The JSE and Major Global Markets End December

US and global markets (MSCI World -4.2% MoM/-17.7% YoY) ended the year with a whimper as most global equity markets recorded losses in December, capping what has been a volatile year which saw sharp movements and declines on world markets. This volatility has been driven by central banks’ aggressive interest rate hikes to curb runaway (and sticky) inflation, ongoing recession fears, Russia’s war on Ukraine and increasing concerns over a surge in COVID-19 cases in China now that the country is opening its borders and scrapping strict pandemic protocols.

US Economic Market

On 14 December, the US Federal Reserve (Fed) raised its benchmark rate by 0.5% – the fifth hike in a row, bringing US rates to the highest level in fifteen years. Fed officials also indicated that they expect to keep rates higher through 2023, with no reductions until 2024. For 2022, the three major US indices ended down – recording their worst year since 2008. Among the three, the Dow (-8.8% YoY) performed best for the year, while the blue-chip S&P 500 dropped 19.4% YoY, and the tech-heavy Nasdaq plummeted 33.1% in 2022. The Nasdaq was also the biggest loser among the three in December – down 8.7% MoM, while the S&P 500 lost 5.9% MoM, and the Dow was down 4.2% MoM.

In US economic data, inflation slowed for a second consecutive month, with November headline consumer price index (CPI) data coming in at 7.1% YoY vs October’s 7.7% YoY print. This was the lowest YoY gain in eleven months. Core CPI, which excludes the erratic food and energy components, also printed lower at 6.1% vs 6.3% YoY in October. MoM, November CPI increased 0.1% vs October’s 0.3% rise. US 3Q22 GDP growth was revised higher than initially estimated, reflecting upward revisions to consumer spending and business investment. GDP increased at a 3.2% annualised rate in 3Q22 vs a previously reported 2.9% advance. In 2Q22, US GDP registered a drop of 0.6%.

German Economic Market

In Germany, the DAX ended the month 3.3% lower (-12.3% for 2022), while France’s CAC Index closed December 3.9% in the red (-9.5% for 2022). The European Central Bank (ECB) opted for a smaller rate hike at its December meeting, taking its key rate from 1.5% to 2%. However, the bank said it would need to continue increasing rates “significantly” further to tame inflation. The ECB increased rates by 50 bps in July and 75 bps in September and October, bringing rates out of negative territory for the first time since 2014. In addition, from March 2023, the ECB said it will reduce its balance sheet by EUR15bn (c. US$15.8bn) per month (on average) until the end of 2Q23.

UK Economic Market

The UK’s blue-chip FTSE-100 Index (+0.9% YoY) was one of the few major indices to post a positive performance in 2022, but for December, the index declined by 1.6% MoM. UK November inflation came in at 10.7% YoY after hitting a 41-year high of 11.1% in October. This, as fuel prices cooled, helping ease price pressures. However, food and energy prices remained high. As expected, the Bank of England (BoE) raised interest rates in November by 50 bps to 3.50% – its eighth increase for 2022.

Chinese Economic Market

China removed the world’s strictest COVID-19 restrictions in early December, but commentators are concerned that surging infections could result in temporary labour shortages and increased supply chain disruptions. China’s major indices ended mixed, with Hong Kong’s Hang Seng Index jumping 6.4% MoM (2022: -15.5%), while the Shanghai Composite Index closed 2.0% in the red (2022: -15.1%). On the economic data front, China’s official manufacturing purchasing managers index (PMI) fell to 47.0 in December from 48.0 in November. This decline was the biggest since February 2020. Official non-manufacturing PMI, which measures business sentiment in the services and construction sectors, fell to 41.6 in December from 46.7 in November. The 50-point mark separates expansion from contraction.

