Major global markets and the JSE April Report

Most major global markets (MSCI World +1.8% MoM/+9.8% YTD) ended April in the green. After teasing MoM declines earlier last week, all three major US indices closed higher for the month as earnings reports from the major tech companies dominated much of the last week of April, with the results coming in better than expected. Wall Street’s so-called “fear gauge”, the CBOE volatility index, also closed 1.25 points down at 15.78 – its lowest close since November 2021. Weaker-than-expected US GDP data saw some pundits bet that the US Federal Reserve (Fed) could soon end its interest rate tightening. Still, worries around a US recession, US-listed Chinese shares losing over US$100bn in market value on concerns around geopolitical tensions between the two superpowers, fears of a US default and reports of the Federal Deposit Insurance Corporation taking receivership of troubled US regional lender First Republic Bank, weighed on sentiment. In addition, the Fed’s March meeting minutes, released in April, revealed that the Fed’s economists are forecasting a “mild recession” later this year due mainly to the potential for a reduction in lending weighing on growth.

In US economic data, March inflation saw annual headline CPI coming in lower than anticipated, decreasing to 5.0% YoY from 6.0% in February. However, annual core CPI, which excludes the erratic food and energy components, picked up from 5.5% YoY in February to 5.6% in March. MoM, headline inflation came in better than expected at 0.1% in March (vs February’s rate of 0.4% MoM and the consensus forecast of 0.2% MoM), while core inflation was in line with expectations at 0.4% MoM in March, vs February’s 0.5% print. US March retail sales declined 1% MoM – a sharper drop than the restated 0.2% MoM fall in February, as lower sales of automobiles, electronics, and at-home and garden stores drove the decline. Personal consumption expenditure (PCE), the Fed’s preferred inflation measure, rose 0.3% MoM in March – unchanged from February and in line with consensus expectations. US gross domestic product (GDP) grew at a 1.1% YoY annualised pace in 1Q23, below consensus economists’ forecast of 2% YoY growth and 4Q22’s 2.6% YoY increase.

The three major US indices closed higher – the Dow rose 2.5% MoM (+2.9% YTD) – its best monthly performance since January, with the blue-chip S&P 500 recording its second consecutive month of gains – +1.5% MoM (+8.6% YTD). However, despite a significant bump on 27 April, as glowing earnings reports from Big Tech in the last week of April saw the Nasdaq Composite rally, the tech-heavy index ended April unchanged (+0.04% MoM/+16.8% YTD).

In Europe, Germany’s DAX ended the month in the green – +1.9% MoM (+14.4% YTD), while France’s CAC Index closed April 2.3% higher (+15.7% YTD). March euro area annual inflation printed lower at 6.9% vs February’s 8.5% YoY. Germany’s inflation rate, which had remained high in January and February (at 8.7% YoY [non-harmonised]), slowed in March to 7.4% YoY. However, food prices continued to soar in Germany – up 22.3% YoY, with the decline in the inflation rate driven by a slowdown in energy prices, which rose only 3.5% YoY (in March 2022, Russia’s invasion of Ukraine caused a massive spike in oil and gas prices). MoM, CPI advanced 0.8%. France’s annual inflation rate rose to 5.9% in April from 5.7% in March – above consensus expectations of 5.7%. MoM, CPI rose 0.6% in April. Meanwhile, eurozone GDP grew 0.1% QoQ in 1Q23, missing consensus forecasts of 0.2% growth, while YoY growth of 1.3% was also below expectations for 1.4%.

In the UK, the blue-chip FTSE-100 Index bounced 3.1% in April (+5.6% YTD) after March’s sell-off. UK inflation fell less than expected in March – slowing to 10.1% YoY vs February’s 10.4% YoY print, as food and non-alcoholic drinks prices accelerated 19.1% YoY (their fastest annual rate since 1977), fuelled by record price increases in the bread and cereals category.

