ECONOMICS

Throughout much of the beginning of the year, the global economy swung towards a fairly optimistic direction. Energy prices (particularly European gas) have decreased significantly, and global food prices continue their downward trend. In addition, improving official data and strengthening survey evidence suggested that Beijing’s reversal of its zero-COVID policy had resulted in recovering demand. However, as we enter 2Q23, over the past few weeks, turmoil across the banking sector (including the failure of Silicon Valley Bank [SVB] and the forced takeover of Credit Suisse) has erased much of the positive economic sentiment present at the start of the year. As such, markets have experienced a tidal wave of volatility with fears expressed over the possible contagion effect across the greater global banking system. Whilst central bank authorities in the US and Europe responded quickly via generous liquidity provisions, concerns are that banks will tighten lending standards, thus impacting growth. As a result, global growth forecasts are slowly being revised downward.

Despite this latest round of banking woes, the US Federal Reserve (Fed) raised its policy interest rate by 25 bps to a target range of 4.75%-5% on 23 March. As a result, the Fed’s target range now stands at its highest level since 2007. Notably, in his post-meeting press conference, Fed Chair Jerome Powell said that the Fed had considered pausing its hiking campaign as conditions in the banking sector remain volatile. Indeed, Powell emphasised how the impact of the current banking mini-crisis on the real economy is still unknown. Moreover, while investors pause to reflect on this latest policy move, the Fed’s most recent full monetary policy statement read “some additional policy firming may be appropriate” instead of the February statement, which noted, “ongoing increases in the target range will be appropriate”. Minor tweaks make a big difference in Fed statements, and this change is a sign that rate hikes could be winding down.

Moving east, China’s recent annual National People’s Congress (NPC) opened with outgoing Prime Minister Li Keqiang presenting a growth target of around 5% for this year (the lowest in over three decades), with the focus being to ‘prioritise economic stability’. Given that the country’s recently disbanded zero-COVID strategy kept growth at just 3% in 2022, economic activity year to date has seemingly been rebounding. In light of this, the 5% target does not seem ambitious. However, aside from the demographic challenges of an ageing population, China is still grappling with the woes of its property development sector. Furthermore, as we move further into 2023, the prospect of stimulus in China (policymakers’ favoured response to past bouts of weakness, notably after the 2008 global financial crisis [GFC]) sits uneasily with the current political rhetoric to push to contain high debt levels.

Locally, in an unexpectedly hawkish move (and in sharp contrast to market expectations of a 25-bpt hike), the South Africa Reserve Bank (SARB) hiked the interest rate by 50 bps in its latest March Monetary Policy Committee (MPC) meeting, taking the repo rate to 7.75%. As a result, the prime lending rate now sits at 11.25% – its highest level since 2009. The latest rate hike marks the tenth hike in the current cycle, with the total adjustment being 425 bps since the current rate-hiking cycle started in November 2021. Whilst the magnitude of the rate hike was surprising, it has taken place against the backdrop of a sharp weakening in the exchange rate since the last SARB MPC meeting was held on 26 January, with the rand weakening by 4.4% in trade-weighted terms. Furthermore, loadshedding continues unabated, and food price inflation remains stubbornly high. Many factors that have driven local food inflation over the past year are not unique to SA. These include high global agricultural commodity prices and increased energy costs, which influence the prices of inputs such as fuel and fertiliser. While a number of these global factors are easing, as evidenced in the continued decline in the FAO Global Food Price Index (FFPI), which declined for an eleventh consecutive month in February, the depreciation in SA’s exchange rate has offset much of the benefits of the decline. At the same time, persistently high levels of loadshedding have added significant costs across the agriculture and food value chain. Notably, the sharp exchange rate depreciation has prevented much of the observed decline in world food prices from transferring to SA.

With higher inflation (particularly food prices) eroding households’ real wages, big interest rate increases lowering disposable income, extreme loadshedding, an increasingly tricky socio-political environment and a generally uncertain future weighing on local consumers across the board, we hold a particularly subdued outlook for household consumption spending in 2023. Typically, in the local economy, material job creation has only occurred when GDP growth approaches 3% p.a. Thus, the SA economy is simply not growing at an adequate rate to sustainably boost long-term employment prospects for South Africans. The latest forecast from the SARB indicates that SA’s economic growth is set to slow to a meagre 0.2% YoY.