Japanese Economic Market

Japan’s benchmark Nikkei fell 6.7% MoM in December (2020: -9.4%), while economic data showed that the country’s economy shrank less in 3Q22 than previously thought. GDP slid 0.8% on an annualised basis (vs a previous expectation of a 1.2% YoY decline). QoQ, the world’s third-largest economy, contracted by 0.2%.

Commodity Prices

In terms of commodity prices, Brent crude oil ended the year 10.5% higher (+0.6% MoM) – its second consecutive YoY gain. However, it was a wild ride, with oil prices climbing on the back of tight supplies and then falling in November (on the back of weaker demand from top oil importer China) to its lowest level in c. 12 months. Natural gas prices fell c. 35.4% in December (2022: +20%), while thermal coal prices dropped 23.7% MoM (2022: +38.5%), and iron ore prices rose 12.1% in December (2022: -4.8%). The gold price rose for a second month running – up 3.1% in December (2022: -0.3%). The platinum price jumped 3.6% MoM (2022: +10.9%), while the price of palladium fell 4.8% MoM (2022: -5.9%).

After surging by 12.2% in November, South Africa’s (SA’s) FTSE JSE All Share Index followed global markets lower in December, ending the month down 2.4% (2022: -0.9%), while the FTSE JSE Capped SWIX dropped 2.8% in December but was up 4.5% for the year. The SA Listed Property Index outperformed other indices, closing December 0.6% up (2022: -7.3%), while the Fini-15 underperformed, ending the month 5.3% lower (2022: +4.9%). The Resi-10 declined by 3.6% MoM (2022: -0.2%), while the Indi-25 closed December 0.2% down (2022: -5.4%). Highlighting the best-performing shares on the JSE by market cap, BHP Group, the largest company on the exchange, managed to eke out a gain in December – up 0.7% MoM. Other large-cap counters that posted good gains for the month included Naspers (+7.1% MoM), Prosus (+6.6%), Anheuser Busch InBev (+3.5% MoM), and Richemont (+1.4% MoM). The rand strengthened by 1.0% MoM against a weaker US dollar, which lost some of its shine towards year-end, but for the year as a whole, the local unit is down 6.4% vs the greenback.

South African Economic Markets

In SA economic data, November headline inflation, as measured by the consumer price index (CPI), surprised to the upside (after slowing for two months), coming in at 7.4% vs October’s 7.6% print. MoM, CPI was 0.3% in November vs the 0.4% recorded in October. The three categories with the highest annual inflation rates in November were transport (+15.3% YoY), food & non-alcoholic beverages (+12.5% YoY) and hotels & restaurants (+7.9% YoY). According to Stats SA data, retail trade sales declined 0.6% YoY in October following MoM changes of 0.2% in September 2022 and -1.3% in August 2022. In the three months that ended on 31 October 2022, seasonally adjusted retail trade sales dropped 1.4% QoQ.

On the political front, President Cyril Ramaphosa emerged victorious from the ANC elective conference, winning a second five-year term as ANC president and beating rival Zweli Mkhize for the position. Paul Mashatile was elected as deputy president of the party. Earlier in December, a report by an independent panel on the theft of US$580,000 from Ramaphosa’s Phala Phala farm in Limpopo found that Ramaphosa may have broken some of SA’s anti-corruption laws, violated his oath of office, and committed misconduct in the matter. This fuelled concerns that he might resign or be impeached (neither of which happened), with the impact on the local bourse being swift as JSE saw outflows of nearly R4bn and c. R9bn flowed out of the local bond market.

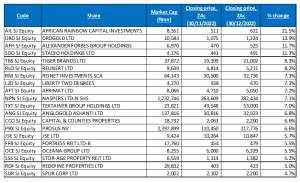

Figure 1: December 2022’s 20 best-performing shares, MoM % change

Source: Bloomberg, Anchor Capital

African Rainbow Capital Investments (ARC) was December’s best-performing share, jumping 21.5% MoM. Earlier in the month, ARC provided a 3Q22 update on its investments which was positively received by the market. The company has investments in the telecoms company, rain, independent phosphate producer Kropz, and financial services provider TymeBank among others. ARC said that rain’s acquisition of additional spectrum was expected to impact the valuation of its investment in the company positively. At the same time, TymeBank continues to sustain its onboarding of new customers. In October, Tyme reported that c. 228,000 new customers were onboarded for the month, representing a record in the number of new customers onboarded in one month.

