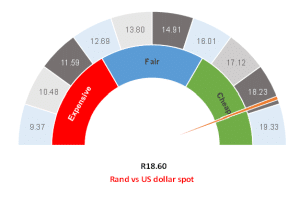

Figure 1: Rand vs the US dollar

Source: Anchor

It was all going swimmingly. Stage-4 loadshedding is a far cry from stage 8 and the total grid failure that people feared. There is increasing evidence that further capacity will be added to the grid. Russia’s President Vladimir Putin was disinvited to this month’s BRICS summit, taking place in South Africa (SA), and the US Trade and Development Agency (USTDA) awarded Eskom with a grant to fund technical assistance, implying that the relationship between the US and SA is salvageable. In addition, we were of the view that the US Federal Reserve (Fed) has probably reached the end of its rate-hiking cycle as US inflation recedes. All summed up; this is a rather supportive environment for the rand.

However, against this backdrop, the local unit has fallen out of bed over the last few days, moving sharply lower from around R17.60/US$1 toward R18.50/US$1 and beyond. Anchor’s view remains that the rand will most likely bobble along at around R17.50 to R18.50/US$1 with a slight strengthening bias, as outlined in The Navigator: Anchor’s Strategy and Asset Allocation, 3Q23 released on 13 July. If you want to externalise some cash, then R17.50/US$1 is a good level.

Unfortunately, global markets have hit a risk-off environment. Perhaps US equities had gotten ahead of themselves, or maybe China’s continued disappointing economic data was too much for investors to bear. In addition, a US credit downgrade would always be bad for risk sentiment. On 1 August, rating agency Fitch downgraded the country’s rating from AAA to AA+, citing fiscal deterioration over the next three years and repeated last-minute debt ceiling negotiations, which threaten the US government’s ability to pay its bills, as major reasons. Fitch is the second major rating agency after Standard & Poor’s to take away the US triple-A credit rating. A strong US economy based on GDP and jobs data has traders speculating that we might see another rate hike in September. It is difficult to pinpoint what sparked the risk-off shift; however, while this sentiment persists, the rand will remain on the back foot.

We do not think the risk-off sentiment or the movement in the local currency is justified on fundamentals, and we are looking to take advantage of this. The rand is a few cents cheaper than the top-end of our range. Local bonds are also weaker but close to their ranges. The movements have not been strong enough for us to act as yet. We are waiting for the rand to fall to R19.00/US$1 before accumulating risk assets for our portfolios. From the fixed-income side, risk assets are cheaper but not cheap enough to justify significant changes to our portfolios.

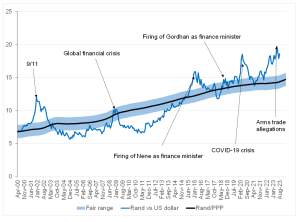

Looking at the purchasing power parity (PPP) chart (Figure 2 below), the rand is still cheaper than its fair value and with good reason. We do not expect to close this gap any time soon. Instead, we believe that the rand has moved from the bottom of our 2022 fair range to just outside the top. This is quite normal for the local unit during periods of risk-off sentiment. If you want to externalise cash, we recommend not rushing to do so at current levels. Rather wait out the risk-off storm. We maintain that the local currency will likely bounce between R17.50 and R18.50/US$1 for much of the next year, with a slight strengthening bias.

Figure 2: Actual rand/US$ vs rand PPP model

Source: Thomson Reuters, Anchor

At Anchor, our clients come first. Our dedicated Anchor team of investment professionals are experts in devising investment strategies and generating financial wealth for our clients by offering a broad range of local and global investment solutions and structures to build your financial portfolio. These investment solutions also include asset management, access to hedge funds, personal share portfolios, unit trusts, and pension fund products. In addition, our skillset provides our clients with access to various local and global investment solutions. Please provide your contact details here, and one of our trusted financial advisors will contact you.