Undoubtedly, the world geopolitical order has undergone significant transformations since the end of the Cold War, with profound implications for global economic dynamics. Key to this transformation has been the decline of bipolarity and the rise of multilateralism. The end of the Cold War marked the decline of the bipolar world order dominated by the US and the Soviet Union. The dissolution of the Soviet Union led to the emergence of new independent states and a more multipolar international system. As a result, multilateral institutions and frameworks, such as the United Nations (UN) and the World Trade Organization (WTO), gained prominence in shaping global economic governance.

Consequently, the post-Cold War era witnessed an unprecedented acceleration of globalisation, characterised by the free flow of goods, capital, and information across borders. Technological advancements, particularly in communication and transportation, facilitated the integration of economies into global supply chains and increased cross-border investments. The expansion of international trade, aided by the proliferation of free trade agreements and regional economic blocs, has been a defining feature of the new economic order. As such, the post-Cold War period has seen the rise of several emerging economies as major players in the global economic landscape. Countries such as China, India, Brazil, and other EMs have experienced rapid economic growth, fuelled by market-oriented reforms, investments in infrastructure, and export-oriented strategies. The growing economic power of these countries has reshaped global trade patterns, investment flows, and regional dynamics. While the US remains a dominant economic force, the rise of emerging economies has led to a rebalancing of global economic influence.

China, in particular, has emerged as the world’s second-largest economy and a key driver of global growth. With its rapid internal economic growth, expanding influence, and strategic initiatives, China has positioned itself as a major force in the global economy. Moreover, in recent years, China has also demonstrated its growing influence through regional and bilateral economic agreements worldwide, solidifying its economic ties and expanding its global reach. Simultaneously, China’s economic rise has raised concerns and generated geopolitical tensions as intellectual property rights, market access, and fair-trade practices have become areas of contention with its trading partners. Additionally, geopolitical frictions arise from China’s territorial disputes, military expansion, and differences in political systems and values. The most notable of these ‘frictions’ is the one that has arisen between China and the US, as both seek to shape the new emerging global economic order.

This rivalry between the US and China has led many to question whether we are in some form of a new ‘Cold War’. Whether this is an oversimplification of the complicated relationship between these two powerful nations is a debate for another day. What is clear, however, is that the economic and geopolitical crossfire between China and the US has broader implications beyond their bilateral relationship, affecting the economic fortunes and policy choices of countries worldwide. Africa, in particular, occupies a significant place in the unfolding rivalry between the US and China. The continent’s vast resources, growing markets, and strategic importance have drawn the attention of both superpowers as they vie for influence and economic advantages. The US-China rivalry in Africa is intertwined with their broader competition for geopolitical influence. Both countries are keen to expand their diplomatic and strategic foothold on the continent. China has pursued a policy of deepening diplomatic ties with African countries through extensive high-level visits, development assistance, and military cooperation. The US, in response, has been bolstering its engagements with African governments, focusing on issues such as counterterrorism, governance, and security cooperation. Regardless of their methods, the US and China view Africa as a critical economic partner.

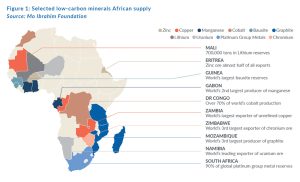

The African continent is rich in natural resources, including minerals, oil, and gas, making it a crucial target for resource-hungry nations. Africa currently holds 30% of the world’s mineral reserves, many of which are critical to renewable and low-carbon technologies, including solar, electric vehicles (EVs), battery storage, green hydrogen, and geothermal. To meet the expected rise in global demand, the production of minerals and metals such as lithium, graphite and cobalt will need to increase by nearly 500% by 2050. In simple terms, this cannot be achieved without Africa’s resources.

The US and China seek access to these resources to meet domestic needs and maintain economic competitiveness. Africa’s potential as an energy producer also plays a vital role in global energy security. China’s demand for energy resources has driven its investments in African oil and gas sectors, while the US also seeks to secure energy supplies from the continent.

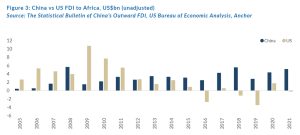

The US, however, has begun this competitive scramble for resources and political relevance on the back foot. After a period of relative diplomatic retreat since the 2008/2009 global financial crisis (GFC), the US has lost its sway in the African continent. The US’s withdrawal from Africa in the last decade has, in turn, allowed China to expand its hold on Africa. In 2011, China overtook the US as a major African export partner, placing the US in the position to play a significant catch-up.

Furthermore, compared to the US’s somewhat stagnant rate, China has become a significant source of foreign direct investment (FDI) in Africa over the past two decades. China’s FDI flows to Africa have been substantial, and the country has emerged as one of the continent’s largest investors – particularly in infrastructure projects.