ARC was followed by DRD Gold (+13.9% MoM) in second place, likely buoyed by a higher gold price, and financial services company Alexander Forbes (+11.7% MoM) in the third spot. In its 1H22 results, Alexander Forbes indicated that its fee and commission revenue rose to R2.2bn from R2.1bn posted in 1H21, while its diluted EPS increased by 11.9% YoY to ZAc13.20. The Group also lifted its interim dividend by 25% YoY to ZAc15/share.

Stadio Holdings, which invests in private higher education, Tiger Brands and Reunert recorded monthly gains of 11.3%, 8.3%, and 8.2%. Food producer Tiger Brands recorded robust FY22 results early last month despite headwinds such as input cost inflation and difficult trading conditions. The Group reported that its total revenue rose c. 10% YoY to R34.03bn from R30.95bn posted in the previous year, while its diluted EPS from continuing operations increased 64.2% YoY to R17.38. It also declared a full-year dividend of ZAc973 – up 18% YoY, representing a c. R1.75bn payout. Meanwhile, automation equipment company, Reunert reported good FY22 results on 30 November, which showed that its revenue rose to R11.1bn from R9.6bn posted in the previous year. In addition, its diluted EPS increased by 7.5% YoY to R5.17.

Reinet Investments and retail-centred real estate investment trust (REIT) Liberty Two Degrees (L2D) both posted MoM share price gains of 7.3% in December. L2D said at the end of November that demand for space at its malls is high, with retail occupancies reaching 98% in October 2022. L2D’s super-regional malls (Sandton City and Eastgate) recorded occupancies of 98.7% and 96.1%, respectively, the company said. According to the latest South African Property Owners Association’s (SAPOA) Retail Trends Report, super-regional shopping centres are trading at 6.4% above their pre-pandemic level. L2D achieved a 29.6% growth in foot count for 9M22 compared to 9M21 and is also 9.8% ahead of 2019.

Rounding out the top-10 performers were Afrimat Ltd (+7.2% MoM), a leading mid-tier open-pit mining company, and Naspers -N- (+7.1% MoM). Naspers said last month that its e-commerce businesses are on the verge of reaching sufficient scale to become self-sustaining, placing the division on track to be profitable by 2025 as scheduled. In its latest earnings report for the six months to the end of September, Naspers trumpeted the performance of its e-commerce portfolio, which has shown strong organic revenue growth of 41%.

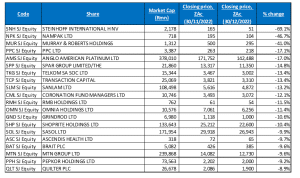

Figure 2: December 2022’s worst-performing shares, MoM % change

Source: Bloomberg, Anchor Capital

Steinhoff was December’s worst-performing share, with its share price plunging 69.1% MoM. The company’s share price tumbled after it announced that its assets’ value remains lower than its liabilities and is likely to remain so at the end of June 2023, when it has to settle its debt. Steinhoff issued several statements to outline a new plan to buy itself more time, but this will result in shareholders getting much less than hoped and creditors taking control of the company. According to the new proposal, creditors will receive an 80% interest in Steinhoff and shareholders 20% (housed in an unlisted entity). In return, Steinhoff’s creditors will extend the maturity dates for debt by three years (to June 2026), and in some cases, its creditors are also offering slightly lower interest rates. However, creditors will likely end up with 100% if shareholders do not agree to the proposal and ratify it when resolutions to the effect are put to a general meeting of shareholders.

