Global markets at the end of June

Most major global markets (MSCI World +6.1% MoM; +15.4% YTD/1H23; +7.0% 2Q23;) ended June, and 1H23, higher building on the solid start to this year. Despite some recent market weakness, US equity markets performed well as a rally in growth stocks, an upbeat earnings season, and hopes of the US Federal Reserve (Fed) ending its aggressive monetary tightening sooner rather than later buoyed the leading US indices and lifted investor sentiment. Recent US economic data have reflected a resilient economy despite the higher interest rate environment, soothing investor fears of a possible recession triggered by the Fed’s aggressive rate hikes.

In US economic data, manufactured capital goods orders unexpectedly rose in May, sales of new single-family homes surged, and US consumer confidence advanced to a c. 18-month high in June. On the inflation front, personal consumption expenditure (PCE), the Fed’s preferred inflation gauge, cooled to 0.1% MoM in May vs April’s 0.4% print, according to data released on 30 June. The reading came in below consensus forecasts of 0.4% and is a reassuring sign that the Fed may not have to raise rates much higher to fight inflation. YoY, PCE rose 3.8% in May (its lowest annual change in two years) vs 4.3% in April. As measured by the consumer price index (CPI), May headline inflation also came in lower-than-expected – at 4.0% YoY vs 4.9% in April. Core CPI, excluding the erratic food and energy components, declined to 5.3% YoY in May vs 5.5% in April. MoM headline inflation met consensus expectations, increasing to 0.1% in May (vs April’s rate of 0.4%), while core inflation was in line with expectations and unchanged from April at 0.4%. May retail sales unexpectedly rose again (+0.3% MoM) after advancing by 0.4% in April. Reuters consensus economist forecasts had expected a decline (by 0.1% MoM). Retail sales increased by 1.6% YoY in May.

As widely expected, the Fed’s Federal Open Market Committee (FOMC) held rates steady at its June meeting. Fed Chair, Jerome Powell, highlighted that the next meeting will likely see a rate hike, noting that the Fed continues to closely watch credit conditions and its impact on the US economy. Powell also spoke about commercial real estate and how the Fed expects some losses to occur due to pressure on the small to medium banks in the US.

Among the three major Wall Street indices, for 1H23, the tech-heavy Nasdaq Composite Index (Nasdaq) and blue-chip S&P 500 posted sizeable gains, while the Dow Jones made advances but lagged the other two. The S&P was up 6.5% MoM (its best monthly performance since October last year), while it added 8.3% in 2Q23 and is up 15.9% YTD/1H23 – its best first-half performance since 2019. The Nasdaq rose 6.6% MoM in June, gained 12.8% in 2Q23 (notching up back-to-back positive quarters for the first time since its five-quarter streak ended in 2Q21) and is up 31.7% for 1H23/YTD – its best first half performance in 40 years as enthusiasm around artificial intelligence (AI) buoyed the index. The Dow rose 4.6% MoM, advanced by 3.4% in 2Q23 and is up 3.8% in YTD/1H23.

In Europe, Germany’s DAX ended June 3.1% higher (+16.0% YTD/1H23 and +3.3% 2Q23), while France’s CAC Index closed 4.2% up MoM (+14.3% YTD/1H23 and +1.1% 2Q23). As expected, the European Central Bank (ECB) raised rates by 25 bps at its meeting in June, taking the ECB deposit rate to 3.5% – well above the negative rates territory seen for most of the decade leading up to the end of 2022. In economic data, May euro area annual inflation printed lower at 6.1% YoY vs 7.0% in April, while EU annual inflation was 7.1% in May vs April’s 8.1% print. Germany’s June annual inflation rate rose more than expected, coming in at 6.8% vs consensus forecasts of a 6.7% print. MoM prices increased by 0.4%.

