President Cyril Ramaphosa won the December 2017 ANC Nasrec Elective Conference in a tightly fought battle. The markets celebrated his triumph and festivities ensued (a period of so-called Ramaphoria). However, six months later it became apparent that all was not well and that the Game of Thrones was not over when Ramaphosa ascended to the Iron Throne. We waited in anticipation as he unseated the incumbent President Jacob Zuma for the seat of power but, alas, Ramaphosa’s own Game of Thrones was just beginning. The next season involved us waiting with bated breath for the May general election where 57.5% of South Africans gave Ramaphosa a mandate. Still, it was not over, the next cliffhanger was the anticipation of a reduced and untainted cabinet, which a battle-weary president announced last week. The events of the past few days have made it clear that the war for the Iron Throne is only beginning and that the next season promises to be even more riveting than the last.

ANC Secretary-General Ace Magashule used his two-hour press briefing post the ANC Lekgotla this week to set the tone for the upcoming season. First, he made it clear that he had cushy and attractive deployment opportunities available for those cadres, tainted by the stench of corruption, who weren’t appointed to Cabinet. As they say, the devil looks after his own. This was also a clear show of power by Magashule for those who have been calling him weak. He then set the president the impossible task of reducing unemployment from 27% to 14% in the next 5 years and, as a coup de grâce, opened the Pandora ’s box of the SA Reserve Bank’s (SARB’s) mandate. This was the clearest indication yet of a factional fight-back strategy. Ramaphosa ran his campaign on an economic recovery ticket. If his westernised, neo-liberal strategies to turn around the economy do not work, then clearly the only solution is radical economic transformation (effectively a pseudonym for state-sanctioned theft). Magashula has weaponised the SA economy – he needs it to languish. To tilt the odds in his favour, a little policy uncertainty, some rand weakness and stoking socialist fires are extremely useful. The SARB was his perfect pawn.

The Game of Thrones never has only one plotline, but is an amalgamation of many. The Public Protector, Busisiwe Mkhwebane, is the next weapon in the fight-back strategy. It is no mere coincidence that she issued a finding against Minister of Public Enterprises Pravin Gordhan days prior to the Cabinet announcement. Similarly, it is no coincidence that she is working hammer and tongs on a finding against Ramaphosa for the Bosasa donation to his campaign. We cannot think of a single material finding of hers that has stood up to the scrutiny of SA’s courts. But logic, law and common sense won’t hold our Public Protector back from finding against Ramaphosa and setting up a situation where he has to fight in court to retain the presidency. Will an adverse finding from the Public Protector be enough to unseat Ramaphosa? Probably not. Nevertheless, he will have a black mark against his name and, in the unlikely event of an adverse finding by a court, his ability to remain in office will be severely impaired.

All is not lost, however, and Ramaphosa has his own weapons and tools for the coming showdown. This season of the Game of Thrones promises to be the most thrilling yet. Alas, while politicians make plans and play games, the common folk are jobless, go hungry, suffer and even die. Such is the Game of Thrones.

The rand and bond markets are now coming to the realisation that the fight for the soul of SA has only just begun. We remain of the view that talk is cheap, and action is both painful and difficult. We avoided a downgrade from Moody’s by promising to cut staff costs at both state-owned enterprises (SOEs) and at a government level. This is easier said than done. The SA Federation of Trade Unions (SAFTU) recently expressed its outrage at the suggestion of putting government employees over the age of 55 on early retirement. We expect some progress from the government on this, but we are realistic about the prospects of success and we remain of the view that a ratings downgrade towards year-end is plausible.

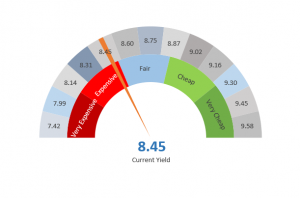

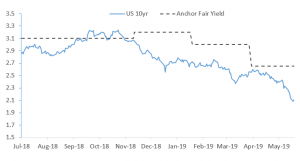

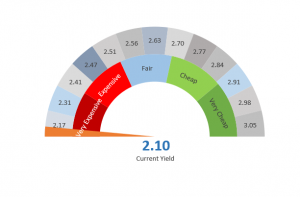

Domestic bonds have weakened to 8.50% Thursday morning (6 June) as markets digest the political and economic landscape we face. SA bonds would be far weaker, were it not for the particularly forgiving environment that is being created by US President Donald Trump’s trade war. US bond yields have pushed to yields far lower than we had anticipated. We don’t want to take strong positions one way or the other in the current environment and we would rather sit very neutrally positioned as this all plays out.

Figure 1: Anchor SA benchmark bond yield

Source: Anchor, Reuters

Figure 2: SA bond yield – Anchor view

Source: Anchor, Reuters

Figure 3: Anchor US bond yield monitoring

Source: Anchor, Reuters

Figure 4: US bond yield – Anchor view

Source: Anchor, Reuters