In 2023, loadshedding is expected to continue at a relatively high intensity throughout the year. Household consumption is expected to weaken, given the high-interest rate environment. Additionally, the economic slowdown in developed markets (DMs) will likely reduce export demand (even as imports grow). However, this could be countered to some extent by demand from China. Electricity supply and other structural constraints prevent the domestic economy from taking off in any real, meaningful way. Without power, the cogs of our economy cannot turn. Nonetheless, whilst global and local economic growth prospects may appear muted for the foreseeable future, opportunities remain throughout most asset classes.

SA EQUITIES

The FTSE/JSE Capped Swix ended 1Q23 up 2.5% in rand. In US dollar terms, the index ended the quarter 1.5% lower, with the rand depreciating by 4.3% for the quarter (after a strong 3% rally in the final two trading days of March). 1Q23 started strong, with the index up c. 9% at the peak in late January, with the highly volatile basic materials sector still rising on optimism around the likely stimulus out of China after that country abandoned its zero-COVID policy in October 2022. However, as results started to trickle in across the JSE, investors were made aware of how difficult conditions on the ground have become in SA, mainly due to loadshedding reaching stage 6 in 4Q22. As a result, downgrades have come in across the board. GDP estimates are still positive in aggregate, but we note that these estimates are falling, and conditions are deteriorating. Therefore, we may see a few quarters of negative growth. Nevertheless, with the JSE trading at multi-decade valuation lows, we caution investors on getting too negative on the performance outlook, and we believe that our 11% total return outlook (down from 13% a quarter ago) and neutral rating on JSE-listed equities captures the balance between low valuations and low growth estimates.

1Q23 was a challenging quarter for diversified portfolios across the JSE. The positive index return would suggest the outcome was fairly ordinary. However, there were extreme outcomes below the surface in various sectors, nowhere more so than in the divergent performances of the platinum group metal (PGM) and gold sectors. The gold sector added 1.6% to the overall FTSE/JSE Capped Swix Index performance for the quarter, and at the start of the year, the sector was just shy of a 4% weighting in the index. Gold rallying is typically not good for the rest of the market, as the conventional thinking is that gold rallies during times of great uncertainty (globally) and the extreme moves we saw in the global banking space (particularly in the US and Europe) seem to have added fuel to the rally. Outside of gold, the rest of the positive performance of the index was again concentrated in the showing of a few large-cap global franchises, namely Naspers and Richemont, both benefitting from increased growth expectations from China for the rest of the year.

Across our investment universe in SA, there were a few other very positive operational performances, some from businesses operating predominantly in SA, like Bidvest, but also from those outside our borders, such as food services group Bidcorp, both with excellent operating performances for the six months to December 2022. The local banks were another sector that produced really strong results, and this was off a high base after a few periods of earnings tailwinds from impairment unwinds. A year ago, we thought that SA banks would struggle to grow off the relatively high earnings base, but their performances, across the board, far exceeded the expectations we had set at that stage. It was, therefore, surprising for us to see the extent to which the banks pulled back off their highs over the quarter as their valuations are around the cheapest they have ever been (apart from March 2020, when there was extreme uncertainty on how to value them). In the face of continued positive operational momentum in a tough operating environment, the de-rating in local banks seems to be driven by factors at play globally and, on our assessment, factors that should not have a material impact on their earnings. We have been saying this for a few years, but we continue to see the local banks as a critical pillar in constructing a JSE portfolio. In our view, developments over the past quarter, including strong results, double-digit expected earnings growth and dividend yields north of 7% in aggregate, have set JSE-listed banks up for another positive year.

While we remain positive on the banks, in aggregate, the recent surprise 50 bps interest rate increase, which pushed the prime lending rate north of 11%, is a development we had not anticipated. From years of discussions with the local banks’ management teams, the impression we get is that higher interest rates are generally good for banks as they can earn higher rates of interest on their lending portfolios (margins go up). However, when the prime lending rate exceeds 11%, banks typically start to see some stress in the system, and bad debts begin to pick up. So, it is safe to say that higher interest rates are good up to a point, and in SA, we are now dangerously close to high interest rates becoming too much of a burden on the general consumer.

