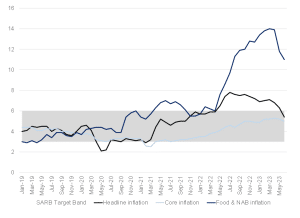

Coming in slightly lower than expectations, South Africa’s (SA) headline inflation, as measured by the consumer price index (CPI), cooled to 5.4% YoY in June from 6.3% YoY in May – sinking below the upper limit of the South African Reserve Bank’s (SARB) monetary policy target range of 3%-6%. The last time inflation was below 6% was in April 2022. The rate in June is the lowest reading in 20 months (since October 2021) when the inflation rate was 5.0%. Declines in food and fuel inflation largely drove this cooling in inflation. Annual inflation for food and non-alcoholic beverages (NAB) slowed for the third successive month, cooling to 11.0% from a high of 14.0% in March, primarily due to the continued decline in global food prices and partly reflecting some base effects. Similarly, the combination of fuel price cuts in June and base effects likely pushed fuel inflation by 8.3% in June 2023 compared with June 2022.

Whilst we believe that food inflation will continue to moderate, there are considerable risk events to be cognisant of within the medium term. These include a shift from the current La Niña weather cycle to an El Niño cycle, Russia’s withdrawal from the Black Sea Grain Deal (which allowed safe passage of grain exports from Ukraine) and the possibility of a ban on rice exports in India. Interestingly, core inflation (excluding the volatile categories of food and energy costs) surprised to the downside in June, at 5% YoY from 5.2% in May, indicating that the broadening in price pressures has been fairly limited in recent months.

Figure 1: SA inflation, YoY % change

Source: Stats SA, Anchor

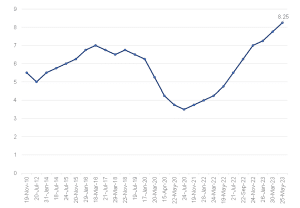

Against the backdrop of this latest positive inflation print, the SARB’s Monetary Policy Committee (MPC) voted to keep interest rates at current levels at its meeting on 20 July. Thus, the repurchase (repo) rate stays at 8.25% and the prime lending rate at 11.75% – which will help offer some temporary relief to strained local consumers. The SARB deems monetary policy restrictive at the current repo rate, consistent with elevated inflation expectations and outlook. A restrictive repo rate refers to a relatively high interest rate set by a central bank to curb excessive borrowing and spending in the economy. When the central bank wants to rein in inflationary pressures, slow economic growth, or address concerns about asset price bubbles, it raises the repo rate. As such, the SARB’s current policy stance aims to anchor inflation expectations more firmly around the mid-point of the target band and increase confidence in attaining the inflation target sustainably over time.

The question of whether this is the last rate hike in the current cycle remains uncertain – much will depend on the direction of the rand and the overall inflation environment over the next few months. The SARB also remains concerned about surveyed inflation expectations and the inflationary impact of loadshedding and logistical constraints within the economy on the inflation outlook. Surveyed inflation expectations have, overall, increased further (albeit marginally) since the previous MPC meeting in May. The rand remains as volatile as ever, depreciating by about 5% YTD against the US dollar and showing high volatility in response to risk-on and risk-off episodes across local and global markets.

Nonetheless, off the back of this latest pause in interest rate hikes, SA consumers across the board will breathe a sigh of relief. With a generally heightened inflation environment (particularly food prices) eroding households’ real wages over the last few months, the previous big interest rate increases, lowering disposable income, extreme loadshedding, an increasingly tricky socio-political environment, and a generally uncertain future have weighed heavily on consumers this year.

Figure 2: The history of the SARB’s repo rate changes, %

Source: SARB, Anchor

At Anchor, our clients come first. Our dedicated Anchor team of investment professionals are experts in devising investment strategies and generating financial wealth for our clients by offering a broad range of local and global investment solutions and structures to build your financial portfolio. These investment solutions also include asset management, access to hedge funds, personal share portfolios, unit trusts, and pension fund products. In addition, our skillset provides our clients with access to various local and global investment solutions. Please provide your contact details here, and one of our trusted financial advisors will contact you.