In the UK, the blue-chip FTSE-100 closed 1.1% higher in June (+1.1% YTD/1H23; -1.3% 2Q23). To tackle sticky inflation, the Bank of England’s (BoE) Monetary Policy Committee (MPC) raised the main interest rate from 4.5% to 5.0% – the highest since 2008 and its largest increase since February. May UK inflation remained at 8.7% YoY – unchanged from April. Core inflation, excluding the volatile food and energy items, surprised the market by again rising sharply in May (to 7.1%, the highest rate since March 1992) vs 6.8% in April.

Chinese markets were mixed, with Hong Kong’s Hang Seng Index up 3.7% MoM (-4.4% YTD/1H23; -7.3% 2Q23), while the Shanghai Composite Index fell by 0.1% MoM (+3.7% YTD/1H23; -2.2% 2Q23). Despite China’s economy reopening in December following the lifting of the country’s zero-COVID policy, the country has experienced a slower-than-expected ramp-up in spending. In June, China’s factory activity recorded a third MoM contraction, with the official manufacturing purchasing managers index (PMI) coming in at 49.0, down from May’s 48.8 print. The official non-manufacturing PMI, measuring business sentiment in the services and construction sectors, also declined to 53.2 (the weakest level this year) vs May’s 54.5 print. The 50-point mark separates expansion from contraction. The disappointing PMI points to a patchy recovery in the world’s second-biggest economy, raising questions about the strength of the country’s economic rebound.

Japan’s equity market rallied, with the benchmark Nikkei posting a second consecutive MoM rise as it jumped 7.5% in June (+27.2%YTD/1H23; +18.4% 2Q23). Core CPI (excluding the volatile fresh food category but including energy costs) rose 3.2% YoY in May vs April’s 3.4% increase but exceeded market forecasts of a 3.1% YoY gain. The so-called “core-core” inflation rate, which excludes fresh food and energy prices, accelerated to 4.3% in May, up 0.2 ppts vs April.

In commodities, Brent crude oil rose 3.1% MoM (-12.8% YTD/1H23; -6.1% 2Q23) – its first monthly gain of 2023 as markets worried about tightening supply after the US Energy Information Administration said crude inventories dropped by 9.6mn barrels for the week ended 23 June. This drop exceeded the 1.8mn barrels consensus analyst forecasts had expected. Iron ore prices rose 10.0% MoM but are down by 3.0% YTD/1H23 and 11.1% lower for 2Q23. Meanwhile, gold declined 2.2% MoM (+5.2% YTD/1H23; -2.5% 2Q23), closing June at c. US$1,919 on a stronger US dollar, expectations of more US rate hikes for the remainder of 2023, the US debt ceiling deal and subsiding concerns around US regional bank failures. The platinum price dropped 9.2% MoM (-15.6% YTD/1H23; -8.9% 2Q23) to close June at c. US$906.30/oz, while palladium ended the month 10.1% lower (-31.4% YTD/1H23; -15.9% 2Q23). Natural gas prices rose by 23.5% MoM (-37.5% YTD/1H23; +26.3% 2Q23), while thermal coal prices advanced by 4.5% MoM (-42.8% YTD/1H23; -18.7% 2Q23).

South Africa’s (SA’s) FTSE JSE All Share Index rose 1.3% in June (+4.1% YTD/1H23), while the FTSE JSE Capped SWIX jumped 3.8% MoM (+3.7% YTD/1H23; +1.2% 2Q23). Financials were by far the best performers in June (Fini-15 +11.4% MoM; +3.4% YTD/1H23), followed by industrial counters (Indi-25 +3.5% MoM; +17.8% YTD/1H23) and property (the SA Listed Property Index +0.4% MoM; -7.4% YTD/1H23). However, the Resi-10 plummeted 8.2% MoM (-12.4% YTD/1H23) on a broad sell-off in commodity markets, resulting in lower commodity prices, especially platinum group metal (PGM) prices and gold. Ongoing issues at SA rails and ports also weighed on the miners. Highlighting the performances of the biggest shares on the JSE by market cap, the largest company on the exchange, BHP Group, rose by 4.0% MoM, while Prosus (the second-biggest listed share) was up 6.5% MoM and Naspers gained an impressive 14.2% MoM. Anheuser Busch InBev, the third-largest listed company, advanced by 1.1% MoM. After weakening dramatically in May and breaching the R19.90/US$1 level, the rand recorded a strong performance in June as loadshedding eased somewhat for the first time this year. The local unit firmed by 4.7% MoM (-10.6% YTD/1H23; -5.6% 2Q23), ending June below the psychological R19.00/US$1 level at R18.85/US$1.