In addition to trade and FDI, China is a major creditor to the African continent, often as a ‘lender of last resort’. China has provided substantial financial support to African countries through various financing mechanisms, such as loans, export credit, and development assistance. Approximately 20.6% of Africa’s external debt is now owed to China. In addition to its economic diplomacy, China has emphasised cooperation with Africa as a partnership between equals (regardless of the truth of that fact) and through what it terms “principles of sincerity,” often referred to as “sincerity in foreign relations,” which is an important aspect of China’s diplomatic approach. The principle of sincerity is rooted in the Chinese philosophy of Confucianism, which emphasises harmonious relationships, trust, and mutual respect. This fresh, new approach has been well received in a region where engagement with traditional partners (such as the US and Europe) has been on unequal and, at times, paternalistic and somewhat condescending terms. In simple terms, China has three key aims for the African continent with regard to its global growth agenda:

- Africa forms a strategic exterior line for China to geopolitically contain the US whilst providing a backbone of support for China on its self-interest issues (naturally).

- Africa is a source of inputs to sustain China’s economic development, including new energy.

- Africa is an ally for China to play a more significant role in global governance, advancing the reform of the global governance system and reshaping the international order.

In turn, however, the US and Africa share a complicated history. During the Cold War, the US was engaged in several proxy wars against communist influence on the continent, most notably in the Democratic Republic of Congo (DRC). Whilst the end of the Cold War saw a cooling in these particular tensions, the relationship between the two has remained stagnant, hitting an all-time low during former US President Donald Trump’s administration. During his term as president, Trump made little effort to engage Africa, failing to visit the region and managing to anger African leaders with his disparaging comments about the continent. Under US President Joe Biden’s administration, however, the US has acknowledged its diminished position in Africa and has shown its commitment to prioritising economic partnership with the region through several investment and trade-boosting packages.

Nevertheless, the real question at the end of the day is, where does this leave Africa as it muddles through a complex game of geopolitical chess between these two global titans? With China being the primary threat to US interests, African countries may have justifiable reason to be wary of the sudden outpouring of diplomatic engagement from the US following years of silence and stagnant relations. Centuries of Western imperialist policies, from slavery and colonialism to Cold War support for undemocratic regimes in the name of anti-communism, rightfully continue to taint how African countries view US policy. Today, modern-day challenges such as climate change, debt distress, and pandemic response and recovery continue to be viewed through the lens of that history — problems emerging or made worse by powerful, developed nations imposing unfair costs on the African continent.

Conversely, from a broad strategic perspective, China’s interests in Africa are driven more by geopolitical considerations than commercial ones. By supporting African countries economically and financially, China is building a loyal base of ‘friendly’ countries that will enable it to reshape the global order to better accommodate and promote China’s interests. China’s primary policy task is sovereignty, security, and domestic development. Africa is simply a means to that end. Ultimately, African countries represent the largest voting block of UN member states, with more than one-quarter of the world’s voice. No geopolitical power can credibly claim the title of global leader without Africa as a ‘friend’.

But concerns are mounting regarding the sustainability and implications of Africa’s debt to China. As mentioned, c. 20.6% of Africa’s external debt is now owed to China. African countries have increasingly turned to China to finance infrastructure development projects due to its willingness to provide loans with fewer conditions than traditional lenders. However, there is a growing worry that some African countries may be accumulating unsustainable debt levels, which could hamper their long-term economic growth and development. Moreover, the terms of Chinese loans have been criticised for lack of transparency and potentially unfavourable conditions. Some loans may have high interest rates, short repayment periods, or have been collateralised against strategic national assets.

This raises concerns about debt sustainability and the potential for future debt distress. Critics argue that excessive debt to China may result in economic dependency as African countries become more reliant on Chinese financing and expertise. This dependency could potentially limit African governments’ policy space and decision-making autonomy, impacting their ability to negotiate fair terms and prioritise their national interests. Whilst China-financed infrastructure projects have brought tangible benefits to some African countries, there are concerns that the focus on infrastructure development may overshadow investments in social sectors like education and healthcare. Thus, it is crucial for African countries to carefully manage their debt levels, ensure transparency, and strike a balance between infrastructure development and other social and economic priorities.

Regardless of the geopolitical complexities, it is important to remember that African nations have agency in navigating the US-China rivalry and should seek to maximise their interests by engaging with both powers. African countries should look to increasingly diversify their partnerships and pursue a more balanced approach to benefit from the economic opportunities and development assistance offered by both the US and China. While the US and China are engaged in a complex contest for influence and economic advantages on the continent, African nations are well poised to leverage these rivalries to promote their economic growth and development.

At Anchor, our clients come first. Our dedicated Anchor team of investment professionals are experts in devising investment strategies and generating financial wealth for our clients by offering a broad range of local and global investment solutions and structures to build your financial portfolio. These investment solutions also include asset management, access to hedge funds, personal share portfolios, unit trusts, and pension fund products. In addition, our skillset provides our clients with access to various local and global investment solutions. Please provide your contact details here, and one of our trusted financial advisors will contact you.