Chinese markets were mixed, with Hong Kong’s Hang Seng Index dropping 2.5% MoM (+0.6% YTD), while the Shanghai Composite Index rose by 1.5% MoM (+7.6% YTD). On the economic data front, China’s factory activity unexpectedly fell in April – the official manufacturing purchasing managers index (PMI) came in at 49.2, down from March’s 51.9 print. In addition, the official non-manufacturing PMI, measuring business sentiment in the services and construction sectors, also declined to 56.4 in April vs March’s 58.2 print. The 50-point mark separates expansion from contraction.

Japan’s benchmark Nikkei rose 2.9% in April (+10.6%YTD). Japan’s annual CPI fell to 3.2% in March vs February’s 3.3% – the lowest inflation rate since September 2022. Core CPI (excluding the volatile fresh food category but including energy costs) rose 3.1% YoY in March vs February’s 3.1% increase. On 28 April, at its first meeting under new governor Kazuo Ueda, the Bank of Japan (BoJ) held its benchmark rate at a negative 0.1%. It signalled that the BoJ will continue to enact its quantitative easing and yield curve control policy for now.

In commodity prices, Brent crude oil had a volatile month. The oil price had seen a selloff in 1Q23, almost breaking below the US$70/bbl level, but a surprise production cut from OPEC+ at the beginning of April saw the price jump c. US$6/bbl before returning most of those gains as the impact of a possible economic downturn on demand weighed on the price. MoM, Brent crude was down 0.3%, and YTD, the price has dropped by 7.4%. Iron ore plummeted 12.4% in April (-4.2% YTD). Following March’s 7.8% MoM jump, a weaker dollar and higher commodity prices saw the gold price record its second consecutive monthly gain – +1.1% MoM (+9.1% YTD). The yellow metal reached a c. one-year peak of US$2,048.71/oz mid-month but ended April below the psychological US$2,000/oz at US$1,990/oz. The price of platinum shot up 8.3% MoM (+0.4% YTD) to close April at c. US$1,078.30/oz, also buoyed by a weaker US dollar, while palladium ended the month 2.9% higher (-15.9% YTD). Natural gas prices rose 8.8% MoM (-46.1% YTD), while thermal coal prices fell 1.3% MoM (-30.5% YTD).

South Africa’s (SA’s) FTSE JSE All Share Index recorded a 2.8% MoM gain (+7.1% YTD), while the FTSE JSE Capped SWIX rose by 3.4% MoM (+6.0% YTD). Gold counters and platinum group metal (PGM) stocks outperformed in April, buoyed by higher commodity prices, while SA-focused shares were patchy as ongoing loadshedding continued to weigh heavily on sentiment. The Resi-10 soared 4.2% MoM (-2.5% YTD), while the SA Listed Property Index advanced by 3.8% MoM (-1.7% YTD), and the Indi-25 rose 3.0% MoM (+17.4% YTD). The Fini-15 also gained ground (+1.3% MoM and +1.1%/YTD). Looking at the performances of the biggest shares on the JSE by market cap, the largest company on the exchange, BHP Group, lost 4.7% while Prosus (the second biggest listed share) was down 1.3% MoM. Naspers retreated c. 1.0% MoM. Anheuser Busch InBev, the third-largest listed company, rose 0.4% MoM. For the most part, the mining counters outperformed in April, with Gold Fields soaring by 19.9%, Anglo American Platinum (Amplats) jumping 13.6%, and Glencore rising by 5.7%. British American Tobacco gained 7.2% MoM. The rand weakened by 2.7% MoM against the US dollar, and YTD, the local unit is down 6.9%.

