November saw global markets end on a positive note (MSCI World +7.0% MoM) for the second consecutive month as lower US inflation, decent US quarterly earnings and a weaker US dollar buoyed equity markets. In addition, while widespread protests in China against that country’s stringent COVID-19 restrictions roiled investor sentiment earlier in the month, Chinese authorities said on Tuesday (29 November) that they are working on gradually easing the country’s strict zero-COVID policy, indicating a possible end of the policy being in sight, and, consequently, an improvement in the Chinese economy, which also boosted sentiment.

On 2 November, the US Federal Reserve (Fed) delivered a much anticipated 0.75% rate hike – the fourth hike in a row. US rates have increased by 3.75% in eight months (since mid-March 2022). Last week, the consistent message from two Fed presidents (St. Louis’s James Bullard and Bank of New York’s John Williams) seemed to be that US rates are likely to remain higher for longer and cuts are only likely to come through in 2024. However, Fed Chair Jerome Powell said on Wednesday (30 November) that smaller rate hikes are likely ahead and could start “as soon as December.” He cautioned that monetary policy would likely remain restrictive until real signs of progress emerge on inflation. Investors applauded his comments, and US indices rallied into month end. The blue-chip S&P 500 rose 5.4% (-14.4% YTD) in November, with all eleven S&P sectors ending the month on a positive note and the materials sector (+11.5% MoM) the standout performer. The tech-heavy Nasdaq gained 4.4% MoM (-26.7% YTD), and the Dow was up 5.7% (-4.8% YTD).

In US economic data, we finally saw an inflation print that was better than expected as October consumer price index (CPI) data slowed more than expected. Consensus economist forecasts were anticipating headline CPI to decrease from 8.1% YoY in September to 7.9% YoY in October, but instead, headline CPI came in at 7.7% YoY. Core CPI, which excludes the erratic food and energy components, also came in lower than expected at 6.3% YoY in October vs September’s 6.6% print and a consensus forecast of 6.5% YoY. MoM, October core CPI came in at 0.3% vs September’s increase of 0.6%.

In Germany, the DAX ended the month 8.6% higher (-9.4% YTD), while France’s CAC Index closed November 7.5% in the green (-5.8% YTD). Europe’s biggest economy, Germany, saw its November inflation cool slightly (although it remained near a record high), coming in at 11.3% YoY from October’s 11.6% YoY jump. MoM prices were unchanged. France’s inflation rate remained at a record high of 6.2% YoY – unchanged from October’s print, while Spain’s November CPI fell 0.1% MoM, bringing that country’s YoY inflation rate down to 6.8%. Eurozone inflation slowed more than expected, coming in at 10.0% in November vs October’s revised reading of 10.6% YoY. Nevertheless, that number remains at five times the European Central Bank’s (ECB’s) stated 2% target, with the energy and food components continuing to contribute to high inflation, although energy did see a drop last month (+34.9% YoY in November vs +41.5% YoY in October). Earlier in November, ECB President Christine Lagarde told the EU Parliament that she did not believe eurozone inflation had peaked yet.

The UK’s blue-chip FTSE-100 Index closed November with an impressive 6.7% gain (+2.6% YTD). UK October inflation hit a 41-year high of 9.6% YoY vs September’s 8.8% YoY print. Food prices soared to a new high of 12.4% in November as prices of basics such as eggs, dairy products, and coffee rose significantly.

In China, that country’s ongoing zero-COVID policy saw an unprecedented show of defiance and anger from the populace over harsh (and costly) curbs instituted by the government to combat the spread of the virus. There was a heavy police presence in protest cities, weighing on market sentiment for most of the month. However, towards month-end growing signs that China was easing its zero-COVID policy soothed sentiment as global investors bet on China pushing ahead with reopening plans and relaxing its strict COVID-19 protocols. Following Chinese equities’ extended losses in October, last month saw China’s major indices end on a positive note. Hong Kong’s Hang Seng Index soared 26.6% MoM (-20.5% YTD), while the Shanghai Composite Index closed 8.9% higher MoM (-13.4% YTD). On the economic data front, China’s official manufacturing purchasing managers index (PMI) fell to 48 in November vs October’s 49.2 print. This was lower than Reuters consensus analysts had expected (the forecast was for a reading of 49). Official non-manufacturing PMI, which measures business sentiment in the services and construction sectors, also disappointed, falling to 46.7 in November vs October’s 48.7 print. The 50-point mark separates expansion from contraction. The service sector was weaker last month as a resurgence of COVID-19 cases (and China’s strict zero-COVID policies) dampened market activities.

