Foreign direct investment (FDI) is crucial in countries’ economic development and growth, particularly in African nations. FDI refers to the investment made by individuals, businesses, or entities from one country into companies or assets in another. In simpler terms, it involves a foreign entity’s direct ownership of assets in a country. FDI can take various forms, including:

- Equity investments: This involves acquiring ownership stakes in foreign companies, either through the purchase of shares or by establishing new subsidiaries. The foreign investor gains a significant degree of control over the operations and management of the invested company.

- Mergers and acquisitions (M&A): This occurs when a foreign company merges with or acquires a local company in the host country. M&A activities are often used as a way for foreign companies to gain access to local markets, resources, or technologies.

- Greenfield investments: In this type of FDI, foreign investors establish new businesses or operations from scratch in the host country. This can involve constructing new factories, offices, or production facilities.

- Joint ventures: Foreign companies collaborate with local companies to form a new entity with shared ownership and control. Joint ventures allow for risk-sharing and leveraging the expertise of both partners.

FDI is different from portfolio investment, which involves investments in financial assets like stocks and bonds without acquiring a significant degree of control over the underlying company’s operations. It is important to remember that for a given transaction to be defined as FDI, all that is required is that a foreign entity obtains a significant share (at least 10%) of a domestic undertaking. Simply put, if a foreign entity purchases more than 10% of the shares in an existing African company, this is classified as FDI – irrespective of whether any new productive capacity or additional opportunities are created.

FDI can significantly impact the host country and the investing country. For the host country, FDI can bring in much-needed capital, technology, employment opportunities, and, most importantly, market access. As a result, FDI often contributes to economic growth, industrial development, and infrastructure improvement within a given host country. For the investing country, FDI allows companies to expand their operations into new markets, access raw materials and resources, reduce production costs, and diversify their revenue streams. When considering the African continent specifically, FDI essentially serves as a catalyst for economic growth and development in African countries. When foreign investors inject capital into the region, they create new businesses, industries, and jobs, increasing productivity and prosperity. Furthermore, foreign investors often bring much-needed advanced technologies, skills, and know-how to African countries. This technology transfer can improve local industries’ efficiency and competitiveness, helping them integrate into global markets.

Of particular importance for African economies, FDI can often contribute to improving infrastructure. Foreign investors may invest in building roads, ports, power plants, and other vital infrastructure, which benefits their operations and enhances the overall economic environment in any given host country. As such, FDI can diversify African economies by introducing new sectors and industries. Many African countries have historically relied on a few primary commodities for revenue. However, FDI can encourage the growth of other sectors, reducing the region’s vulnerability to commodity price fluctuations. Of particular importance, however, foreign investors can provide African businesses with access to international markets. Through joint ventures or partnerships with local companies, African enterprises can reach a broader customer base and expand their export opportunities.

Concurrently, FDI brings in foreign capital, which contributes to the balance of payments and can help address trade deficits in some African countries – a rising issue of late for most African economies. As foreign investors establish their businesses, they generate tax revenues for the host country. These funds can be used to finance public services and government initiatives. Lastly, and perhaps more holistically, FDI helps enhance the African continent’s global image. Attracting FDI demonstrates confidence in a given African economy’s potential and sends a positive signal to other investors and international markets, encouraging further investment.

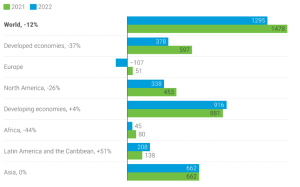

If we consider recent FDI flows, after a strong rebound in 2021, global FDI fell by 12% YoY in 2022 to US$1.3trn, mainly due to overlapping global crises such as Russia’s war on Ukraine, high food and energy prices and soaring public debt. Interestingly, the decline was primarily felt in developed markets (DMs), where FDI fell 37% YoY to US$378bn. Flows to developing countries, however, grew by 4% – albeit unevenly, with a few large emerging countries attracting most of the investment while flows to the least developed countries declined. Positively, global greenfield investment project announcements were up 15% YoY in 2022, growing in most regions and sectors. Unsurprisingly, given the continued focus on ramping up energy generation globally, international investment in renewable energy generation, including solar and wind, continued to grow – albeit at a slower growth rate of 8% YoY vs the 50% YoY growth recorded in 2021. Notably, projects announced in battery manufacturing tripled to more than US$100bn in 2022.

Overall, the 2022 decline in DMs reflected the uncertainty in financial markets and the winding up of stimulus packages. Still, the volatile nature of FDI flows in DMs continued to affect aggregate values. Conversely, developing countries accounted for more than two-thirds of global FDI – up from 60% in 2021. The impacts of the multidimensional crises (particularly in food and energy) and overall financial and debt distress hit investment flows to the poorest countries disproportionally. Flows to the least developed countries (LDCs) fell by 16% YoY, and LDCs continue to account for only 2% of global FDI.

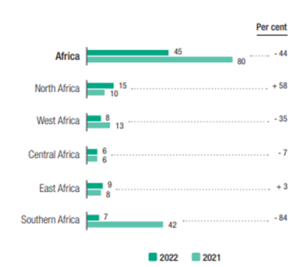

Inflows into Africa fell by 44% YoY following the abnormal peak in 2021, caused by a large corporate reconfiguration in South Africa ([SA] a share exchange between Naspers and Prosus in 3Q21). Excluding this deal, FDI flows to Africa in 2022 would have increased by 7% YoY.

