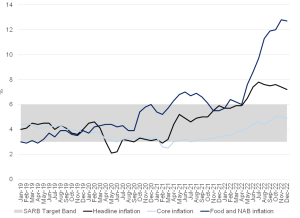

Cooling Inflation Rates

Surprising slightly to the downside, December’s annual headline inflation, as measured by the consumer price index (CPI), printed at 7.2% YoY, from 7.4% YoY the month before, supporting our belief that South Africa (SA) has reached the peak of its current inflation cycle. However, whilst we maintain that inflation has peaked, current pressures (which keep headline inflation above the 6% upper level of the SA Reserve Bank’s [SARB’s] inflation target band) stem primarily from food and fuel prices. Food prices are, however, expected to have peaked in 3Q22 but have remained elevated into 1Q23. Thereafter, we believe that a decline in fuel and food inflation will guide headline inflation back to within the SARB’s inflation target range in 2H23 – albeit at elevated levels.

Figure 1: The SA inflation rate, YoY

Source: Stats SA, Anchor Capital

On the monetary policy front, 4Q22 inflation averaged 7.4%, significantly higher than the 6.8% average forecast at the November 2022 Monetary Policy Committee (MPC) meeting. However, with fuel prices moderating and an expected moderation in food prices, we now think that the below-7% average inflation rate for 1Q23 is likely. Therefore, in next week’s meeting, the MPC will probably highlight rising inflation expectations and continued uncertainty, particularly around the persistently high and sticky food inflation component.

Currently, the money market seems to fully discount a 25 bps rate hike at the upcoming SARB MPC meeting while attaching some probability that rates may still rise by a cumulative 50 bps (at this meeting or the next). Whilst a single dataset does not typically sway SARB decisions, the MPC has continued to stress the increased data dependence of its interest rate decisions – as is usually the case around turning points in the inflation and interest rate cycles. Overall, we expect an intense debate at next week’s MPC meeting surrounding the extent to which rate hikes can slow (to smaller increments).

Given this latest moderate inflation print, the debate will likely fall between 25 bps and 50 bps. However, it is worth bearing in mind that the repo rate is already at its neutral level on a forward-looking basis.

At Anchor, our clients come first. Our dedicated Anchor team of investment professionals are experts in devising investment strategies and generating financial wealth for our clients by offering a broad range of local and global investment solutions and structures to build your financial portfolio. These investment solutions also include asset management, access to hedge funds, personal share portfolios, unit trusts, and pension fund products. In addition, our skillset provides our clients with access to various local and global investment solutions. Please provide your contact details here, and one of our trusted financial advisors will contact you.