusing on SA’s fiscal situation and questioning the government’s ability to achieve a sustainable primary surplus by 2025. We expect the global environment to gradually become more supportive as we head into 2024. Therefore, while the rand will continue to trade with a negative overhang over the near term, we see some recovery for the local unit in the next calendar year.

We retain our purchasing power parity (PPP) based model for estimating the fair value of the rand, and we have extended this out by three months since the publication of The Navigator – Anchor’s Strategy and Asset Allocation, 2Q23 report, dated 14 April 2023. Over our forecast period, we expect inflation abroad to come under control and return towards more normalised levels. This means that our PPP model shows an increasing propensity for long-term rand weakness from next year again. As a result, our PPP-modelled value for the rand vs US dollar at the end of the next 12 months is R14.98/US$1 (See Figure 1). We apply a R2.00 range around this to get to a modelled fair-value range between R13.98/US$1 and R15.98/US$1.

The global backdrop means we are starting with the rand meaningfully weaker than our modelled fair-value range. In previous cycles, US dollar strength has tended to dissipate (and reverse) toward the end of the US rate-hiking cycle. Current indications are that the US Fed will reach peak rates toward the end of 2H23, meaning that we expect to see currency normalisation, with the dollar giving up some of its gains in the latter part of this year. However, we do not expect the currency to recover fully, and we are projecting a rand in the R17.00-R18.00 range against the US dollar in one year. For this report, we have modelled on R17.50/US$1.

We expect the rand to remain particularly volatile, and surprises are certain in the year ahead.

GLOBAL EQUITIES

World markets have surprised everybody in 1H23, with a 16% rise in the MSCI World Index in US dollar terms. This exceeded the most bullish forecasts for a full 12 months in 2023. However, the stock market bloodbath of 2022 serves as a backdrop and market levels are similar to those of two years ago. We expect further real returns from global markets over the next 12 months (7% projected), although some volatility should be expected as inflation remains stubbornly high, and rates could still increase further.

In 1H23, markets were driven by a growing euphoria related to artificial intelligence (AI). Microsoft unveiled ChatGPT, which forced rival companies to reveal their progress on AI, and global IT capex budgets rapidly shifted towards AI. Nvidia’s powerhouse H100 graphics processing unit (GPU), which enables AI processing, suddenly became like gold, and its orders tripled in weeks. Imaginations and projections ran wild, which saw the top 10 “AI stocks” (including Nvidia, Microsoft, Meta, Apple and Alphabet) rise by a collective 60%. This accounted for most of the gains in the US S&P 500, with the “other 490” shares only increasing by an average of 4% in 1H23.

Hence, while the moves in the market index level look strong, there is still significant potential catch-up for the rest of the market. The outlook for the general market is reliant on how the economic cycle continues to play out. Global bond yields have been rising lately as prior expectations of interest rate cuts in 2023 have faded. Inflation remains strong, the US economy is proving resilient, and the US Fed is insistent that there will probably be more interest rate hikes in the remainder of this year. The key risk is that the Fed goes too far, and the economy suffers late in the cycle.

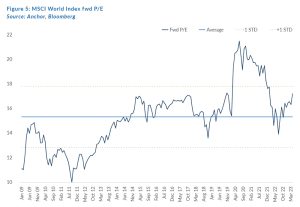

Valuations at the index level in global DMs look full (the MSCI World has a forward P/E of 17x), but given the AI phenomenon, it is illustrative to look a little deeper. The “AI cohort” is dragging the index valuation up – the S&P 500 fwd P/E is 16% above its 2014-2019 average P/E, with the AI cohort 50% above its average valuation for the pre-2020 period. The rest of the index is only 4% pricier than its pre-2020 average (see Figure 2 below).

The most important determinant of markets is earnings, which have proved resilient in the face of higher interest rates. While many companies have been negatively impacted, those who have been able to pass on the inflation pressures have flourished. 2023 US earnings growth is projected to decline by 2%. However, double-digit US dollar earnings growth should resume in 2024 and beyond, which is positive for equities. Declining interest rates and increasing earnings are a positive concoction when looking further out to 2024 and beyond.

The MSCI World Index forward P/E is 17x (see table below). Multiples often increase when earnings dip as long as the future outlook is more positive. EMs are much cheaper, with strong recovery potential.

This is shown graphically in the chart below.