In economic data, SA headline CPI slowed for a second month in May to 6.3% YoY (the lowest reading since April last year) from 6.8% YoY in April as 2022’s fuel price increases fell out of the base. MoM, CPI rose 0.2% in May vs April’s 0.4% print. The annual rate for food and non-alcoholic beverages, a critical upward driver of inflation over the past few months, came in significantly lower than expected – at 11.8% YoY in May vs April’s 13.9% print. This latest decrease in local food prices is driven by the strong base effect created by the 2.1% MoM jump in prices last May and the continued moderation in global food prices. Still, inflation remains outside the SA Reserve Bank’s (SARB’s) target range of 3%-6%. April retail sales data (released in June) fell for a fifth consecutive month, with data showing that retail trade shrank 1.6% YoY, following a downwardly revised 1.5% YoY drop in March.

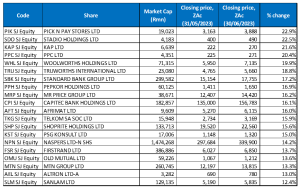

Figure 1: June 2023 20 best-performing shares, MoM % change

Source: Bloomberg, Anchor

Beaten-up discretionary retail counters such as Pick n Pay, Woolworths, Mr Price, etc. made a comeback in June, with several of May’s worst-performing discretionary retailers posting good monthly gains. Following its 27.2% MoM share price drop in May (to levels last seen a decade ago), Pick n Pay Stores’ share price saw a significant turnaround in June, jumping by 22.9% MoM and emerging as the month’s best-performing share. Pick n Pay has been facing a tough local operating environment and strong competition from the likes of Checkers. In addition, CEO Pieter Boone said in May (at the release of the company’s results) that loadshedding had “a material impact on our results, particularly through massive increases in diesel costs,”. Pick n Pay’s FY22 results also showed a 16.3% YoY drop in headline EPS, while profit before tax, excluding an insurance payout, fell by 15.1% YoY to R1.6bn. At that stage, the retailer warned that its FY23 results might be similar. In FY22, Pick n Pay spent R522mn on diesel and a net amount of R430mn when its electricity savings initiatives are taken into consideration.

Private education provider Stadio Holdings was June’s second best-performing share with a 22.5% MoM gain. In a business update that formed part of its AGM last week, the Group said that its learner base is expanding rapidly, with a 8% YoY rise in total tertiary enrollments.

KAP Ltd, a diversified industrial company with logistics and manufacturing businesses and May’s third worst-performing share, with a 27.0% MoM share price decline, also recovered in June. KAP gained 21.6% MoM – June’s third best-performing share. KAP said that the operating environment in SA was demanding, with the impact of loadshedding worse than anticipated.

KAP was followed by PPC Ltd, Woolworths and Truworths International with MoM gains of 20.4%, 19.9% and 18.8%, respectively. Cement company PPC said last month, in its FY22 results, that its revenue climbed to R9.90bn from R9.88bn posted in FY21, while its diluted loss per share stood at ZAc43.0, compared with ZAc4.0 recorded in the previous year. The company’s board has given it the go-ahead to start repurchasing up to R200mn worth of its shares to boost shareholder value. PPC has paid down one-fifth of its debt in the year to the end of March (its gross debt declined from R1.2bn to R931mn) in its SA obligor group, which comprises its SA and Botswana cement and materials operations accounting for c. two-thirds of total sales.