Nampak (-46.7% MoM) was December’s second worst-performing share. In December, the packaging company, in its FY22 results, reported that its revenue advanced 21.3% YoY to R16.94bn, while its diluted loss per share stood at ZAc23.1, compared with EPS of ZAc32.1 recorded in FY21. Earlier in the month, Nampak announced plans to approach shareholders for approvals to proceed with a rights issue. However, the Group has R5bn in debt after the African expansion, which started in 2013, and Nampak’s CEO said the company should have acted sooner in approaching shareholders for capital. He added that Nampak had been avoiding a rights offer but had no choice after an unsuccessful bid to sell off assets.

Nampak was followed by engineering and mining contracting company Murray & Roberts (-41.0% MoM), which announced in December that it has entered into a sale and purchase agreement with Intertoll International Holdings B.V. to dispose of its entire interest in the Bombela Concession Company for R1.38bn, which should provide some relief to its balance sheet by 2H23. However, previous efforts to restructure the business have hit snags, with the sale of its Clough business in Australia falling through, which has meant that not only Clough but its holding company, Murray & Roberts Pty Ltd, have been placed in voluntary administration (Clough’s debt of AUD350mn will be ring-fenced in Australia).

PPC, Anglo American Platinum (Amplats), and Spar Group followed, with MoM losses of 17.1%, 17.0% and 14.8%. After losing 14.5% in November following disappointing results, which missed the Group’s full-year profit target, Spar’s share price dropped again last month following a raft of allegations and a wave of negative news emerging against the company. This included legal battles with one of its Johannesburg store owners amid allegations it inflated the price of a store. Fraud charges were also filed against senior executives of Spar, including Group chair Graham O’Connor, amid allegations the company falsely claimed in 2019 it was owed money to gain control over certain supermarkets. In addition, Business Day reported that two ‘fictitious’ loans had been uncovered in a report compiled on behalf of Spar’s board, which was looking into allegations of unfair treatment and racism. The company’s governance is also under scrutiny after O’Connor became Spar chairperson just one month after retiring as CEO, which is at odds with the King Code’s recommendation of at least a three-year break. The ongoing negative media coverage and allegations saw O’Connor step down from his leadership position, although he remains on the company’s board.

Spar was followed by Telkom, Transaction Capital (both down 13.4% MoM) and financial services Group, Sanlam (–13.2% MoM). In early December, Sanlam released a mixed operational update for the ten months ended 31 October 2022 as profit in the Group’s life businesses showed a marked recovery as COVID-19-related death claims declined, but global market volatility negatively impacted its investment returns. Sanlam revealed that its net result from financial services for life insurance increased 23.0% YoY, asset management rose 21.0% YoY, and credit and structuring operations advanced by 17.0% YoY. However, it said that its general insurance operations declined 50.0% YoY. The high claims inflation, electrical power surge and vehicle theft-related claims also hit its short-term insurance arm, Santam. This was further compounded by adverse weather conditions and the deadly floods in KwaZulu-Natal (KZN) during the first half of 2022.

Rounding out December’s ten worst-performing shares was Coronation Fund Managers, which saw its share price decline 12.1% MoM. Towards the end of November, Coronation reported lacklustre results, with headline EPS falling 25% YoY to ZAc366.3 for the year to end September. The Group’s revenue also declined by 12% YoY to R3.74bn.

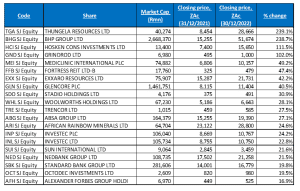

Figure 3: Top-20 performers of 2022

Source: Anchor Capital, Bloomberg

Seventeen out of November’s top-20 YTD best-performing shares remained among the top-20 best performers for the year to the end of December, with Stadio Holdings (+30.9% YoY), Investec Ltd (+22.8% YoY), and Alexander Forbes (+16.9% YoY), replacing Bidvest, Shoprite and Pick n Pay Stores.