In Japan, the benchmark Nikkei gained 1.4% MoM in November (-2.9% YTD), while economic data showed that the country’s economy unexpectedly shrank in 3Q22 (GDP slid 1.2% YoY annualised) as a drop in the yen battered the country’s growth momentum. Consensus economists’ forecasts had expected GDP growth of 1.2% YoY.

Commodity prices were quite volatile in November on the back of China concerns. The oil price came under pressure, dropping sharply in November (to its lowest level in c. 12 months), with investors concerned that surging COVID-19 cases and protests in China could dampen oil demand from one of the world’s biggest oil consumers. In addition, details around the Russian oil price cap and, more specifically, where it should be set looked likely to be done at a level which does not significantly hinder Russia’s ability to sell crude and thus contribute to a drop in oil prices. After gaining 7.8% in October, Brent crude fell by 9.9% (+9.8% YTD) in November. Regarding energy prices, natural gas prices bounced by c. 9% in November as Russia threatened to cut off its supply to Europe. Although thermal coal has seen a c. 4% drop in prices, the current spot price of US$230/tonne is still high, while iron ore rose 21.7% in November (-15.8% YTD) to c. US$103/tonne. After seven consecutive monthly declines, the gold price rose 8.3% in November (-3.3% YTD) on the back of a weaker US dollar. The platinum price jumped 11.5% MoM (+7.1% YTD), while the price of palladium rose 2.0% MoM (-1.2% YTD).

On the JSE, South Africa’s (SA’s) FTSE JSE All Share Index surged 12.2% MoM (+1.5% YTD), while the FTSE JSE Capped SWIX advanced by 9.6% MoM (+7.4% YTD). The local bourse was buoyed by Chinese markets rebounding earlier this week (local companies stand to benefit from a China reopening, given the sway of commodities, tech and luxury retail on the JSE), and the JSE has now rallied 19.2% since reaching a 2022-low of 6,263.9 on 29 September. Resources were the main drivers (and star performers) in November as mining counters’ share prices rallied, with the Resi-10 soaring 17.3% MoM (+3.5% YTD). The Indi-25 was a close second with a 15.1% MoM gain (-5.2% YTD). Financials and locally listed property counters also put in a solid performance, with the Fini-15 jumping 5.5% MoM (+10.8% YTD) and the SA Listed Property Index rising by 5.2% MoM (-7.9% YTD). Highlighting the best-performing shares on the JSE by market cap, BHP Group, the largest company on the exchange, was up 19.1% MoM, with the JSE’s second-biggest listed company, Prosus jumping 39.0% MoM. Other large-cap counters that recorded impressive gains for the month included Naspers (+38.7% MoM), Anglo American Plc (+23.8% MoM), Richemont (+22.4% MoM), and Anglo American Platinum (Amplats; +17.5% MoM). The rand strengthened by 6.7% against a weaker US dollar as the greenback fell from multi-decade highs. YTD, however, the local unit is still down 7.3% vs the dollar.

In local economic data, October headline inflation, as measured by the consumer price index (CPI), surprised to the upside (after slowing for two months), coming in at 7.6% vs September’s 7.5% print. With fuel inflation already known in advance (and thus ultimately factored in) and food inflation broadly steady in October, the upside surprise in this particular release came from core CPI (5.0% YoY in October vs September’s 4.7% YoY print). Whilst the additional, out-of-cycle survey of medical health insurance turned out higher than initially forecast, the overall rise in core CPI was fairly broad-based, adding to signs that inflation is continuing to broaden beyond the energy and food price shocks and, thus, becoming more entrenched. According to Stats SA data, retail trade sales declined 1.9% in 3Q22, increasing the chances that the economy fell into a recession and the path out will be arduous amid Eskom’s mounting woes. Unsurprisingly, the interruption of the downtrend in inflation from the recent peak in July served to stoke the South African Reserve Bank’s (SARB’s) inflation concerns while supporting its general approach in this rate-hiking cycle of erring on the side of caution and front-loading the interest rate hikes. Subsequently, the SARB’s Monetary Policy Committee (MPC) voted in its last meeting of 2022 to hike rates by a further 75 bpts, taking the repo rate to 7.0%. The latest (3Q22) Quarterly Labour Force Survey (QLFS) print, released on 29 November, showed that the total number of employed South Africans rose 1.3% QoQ to 15.8mn, while the official unemployment rate declined from 33.9% in 2Q22 to 32.9% in 3Q22.

