Unemployment continues to rise amid loadshedding woes

South Africa (SA) faces a significant unemployment problem that continues to pose challenges for the country’s economic and social development. The unemployment rate has remained stubbornly high for many years, with a complex range of factors contributing to the issue. A combination of structural deficiencies, such as a lack of skills, limited access to quality education and training, and inadequate job creation, has resulted in a large portion of the population being unable to find gainful employment. Indeed, the latest Quarterly Labour Force Survey (QLFS) data indicate that employed persons increased by 258,000 to 16.2mn in 1Q23 vs 4Q22. Despite the slight increase in employed persons, the official unemployment rate has risen to 32.9% in 1Q23 from 32.7% in 1Q22.

Figure 1: SA quarterly unemployment rate

Source: Stats SA, Anchor

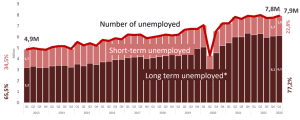

The unemployment rate, according to the expanded definition (which includes those discouraged from seeking work and is thus more reflective of the actual number of unemployed persons in SA), now sits at 42.4% – concerningly high. This points to longer-term, structural issues within the local economy as it is difficult to reincorporate and entice discouraged work seekers back into the labour force. Of further concern is the long-term unemployment rate (i.e., those unemployed for a year or longer), which has steadily increased over the past decade – from 65.5% in 1Q13 to 77.2% in 1Q23. Moreover, SA’s unemployment problem remains particularly acute among the youth, where high levels of unemployment hinder their prospects and exacerbate social inequalities. As such, the youth unemployment rate has risen again and is now at 62.1%.

Figure 2: SA long-term unemployment (unemployed for a year or longer)

Source: Stats SA

Regardless of the exact details in the data, typically, in the domestic economy, material job creation has only occurred when GDP growth approaches 3% p.a. Currently, businesses remain under significant pressure from the ongoing effects of loadshedding, which is also weighing on jobs and the unemployment data. Thus, the economy is simply not growing at an adequate rate to sustainably boost long-term employment prospects for South Africans. At the end of the day, SA’s unemployment problem is a complex and multifaceted issue that requires sustained and coordinated efforts from all sectors of society to create inclusive and sustainable employment opportunities for all South Africans.

At Anchor, our clients come first. Our dedicated Anchor team of investment professionals are experts in devising investment strategies and generating financial wealth for our clients by offering a broad range of local and global investment solutions and structures to build your financial portfolio. These investment solutions also include asset management, access to hedge funds, personal share portfolios, unit trusts, and pension fund products. In addition, our skillset provides our clients with access to various local and global investment solutions. Please provide your contact details here, and one of our trusted financial advisors will contact you.