Anchor Rand view

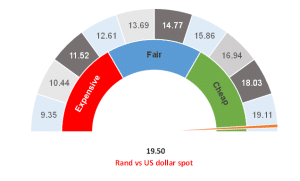

Figure 1: Rand vs the US dollar

Source: Anchor

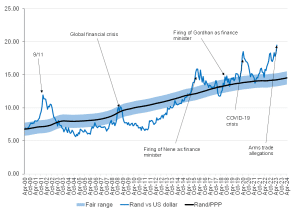

This past week has been a horrible time for investors to own most South African (SA) assets. Years of mismanagement of our state resources, economic policies that erode growth and short-sighted foreign policy have converged as a crisis for the rand and the country. Perhaps the most significant cost of SA being booted out of the World Government Bond Index when we lost our last investment grade rating in 2020 was that the liquidity of SA financial assets has been declining. As a result, we find that what was once considered a relatively manageable trade for bond and currency markets can now result in rather stark swings in market prices. In such an environment, there can be greater opportunities but also periods of greater risk.

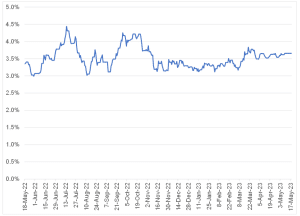

The accusation by the US that SA has supplied arms to Russia was perhaps, in retrospect, not as surprising as it should have been. SA’s allegiances have been apparent to anyone who cared to pay attention. Nevertheless, we were perhaps most surprised by the market reaction. The cost of insuring against the credit risk of local debt has barely moved. In fact, the cost is less than it was in November 2022. We are not seeing the market lose further faith from the already low levels of confidence that it had in SA. Instead, we are seeing concerns around the SA Reserve Bank’s (SARB) ability to hike rates, coupled with potentially significant portfolio flows in an increasingly illiquid market.

Figure 2: The cost of SA credit insurance over the past ten years

Source: Anchor, Thomson Reuters

We have seen the market price in a further 1% of domestic interest rate hikes (with a 0.5% rate hike on 25 May and the remainder at subsequent meetings) at a time when the country’s growth is zero or quite likely slightly negative. SA is one of the very few countries with an economy smaller than before the COVID-19 pandemic. The SARB is walking a tightrope between raising interest rates too much and allowing inflation to rise. Unfortunately, the current circumstances suggest that it will have no choice in the matter. Anchor’s base view is that interest rates will be hiked by 0.5% at next week’s SARB’s Monetary Policy Committee (MPC) meeting. This will see the prime rate increase to 11.75%, which is extortionate, in our view. The price of our foreign policy, our economic policy and failing state resources is that borrowers will have to pay almost 1% of the value of their mortgages as interest every month. Businesses will close, and jobs will be lost.

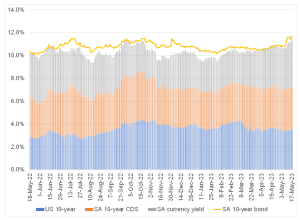

Anchor looks at the fair value of bonds as the summation of the yield on the US 10-year bond (blue in Figure 3 below), the cost of credit insurance for SA (orange) and the differential between short-term monetary policy rates between SA and the US (grey).

Figure 3: Anchor’s fair yield on SA 10-year debt

Source: Anchor, Thomson Reuters

Based on Figure 3, local 10-year bonds are trading at 11.65% while our fair value is closer to 11.37%. Bonds are probably trading at fair to slightly cheap levels right now. The moves we have seen over the past week are about widening the grey bar in Figure 3 as markets price in additional interest rate hikes. More importantly, the market pricing is appropriate for the level of risk in SA bonds. The market is a little oversold at the moment, but we do not see a catalyst that will bring any of these three components massively lower in the next month. A slight recovery is expected, but the most likely scenario is that SA bonds bounce around current levels for a while. We think there will be gradual gains as rate-hiking expectations calm down toward a sensible level.

It has been a difficult and tiresome journey for bond yields. However, the prospect of earning a running yield of close to 1% per month on the Anchor BCI Bond Fund makes sense. Over the longer term, we expect loadshedding to decline (as the private sector ramps up generation capacity), economic growth to rebound (jobs were created last quarter [1Q23] even with loadshedding), and the conciliatory tone from the government sounds like some foreign policy lessons have been learned. SA has certainly bungled. Nevertheless, we believe that SA is still quite far from being dead and buried.

Looking at the rand, the local unit has weakened dramatically in response to SA’s own goals and is trading at around R19.50/US$1 as we write this note on the morning of 18 May. Wow!!! This level of the rand vs US dollar exchange rate would have been unthinkable just one week ago. Market participants are pushing the domestic currency one way at the moment – they want a weaker rand and a sizeable rate hike from the SARB on 25 May. They will force the SARB’s hand at a time that foreigners are reducing their holdings of our bonds. We stated that we do not see an immediate catalyst for bonds to recover massively, and this comment can be extended to the rand. We also said that we see a local bond market recovery over the medium term – this, too, can be extended to the rand.

The currency is sentiment-driven, and sentiment towards SA is currently quite negative. The SARB is one of the few bastions of excellence left in the country, and we believe that a 0.5% rate hike will calm markets. It is becoming increasingly expensive for traders to short the rand, meaning that short positions will likely be closed out soon, spurring some rand strength. The currency is significantly oversold, yet the negative sentiment will probably keep it that way for a while. Over the longer term, there are some prospects for a recovery of sorts (as we have outlined for bonds), but over the short term, it is difficult to see the rand trade much below its current levels. We, therefore, advise taking a phased approach towards externalising one’s wealth. Today is as good a day as any to start, but do not rush it, as investors may see a stronger rand at future dates.

Figure 4: Actual rand/US$ vs rand PPP model

Source: Thomson Reuters, Anchor

At Anchor, our clients come first. Our dedicated Anchor team of investment professionals are experts in devising investment strategies and generating financial wealth for our clients by offering a broad range of local and global investment solutions and structures to build your financial portfolio. These investment solutions also include asset management, access to hedge funds, personal share portfolios, unit trusts, and pension fund products. In addition, our skillset provides our clients with access to various local and global investment solutions. Please provide your contact details here, and one of our trusted financial advisors will contact you.