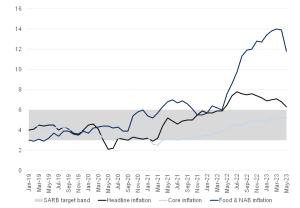

South Africa’s local inflation in 2023

Positively, South Africa’s (SA) headline CPI eased by more than expected in May, printing at 6.3% YoY from 6.8 YoY in April as last year’s fuel price increases fell out of the base. Importantly, food and non-alcoholic beverages, one of the key upward drivers of inflation over the previous few months, came in significantly lower than expected – at 11.8% YoY for May vs April’s 13.9% YoY print. This latest decrease in local food prices is driven by the strong base effect created by the 2.1% MoM jump in prices last May and the continued moderation in global food prices. The FAO Global Food Price Index (FFPI), which measures the monthly change in the international prices of a basket of food commodities, declined by 2.6% MoM in May 2023, marking the fourteenth consecutive monthly decline since reaching its peak in March 2022. The index has fallen by as much as 22.1% from this all-time high. However, this moderation in global food prices is taking longer to filter through to the local market, as SA’s rand depreciation has offset much of this global decline.

At the same time, persistently high levels of loadshedding have added significant costs across the agriculture and food value chain. Regardless, local markets have cheered this latest moderation in the inflation numbers, with the rand and the local bond market marginally stronger off the back of the announcement. The rand has given a very impressive performance in June, completely reversing the significant losses witnessed back in May and even making back a little more ground. The local currency has recovered more than R1.50 against the greenback in a colossal monthly move – even by the rand’s standards. Whilst it is difficult to foresee any further strengthening from current levels, any further appreciation would naturally significantly impact the inflation outlook for the better. This, in turn, will encourage investors back to SA bonds.

Figure 1: SA inflation, YoY % change

Source: StatsSA, Anchor

Looking ahead, while inflation is beginning to show clear signs of abating, it is still hovering above the SA Reserve Bank’s (SARB) target band of 3%-6%, and food price inflation is still in the double digits. In addition, SA’s energy crisis, which has worsened this year, is weighing heavily on the country’s already strained economy, presenting more inflationary risks.

At Anchor, our clients come first. Our dedicated Anchor team of investment professionals are experts in devising investment strategies and generating financial wealth for our clients by offering a broad range of local and global investment solutions and structures to build your financial portfolio. These investment solutions also include asset management, access to hedge funds, personal share portfolios, unit trusts, and pension fund products. In addition, our skillset provides our clients with access to various local and global investment solutions. Please provide your contact details here, and one of our trusted financial advisors will contact you.