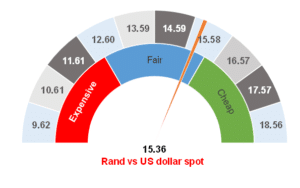

Figure 1: Rand vs US dollar

Source: Anchor

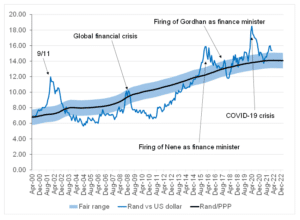

At the time we published The Navigator: Strategy and asset allocation report, 1Q22 on 16 January 2022, the rand was at R16.00/US$1. Our view, at the time, was that the rand would appreciate slightly against the greenback and probably hover just weaker than R15.00/US$1 for much of 1Q22. This view was based on the terms of trade remaining favourable and on a gradual, but protracted, rate-hiking cycle both in South Africa (SA) and in the US. Uncharacteristically, the rand behaved and did what we were expecting. A well-behaved currency made it unnecessary to update our rand views. However, with Russia’s invasion of Ukraine, much has changed. We have written about the minor trade and investment linkages between the local economy and the economies of Russia and Ukraine and the direct impact on SA is negligible (see our noted entitled Russia’s invasion of Ukraine: How will it impact the SA economy?, dated 8 March 2022).

Instead, we are faced with impacts from other avenues which include:

- Higher commodity prices, which are a double-edged sword for SA. SA’s precious metal export basket is very similar to that of Russia. Higher prices for our exports are positive for our terms of trade and for National Treasury (NT) that stands to benefit from greater tax receipts. This means that in the short term, these events will help SA bring its debt problem under control.

- However, higher commodity prices also mean that SA will pay more for the oil that we import, which is detrimental to our trade balance (although on a net basis, we think that the trade balance is more positive overall). It is also negative for local consumers, who will see the petrol price spike to around R23.00/litre in April and the risk is that oil prices rise even more.

- We expect that there will be global food price inflation although SA is somewhat insulated from this by its own production. Nevertheless, we will not be immune to the global environment and food will cost more.

- Higher prices are inflationary, and we now expect that inflation, as measured by the consumer price index (CPI), will be just over 6% for the year, while core CPI, which excludes volatile items such as food and non-alcoholic beverages, fuel, and energy, will be closer to 5.00% for the year. We believe that the SA Reserve Bank (SARB) will be under pressure to act, and we now think that it is a coin toss between a 0.25% rate hike and a 0.50% rate hike at the SARB Monetary Policy Committee’s (MPC’s) meeting on 24 March. Either way, we think that interest rates will be 1.25% higher by the end of 2022 and a further 0.75% higher the following year.

- Sentiment towards emerging markets (EMs) has turned significantly negative and we have seen the first waves of exchange-traded fund (ETF) selling, which is indiscriminate and is not price sensitive. We have learnt through the COVID-19 crisis of 2020 that such selling can cause a dislocation in markets, where sheer volumes overwhelm fundamentals, causing market pricing to become irrational. The last time it happened, this provided the astute investor with significant opportunities in bond markets. We expect less ETF selling this time around and we also believe that the SARB will act on its learnings from the COVID-19 crisis and act sooner than it did in 2020. Still, there is a possibility of significant market dislocation with painful paper losses. We expect that this will present an uncomfortable buying opportunity.

- A significant source of commodities (Russia) has been taken out of the market and prices will remain high, while the world adjusts. We expect that this adjustment might take a while to work itself out, meaning that the recovery might prove to be slower, and longer, than the previous one.

Looking at the rand, we are somewhat surprised that it has been so impervious to the negative EM sentiment and to bond outflows. For now, there is differentiation in the currency market between countries that are directly exposed to the conflict and those that are removed. We have seen the currencies of other commodity producing countries also hold up well. Our assessment is that if this escalates, then there is a point where all EM currencies will behave similarly, and the rand will capitulate. For now, the nature of our export basket, high interest rates, and limited contagion mean that we are being treated as one of the ‘good’ currencies to own.

We have adjusted our fair yields for bonds by c. 0.25% to 0.40% higher than they were previously. What this means is that we continue to think that bonds are cheap, even adjusted for the ‘new world’. We expect that bonds will bounce back from their recent sell-off once ETF selling dissipates. Unfortunately, we are in a position where we expect that the Anchor BCI Bond Fund and the Anchor BCI Flexible Income Fund will report losses this month, although it is too early in the month to guide as to the likely final outcomes.

We are watching the pace of ETF flows (which seem slower over the past 48 hours or so) and the oil price for short-term direction on how the market is likely to behave. Longer-term, it is going to be about keeping our inflation in check and making the most of the higher prices for the commodities that SA is producing. We have bought a few US dollars in our portfolios as a hedge. Our base case is that the rand will continue to confound by remaining strong, however, it makes sense to sell a small portion of rand for US dollars below R15.30/US$1, just in case our assertions are wrong.

Figure 2: Actual rand/US$ vs rand PPP model

Source: Thomson Reuters, Anchor