Fear around the impact of trade war has dominated headlines in 3Q18 with US President Donald Trump making it his mission to use the US’ massive import bill (in 2017 the US spent $2.9trn on imports) as leverage to renegotiate its relationships with major trading partners. This has unnerved markets and left economists scrambling to calculate the potential economic impact. While much has been written about the potential of trade wars to derail the current robust economic growth environment, the focus of this article is on the potential impact on US inflation and the knock-on effect this may have on US rates (a key driver of most investment values).

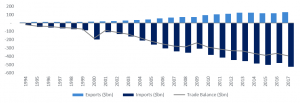

The US has a particularly skewed trading relationship with China – in 2017 the country imported goods worth around $526bn from China, while China imported only $130bn of US goods. Trump has implemented tariffs on Chinese imports as punishment for what he believes are unfair trade practices related to theft of US intellectual property.

Figure 1: US trade with China

Source: Bloomberg, Anchor

Since July 2018, the US has imposed import tariffs on almost half of Chinese imports ($250bn) and by January 2019 the US will be taxing Chinese importers 25% on the value of these imported goods. There is also the threat to expand tariffs to include all of the approximately $536bn in Chinese imports. If we were to assume that these tariffs are all passed on to the US consumers in the form of higher-priced goods, then that could have consequences for US inflation. US consumers spent around $13.9trn in 2017, so if the US were to end up levying 25% tariffs on all Chinese imports, that would add around 1% to the US consumption bill each year in the form of price inflation. The US Fed’s preferred measure of US inflation is currently around its 2% target, so if tariffs were to add 1% to that it’s likely the Fed would need to start aggressively hiking interest rates, which usually ends badly for the global economy. We think there are three reasons to believe that the outcome is unlikely to be that extreme.

a) There is evidence to suggest that the full impact of tariffs won’t be passed on to consumers.

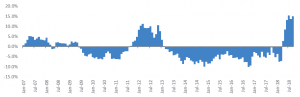

European Central Bank (ECB) board member Benoît Cœuré discussed the consequences of protectionism in a recent speech, saying that “Although import prices would likely rise as a result of the increase in tariffs … consumer price inflation and wage growth are likely to decelerate as the effects of lower aggregate demand and higher unemployment can be expected to prevail, both in the United States and globally.” There is also a good recent example of what happens to prices of US goods affected by tariffs. On 22 January 2018, the US imposed a 20% tariff on the first 1.2mn imported washing machines and a 50% tariff on imports above that number. Fortunately for us the US publishes data on washing machine inflation, which we saw spike to around 15% in the months that followed the tariffs (lower than the level of the tariffs).

Figure 2: US laundry equipment inflation:

Source: Bloomberg, Anchor

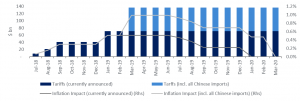

b) The impact of tariffs on inflation will be transitory and the staggered implementation will further dilute the impact.

A once-off shock in prices has a transitory impact on inflation which is measured relative to prices a year earlier so, once the prices have been higher for over a year, they no longer result in inflation. That combined with the fact that the implementation of the tariffs has been staggered over the course of about six months for the initially enacted tariffs (and potentially even longer if additional Chinese imports are subjected to tariffs) will mean that the impact will likely be stretched over a period of around two years, diluting the impact in any single period. The chart below shows our estimate of the impact on US inflation under the two different scenarios: a) no additional goods subject to tariffs, b) tariffs expanded to include all Chinese imports.

Figure 3: Impact of Chinese tariffs:

Source: Bloomberg, Anchor

These calculations also assume 100% pass-through of tariffs to consumer prices, which we’ve already noted above we believe is unlikely.

c) We’re hopeful that some sanity will prevail and the US will not expand tariffs to include all Chinese imports.

Trump has been a bit like a bull in a china shop (pun intended) when it comes to international relations, so there is clearly a possibility that he follows through on his threat to expand tariffs to all Chinese imports. However, we’re hopeful that might not be the case and, even if it does happen, that it won’t be at the 25% level currently in effect (perhaps only 10%). Its likely that the tariffs already cover goods the US has cherry-picked to have the least impact on US companies and it will become increasingly difficult to insulate Americans and their companies as more goods get added to the tariff lists.

So, while we do think the trade tariffs imposed on Chinese imports will cause some inflation in the US, we believe that the Fed is unlikely to respond with additional rate hikes (over and above the hikes we are already expecting), primarily due to the transitory nature of the inflation, but also likely due to the muted impact that will be seen in the data.