While loadshedding and policy uncertainty/inertia seem to plague corporate SA, one positive development we are starting to factor in is the additional energy capacity coming online from the private sector. We see this as one of the most promising developments for corporate SA since Cyril Ramaphosa took over the SA presidency from Jacob Zuma in February 2018. One could probably argue that privatising the energy grid is more bullish for the country than Ramaphosa becoming president, as the same issues that plagued the country seem to still be prevalent today – and privatising the grid seems to be happening much faster than we thought. It is difficult to factor that into earnings and valuations. Still, we believe a multiplier effect on the economy following years (possibly decades) of underinvestment by corporate SA could be unleashed. When we met with the Standard Bank management team at its Africa Conference in London in 2Q22, we started getting a sense of the size of the potential investment into private energy generation. In the meeting, they commented that the investment bank’s entire lending pipeline for the next year was in energy generation. That statement alone is difficult to comprehend. However, there are now more detailed research reports suggesting that local banks could fund up to R1trn (or US$55bn) worth of renewable energy projects over the next five years – primarily focused on creating additional capacity at mines, thus freeing up the grid for the rest of the country. We will keep monitoring developments in this space with great interest. If it transpires along the lines that the initial research points to, we think there could be material upgrades to growth expectations across the market.

If, in one year, loadshedding is in the rear-view mirror, there will be some fairly low earnings bases and trough multiples, specifically across the discretionary retailers. We could be in a position where we are at peak rates, loadshedding, and negative consumer sentiment but at trough valuations. On our models, this part of the market offers a highly attractive upside should there be evidence of a reversal of the above negative factors. Nevertheless, our base case is that we still have not seen the worst of the bad news, with the half-year reporting season potentially a catalyst for finding the lows.

Positioning within our local funds remains defensive. We remain underweight in the basic materials sector and domestic companies. We are overweight rand-hedge industrial shares. Drilling deeper into each subsector, we retain our preference for banks, Naspers/Prosus, Bidcorp, and diversified miners over gold. Within the retailers, we prefer best-in-class general retail (Shoprite) over discretionary retail. However, we note that this positioning is being heavily tested considering the value on offer in discretionary retail. Within telcos, we have a preference for MTN at current levels.

SA LISTED PROPERTY

Over the last three and 12 months, the average SA property share has gone broadly sideways, with returns coming from distributions rather than capital. We expect the outcome for the next year to be similar, as SA property companies are stuck in a no/low-growth environment. As a result, we are underweight SA property with a projected 12-month total return of 8%. The forward distribution yield is closer to 11%, implying flat to slightly negative share prices.

The prospects for SA property companies have worsened of late, with interest rates rising ahead of expectations and loadshedding increasing the costs of a tenancy. The challenged outlook is reflected in share prices (with average discounts to book NAV of around 30%). At the same time, higher interest rates have also resulted in alternative income-yielding assets becoming relatively more attractive.

For SA-domiciled properties, the growth outlook is mediocre – a reasonable quality SA diversified portfolio should grow in the low single digits for the next few years. This is through a combination of 6%-7% escalations, roughly 10% reversions for new leases, and increasing cost pressure from rates and utilities. We remain concerned about the challenged long-term net rental growth trajectory of large urban malls and the inability of landlords to pass on increasing utility and other property operating costs to tenants in the current environment. In addition, the prospects for filling office space are limited as office occupation in the professional services space is very low.

For foreign-dominated property portfolios, Eastern European (the majority of exposure in SA-listed offshore property companies) profit growth still looks reasonable. However, the impact of the Russian-Ukraine war is still uncertain. For now, the impact on countries like Poland looks profit-positive as millions of people have flowed over the border from Ukraine.

In summary, it is tough to grow out there, but earnings risks are also much lower than the average listed company. A reasonable portfolio of SA-listed property equities can generate a distribution yield of around 11%, but we are not projecting material capital growth given the abovementioned scenarios. When bond yields decline, there are prospects for capital revaluation.

