Transnet SOC Limited (Transnet)

Transnet SOC Limited (Transnet) is a wholly government-owned state entity that owns and operates SA’s national freight railway network, ports, and pipeline infrastructure. The state-owned entity’s (SOE’s) main objectives include constructing an efficient rail freight system to reduce reliance on road transport and operating ports efficiently to reduce ocean freight costs. In this article, we discuss Transnet’s current financial and operational challenges and make recommendations that we think would make Transnet a more effective SOE.

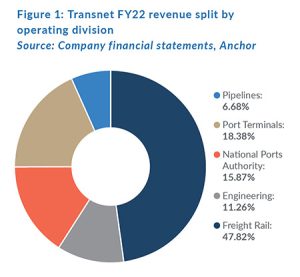

Transnet has five operating divisions, with Transnet Freight Rail (TFR) being the largest in terms of revenue (Figure 1). The TFR division generates revenue from freight transportation over the rail network. More than 66% of TFR revenue is generated from the transportation of export coal, iron ore, and manganese.

Historically, Transnet had a strong track record of moderate revenue growth and operated without any extraordinary government support. However, over recent years, Transnet’s operational and financial performances were negatively impacted by a combination of the following:

- Pandemic-related sharp volume declines.

- Declining capital expenditure (CAPEX) and, consequently, infrastructure capacity constraints.

- High debt levels and a weak liquidity position.

- Compromised corporate governance structures.

- Several operational challenges, including incidents of crime and environmental disruptions.

Pandemic-related sharp volume declines

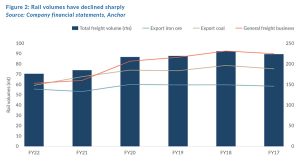

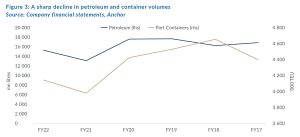

In FY21 (Transnet’s financial year ending 31 March 2021), Transnet’s financial and operational performances were severely impacted by the COVID-19 pandemic as SA was in hard lockdown for four weeks. During this hard lockdown, Transnet’s primary customers, the mining industry, halted operations, and as a result, freight volumes declined sharply (Figure 2). General Freight Business (GFB) volumes were hit the hardest – down c. 22% YoY (Figure 2). In addition, the Pipeline and Port Terminal divisions combined account for more than c. 30% of Transnet’s profit and also experienced a sharp drop in petroleum and port container volumes (Figure 3). These sharp drops in volumes resulted in Transnet’s FY21 revenue declining by 11% YoY, and the SOE reported a loss for the year of R8.7bn, compared to R2.9bn profit in the previous financial year (FY20).

Declining CAPEX and infrastructure capacity constraints

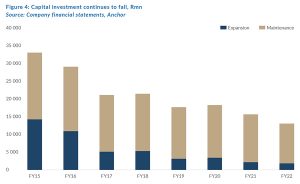

Transnet has a large CAPEX programme. The expenditure is for maintaining existing infrastructure (maintenance) and creating new capacity (expansion). To try and offset the lost revenue from lower volumes, Transnet has for years opted to reduce or defer its immediate spending on infrastructure to preserve cash flows. As a result, Transnet’s CAPEX dropped to c. R13bn in FY22 compared to the c. R33bn that was reported in FY15 (Figure 4). This strategy does alleviate immediate funding pressures; however, it also compromises the existing infrastructure over the long term as the risks of accidents and rail incidents increase.

Transnet’s new locomotive fleet’s reliability is compromised as manufacturers make it difficult to obtain spare parts, and contracts are suspended. The older locomotive fleets are unreliable due to obsolescence, which has resulted in the decommissioning of c. 25% of Transnet’s locomotive fleet since 2018. The freight railway network is currently operating with a sub-optimal number of locomotives. Speed restriction measures were implemented on several infrastructure lines to minimise the risk of rail incidents and avoid a network collapse. However, a sharp rise in crime incidents, including infrastructure sabotage, vandalism, cable theft, and cyber-attacks, has put additional pressure on its infrastructure. Thus, Transnet’s ability to meet customer demand has become increasingly limited, given these infrastructure constraints. All this is negative for the company’s earnings generation.

The years of capital underinvestment and operational disruptions are also undermining volume recovery at Transnet despite the lifting of lockdown restrictions. In FY22, freight rail volumes continued to decline while petroleum and container volumes remained significantly below pre-pandemic levels (see Figures 2 and 3). FY22 revenue growth was low at c. 1.8% YoY, illustrating how Transnet has been unable to benefit from the economic recovery and elevated commodity prices. The difference between targeted and actual freight volumes also keeps growing, registering 36mnt in FY22 (Figure 5). Muted revenue growth, and high inflation on operational costs, will make the recovery of profitability margins challenging.

