I would describe 2022 as learning how to surf for the first time. But then, just when you think you are getting the hang of it, you get knocked down and realise that the ocean (markets) can be unpredictable, and every wave you try to catch has an unknown element – volatility.

It has been difficult for investors to navigate markets in 2022 and 1Q23. Last year was probably the hardest to navigate, but it is getting easier in 2023 to see past high-interest rates and earnings downsides for companies. Over the last few years, clients with offshore, long-only equity exposure have had a challenging ride. Depending on when an investor got into the market or started to deploy their capital offshore, such an investor probably experienced a volatile journey – going from all-time highs during the COVID-19 pandemic to all of their profits being wiped out in 2022.

Nobody thought that the Fed and other countries’ central banks would be hiking interest rates as high and fast as they did, leading to company valuations declining substantially from their 2021 highs. At the beginning of 2022, market consensus forecasts only expected US interest rates to increase by 2%. Still, we are now at over 5% and possibly expecting further rate hikes in the next 6-12 months. Nevertheless, economies are holding up at these high-interest rate levels, indicating that rates will stay higher for longer. This is not great news for share prices or clients investing in equities, as valuations are impacted by higher rates, especially those high-growth and tech companies in which Anchor likes to invest.

What does that mean for clients moving forward?

As a wealth manager, the last year has been very uncomfortable dealing with market volatility and ensuring our clients have the correct risk profile and asset allocation. The hardest part for me has been keeping clients calm during incredible fluctuations in global markets, which affects client portfolios, and ensuring that we decrease clients’ risk to generate returns during this period. As a result, I have driven our portfolio managers and macroeconomic teams up the wall over the past 12 months, asking for guidance. After every conversation where I would be trying to take some risk off the table for clients, we would end up discussing each client’s overall asset allocation. The conclusion would be that nine out of ten clients are sufficiently diversified in terms of their overall asset allocation.

However, I have still not been satisfied just holding long-only equities during this period, and, as a business, we have been identifying ways in which we can generate returns and de-risk our clients during these volatile periods while still having the correct equity exposure as not to miss out when sentiment starts to change (no one knows when this will happen). I have a responsibility towards my clients to find further diversification within the asset classes to generate returns during volatile periods while also being aware that market sentiment can change and that we should be taking advantage of the good months during the next 6-12 months.

So, what has Anchor done to diversify clients within the various asset classes? We have identified hedge funds that perform during times of volatility in both local and offshore equities that play on different macroeconomic themes. Alternatives in private equity/credit that are generating a steady yield locally of 13%-14% p.a. and an offshore yield of 9% p.a. as well as structured products which, depending on your level of risk, generate a 10%-12% p.a. return while having capital protection barriers at different levels.

These are great diversifiers because they generate equity-type returns in a very volatile market environment with downside protection. This does not mean we should take all the equity risk off the table and only invest in alternatives, but rather that we are diversifying each asset class. Let us take January as an example of when market sentiment changed to positive. Markets were up anywhere between 5%-10% in January alone. If you miss these positive months, it can severely impact your long-term overall portfolio performance. In Figure 1, Bank of America highlights the impact of missing the US market’s best and worst days in each decade.

Markets are going to be choppy over the next 12 months. Your asset allocation and diversification within various asset classes are going to be very important when markets start to recover (no one knows when this will take place and what else may happen during this journey, in March, we have already seen a banking mini-crisis in the US and a crisis of confidence in Swiss bank Credit Suisse- see our report entitled, The excess deposits banking mini-crisis, dated 16 March 2023). I cannot predict what will happen next in markets, but as wealth managers, we can most certainly de-risk clients where appropriate within the various asset classes and, by doing so, try to prevent their portfolios from being very volatile, instead only having portions of volatility within the various asset classes. Whether it is in your portfolio’s fixed income or equity portion will depend on your appetite for risk and volatility.

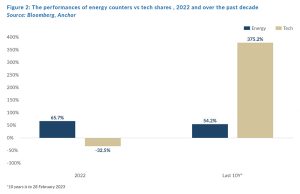

We are constantly looking for opportunities to achieve better returns for our clients or themes that can generate better returns in the future. Tech shares have been hit hardest during the past year’s volatility while the share prices of energy companies have been soaring. Market cycles repeat themselves, and we believe in upweighting into good tech companies with growth prospects. These companies will have their turn to shine again; this is one theme we are starting to upweight in our portfolios.

Conclusion

We cannot predict the future. All we can do is manage to catch the wave and ride it for as long as we can, knowing that there is still some volatility ahead this year. We can also diversify across various asset classes and de-risk where appropriate to limit volatility within a client’s portfolio.

Interest rates are higher now, allowing us to take some risk off the table and still generate a good return without the volatility of holding equities. Alternative investments have been a great diversification within the fixed-income space, generating equity-type returns in a low- to medium-risk profile. Equities have been very volatile, but the SA market has performed well over the past year. However, over the past 5-6 years, the JSE has not performed as well, and investors would likely be disappointed with their overall returns over that period. Over this period, hedge funds have performed consistently and are a great way to diversify your portfolio. In addition, hedge funds love the market volatility we have been experiencing, and we recommend that you have an allocation in this asset class. Offshore equities performed well over the past 5-6 years, but 2022 was incredibly volatile, and we have diversified clients into hedge funds, structured products and alternatives. This type of diversification in a highly volatile market environment allows us to de-risk the asset class and generate some returns while holding equities for when market sentiment does turn.

As Bette Davis said in the movie All About Eve, “Fasten your seat belts, it’s gonna be a bumpy ride”, and that is why it is important to diversify within asset classes and take some risk on themes!

At Anchor, our clients come first. Our dedicated Anchor team of investment professionals are experts in devising investment strategies and generating financial wealth for our clients by offering a broad range of local and global investment solutions and structures to build your financial portfolio. These investment solutions also include asset management, access to hedge funds, personal share portfolios, unit trusts, and pension fund products. In addition, our skillset provides our clients with access to various local and global investment solutions. Please provide your contact details here, and one of our trusted financial advisors will contact you.