DOMESTIC BONDS

For 1Q23, SA government bonds (SAGBs) returned 3.42% at an All Bond Index (ALBI) level. This follows a strong performance in 4Q22, where the index returned 5.19%.

Currently, yields across the curve remain attractive, with most bonds having strengthened by 20-30 bps over 1Q23. The most important actions throughout this year have been central bank actions to curtail inflation. Domestically, the SARB MPC has continued its rate hiking cycle, ending the quarter with a surprise rate hike (hiking rates by 50 bps and not the widely expected 25bps) and taking the repo rate to 7.75% – 125 bps higher than the level at which the repo rate entered the COVID-19 pandemic. Given the pace of the rate hiking cycle, most analysts and the forward rate agreement (FRA) market have responded by increasing their expectations for future rate hikes, with peak rates now being seen at 8%-8.25% (25 bps to 50 bps of additional hikes). This is expected to be followed by a rapid cutting cycle, with the repo rate at 7.5%-7.75% by mid-2024.

As measured by the consumer price index (CPI), SA headline inflation has moderated downwards since its 7.8% peak in July 2022. However, the most recent print (February 2023) accelerated slightly, back to 7% (from 6.9% in the prior month). Of note is that the inflation prints have consistently been above the SARB target band and materially above the midpoint (4.5%) of the band which the SARB MPC has explicitly targeted. Given this, the MPC has been persisting with its rate-hiking schedule.

We have for some time viewed rate hikes as more likely to curtail growth, which, combined with the heavy burden of elevated stages of loadshedding, has resulted in the SARB slashing its projections for 2023 growth to a mere 0.2% YoY.

Added to the above, loadshedding is broadly viewed as inflationary. A persistent stage 6 loadshedding schedule contributes as much as 50 bps to inflation, depending on the underlying assumptions regarding replacement electricity.

Considering the above, we are cautiously optimistic and have positioned our funds appropriately. With bond yields across the back end of the curve at over 11% and with the 3-month JIBAR at just below 8%, we have attractive instruments in the duration and floating rate spaces in which to invest.

We expect bond yields to be somewhat volatile in the short term, with a portfolio-level yield expectation of 10.1% over the next year.

THE RAND

In 1Q23, the rand weakened on the back of a stronger dollar, risk aversion and domestic economic malaise. However, the shock 0.5% interest rate hike from the SARB on 30 March helped the local unit bounce back to about R17.73/US$1 at the end of March.

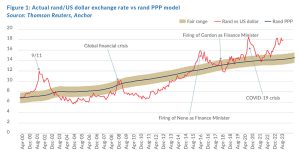

Projecting the rand’s value in a year’s time is a fool’s errand. This is because the rand vs US dollar exchange rate is one of the world’s most volatile currency pairs and trades well away from any modelled fair value for long periods. We note, however, that the rand trades within a R2.50 range to the US dollar in most 12-month periods.

The indicators for the rand’s fair value are continuing to turn negative. We note that the current account surplus of 2022 will most likely give way to a shallow deficit in 2023, thus eroding some currency support. The boon from high commodity prices will also dissipate, shining a light on SA’s fragile fiscal situation and poor government finances. Thus, we expect the rand to be under pressure for much of 2Q23.

We retain our purchasing power parity (PPP) based model for estimating the fair value of the rand, and we have extended this out by three months since the publication of The Navigator – Anchor’s Strategy and Asset Allocation, 1Q23 report on 20 January 2023. Over our forecast period, we expect inflation abroad to come under control and return towards more normalised levels. This means that our PPP model shows an increasing propensity for long-term rand weakness from next year again. As a result, our PPP-modelled value for the rand vs US dollar at the end of the next 12 months is R14.52/US$1 (See Figure 1). We apply a R2.00 range around this to get to a modelled fair-value range between R13.52/US$1 and R15.52/US$1.

