Budget for 2023

National Treasury’s (NT’s) 2023/2024 Budget, tabled in Parliament on Wednesday (22 February) by South Africa’s (SA’s) Minister of Finance Enoch Godongwana, turned out to be a reasonably neutral affair followed by a somewhat positive, albeit slightly muted, market reaction. Overall, the primary fiscal intent is unchanged, and the 2023 budget reiterates the government’s commitment to debt stabilisation via fiscal consolidation.

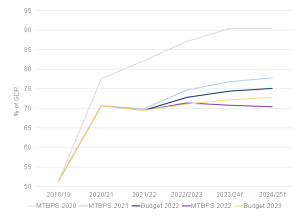

The latest fiscal forecasts matched general expectations – specifically, government debt is now forecast to peak at around 73.6% of GDP, with the higher peak mainly owing to R254bn of relief for Eskom. Whilst the debt relief arrangement for Eskom may seem a significant move at first (and it is, by no means, a small number), in the NT’s own words, it is simply a ‘balance sheet transaction’. As such, it does nothing to actually assist in rectifying the deep structural issues that plague the state-owned entity (SOE). The new FY22/23 budget deficit is forecast to be slightly smaller, mainly owing to more (persistent) underspending and the additional diesel spending by Eskom pledged in the State of the Nation Address (SoNA) not being funded by the fiscus, as well as a small revenue overrun. Overall, however, SA’s public debt remains high. Debt-service costs will rise from R307.2bn in 2022/2023 to R397.1bn in 2025/2026. The continuing rise in the cost of servicing debt underscores the importance of ensuring that the gap between government spending and revenues does not expand.

Read more about Anchor Capitals Budget Wishlist here.

Figure 1: SA government debt forecasts

Source: National Treasury, Anchor Capital

The Economic Forecast

NT’s new economic growth forecasts may err on the side of optimism – for example, NT forecasts economic growth of 0.9% for 2023, whilst we believe that the SA Reserve Bank’s (SARB’s) latest estimate of 0.3% growth is more realistic. On balance, however, while the risks from the macroeconomic backdrop persist, the budget has reduced the fiscal uncertainty that still prevailed after the October 2022 Medium-Term Budget Policy Statement (MTBPS).

It was interesting to note the minister’s mention of the upcoming potential greylisting announcement and his announcement of the allocation of R14bn over the medium term to fight crime and corruption. This appeared to be a last-ditch attempt to extend the grace period before the formal announcement – unfortunately, this is likely a case of too little, too late. Our baseline view remains that SA will likely be greylisted, although there is a slight risk that we can get a reprieve for another year. While the government has made efforts to pass the required legislation, the lack of implementation will weigh heavily on the outlook.

Overall, the 2023 Budget installed a sense of policy continuity in difficult fiscal and socio-economic times for the country, which, in turn, will be viewed positively by financial markets. In instances such as these, no ‘bad news’ is, in fact, good news. Nonetheless, investors will naturally remain concerned about the numerous downside risks to SA’s economic growth trajectory amidst record loadshedding, a less supportive global economic backdrop, and an upside risk to spending on social grants, wages and SOE support.

At Anchor, our clients come first. Our dedicated Anchor team of investment professionals are experts in devising investment strategies and generating financial wealth for our clients by offering a broad range of local and global investment solutions and structures to build your financial portfolio. These investment solutions also include asset management, access to hedge funds, personal share portfolios, unit trusts, and pension fund products. In addition, our skillset provides our clients with access to various local and global investment solutions. Please provide your contact details here, and one of our trusted financial advisors will contact you.