Rands weakness and inflationary loadshedding

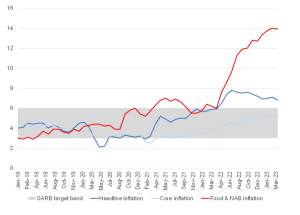

Marking the lowest reading since May 2022, annual inflation, as measured by the consumer price index (CPI), slowed to 6.8% YoY in April from 7.1% in March. Inflation eased mainly due to the expected decline in fuel inflation to 5.0% YoY in April from 8.1% in March but also partly due to an unexpected softening in food and non-alcoholic beverages (NAB) inflation to 13.9% from 14.0%. This latest food inflation print hopefully marks the start of a general downward trend, which is expected to underpin the easing of headline inflation too. Furthermore, notwithstanding the price adjustments as businesses pass on the additional costs incurred for alternative electricity sources during loadshedding, we expect some relief in the coming months from the retreat in agricultural prices, even with the rand weakness. Nonetheless, as expected, core inflation (which excludes the volatile price categories of energy and food) rose 0.1 pp to 5.3% YoY in April, as headline price pressures continue to filter through to the rest of the economy. Unusually, this latest rise in core inflation was driven by services instead of goods.

Figure 1: SA inflation, YoY % change

Source: StatsSA, Anchor

Whilst this latest CPI print came in lower than consensus expectations of a 7% YoY print, it is important to remember that inflation remains above the South African Reserve Bank’s (SARB) target band of 3%-6%, and risks to the outlook remain on the upside. The rand has depreciated 11.2% on a trade-weighted basis since the start of this year, and the general expectation is for the rand to remain weak throughout the foreseeable future, given the many headwinds facing the local economy. As such, imported goods inflation will be key to watch. Overall, with the rand’s substantial weakness and markedly higher production and retail costs stemming from sustained, intensive loadshedding, the risk to the inflation outlook, on balance, is still on the upside.

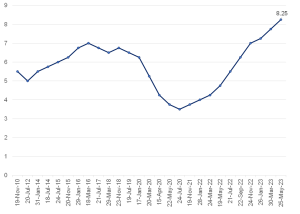

Against this backdrop, and in line with expectations, the SARB’s Monetary Policy Committee (MPC) decided to increase the repurchase (repo) rate for the tenth time in 18 months by 50 bps. The repo rate now stands at 8.25%, with the prime rate at 11.75%. With a unanimous decision, the MPC now deems monetary policy in South Africa (SA) restrictive, consistent with the current elevated inflation and risk outlook. A restrictive repo rate refers to a relatively high interest rate set by a central bank to curb excessive borrowing and spending in the economy. When the central bank wants to rein in inflationary pressures, slow economic growth, or address concerns about asset price bubbles, it raises the repo rate. As such, the SARB’s current policy stance aims to anchor inflation expectations more firmly around the mid-point of the target band and increase confidence in attaining the inflation target sustainably over time.

Figure 2: The history of the SARB’s repo rate changes, %

Source: SARB, Anchor

Looking ahead, while inflation may be showing signs of abating, it is still hovering above the SARB’s target band of 3%-6%, and food price inflation is still in the double digits. In addition, SA’s energy crisis, which has worsened this year, is also weighing heavily on the country’s already strained economy, presenting more inflationary risks. When delivering the MPC statement, SARB Governor Lesetja Kganyago stated that the SARB forecasts that loadshedding alone will shave 2% from growth this year. However, he added that the bank now expects slightly higher growth than its previously forecast GDP growth of 0.3% YoY for 2023.

Unfortunately, SA is one of the few countries with an economy smaller than before the COVID-19 pandemic began. As a result, the SARB is walking a tightrope between raising interest rates too much and allowing inflation to rise. Regrettably, in the current environment of heightened geopolitical tensions, economic malaise and a concerningly weak currency, circumstances forced the hand of the SARB to hike once again. The question of whether this is the last hike in the current cycle remains uncertain – much will depend on the direction of the rand and the overall inflation environment over the next few months.

At Anchor, our clients come first. Our dedicated Anchor team of investment professionals are experts in devising investment strategies and generating financial wealth for our clients by offering a broad range of local and global investment solutions and structures to build your financial portfolio. These investment solutions also include asset management, access to hedge funds, personal share portfolios, unit trusts, and pension fund products. In addition, our skillset provides our clients with access to various local and global investment solutions. Please provide your contact details here, and one of our trusted financial advisors will contact you.