In SA economic data, March headline inflation, as measured by the consumer price index (CPI), rose slightly (its second consecutive upward surprise), coming in at 7.1% vs February’s 7.0% print. MoM, CPI rose 1.0% in March – its biggest monthly increase since July 2022 when it came in at 1.5%. Stubbornly high food price increases were again at the forefront of this latest increase, remaining upwardly sticky and contributing about one-third of the increase in the headline reading. Price growth in the food subcomponent rose at the quickest pace in fourteen years (+14.4% YoY), led by significant price increases for milk, eggs and cheese, and fruit and vegetables. Local retail trade sales shrank for a third consecutive month in February (-0.5% YoY) following January’s 0.8% YoY decline. MoM retail trade sales declined 0.1% in February, compared to a 1.5% MoM increase decline in January.

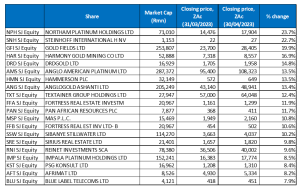

Figure 1: April 2023 20 best-performing shares, MoM % change

Source: Bloomberg, Anchor

Gold and platinum shares were big winners on the JSE in April, buoyed by stronger gold, platinum and palladium prices, a weaker US dollar, easing US headline inflation, gold’s status as a safe-haven asset and the softer rand. In a March report, the World Platinum Investment Council said platinum would be in a global deficit in 2023 after two successive years of significant surpluses. It has forecast a shortage of 556,000oz in 2023 due to the strong demand/supply imbalance.

Among the platinum miners, Northam Platinum (+23.7% MoM) was April’s best-performing share. At the beginning of April, Northam announced that it had terminated its offer for Royal Bafokeng Platinum (RBPlats). Northam’s share price jump suggests that the market backed the company’s decision to call off the deal as the RBPlats valuation looked increasingly expensive. PGM prices have declined since the offer was made – Northam’s initial R17bn cash offer was determined at materially higher PGM price levels in December. The deteriorating performance of RBPlat’s Styldrift operation was also a concern for Northam management.

Meanwhile, beleaguered Steinhoff was in second place with a 22.7% MoM gain, albeit from a very low base. Steinhoff’s European discount retailer, Pepco (Steinhoff owns a 79% stake in Pepco and the Dealz brands in Europe and Poundland in the UK), reported a 1H23 increase in sales as high inflation and interest-rate hikes impacted consumers’ disposable income, resulting in these customers shopping at Pepco because of its budget offerings. Pepco’s revenue rose 22.8% YoY to EUR2.84bn for the six months to the end of March, as it added 166 net new stores. Like-for-like (LfL) sales increased 8.5% YoY, with Pepco’s sales advancing 10.7% YoY and at Poundland by 5.7%.

After an impressive performance in March, when it gained 42.1% MoM, March’s best-performing share, Gold Fields, continued to gain ground coming in third in April with a 19.9% gain. It was followed by Harmony Gold (+16.9% MoM), DRDGold (+14.8% MoM) and Amplats (+13.5% MoM). Last month, Harmony said that it and its partner Newcrest Mining had signed a framework memorandum of understanding (MDD) with Papua New Guinea for the joint Wafi-Golpu projects. Harmony and Newcrest each own 50% of the project. Amplats reported a 13% YoY decline in its 1Q23 refined PGM output to 626,000oz from 718,500oz in 1Q22. Amplats blamed the decline on loadshedding and plant downtime. Although the company maintained its FY23 forecast for refined PGM production at 3.6mn-4mn oz, it warned that this was subject to power supply.

Rand-hedge, Hammerson PLC (+13.5% MoM), the UK and JSE-listed owner of retail centres in the UK, said in a trading statement last week that it had successfully focused on executing its 1Q23 strategy. According to its CEO, the company has “… a strong operational grip that is delivering top-line growth, with continued momentum in leasing and a strong pipeline. We have further reduced costs, with more to come as we create a sustainable and agile platform.” Hammerson’s LfL gross rental income grew 5% in 1Q23, reflecting good leasing, car parking and commercialisation performance, while net rental also rose 5%, as it benefitted from solid collections, lower bad debt charges and tenant incentive impairments. Footfall in the UK and France rose 6% YoY and 13% YoY in Ireland. The company also said there had been continued momentum in leasing, with 61 leases signed YTD, representing GBP9mn of rent on a 100% basis. The occupancy rate at its properties stood at 95%, while portfolio valuations were flat vs 31 December 2022.

