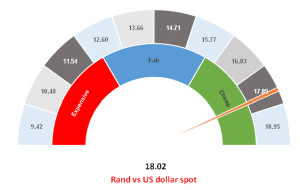

Figure 1: Rand vs US dollar

Source: Anchor Capital

The Electricity Crisis And Its Effect On The Rand

We are a mere 47 days into 2023, and the rand has already traded down to R16.75/US$1 before a rapid depreciation of the local unit saw it touch R18.10/US$1 on 13 February. The currency had been more volatile than we expected this year, underperforming its peers. This weakness arises as domestic and foreign factors turn negative for the local currency.

Domestically, it is pretty evident that the government’s failures are weighing on the rand. State-owned enterprises (SOEs) are a significant drag on our economy and the currency. Eskom is front and centre of the rot, while Transnet and other parastatals are also rapidly deteriorating. Unfortunately, President Cyril Ramaphosa’s State of the Nation Address (SONA) on 9 February did little to convince anyone that there are meaningful plans to stem the decay. The market has also been unsettled by the SONA announcements of permanent grants and probable grant increases at a time when the South African Revenue Service (SARS) Commissioner Edward Kieswetter is saying that tax collection will likely be lower in 2023. The president also announced plans for a new minister of electricity and gazetted a state of emergency to enable the government to circumvent its own rules to procure power faster.

Local news website, Business Insider, is tracking all the actions that the government has taken to address the energy crisis under its new state of emergency powers (click here for a complete list of everything the government has done since declaring electricity a disaster). As of 16 February, the list is blank. In the first week following the declaration of a state of emergency, the government has yet to do anything. Domestically, the economy and the rand and bonds will remain under pressure for a while longer.

Looking Offshore?

Looking offshore, the broad expectation is that US interest rate hikes will slow and eventually come to a stop. Markets have been pricing in rate cuts toward the end of 2023. This optimistic outlook was given impetus when the January jobs report showed that the US created just over 520,000 jobs – well over the 125,000 or so jobs forecast. Nevertheless, the US labour market remains tighter than the Federal Reserve (Fed) would like. Robust retail sales data have also called the narrative of a possible US recession into question. Clearly, the US economy is withstanding the higher interest rates better than expected. Things are moving in the right direction. Inflation is lower than six months ago, job openings are down, wage inflation has slowed, and the housing market is cooling. It is just that we are getting there slower than many expected. This likely means that there will be another two rate hikes of 0.25% in the US this year and that interest rates will need to remain higher for much longer than markets had expected. Quite plausibly, well into 2024, and as markets adjust to this reality, we see a stronger dollar and a weaker rand.

While the strong US dollar has dominated headlines for the past fortnight, things are moving in the right direction, and we expect that the dollar will give up some of its gains later this year. This creates a more favourable environment for the rand. However, much depends on the National Budget to be tabled in Parliament on 22 February and what the government eventually does with its newly established powers under the National State of Emergency. As things stand, the dollar is probably slightly overbought, and the rand is a little oversold. While the aforementioned storm clouds continue to circle, we anticipate the rand will hover around its current levels. Nevertheless, bad news on either front could quite easily see the currency move above R18.25/US$1 once again.

Read more about the state of the US Economy here.

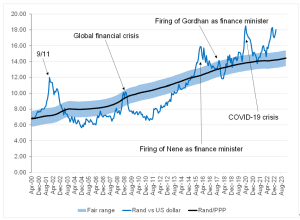

Longer term, we believe that the government will do something about the energy crisis and that the greenback should give up some of its gains. The rand is currently trading well above its fair band, and historically, each time it has done so, it has come back over time. This might well be the case again. Still, there are good reasons to believe that the local unit will remain weaker for longer, and we maintain our view that the rand will only partially recover this year. As a result, we continue to view R16.50/US$1 as a reasonable target for the end of 2023, but unfortunately, the risks are growing, that the outcome may be weaker than we project.

Figure 2: Actual rand/US$ vs rand PPP model

Source: Thomson Reuters, Anchor Capital

At Anchor, our clients come first. Our dedicated Anchor team of investment professionals are experts in devising investment strategies and generating financial wealth for our clients by offering a broad range of local and global investment solutions and structures to build your financial portfolio. These investment solutions also include asset management, access to hedge funds, personal share portfolios, unit trusts, and pension fund products. In addition, our skillset provides our clients with access to various local and global investment solutions. Please provide your contact details here, and one of our trusted financial advisors will contact you.