The JSE: Finding the horizon amid the desert

Investing on the JSE has been a hard grind for the last three years and 2018 has thus far provided little relief. At 29 June 2018, the JSE All Share is down 1.7% (on a total-return basis including dividends) for the year and the three-year compound total return for the Capped Swix is 3.4% p.a. And without Naspers, that’s closer to zero …

On a daily basis at Anchor we are experiencing equity fatigue from clients as they question sustained exposure to equity markets. A young talented employee, who has been with us for just over three years, yesterday posed the question: “Pete, does the market ever go up?” It’s certainly been among the longest periods of flat returns that I have experienced in my 25-year career in the industry.

JSE market drivers seem to have conspired against each other with frustrating regularity for some time now. When SA Inc. has rallied, the rand has strengthened (and vice versa); when Naspers was running, SA Inc. was battling; when we were getting some momentum, Steinhoff and Resilient happened. The net result has been a spluttering, stalling, frustrating sideways slog. Remember that eventually some of these factors (except for Steinhoff) will combine in a favourable manner to produce an outsized positive surprise.

So, the key question is whether this is reason to be positive or negative. After all, there are some great companies on the JSE that have grown their earnings consistently, but are trading at the same (or lower!) price levels than four years ago. That makes these companies much cheaper and, theoretically, much more attractive. Recent price moves have also taken many of these shares even lower. Human nature is such that when markets are going up, it’s easier to be more bullish and vice versa, which seems to defy logic. The expected script from somebody in my position is to talk through the issues and then conclude that the market looks attractive. I will try to avoid that.

So, instead, let’s take a step back and think about what drives our market and assess each of the factors. Each of these tend to have differing levels of impact on the market, depending on the mood of Mr Market. It must also be borne in mind that many of these factors are inter-linked:

- Global markets and more especially EMs.

- Commodity markets.

- Rand/US$ exchange rate.

- Tencent and, to a lesser extent, Naspers management.

- Prospects for SA local economic growth and earnings prospects for SA-Inc. companies.

- Valuation of SA companies and company specific prospects.

Global markets and more especially EMs: A stronger dollar, rising global interest rates and intensifying trade tensions have conspired to create a new mood of uncertainty. Ironically, this has had a negative impact on EMs, while the US market has remained firm. In times of risk, investors take refuge in the US (more so for bonds than equities). One of the key questions therefore is whether Trump is embarking on political posturing, or is he really prepared to take the world down the route of a damaging trade war? You will read elsewhere in our musings that we are moderately optimistic on global markets and this offers the prospect of an EM bounce-back in the second half of the year. This will be good for SA.

Commodity markets: A large component of our stock market is driven by commodity prices and thus commodity prices (and demand), in turn, have a material impact on the SA economy. The share prices of the big diversified miners are all pricing in a decline in commodity prices. BHP Billiton and Glencore are trading at free cash flow yields above 10% and Anglo American in the region of 15% – if prices do not decline materially these shares are especially cheap. Unless global economic growth gets derailed, the shorter-term (at least) prospects of commodity prices look fairly positive and this would be supportive to the SA market.

Rand/US$ exchange rate: Our view is that in 12 months’ time the rand is more likely to be stronger than weaker; that’s after a strong rout from around R11.50/US$1 to R13.80/US$1. YTD, the currency is 11% weaker. There’s a sweet spot range for the rand – that’s where exporters can make a margin, imported goods are less competitive and the impact on inflation is muted. Based on our collective assessment of the performance of SA companies in different scenarios, our estimation is that this rate is in the region of R12.75-R13.25/US$1. So, if the rand strengthens a few percentage points, we are back in this region and local companies should get a benefit, in aggregate.

Tencent and, to a lesser extent, Naspers management: The weighting of Naspers in our All Share Index (c. 20%) is such that this share is a market factor all by itself. “What did Tencent do last night?” is a common call in SA trading rooms every morning as fund managers mull over what to expect for the day. We believe Tencent is one of the best businesses in the world and it is also one of the world’s top-ten businesses by market cap. Its share price has dropped 17% from its highs and, while the 34x forward PE is optically expensive, we have a relatively high conviction in strong earnings growth for the next three years. Naspers will take most of its direction from Tencent in the short term. However, the recent Naspers results confirmed that its businesses outside of Tencent are all growing rapidly and the investment case is strengthening. Naspers trades at over a 40% discount to its sum-of-the-parts (SoTP) valuation. Frustratingly, Naspers management is not doing any of the obvious things to unlock the discount – they have never taken action to divest of core assets or shrink their business and we don’t think they ever will. Their “unlock” actions will be incremental, which means Tencent will be the guiding star for short-term performance and the growth in the core business should result in a gradual move to a lower discount.

Figure 1: Tencent share price

Source: Iress

Prospects for SA local economic growth and earnings prospects for SA-Inc. companies: It’s been a rollercoaster ride for SA GDP growth expectations over the last 9 months. From despair in November 2017 to euphoria in December and January to the current phase of uncertainty. There is no doubt that prospects have improved, but a negative 2.2% QoQ GDP growth rate for 1Q18 rocked market confidence and, on the ground, company CEOs are waiting for an upturn with bated breath.

Most economists still forecast a steady recovery from here, but recent sharp rand weakness poses risks to the interest rate outlook and the share market is not giving SA the benefit of the doubt. The Foschini Group is a good barometer of the shift in expectations: flat for four years, then up 70% and subsequently down 25%.

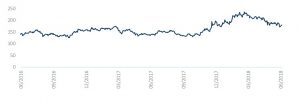

Figure 2: The Foschini Group share price

Source: Iress

The future outcome for local shares looks fairly binary. They have reduced to price levels that don’t factor in much optimism, with most SA-Inc. shares 20%-40% off their highs. If economic growth accelerates they could deliver 20%-plus returns over the next 12 months, but if the economy remains muted they could very well linger around current price levels. Our positioning at present is to have reasonable exposure to this category of shares, but not to “bet the house”. A key indicator we will be watching is vehicle sales, historically a meaningful leading indicator.

Valuation of SA companies and company specific prospects: The weighted forward PE multiple for SA shares is 14.5x. Within that, resource companies are cheap (if commodities hold up), SA-Inc. shares are now attractive and there are specific shares that have retreated firmly into good-value territory. For example:

- Vodacom has declined from R180 to R120/share and now trades at a forward 12x PE and 7.7% DY.

- The implied PE of Outsurance in RMI is now 10x – a bargain for a great quality company.

- Barclays Africa now trades at a forward 7.5x PE and 7.7% DY.

- The basket of mid-cap, SA-listed property companies trades in the region of a forward 11% dividend yield, with 4% growth in dividends prospects for the next 12 months.

- Exxaro trades at a forward 7.6x PE and 5% dividend yield. The implied PE multiple on the annuity-type coal assets is in the region of 4x.

- Sasol trades at roughly a forward 10x PE and you get the impact of the US Lake Charles project for free.

- When you can find bargains like these in big listed SA companies, we tend to view the outlook as positive.

Conclusion

JSE earnings were up over 10% in the last 12 months and we expect earnings growth of 12% and 16% over the next 12 and 24 months, respectively. If SA economic growth accelerates, 2019 could see even higher growth rates. Following the 6% YTD decline in the Capped Swix, many shares and sectors have moved into attractive territory. Risks have certainly increased, but all of the factors highlighted above indicate the potential for more positive returns than we have experienced over the last few years. In our 1Q18 strategy document we had nudged equities to overweight (a 14% projected return) and we retain this positioning.