Figure 1: Global FDI fell by 12% YoY in 2022 by sub-region, US$bn

Source: UNCTAD, FDI/MNE database

On a regional basis, North Africa recorded the strongest FDI inflows in 2022, with investment more than doubling from the previous year to US$15.0bn. FDI inflows into North Africa were driven mainly by Egypt, which received an impressive US$11.4bn in inflows – a strong turnaround in investor sentiment for the beleaguered Egyptian economy. Flows to Morocco, however, decreased slightly, by 6% YoY, to US$2.1bn. FDI inflows to other regions on the continent were modest in comparison.

East Africa received US$8.7bn in FDI in 2022. Despite a 14% YoY drop in FDI to US$3.7bn, Ethiopia remained the continent’s second–largest FDI recipient – again in stark contrast to the generally negative and cautious investor sentiment surrounding the country’s financial markets. FDI to Uganda grew by 39% YoY to US$1.5bn on investment in extractive industries. FDI to Tanzania increased by 8% YoY to US$1.1bn.

In West Africa, Nigeria saw FDI flows turn to outflows – -US$187mn due to equity divestments. Announced greenfield projects, however, rose by 24% YoY to US$2bn. Flows to Senegal remained flat at US$2.6bn. FDI flows to Ghana unsurprisingly fell by 39% YoY to US$1.5bn as that country continues to muddle through its current debt crisis.

In Central Africa, FDI in the Democratic Republic of the Congo (DRC) remained flat at US$1.8bn, with investment sustained by offshore oil fields and mining flows.

In Southern Africa, flows returned to prior levels after the abnormal peak in 2021. FDI in SA was US$9bn – well below the 2021 level but double the past decade’s average. Cross-border M&A sales in SA reached US$4.8bn from US$280mn in 2021. In Zambia, after two years of negative values, FDI rose to US$116mn.

Figure 2: FDI inflows in Africa, by sub-region, 2021–2022 (US$bn)

Source: UNCTAD

Over the past five years, FDI inflows have risen in four regional economic groupings on the continent. FDI in the Common Market for Eastern and Southern Africa (COMESA) grew by 14% YoY to US$22bn. Flows also rose in the Southern African Development Community (SADC; quadrupling to US$10bn), the West African Economic and Monetary Union (WAEMU; doubling to US$5.2bn) and the East African Community (EAC; up 9% YoY to US$3.8bn). Notably, intraregional investment remained relatively small, despite an increase over the past five years. In 2022, intraregional greenfield project announcements represented 15% of all projects in Africa (2% in terms of value), as compared with 13% (2% in value) in 2017. However, considering announced projects invested in by only African multinational enterprises, three-quarters of their value remained on the continent. International project finance deals targeting Africa showed a 47% YoY decline in value (US$74bn – down from US$140bn in 2021) but a 15% YoY increase in project numbers to 157. European investors remain, by far, the largest holders of FDI stock in Africa, led by the UK (US$60bn), France (US$54bn) and the Netherlands (US$54bn).

In their quest to attract FDI, African governments employ various strategies, including tax breaks, regulatory support, infrastructure development, and the reassurance of political stability (regardless of whether that reassurance is misplaced). However, finding a delicate balance is imperative to harness the full potential of FDI and safeguard national interests and development objectives. This necessitates the implementation of effective regulations and monitoring mechanisms, allowing for optimal benefits while mitigating potential risks. As such, African economies can implement several measures to attract and retain FDI effectively. These include:

- Improve infrastructure: Investing in quality infrastructure, such as transportation, energy, and telecommunications, creates an attractive business environment for foreign investors.

- Enhance political stability and governance: Maintaining stable political environments and transparent governance systems instils confidence in investors and reduces investment risks.

- Offer incentives: Governments can provide tax incentives, grants, and other benefits to foreign investors, encouraging them to establish operations in the host country.

- Simplify regulations: Streamlining bureaucratic procedures and reducing red tape will facilitate the ease of doing business for foreign investors.

- Focus on education and skills development: A skilled workforce is an asset to attract FDI. Governments should invest in education and vocational training programmes to ensure a capable and adaptable labour force.

- Promote regional integration: Encouraging regional economic cooperation and integration can create larger markets and attract more FDI to the region.

- Engage in public-private partnerships (PPPs): Collaborating with private sector entities can lead to mutually beneficial projects and demonstrate a commitment to sustainable development.

Overall, FDI presents a significant opportunity for African economies to accelerate growth, create jobs, and foster sustainable development. By implementing targeted policies, improving infrastructure, enhancing governance, and investing in education, African countries can attract more FDI and leverage it to realise their economic potential. A favourable business environment coupled with strategic efforts will lead to mutually beneficial partnerships between African countries and foreign investors, driving inclusive economic prosperity on the continent.

At Anchor, our clients come first. Our dedicated Anchor team of investment professionals are experts in devising investment strategies and generating financial wealth for our clients by offering a broad range of local and global investment solutions and structures to build your financial portfolio. These investment solutions also include asset management, access to hedge funds, personal share portfolios, unit trusts, and pension fund products. In addition, our skillset provides our clients with access to various local and global investment solutions. Please provide your contact details here, and one of our trusted financial advisors will contact you.