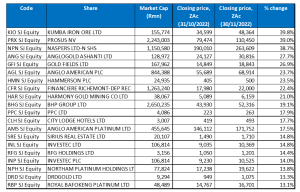

Figure 1: November 2022’s 20 best-performing shares, % change

Source: Bloomberg, Anchor

The JSE-listed resources counters performed well in November, featuring prominently among last month’s best-performing shares as commodity prices rallied on the prospect of China gradually emerging from the grip of ongoing COVID-19 lockdowns. The price of iron ore climbed, buoyed by China’s moves to ramp up support for its struggling property sector which accounts for a sizeable chunk of China’s steel demand. Last week, China’s biggest commercial bank pledged c. US$162bn in new credit to property developers – the latest move to restore confidence in China’s housing sector This has resulted in the steelmaking ingredient experiencing a strong price recovery from its lows of c. US$80/tonne at the end of October to c. US$100/tonne by the end of November. The jump in the iron ore price saw Kumba Iron Ore’s share price soar 39.8% MoM, with Kumba the best-performing share on the JSE for November.

Kumba was closely followed by Prosus (+39.0% MoM) and Naspers (+38.7% MoM). The share prices of these two counters rebounded from their poor performances in October (when their share prices fell by 16.2% and 16.0% MoM, respectively) to emerge as November’s second and third-best performing shares. The Naspers/Prosus complex was boosted by Chinese tech conglomerate Tencent, in which they have a c. 28% stake, which recorded a c. 39% MoM share price rise. Both Prosus and Naspers also released their interim results last month, with Prosus’ 1H23 results seeing revenue climb 9% YoY to US$16.5bn, driven mainly by a 41% increase in e-commerce revenue, which benefited from a robust operating performance across all its core segments. However, EPS of US$1.81 was down 82% YoY due to higher investment costs and a smaller contribution from Prosus’ large stake in Tencent. Meanwhile, Naspers reported strong 1H23 e-commerce growth, but Group trading profit declined by 38% YoY to US$1.4bn, also negatively impacted by a lower contribution from Tencent. Naspers’ revenue rose 9% YoY to US$17bn, but core headline earnings were down 51% YoY, or US$1.1bn to US$372mn.

Naspers was followed by AngloGold Ashanti and Gold Fields, which recorded share price gains of 27.7% and 26.9% MoM, respectively, helped by November’s stronger gold price (+8.3% MoM). For Gold Fields, the termination of the Yamana deal also resulted in its share price jumping over 21% on 9 November – one day after Yamana Gold accepted a rival offer, which ended Gold Fields’ journey to bring the Canadian miner under its wing. Gold Fields will receive US$300mn (c. R5.3bn) from Yamana as a termination fee.

Anglo American Plc, UK-based real estate investment trust (REIT) Hammerson Plc, and Richemont recorded MoM gains of 23.7%, 23.5% and 22.4% in November. Anglo’s iron ore exposure has also seen the share price perform well, while Richemont released strong 1H23 results in mid-November. The results marginally beat consensus analyst estimates across the board, and the Richemont share price rose 12.8% on the day following the results. All its divisions posted YoY revenue growth of 20%-plus, with total revenue increasing 24.3% YoY. Regionally, Europe and Japan posted strong growth of 44.9% and 66.4% YoY, respectively, while growth in the Asia-Pacific (APAC) region was only 3.3% as lockdowns in China constrained the country’s economy. EPS increased 40% YoY, but we note that this number is not an accurate representation as it no longer includes the loss-making online retailer YOOX Net-a-Porter (YNAP) division, which has been stripped out and now forms part of discontinued operations in its financial statements.

In its 1Q23 operational update, Harmony Gold (+21.0% MoM) reported a decent quarter despite Eskom power cuts costing the company c. R95.5mn in lost revenue. Total Group production declined by 4.0% YoY to 11,396kg, but the gold price increased 1.0% YoY to R954,916/kg from R944,671/kg in 4Q22.