In a trading statement in June, Standard Bank (+17.2% MoM) said that it expects its headline EPS to increase by more than 20% YoY for the six months to 30 June. The bank said that its top-line growth was strong, driven by balance sheet growth, the endowment impact of higher interest rates, improved customer activity levels and increased use of its risk management capabilities in volatile trading environments. While Standard Bank’s credit loss ratio was elevated, it remained within the Group’s through-the-cycle target range of 70 bps to 100 bps. The positive earnings forecast buoyed its share price.

Standard Bank was followed by Pepkor Holdings (+16.9% MoM), whose share price rose from the two-year low levels it reached in May. Rounding out the top 10 were Mr Price and Capitec Bank, with MoM gains of 16.2% and 16.1%, respectively. Retailer Mr Price released annual results for the period ended 1 April 2023, which showed that its revenue rose to R32.85bn from R28.08bn posted in the previous year, while its diluted EPS fell by 6.8% YoY to R11.83. Mr Price said that loadshedding impacted its revenue by c. R1bn for the full year, with the Group’s core trading divisions severely impacted in its second half, especially during the busy festive season shopping period.

Figure 2: June 2023 20 worst-performing shares, MoM % change

Source: Bloomberg, Anchor

Steinhoff International’s share price dropped by 87.5% MoM in June to only ZAc4 – the worst-performing share on the JSE by far. This after the company said in its interim results to 31 March that the sum-of-the-value of its key investments did not cover its debt. In June, a Dutch court also approved management’s restructuring plans that shareholders had opposed at two shareholder meetings. However, to contextualise the share price performance, we highlight that Steinhoff’s share price decline is largely irrelevant as the share price movement is, in effect, just a bet on whether there is any value left in the company – the end outcome could be zero value.

JSE-listed miners were under pressure in June as commodity prices dropped. The platinum price fell 9.2% to US$915.30/oz, its lowest since October 2022, while palladium dropped 10.1% to US$1,284/oz, hurting PGM shares. At the same time, the gold price also ended June c. 2.2% lower, weighing on the gold counters. The sharp sell-off in the resources sector was initially sparked by the lacklustre post-COVID-19 reopening recovery in China and insufficient stimulus to boost growth in the world’s second-largest economy. The broad sell-off in commodity markets reverberated across the JSE, with Anglo American Platinum (Amplats; -25.0% MoM) emerging as June’s second worst-performing share, followed by Northam Platinum (-22.7% MoM) in third place. Impala Platinum (Implats; -20.9% MoM), AngloGold Ashanti (-17.6% MoM), Sibanye Stillwater (-17.2% MoM), Harmony Gold (-15.3% MoM), and Gold Fields (-13.2% MoM) all posted double-digit share price declines.

Meanwhile, amid the gold and PGM counters’ declines, investment holding company Transaction Capital, May’s worst-performing share with a 43.3% MoM drop, fell by a further 15.4% MoM in June as ongoing negative sentiment weighed on the stock. The share price reached its lowest level in c. ten years on 29 June. Transaction Capital has been under pressure since March, when it first revealed the structural deficiencies in its taxi-lending business, once its crown jewel, resulting in an overhaul of that division. Part of the planned restructuring of SA Taxi (now known as Mobalyz) consists of reducing the number of vehicles to be refurbished and refinanced, finding alternative channels to sell repossessed vehicles, cutting its staff numbers and resizing its cost base.

Finally, rounding out the ten worst-performing shares was the diversified pulp, paper and wood fibre Group, Sappi Ltd, down 10.6% MoM.

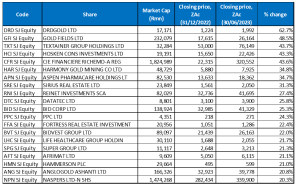

Figure 3: Top-20 best-performing shares, YTD/1H23

Source: Anchor, Bloomberg

Sixteen out of May’s top-20 YTD best-performing shares were again among the top-20 best performers for the year to the end of June. Despite gold (and PGM) shares coming under pressure last month, the two top-performing shares were once again gold miners. Richemont, PPC Ltd, Afrimat and Naspers were the new entrants among the best YTD performers, bumping Trencor, Oceana, Prosus and Quilter Plc from the list.