Coal miner Thungela Resources (+239.1% YoY) had a bumper 2022 and was the top-performing share for the year (it was also at the YTD top spot for eleven consecutive months), although its share price did decline 8.1% in December. Thungela’s share price has soared for most of the past year thanks to demand for its coal (the coal price has been under pressure over the past few months but is still up 38.5% in 2022) as European countries scrambled for energy supplies in the wake of Russia’s war on Ukraine and the sanctions adopted against Moscow, a major European gas supplier, by the international community. As a result, Thungela’s 2022 total return (which includes the dividend) stands at 334.7%.

BHP Group (+238.7% YTD) remained in the second spot and was followed by investment holding company Hosken Consolidated Investments (HCI;+111.5% YoY) for a third consecutive month. In its 1H22 results, released in December, HCI said that its revenue rose to R6.2bn from R4.9bn posted in 1H21, while its diluted EPS from continuing operations stood at R11.62, compared with R3.02 recorded in the corresponding period of 2021. HCI was again followed by logistics company Grindrod Ltd (+102.0% YoY).

Healthcare Group Mediclinic International (+49.2% YoY) moved up one spot after gaining 1.5% in December. It was followed by Fortress REIT -B-, Exxaro Resources and Glencore Plc with YoY gains of 47.4%, 42.2%, and 40.5%, respectively. In early December, it was reported that Glencore had agreed to pay the Democratic Republic of Congo (DRC) c. US$180.0mn to cover claims arising from alleged acts of corruption. This is the mining company’s latest settlement with global authorities over its conduct.

Rounding out 2022’s ten best-performing shares were Stadio Holdings and Woolworths, with YoY gains of 30.9% and 28.1%, respectively. Woolworths’ share price gained 1.9% on the day after it announced the sale of its Australian department store unit David Jones to Anchorage Capital Partners for an undisclosed sum.

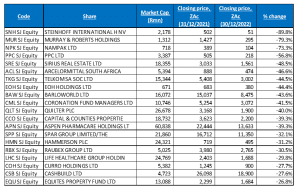

Figure 4: Bottom-20 performers of 2022

Source: Anchor Capital, Bloomberg

Among the YTD worst-performing shares, 19 of the 20 shares for the year to the end of December were also among the 20 worst-performers for the year to the end of November. Spar Group (-32.1% YTD) was the only newcomer (following its dismal share price performance in December when it lost 14.8% – see earlier comment). As a result, Spar replaced Lighthouse Properties in 2022’s twenty worst-performing shares.

Not surprisingly, after its share price plummeted c. 70% in December, Steinhoff (-89.8% YoY) was 2022’s worst-performing share. It was followed by Murray & Roberts (-79.3% YoY) in the second position and Nampak (-73.3% YoY) in the third spot (all three are discussed earlier in this note).

Nampak was followed by PPC (-56.8% YTD), Sirius Real Estate (-48.5% YoY), ArcelorMittal SA (-46.6% YoY) and Telkom (-44.5% YoY).

EOH Holdings, Barloworld and Coronation rounded out the ten worst-performing shares with YoY losses of 44.4%, 43.6%, and 41.5%. YTD, EOH’s share price has been under pressure as legacy debt issues, and the announcement of a rights issue in November continued to weigh on investor sentiment. The share price came under further pressure after EOH said last month that it had received unanimous approval from shareholders to raise up to R600mn through a rights issue.

At Anchor, our clients come first. Our dedicated Anchor team of investment professionals are experts in devising investment strategies and generating financial wealth for our clients by offering a broad range of local and global investment solutions and structures to build your financial portfolio. These investment solutions also include asset management, access to hedge funds, personal share portfolios, unit trusts, and pension fund products. In addition, our skillset provides our clients with access to various local and global investment solutions. Please provide your contact details here, and one of our trusted financial advisors will contact you.