Rounding out November’s top-ten performers, BHP Group’s share price rose 19.1% MoM. Last month, BHP raised its offer for Australian copper miner OZ Minerals to AUD9.60bn (c. US$6.40bn) in a deal that is set to be one of the largest mining takeovers of the year.

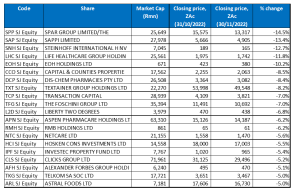

Figure 2: November 2022’s worst-performing shares, % change

Source: Bloomberg, Anchor

Spar Group (-14.5% MoM) was November’s worst-performing share. The grocery retailer’s share price plummeted 15% on 17 November after it released FY22 results which missed its full-year profit target and cut its dividend by more than half to fund IT systems upgrades across SA and Europe. Consensus forecasts expected HEPS to come in at ZAc1,226, but HEPS fell 3.0% YoY to ZAc1,160.5 from ZAc1,196.2 in FY21. Spar’s turnover growth of 6% YoY was also weak compared to the other food retailers. In terms of the revenue numbers, Spar Southern Africa saw segmental revenue grow 8.5% YoY, which is again weak when compared to, for example, Shoprite, which recorded topline growth of 19% YoY in 1Q23. According to Spar, the consequences of the COVID-19 pandemic and higher energy prices resulted in its operating expenses rising 8.5% YoY to R15.9bn. These pressures were magnified in SA by loadshedding, the company said.

Pulp and paper producer Sappi, which was October’s best-performing share with a gain of 28.7% MoM, recorded a 13.4% share price loss in November. Last month, the company said that it had achieved EBITDA of US$1.34bn (R24bn) for the period ended September 2022 (4Q22), exceeding its previous record of US$1.05bn. Sappi recorded a net profit of US$536mn for the period under review, compared with a net profit of US$13mn for the prior year. The Group also announced it would resume dividend payments from its cash reserves (it declared a dividend of US$0.15/share), to be paid in January 2023. EPS, excluding special items, rose to US$1.38 vs US$0.15 in the previous financial year. Steinhoff was the third-worst performing share, with a MoM share price decline of 12.7%.

Steinhoff was followed by Life Healthcare, EOH Holdings and UK-based property and investment company Capital & Counties Properties Plc (CapCo), which recorded MoM losses of 11.8%, 10.2% and 8.5%, respectively. Last month, Life Healthcare posted a 4.9% YoY increase in Group revenue to R28.2bn, of which 70.8% came from its Southern Africa business. Growth in SA was driven by a 5.8% increase in paid patient days, a 4.25% tariff increase and revenue from its new imaging businesses. Still, it was negatively impacted by a decline in COVID-19 patients, which had longer and more expensive stays than other patients. Life’s UK-based diagnostic and imaging subsidiary, Alliance Medical Group (AMG), reported a 2.8% YoY increase in revenue to R7.86bn, with increased volumes offset by the end of its COVID-19 contracts. Despite reporting a solid operating performance, headline EPS fell 4.5% YoY to ZAc106.1, as the results were negatively impacted by the end of the short-term COVID-19 contracts between AMG and governments in the UK and Italy, as well as the disposal of its Polish hospital business Scanmed in March 2021. Meanwhile, EOH’s share price dropped after it announced details about its rights issue plan. Although the market expected the rights issue, EOH’s formal announcement about the plan sent its shares as low as R3.51 on 11 November. YTD, EOH’s share price has lost c. 44.4% as legacy debt issues have continued to weigh heavily on investor sentiment.

In its interim results for the six months ending 31 August 2022, Dis-Chem Pharmacies (-8.4% MoM) reported revenue growth of 9.3% YoY to R16.3bn, while retail revenue grew 9.3% YoY to R14.4bn. Headline earnings increased by 44.3% YoY, with basic headline HEPS at ZAc70.3 – a YoY jump of 44.3%.

Textainer Group (-8.2% MoM), investment management company Transaction Capital (-7.0% MoM) and The Foschini Group (also down 7.0% MoM) rounded out November’s worst-performing shares. Last month Transaction Capital reported FY22 results, which showed that its revenue rose to R22.65bn from R5.84bn posted in the previous year, but its diluted EPS decreased 32.7% YoY to ZAc226.50. In its 1H23 results, retailer Foschini reported a revenue rise to R25.08bn from R20.39bn posted in the corresponding period of the previous year, while diluted EPS increased 43.9% YoY to R4.58. However, SA profit was down over 12% YoY, and the retailer said it had lost c. R400mn in sales over six months because of Eskom’s ongoing power cuts.

