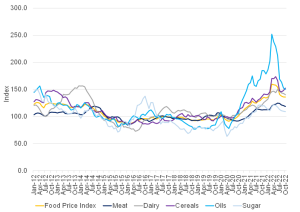

Amid increasingly uncertain global macroeconomic conditions, the FAO Food Price Index (FFPI), which measures the monthly change in the international prices of a basket of food commodities, averaged 135.9 points in October 2022 – virtually unchanged from September. An upturn in the Cereal Price Index countered drops in vegetable oils, dairy, meat, and sugar indices. With this latest update, the index printed 14.9% lower than its all-time high recorded in March 2022, while it remained 2.0% above its October 2021 level. Nonetheless, global food prices steadied in October, as supply disruptions wrought by Russia’s war on Ukraine were partly offset by slowing demand for staples. Furthermore, good weather has bolstered supplies of crops like barley, and soaring inflation is curbing the trade of goods from cheese to pork. In turn, this has helped buffer supply shocks from the Black Sea.

Figure 1: FAO’s Global Food Price Index performance

Source: FAO, Anchor

Overall, this continued decline offers some relief to households grappling with a cost-of-living crunch. The index is down for a seventh month, its longest slump in nine years, and food inflation has begun to slow in nations from Indonesia to Paraguay. Still, the index remains significantly elevated vs recent years, and the soaring US dollar is making it more difficult for food-importing countries to bring in supplies. Furthermore, it can take time for commodity price shifts to filter down to retail prices for consumers, and globally manufacturers are struggling with the additional higher expenses for labour and energy. Lastly, the trajectory of grain and vegetable-oil shipments from Ukraine, a key determinant for food prices going forward, remains unclear. In that vein, grain prices rose 3% YoY in October – the only commodity group in the index to increase. This week, Russia resumed its part in the Ukraine crop-export pact after a brief suspension that temporarily halted ships. The deal comes up for renewal in mid-November, and officials have yet to verify an extension.

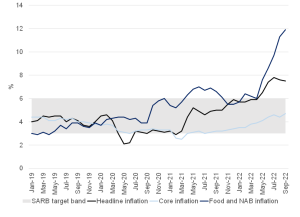

On the local front, inflation, as measured by the consumer price index (CPI), eased further in September to 7.5% YoY, from 7.6% in August (and a recent peak of 7.8% in July). The driver of the softer headline inflation print was fuel inflation, reflecting the base effects and the 6.4% MoM fuel price cut in September (after a 3.8% cut in August). This resulted in fuel inflation falling to 34.1% YoY in September from 43.2% YoY in August, which lowered its direct contribution to headline inflation by 0.5 ppts. However, there was some offset to this from core CPI (which excludes the volatile categories of food and energy costs) and food prices.

Figure 2: SA inflation, January 2019 to date (YoY % change)

Source: Stats SA, Anchor

In South Africa (SA), the prices of food and non-alcoholic beverages increased by 11.9% YoY in September. The main inflation contributors were bread and cereals (+3.6% YoY), followed by meat (+3.1% YoY) and milk, eggs and cheese (+1.3% YoY). The major drivers behind double-digit food inflation are global grain and oilseed price surges, which have been further exacerbated in the local context by a weakening exchange rate. Locally, surges in commodity prices take between two to three months to show up in associated retail food prices. Thus, the bread and cereal inflation rate of 19.3% YoY in September can largely be attributed to the high grain commodity prices experienced in July, when average white maize prices were just above R4,300/tonne – 34% higher YoY. Although local maize price increases lost some momentum during August due to easing global maize prices, they gained renewed momentum in September on concerns regarding the size of the maize harvest in the Northern Hemisphere. Subsequently, in early October, expectations of another dry summer production season in South America, amid persistent La Niña conditions fueled another maize price run. This is likely to keep bread and cereal inflation and food inflation in general at elevated levels for the remainder of 2022 and 2023.

In addition, high grain prices are likely to have cost-push inflationary effects on livestock sectors and could result in persistently high food inflation during the first half of 2023. For 2023 specifically, exchange rate movements and the progression of the Southern Hemisphere crop, mainly in South America, will be critical determinants in commodity prices and, thus, the direction of local inflationary data. It is important to note that SA continues to trade at export parity for key commodities such as maize, sunflower, soybeans, and canola. This essentially means that surplus production is keeping local prices low and that current inflationary trends are driven by global prices, the weak exchange rate and the growing costs of logistics and processing of products, such as transport, electricity, and wages.

At Anchor, our clients come first. Our dedicated Anchor team of investment professionals are experts in devising investment strategies and generating financial wealth for our clients by offering a broad range of local and global investment solutions and structures to build your financial portfolio. These investment solutions also include asset management, access to hedge funds, personal share portfolios, unit trusts, and pension fund products. In addition, our skillset provides our clients with access to various local and global investment solutions. Please provide your contact details here, and one of our trusted financial advisors will contact you.