Rounding out April’s best-performing shares was another gold miner, AngloGold Ashanti (+13.4% MoM), while Textainer rose 12.4% MoM, and Fortress Real Estate Investments gained 11.9% MoM. There was no company-specific news in the case of Textainer (which buys, sells and leases shipping containers) in April. However, Brookfield Infrastructure Partners announced its plan to acquire container leasing company Triton at a significantly higher valuation than it was trading at (for US$13.3bn or a 35% premium to its 12 April close), likely resulting in Textainer’s share price jumping on the back of that deal. Triton is one of the world’s largest suppliers of high-quality shipping containers, while Textainer is the world’s fifth-largest.

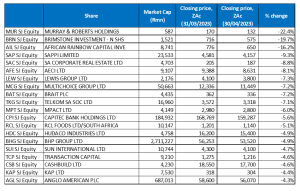

Figure 2: April 2023 20 worst-performing shares, MoM % change

Source: Bloomberg, Anchor

Specialist engineering Group Murray & Roberts was April’s worst-performing share, with its share price falling by 22.4% MoM. Last month Murray & Roberts concluded a deal to sell its 50% shareholding in the Bombela Concession Company (BCC) for R1.26bn – an essential step in reducing its R2bn debt. Its interest in BCC was sold to a wholly owned subsidiary of European toll and motorway developer and operator Intertoll International after shareholders voted in favour of the deal at a general meeting in February. The money will be used to cut its debt to R1.39bn, which should reduce Murray & Roberts’ annual interest costs by c. R95mn. In its 1H23 results, released in March, Murray & Roberts reported a net debt position of R2bn, but it also reported a healthy order book worth R16bn. The company said that it does not expect to declare a dividend this year, considering its debt levels. Murray & Roberts was followed by investment firm Brimstone in second place, with a 19.7% MoM decline and investment banking firm African Rainbow Capital Investments (ARC) in third spot, with a 16.2% MoM share price drop.

ARC was followed by Sappi, SA Corporate Real Estate and AECI, which recorded MoM losses of 9.3%, 8.8% and 8.1%, respectively. Sappi shares slumped after it said in April that the date for the completion of the suspensive conditions contained in the agreement to sell three of its European graphic paper mills to Aurelius had lapsed, and, therefore, the transaction would not proceed. The c. R5.4bn deal would have seen Sappi’s exposure to the struggling graphic paper market decline and helped the Group cut its debt.

Lewis Group (-7.3% MoM), Multichoice (-7.2% MoM), Brait Plc (-7.2% MoM), and Telkom SA (-7.1% MoM) rounded out April’s worst-performing shares.

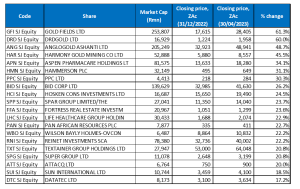

Figure 3: Top-20 best-performing shares, YTD

Source: Anchor, Bloomberg

Thirteen out of March’s top-20 YTD best-performing shares were again among the top-20 best performers for the year to the end of April, and with gold, platinum and real estate shares recording good gains in April, most of the new entrants (and the top performers) came from those segments of the market. Hammerson Plc, Fortress Real Estate, Life Healthcare, Pan African Resources, Reinet Investments, Textainer, and Attacq are the new entrants among the best YTD performers.

A bumper March and April performance from Gold Fields saw it take the coveted top spot with an astonishing YTD gain of 61.3%, pushing DRDGold (+60.0% YTD) from the top position and into the second spot. AngloGold Ashanti was the third best-performing share YTD with a gain of 48.7%.