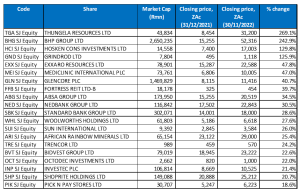

Figure 3: Top-20 November 2022, YTD

Source: Anchor, Bloomberg

Sixteen out of October’s top-20 YTD best-performing shares remained among the top-20 best performers for the year to the end of November, with African Rainbow Minerals (+25.4% YTD), Octodec (+22.0% YTD), Investec Plc (+21.4% YTD), and Shoprite (+20.7% YTD) replacing Sappi, British American Tobacco, Sasol and Omnia.

Coal miner Thungela Resources (+269.1% YTD) was the top-performing share for the tenth consecutive month, with its share price gaining a further 8.1% in November. Thungela’s share price has soared thanks to demand for its coal as European countries scramble for energy supplies in the wake of Russia’s war on Ukraine and the sanctions adopted against Moscow, a major European gas supplier, by the international community. Thungela’s YTD total return (which includes the dividend) now stands at 373.1%.

BHP Group (+242.9% YTD) remained in the second spot and was followed by Hosken Consolidated Investments (HCI;+129.8% YTD) for a second consecutive month. HCI was again followed by logistics company Grindrod Ltd (+125.9% YTD.

Exxaro Resources (+47.8% YTD) moved up one spot after gaining 10.4% in November. It was followed by healthcare Group Mediclinic International which is now up 47.0% YTD. Last month, Mediclinic decided against declaring an interim dividend as it waits for the buyout from its biggest shareholder, Remgro, in a consortium with Switzerland’s MSC Mediterranean Shipping, to go through. In its 1H23 results, Mediclinic stated that its revenue increased 10% YoY to GBP1.73bn (c. R35.5bn) from GBP1.58bn posted in 1H22, while diluted EPS rose by 28.4% YoY to GBp11.30.

Mediclinic was followed by Glencore, Fortress REIT -B-, ABSA Group and Nedbank with YTD gains of 40.7%, 39.7%, 34.5% and 30.5%, respectively.

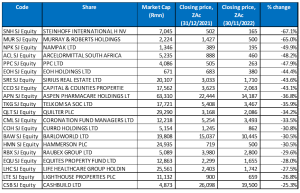

Figure 4: Bottom-20 November 2022, YTD

Source: Anchor, Bloomberg

Among the YTD worst-performing shares, 17 of the 20 shares for the year to the end of October were also among the 20 worst-performers for the year to the end of November. Raubex (-42.0% YTD), Life Healthcare (-39.3% YTD), and Cashbuild (-25.3% YTD) were the newcomers last month, replacing Zeder, Prosus, and DRD Gold.

After taking the worst-performer spot for six consecutive months before being bumped to the second spot in October, Steinhoff (-67.1% YTD) moved back into the top spot. Engineering and mining contracting company Murray & Roberts (-65.0% YTD) claimed the second worst-performer position, followed by Nampak (49.9% YTD) in the third spot. Murray & Roberts’s share price rose c. 5.3% in November after it said that the Italian industrial group Webuild had agreed to buy its stake in its Australian construction subsidiary Clough for AUD350mn (c. R4bn). The surprise announcement on the sale of the business at the heart of Murray & Robert’s growth strategy in Australia buoyed the share price.

Nampak (-49.9% YTD) bumped PPC (-47.9% YTD) from the third position despite the Nampak share price gaining 3.7% in November. Nampak was followed by ArcelorMittal SA, PPC Ltd, EOH Holdings and Sirius Real Estate, which recorded YTD declines of 48.2%, 47.9%, 44.4% and 43.6%, respectively.

At Anchor, our clients come first. Our dedicated Anchor team of investment professionals are experts in devising investment strategies and generating financial wealth for our clients by offering a broad range of local and global investment solutions and structures to build your financial portfolio. These investment solutions also include asset management, access to hedge funds, personal share portfolios, unit trusts, and pension fund products. In addition, our skillset provides our clients with access to various local and global investment solutions. Please provide your contact details here, and one of our trusted financial advisors will contact you.