The global backdrop means we are starting with the rand meaningfully weaker than our modelled fair-value range. In previous cycles, US dollar strength has tended to dissipate (and reverse) toward the end of the US rate-hiking cycle. Current indications are that the US Fed will reach peak rates toward the end of 1H23, meaning that we expect to see currency normalisation, with the dollar giving up some of its gains in the latter part of this year. However, we do not expect the currency to recover fully, and we are projecting a rand in the R16.50 to R17.50 range against the dollar in one year. For this report, we have modelled on R17.00/US$1.

We expect the rand to remain particularly volatile, and surprises are certain in the year ahead.

GLOBAL EQUITIES

In our 20 January edition of The Navigator – Anchor’s Strategy and Asset Allocation, 1Q23 report, we wrote, “We expect global equities to recover some of their lost ground in 2023.” This has indeed been the case, and the 7.9% return for the MSCI World Index in 1Q23 was even higher than our positive expectations. In addition, we indicated an expectation of an S&P 500 year-end level of 4,400 – materially above consensus outlooks (ironically, now a little more positive). A lot has happened (good and bad) in 1Q23, but we maintain that expectation and project an 8% return from global markets over the next 12 months.

After falling sharply at the beginning of 2022, global equity markets have moved broadly sideways over the last 11 months – the S&P 500 has mostly traded between a band of 3,800 and 4,200. This range is likely for the foreseeable future, but if we are genuinely looking out 12 months, by then, interest rates will probably be on the way down, and earnings growth will likely have resumed meaningfully. These conditions should be conducive to positive markets and returns.

Our hesitation with getting more overtly bullish in the short term is that the US Fed is acting very aggressively in raising interest rates (the fastest in 40 years), and this will still have some consequences that we cannot predict, as the much higher-than-expected cost of money has upended many business models and plans. An unforeseen manifestation of this was the collapse of some big global banks in the last two months (notably Credit Suisse and SVB) for precisely this reason. So for now, the market has reacted with a classic “bad news is good news” knee-jerk, with the thinking being that the Fed’s actions have impacts, and that means its job is close to being done, and interest rates will peak sooner.

The consensus among global investors (according to Bloomberg) is that the May 2023 interest rate hike of 25 bps will be the last. Of course, we could still experience a bout of “bad news is bad news” reactions, where the market faces the reality that we will likely enter a short recession, and US earnings in 2023 will go slightly positive. But the short-term moves are impossible to forecast, and if we look further out, our outlook is positive.

It is also crucial to look at the level below the indices, and we are excited about many specific shares. The sharp increase in inflation and interest rates saw the growth premium disappear on many quality shares (or, put simply, their share prices crashed!). Much of this was regained in 1Q23, but we believe there is more to go. Longer duration assets (where typically a higher proportion of cash flows are in the future because of higher-than-average growth rates) have started re-rating again.

The MSCI World Index forward P/E of 16.6x (see table in Figure 2 below) leaves room for an upside but is undoubtedly on the high side. Multiples often increase when earnings dip as long as the future outlook is more positive. In addition, emerging markets (EMs) are much cheaper, with strong recovery potential.

The MSCI World Index’s forward P/E is shown in the chart below.

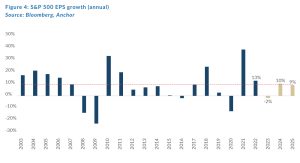

But the most important determinant of markets is earnings, and downgrades have already flowed for 2023 (minus 2%). However, double-digit US dollar-denominated earnings growth should resume in 2024 and beyond, which is positive for equities.

GLOBAL BONDS

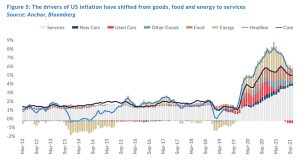

US inflation remains elevated relative to central bank targets. Still, the factors contributing to inflation have shifted from the COVID-19-related supply chain challenges driving goods price inflation and the Ukraine-Russia war-related challenges driving food and energy inflation to service price inflation (predominantly a shelter inflation problem).

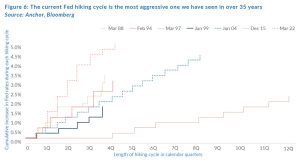

The Fed has embarked on the most aggressive cycle of rate hikes in over 35 years to get inflation under control, raising rates by 4.75% over four quarters – c. 50% more tightening than it achieved in the first year of the previous five hiking cycles.