Although DRDGold’s share price retreated by 10.1% MoM in June, the share remained at the coveted top spot YTD with an impressive gain of 62.7%. In addition, Gold Fields (+48.5% YTD) maintained its second position despite recording a 13.2% MoM drop in June. Textainer was the third best-performing share, with a YTD gain of 43.7%. The company’s primary listing is on the New York Stock Exchange, with a secondary JSE listing. Textainer leases shipping containers to c. 200 customers, including the world’s leading shipping lines. It also leases tank containers and supplies containers to the US military.

Textainer was followed by investment company Hosken Consolidated Investments (HCI; +43.3% YTD), Richemont (+43.6% MoM) and yet another gold producer Harmony Gold (+34.8% YTD). In its recent FY23 results, HCI revealed that its revenue rose 18.2% YoY to R12.58bn, while its diluted EPS stood at R38.97, compared with R25.68 recorded in the previous year.

Aspen Pharmacare, Sirius Real Estate, Reinet and Datatec recorded share price gains of 34.8%, 34.7%, 31.3% and 27.4% YTD, respectively and rounded out the ten best-performing shares YTD. In its FY23 results, rand hedge Reinet reported that its total income fell to EUR164mn from EUR353mn posted in the corresponding period of the previous year, while its headline loss per share stood at EUR0.66, compared with an EPS of EUR3.27 recorded in FY22.

Figure 4: Bottom-20 worst-performing shares, YTD/1H23

Source: Anchor, Bloomberg

Among the YTD worst-performing shares, sixteen of the twenty shares for the year to end May again featured among the twenty worst-performers for the year to the end of June. Amplats (-40.3% YTD), Sibanye Stillwater (-39.2% YTD), Northam (-33.0% YTD), and Royal Bafokeng Platinum (-24.3% YTD) were the new entrants, bumping Pepkor, Tiger Brands, Capitec and Redefine from the list.

Steinhoff (discussed earlier) was also the worst-performing share YTD with a 92.2% decline. It was followed by Transaction Capital (discussed earlier), which moved from the worst-performing share YTD for the year to the end of May to the second spot with a 82.4% YTD share price drop. Transaction Capital was again followed by specialist engineering and construction firm Murray & Roberts (MUR; -67.5% YTD) in third place. Last month, the Federal Court of Australia granted the administrators of MUR’s Australian holding company, MRPL, an extension to convene a second creditors meeting by the end of August. The postponement buys time to revise its deed of company arrangement (Doca) proposal to creditors to return its mining unit RUC Cementation Mining Contractors (RUC), to the Group to re-establish the full-scale capability of MUR’s core multinational mining platform. MUR said in a statement that on completion of the proposed agreement, MRPL would come out of administration, and RUC would be reinstated within the group. MUR lost RUC after MRPL and Clough were placed into voluntary administration in 2022. Clough, which held the energy, resources and infrastructure business unit, and RUC, a diversified underground mining contractor and raise drilling specialist, were spun off from the Group.

Thermal coal exporter Thungela Resources, Implats, Amplats and KAP Ltd recorded YTD share price declines of 48.4%, 41.2%, 40.3% and 39.2% YTD, respectively. In a trading update in June, Thungela said that it expects its half-year profit to fall by as much as 75% YoY on weaker coal prices, higher costs and persistent rail logistics issues. Thermal coal prices have fallen significantly from the record highs reached in 2022 following Russia’s invasion of Ukraine.

Finally, Sibanye Stillwater (-35.2%) and Metair Investments (-33.3%) rounded out the ten worst-performers YTD.

At Anchor, our clients come first. Our dedicated Anchor team of investment professionals are experts in devising investment strategies and generating financial wealth for our clients by offering a broad range of local and global investment solutions and structures to build your financial portfolio. These investment solutions also include asset management, access to hedge funds, personal share portfolios, unit trusts, and pension fund products. In addition, our skillset provides our clients with access to various local and global investment solutions. Please provide your contact details here, and one of our trusted financial advisors will contact you.