EMs have disappointed in 2023 as the much-vaunted Chinese recovery has been a letdown. Chinese government stimulus has been less aggressive than in previous cycles, but the government could act more decisively in 2H23. EM valuations are cheap, and a shift in sentiment could see a sharp rise in 2H23. An exciting opportunity is the Chinese AI shares, which have not shared the same reaction to the rapidly evolving future. This is despite many of them having invested heavily in this space over the past decade.

GLOBAL BONDS

Global bond yields remain elevated vs their history, particularly short-term yields, which are being propped up by the US Fed and other major DM central banks in an effort to get elevated DM inflation under control.

In terms of the direction rates take from here, we need to answer two questions:

- How quickly will inflation normalise?

- How much economic damage will the Fed’s inflation fight cause?

On the first question, investors and the Fed are at odds, with the inflation rate implied by derivative markets suggesting inflation will drop quickly enough for the Fed to start cutting rates in 2H23. However, most Fed members believe it will be too soon to declare victory in the inflation fight this year.

On the second question, the more cautious the Fed, the more likely it is to cause significant economic damage, and the next few months will be key to that outcome.

Long-term bond rates tend to be more sensitive to growth expectations than short-term rates, and so for US 10-year yields to fall meaningfully from here, there likely needs to be a fairly bad economic outcome. We do not place a high probability on that extreme outcome, and we believe that moderating inflation will remove concerns that we are entering a structurally higher inflation environment, taking a lot of pressure off the Fed, resulting in significantly lower short-term and marginally lower long-term rates. That outcome should see US 10-year bond yields in the 3.5%-4% range one-year out, resulting in a 5.5% total return for investors in US 10-year government bonds over the next twelve months.

After a brief wobble around the time of the banking mini-crisis earlier this year, US investment-grade corporate bonds have reverted to pricing in a fairly low probability of meaningful corporate defaults. We think this is perhaps overly complacent, given the significantly higher interest burden and the quantum of corporate debt. We expect that credit spreads will need to widen over the next twelve months. Despite the headwind from higher credit spreads, the offsetting impact of slightly lower rates and above-average yields currently on offer still leave investment-grade corporate bonds investors with the prospect of earning a 5.5% total return over the next twelve months.

GLOBAL PROPERTY

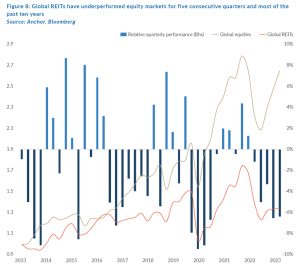

Global DM-listed property shares managed to end 2Q23 with a 3.1% QoQ gain, dragging them into positive territory for the year (+2% YTD). Still, the asset class has dramatically underperformed the broader equity market for a fifth consecutive quarter, underperforming global equities by 20% over those five quarters.

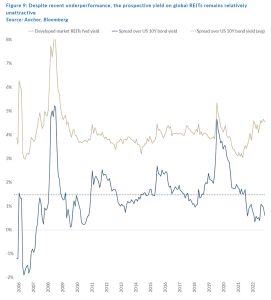

Despite its underperformance, the prospective yields on the asset class remain relatively unappealing given the generally higher rate environment we find ourselves in. At 4.5%, the aggregate forward yield on DM real estate investment trusts (REITs) is barely above the current US 10-year government bond yield.

Tightening lending conditions and higher rates for debt refinancing are likely to remain a headwind for the commercial real estate sector for the foreseeable future, with the sector getting a special mention from US Fed Chair Jerome Powell at his press conference following the recent Fed meeting in June. Powell’s comments included an assessment that the challenges for the sector “feels like something that will be around for some time” and that “the Fed is closely watching commercial real estate risks and expects to see losses”. Some analyst estimates suggest that debt refinancing could have a c. 5% negative impact on cash flows for the sector. In light of this, we think it is hard to anticipate any meaningful earnings growth for the next few quarters. We estimate that investors will likely see a total return of c. 5% in US dollar terms over the next twelve months from the sector.

At Anchor, our clients come first. Our dedicated Anchor team of investment professionals are experts in devising investment strategies and generating financial wealth for our clients by offering a broad range of local and global investment solutions and structures to build your financial portfolio. These investment solutions also include asset management, access to hedge funds, personal share portfolios, unit trusts, and pension fund products. In addition, our skillset provides our clients with access to various local and global investment solutions. Please provide your contact details here, and one of our trusted financial advisors will contact you.