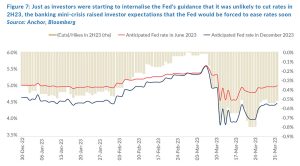

While inflation remains a concern, its trajectory is encouraging, and investors have shifted their focus to anticipating the end of the current hiking cycle and prospects of rate cuts. Messaging from the Fed has attempted to caution investors that it is still too early to declare victory over inflation (and, as such, too early to start anticipating rate cuts). However, that has not deterred investors from pricing in a high probability of rate cuts in 2H23. Just as investors had begun digesting the Fed’s message that there were potentially a few more rate hikes to come in 1H23 and a very low probability of any cuts in 2H23, the banking mini-crisis arrived. As a result, investors have resumed expectations that the Fed will be forced to halt rate hikes by the end of 1H23 and start cutting rates into 2H23 to mitigate against deteriorating economic conditions.

US 10-year government bond yields (which are, to a large extent, a reflection of investors’ expectation for long-term interest rate levels plus a spread to compensate for the uncertainty of 10-year forecasts) have spent the past six months oscillating between 3.3% and 4.3% p.a. as investors shift between the possibility of structurally higher and more volatile inflation and a return to a more benign inflation environment.

Our expectations are skewed towards a return to a more benign inflation environment, with perhaps slightly more volatility in inflation than we have been accustomed to, and a somewhat more vigilant Fed. This leads us to believe that US 10-year government bond yields will reach the bottom end of their recent trading range by the end of our twelve-month forecast horizon. As such, we anticipate a 3.5% total return for US 10-year government bond investors over the next 12 months, predominantly of income.

While US government yields are at the top end of where they have been for the past couple of decades, the same cannot be said for credit spreads. The pick-up in yield corporate bond investors are achieving is around the average level they have been at for the past couple of decades and still well below the peak levels they can experience during a crisis.

With financial conditions tightening in response to the recent banking strains and the aggressive Fed tightening, we think it is reasonable to expect a slight pickup in defaults over the next twelve months. However, we believe that current credit spreads are already priced for this eventuality. Consequently, we forecast a 12-month total return for US investment-grade corporate bond investors of 5.3%, all in the form of income.

GLOBAL PROPERTY

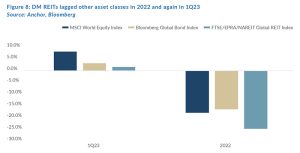

After ending 2022 as the worst performing major asset class (FTSE/EPRA Global DM REIT Index -24.5%), DM real estate investment trusts (REITs) started 2023 strong, only for the banking mini-crisis to derail that progress into quarter-end and leave the asset class as one of the laggards in 1Q23 again.

Despite such a dismal run recently, the anticipated yield on the asset class remains below average compared to yields on offer in the bond markets.

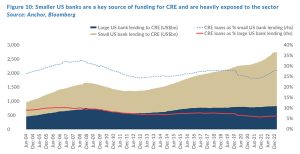

Much of the recent underperformance of listed property is due to concerns about tightening lending conditions, particularly among smaller US banks, where we have recently seen a few bank failures. Smaller US banks have not only been the most significant source of commercial real estate (CRE) lending, particularly over the past decade, but CRE is also a material portion of small bank lending.

The tightening lending standards and higher funding costs will likely act as a headwind to CRE for the foreseeable future, putting growth under pressure. As such, we anticipate that the bulk of DM-listed property returns will be in the form of dividend income over the next year, and we forecast a return for DM REIT investors of 6% in US dollar terms.

At Anchor, our clients come first. Our dedicated Anchor team of investment professionals are experts in devising investment strategies and generating financial wealth for our clients by offering a broad range of local and global investment solutions and structures to build your financial portfolio. These investment solutions also include asset management, access to hedge funds, personal share portfolios, unit trusts, and pension fund products. In addition, our skillset provides our clients with access to various local and global investment solutions. Please provide your contact details here, and one of our trusted financial advisors will contact you.