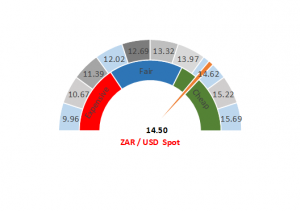

Figure 1: Rand vs US dollar gauge

Source: Anchor

Central banks are coming to the fore once again. On Tuesday (18 June), the European Central Bank (ECB) surprised the market by signalling an increased likelihood of rate cuts (although rates are already at record lows) and stimulus measures. The market is also theorising that the tone from the US Federal Reserve (Fed) at the end of its two-day policy meeting, scheduled for later on Wednesday (19 June), will turn even more dovish. While we do not expect the Fed to cut interest rates, we do anticipate that it will prepare the market for a rate cut in the second half of this year. This marked shift in monetary policy has been positive for emerging market (EM) currencies and, on Tuesday, the rand was a clear outperformer, strengthening by c. 2% against the US dollar on the day.

However, we note that the local currency still has a significant risk premium associated with it. All eyes are on the State of the Nation Address (SONA) by President Cyril Ramaphosa, which is scheduled to take place on Thursday (20 June). There is some excitement that he will give further clarity on the bailout and turnaround plans for Eskom. However, we fear that the market might be getting a little ahead of itself in terms of what it is hoping for and there is some risk of disappointment, in our view.

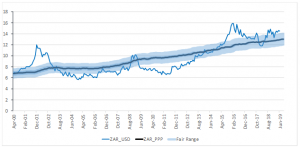

The rand is still too weak against our models, although we do think that it might remain so for quite a while. We will continue with our slight underweight stance towards the US dollar for now.

Figure 2: Actual ZAR/$ vs rand PPP model

Source: Bloomberg, Anchor