AngloGold was followed by yet another gold producer Harmony (+45.5% YTD, discussed earlier), Aspen Pharmacare (+34.1% YTD) and REIT Hammerson Plc (+31.1% YTD, discussed earlier) in fifth place.

Cement company PPC Ltd, Bid Corp, and Hosken Consolidated Investments (HCI) saw their share prices jump by 30.3%, 26.2% and 24.5% YTD, respectively. After a phenomenal run in January and February, PPC’s share price continued its MoM decline in April (-2.7%) following its March FY23 operational update, which revealed that it expected cement sales volumes in SA and Botswana to fall by 4.0% to 7.0% YoY. Moreover, PPC said that the price increases in 2H23 have not kept pace with cost inflation, and it expects the margins for its SA and Botswana Cement business to decline by 9.0% and 11.0%, respectively, for the full year, from 14.5% reported for FY22.

Retailer Spar Group rounded out the YTD top 10 performers. Although JSE-listed retailers have generally underperformed YTD amid high inflation, rising rates, and a weak local currency which has impacted consumer sentiment, Spar has outperformed its peers, albeit from a very low base (the share price dropped 32.1% in 2022) with a YTD gain of 23.7%.

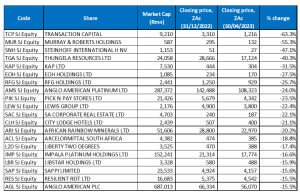

Figure 4: Bottom-20 worst-performing shares, YTD

Source: Anchor, Bloomberg

Among the YTD worst-performing shares, 16 of the 20 shares for the year to end April were also among the 20 worst-performers for the year to the end of March. Libstar (-15.9% YTD), Sappi (-15.6% YTD, discussed earlier), Resilient REIT (-15.5% YTD), and Anglo American Plc (also down 15.5% YTD) were the new entrants.

Following its 59.1% drop in March, Transaction Capital’s share price shed another 4.6% in April, pushing its YTD loss to a massive 63.3% – the worst-performing share YTD. Transaction Capital was followed by Murray & Roberts (-55.3% YTD, discussed earlier), switching places with March’s second-place occupier, Steinhoff, which moved into the third spot after recording a gain of 22.7% in April (discussed earlier).

Coal exporter Thungela Resources, Kap Ltd, EOH Holdings, and Rhodes Foods Group (RFG Holdings) recorded YTD share price declines of 40.3%, 31.5%, 27.5%, and 25.7%, respectively. We note that on a total return basis, Thungela is only down 25.9%– the share has been trading on a dividend yield of c. 50% in April (a final dividend of R40/share was declared for FY22. Meanwhile, EOH (-2.3% MoM in April) said in a recent earnings statement for the six months ending 31 January that the mining, manufacturing and financial services sectors led the pack regarding new contracts with the Group. EOH, which recently raised R600mn from shareholders (including R100mn via a broad-based BEE deal), has signed deals valued at R1.2bn as it expands its operations c. four years after its current management team took over the troubled business.

Amplats (-24.0%), Pick n Pay (-23.5%), and Lewis Group (-22.4%) rounded out the worst performers YTD. Amplats’ share price has been on a downward trajectory since January, and a good performance in April (+13.5% MoM) was not enough to pull it out of the YTD worst-performing shares list. Early last month, Pick n Pay warned shareholders that its FY23 profit might fall by as much as 18% YoY. The group said headline EPS for the year ended February will likely fall by 12% to 18% YoY. It added that Eskom’s power cuts continue to put pressure on its earnings.

At Anchor, our clients come first. Our dedicated Anchor team of investment professionals are experts in devising investment strategies and generating financial wealth for our clients by offering a broad range of local and global investment solutions and structures to build your financial portfolio. These investment solutions also include asset management, access to hedge funds, personal share portfolios, unit trusts, and pension fund products. In addition, our skillset provides our clients with access to various local and global investment solutions. Please provide your contact details here, and one of our trusted financial advisors will contact you.