High debt levels, a weak liquidity position, and high refinancing risks

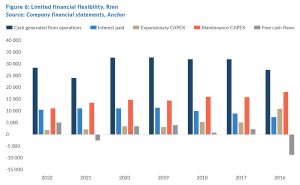

Transnet’s R130bn debt bill comprises mainly rand-denominated bonds, bank loans, and development finance institution (DFI) loans. In addition, interest payments on its debt bill remain high at around R10bn. As a result, finance costs combined with CAPEX continue to absorb a significant portion of cash flows, leaving minimal free cash flows for debt repayments and making the SOE highly reliant on refinancing debt maturities when these become due (Figure 6).

Transnet had a strong track record of refinancing upcoming debt maturities through its diversified funding base. However, recent delays in the release of its financial statements, several loan covenant breaches, a series of qualified audit opinions, credit rating downgrades, weak operational and financial performances, and negative sentiment toward SOEs, in general, have negatively impacted Transnet’s ability to access international and local debt capital markets in a timely manner. This is evidenced by how Transnet struggled to refinance the US$1bn bond that came due in July 2022.

Compromised corporate governance structures

Transnet has made several changes to its executive management after several of its executives resigned, were dismissed, or were suspended in 2018. Sixteen of the seventeen current executive members were appointed in or after 2020. In addition, Transnet’s corporate governance structures have been compromised, given past deficiencies in the risk control framework, which led to insufficient control over procurement and contract management. From FY18 to FY21, Transnet received a qualified audit opinion due to the auditor’s inability to determine the full extent of irregular expenditure. The qualification resulted in a breach of loan covenants, and lenders successfully received waivers.

Executive appointments were made to resolve Transnet’s management and governance deficiencies. In FY22, Transnet received an unqualified opinion, given improvements in the control environment and the continued focus required in the compliance space. In our view, the executive appointments are positive and will allow the Transnet leadership to focus on executing operational and financial improvements in the business. However, we note that, in pursuit of transparency, accountability, and sound financial management, several changes to the executive team in such a short period could result in a phenomenon known as corporate amnesia – “loss of institutional knowledge”.

Operational challenges

Transnet has experienced increased crime incidents, including vandalism, cable theft, infrastructure sabotage, cyber-attacks, fire blowouts, and social unrest, causing operational disruptions in several parts of its business. These operational challenges have contributed to Transnet’s deteriorating operational efficiency – increasing the risk of accidents, derailments, force majeure events, and the incurrence of costs related to security and maintenance, which are pressurising profitability margins. Furthermore, environmental disruptions like the KwaZulu-Natal (KZN) floods damaged Transnet infrastructure, placing additional strain on its capacity levels.

What can Transnet do?

Despite the abovementioned challenges, Transnet remains a strategically important entity for the country. It has a strong business profile underpinned by being a monopoly provider of port and pipeline infrastructure and having a dominant position in freight rail. In the 2022 Medium Term Budget Policy Statement (MTBPS), the finance minister confirmed that Transnet would be allocated a bailout amounting to R5.8bn. However, given the complex nature of Transnet’s operational and financial challenges, the road to recovery is likely to be long, and we could see more state bailouts for the SOE soon.

Even with increasing fiscal pressures coming from other SOEs, such as Eskom Holdings Limited, one can argue that the state’s willingness to provide extraordinary support to Transnet remains high, given its strategic importance to the SA government and the economy.

Transnet can become a more effective business by focusing on and urgently addressing the issues we have highlighted below. These interventions include the following:

- Improving Transnet’s infrastructure capacity by ramping up its CAPEX.

- Focusing on developing public-private partnerships (PPP), which, in our view, is crucial, especially in upgrading SA’s ports. A PPP will reduce pressure on public finances and increase the number of projects in any future government-initiated public infrastructure plan. For example, in 2021, the government said it needed private partners for an R100bn terminal at Durban harbour as part of a port’s master plan in line with the president’s Economic Reconstruction and Recovery Plan. If it does happen, it will make the port the biggest and busiest in Africa. Its capacity for container handling would grow from 2.9mn units to over 11.3mn, according to Business Leadership SA. Any backlog at our ports will take much longer to address and be extremely costly without private sector assistance.

- Improving Transnet’s liquidity profile and its liquidity management by making the entity less reliant on refinancing debt maturities or, alternatively, Transnet can refinance these debt maturities well in advance.

- Increasing the security and maintenance costs of the entity to limit any operational disruptions caused by criminal activities such as theft and vandalism of rail infrastructure. It is essential that when criminals tampering with the network are caught, their convictions move ahead faster, and sentences are harsher. TFR CEO Sizakele Mzimela said in August that at this stage, the conviction rate is only 10%, which is not a deterrent.

- Strengthening Transnet’s governance structures with a continued focus on the compliance space.

At Anchor, our clients come first. Our dedicated Anchor team of investment professionals are experts in devising investment strategies and generating financial wealth for our clients by offering a broad range of local and global investment solutions and structures to build your financial portfolio. These investment solutions also include asset management, access to hedge funds, personal share portfolios, unit trusts, and pension fund products. In addition, our skillset provides our clients with access to various local and global investment solutions. Please provide your contact details here, and one of our trusted financial advisors will contact you.