Anchor’s Rand View

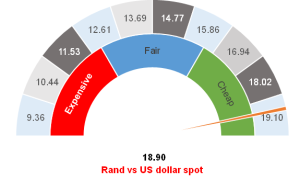

Figure 1: Rand vs the US dollar

Source: Anchor

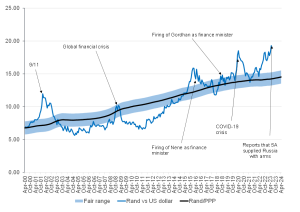

The rand has massively underperformed over the past week, breaching the psychological R19.00/US$1 level on Thursday (11 May). Even on a YTD and one-year basis, the local currency’s performance has been disappointing.

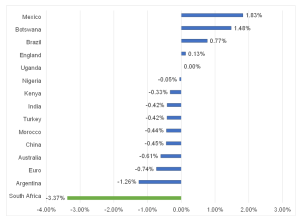

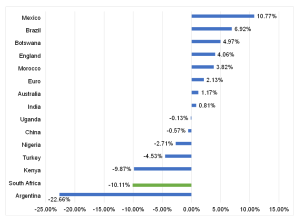

We note that rand weakness is occurring when global interest rate hikes are slowing, and the US dollar is losing some ground. The rand is weakening against all the major currencies (the UK pound, the euro, the Japanese yen, etc.) and its emerging market (EM) peers like the Brazilian real. So, this is clearly more of a South African (SA) story than a global story.

Figure 2: Select countries’ currency movements vs the US dollar, one-week performance (to 11 May 2023)

Source: Anchor, Thomson Reuters

Figure 3: Select countries’ currency movements vs the US dollar, YTD performance (to 11 May 2023)

Source: Anchor, Thomson Reuters

One’s inclination is to look for the bad news that has sparked this sell-off. But, perplexingly, no new information warrants the reaction we have seen. More to the point, in our view, it is the weight of several missteps at the government level that are putting the currency in the doldrums. Eskom remains a weighty issue as the SA economy sits in the dark and politicians fight to maintain turf and the status quo. In addition, SA’s greylisting was a clear own goal and should be considered an embarrassment. Playing war games with the Russian navy and inviting Russian President Vladimir Putin to the BRICS summit in August (despite an International Criminal Court [ICC] arrest warrant, SA is a signatory to the ICC) was always likely to alienate the country’s trade partners and investors. To make matters worse, according to media reports on Thursday the US ambassador to SA Reuben Brigety, has accused SA of giving weapons to Russia, adding that his government believed that SA was not non-aligned when it came to Russia’s war on Ukraine. This is likely to have dire consequences for SA, which could lose its African Growth and Opportunity Act (AGOA) preferential duty-free market access to the US. Added to this mix, we have slumping economic growth, and the announcement that the National Treasury will miss its objective of achieving a primary surplus which would worry any investor. A parliamentary inquiry into Eskom and the corruption allegations at the utility also show the significant failings of the police with limited to no consequences for those in charge. The government has also missed its wage agreement target, settling on something less affordable. Finally, SA is headed into an election in 2024, and the ruling party will likely prove to be spendthrift either to placate voters with grants or to burn diesel in the hopes of keeping the lights on around the time of the election. The list goes on, but the point is that we do not know which of these factors is currently weighing on the rand. The reality is that as a foreign investor looking at this, you are likely to put SA at the bottom of your list of desirable investment destinations.

We have been through a period of global risk aversion, and fund managers have been cutting back on risk. If you look at the facts, SA is probably one of the first investment destinations on which a fund manager will cut back. Outflows from global funds are used as an opportunity to underweight SA. For as long as investors remain risk averse towards EMs, we will be under pressure as an investment destination. We have seen the rand trade to R19.00/US$1, which screens as cheap against any fair-value measure.

The sell-off in the local unit has been prompted by market participants taking an underweight stance and even a short position against SA. These things tend to snap back when they correct, and stronger moves in the rand are certainly plausible when investors close out their short positions. Nevertheless, it is clear that the rand is oversold, though weak fundamentals will keep the local currency oversold and on the back foot for a while to come. Indeed, it is plausible that the rand will again test the COVID-19 lows of R19.30/US$1, but we maintain our view that the rand will likely end the year at c. R17.00/US$1, though more negativity is possible in the short term.

The unfortunate implication of the weaker rand is that it will force the South African Reserve Bank’s (SARB) hand on 25 May when the Monetary Policy Committee (MPC) meets to decide on interest rates. We were previously expecting an interest rate hike, and ominously a rate hike of 0.50% is now looking like a realistic outcome. Financial markets are already pricing this (and even more) in, so we expect limited market impact. Instead, we believe this is a case of the risk premium investors demand for SA increasing to reflect the circumstances on the ground. In the longer run, the remedy is that the country addresses the structural shortcomings in electricity supply and other state services. Private investment in solar and other renewable energy is accelerating as the private sector steps in to fill the void left by the government. A continuation of current trends should see the outlook improve over time.

Figure 4: Actual rand/US$ vs rand PPP model

Source: Thomson Reuters, Anchor

At Anchor, our clients come first. Our dedicated Anchor team of investment professionals are experts in devising investment strategies and generating financial wealth for our clients by offering a broad range of local and global investment solutions and structures to build your financial portfolio. These investment solutions also include asset management, access to hedge funds, personal share portfolios, unit trusts, and pension fund products. In addition, our skillset provides our clients with access to various local and global investment solutions. Please provide your contact details here, and one of our trusted financial advisors will contact you.