Global Markets: A Stellar Start To 2023

Global markets (MSCI World +7.1% MoM) were off to a strong start in the first month of 2023, with equity markets enjoying a rally after ending a dreadful 2022 with a whimper. This was on the back of optimism around China’s economic recovery, GDP data showing that the US economy grew more than expected, the hope that US inflation is now on a sustained downward trend, that US interest rates are close to their peak, and a growing belief that the US will avoid a recession. Hopefully, the old Wall Street saying, “as goes January, so goes the year,” proves true in 2023.

The three major US indices scored a trifecta in January, recording impressive gains for the month as robust 4Q22 earnings and promising US inflation data buoyed sentiment. Among the three, the tech-heavy Nasdaq was the best performer, soaring 10.7% MoM – its best January performance since 2001 and its best MoM rise since July last year. The Dow jumped 2.8% MoM, while the blue-chip S&P 500 (+6.2% MoM) recorded its best January since 2019.

The US Economy

In US economic data, inflation slowed again in December, with headline consumer price index (CPI) data coming in at 6.5% YoY vs November’s 7.1% YoY print. Core CPI, which excludes the erratic food and energy components, also printed lower at 5.7% vs 6.1% YoY in November. MoM, December CPI declined 0.1% vs November’s 0.1% rise due to falling US petrol prices. According to the US Bureau of Labor Statistics, inflation closed out last year with a 6.25% annual reading. US 4Q22 GDP growth rose at an annualised rate of 2.9%, slightly better than expected but below 3Q22’s 3.2% annualised rate, as a sharp drop in the housing category weighed on GDP. Consumer spending weakened from the previous period but remained positive.

The European Economy

In Europe, Germany’s DAX ended the month 8.7% higher, while France’s CAC Index closed January 9.4% up. GDP data released in January showed that the eurozone economy grew by 0.1% YoY in 4Q22. This was better than consensus estimates of a 0.1% YoY contraction but is still a slowdown from 3Q22’s 0.3% YoY growth. France’s January inflation rate rose to 7.0% vs December’s 6.7% print, driven higher by soaring energy prices after the French government stopped some measures that had reined in fuel price increases. In Germany, December retail sales fell unexpectedly (-5.3% MoM) as high inflation, and the ongoing energy crisis weighed on consumers’ pockets.

The UK Economy

The UK’s blue-chip FTSE-100 Index rose by 4.3% MoM in January. UK December inflation eased for a second month, coming in at 10.5% YoY, down from 10.7% YoY in November, as fuel, clothing and recreational costs cooled, helping ease price pressures.

The Chinese Economy

China’s markets bounced back after exiting its strict zero-COVID policy and despite surging COVID-19 infection rates being recorded in the world’s second-biggest economy. Foreign investors turned more optimistic following the lifting of the zero-COVID policy and rushed back into Chinese markets. As a result, all of the country’s major indices closed in the green, with Hong Kong’s Hang Seng Index jumping 10.4% MoM, while the Shanghai Composite Index closed 5.4% in the green.

On the economic data front, China’s factory activity bounced back in January, buoyed by the reopening of the economy following the lifting of the strict zero-COVID policy and expanding for the first time since September 2022. China’s official manufacturing purchasing managers index (PMI) rose to 50.1 from 47.0 in December, while the official non-manufacturing PMI, which measures business sentiment in the services and construction sectors, rose to 54.4 in January from December’s 41.6 print – its highest levels since June 2022. The 50-point mark separates expansion from contraction.

Japan’s benchmark Nikkei rose 4.7% in January, while economic data showed that the country’s core CPI advanced to 4.0% YoY in December, faster than expected and the highest annualised inflation print since December 1981. Japan’s factory activity contracted for a third straight month in January, although manufacturers’ outlook remained upbeat on improved supply conditions.

In terms of commodities, Brent crude oil was down 1.5% in January as Russian oil supply remained strong. Natural gas prices plummeted 39.7%, thermal coal prices dropped 16.9% MoM, and iron ore rose 5.7% in January. The gold price gained ground for a third month running – up 5.7% in January. However, the price of platinum and palladium fell 6.6% and 8.7% MoM, respectively.

The JSE

South Africa’s (SA’s) FTSE JSE All Share Index recorded an impressive 8.8% jump in January, breaking through the psychological 8,000 index level for the first time and reaching new record highs. The FTSE JSE Capped SWIX soared by 7.0%. After outperforming the other local indices in December, the SA Listed Property Index was the loser in January, closing 1.0% in the red. The Indi-25, which closed December 0.2% lower MoM, rose by 13.3% in January, with gains from its biggest constituents, Prosus (+17.9% MoM) and Naspers (+18.5% MoM), pushing the index higher. The Resi-10 closed 7.1% up, while the Fini-15 advanced 4.0% MoM. Highlighting the best-performing shares on the JSE by market cap, BHP Group, the largest company on the exchange, was up 14.7% MoM. Other large-cap counters that posted gains for the month included the aforementioned Naspers and Prosus, as well as Richemont (+18.3% MoM), Sasol (+16.3% MoM), MTN (+15.4% MoM) and Anglo-American (+10.4% MoM). The rand weakened by 2.2% MoM against a stronger US dollar amid heightened concerns over ongoing loadshedding. Blackouts intensified in January as Eskom implemented its worst-ever continuous power outages.

South African Economic Data

In SA economic data, December headline inflation, as measured by the consumer price index (CPI), cooled for a second consecutive month, coming in at 7.2% vs November’s 7.4% print. At its first meeting of 2023, the SA Reserve Bank’s Monetary Policy Committee hiked rates by 25 bps to a repo rate of 7.25%. According to Stats SA data, retail trade sales improved by 1.1% MoM and 0.4% YoY in November, driven mainly by Black Friday sales. The latest reading follows two straight months of declines. Household furniture, appliances and equipment and textiles, clothing, footwear and leather goods categories all posted gains.

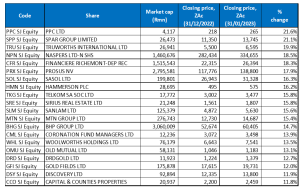

Figure 1: January 2023/YTD 20 best-performing shares, MoM % change

Source: Bloomberg, Anchor Capital

January’s 20 Best-Performing Shares

PPC, which recorded a share price drop of 56.8% in 2022, started the year with a bang emerging as January’s best-performing counter, rising 21.6% MoM, albeit from a very low base. This is likely as investors look for bargains on the local bourse. PPC is one of the largest cement suppliers in SA and has been under pressure for a while now as local infrastructure spending remains low. In its half-year trading statement released in mid-November, PPC reported a 2% YoY drop in cement sales volumes in its SA- and Botswana-based operations.

The Spar Group followed closely in the second spot with a 21.1% MoM gain, also from a low base, as it appeared to be working on cleaning up its image following damaging revelations. Spar’s share price lost 14.5% in November after it released disappointing results, and its share price dropped again in December (-14.8%) following a raft of allegations and a wave of negative news that emerged about the company. These revelations included that an 18-month-old legal report had found “fictitious loans” made by Spar to retailers, a R2.1bn lawsuit by its largest retailers and serious questions over governance. It resulted in the resignation first of its chairman Graham O’Connor and then its chief executive Brett Botten. With effect 1 February, Spar has moved Mike Bosman’s new role as non-executive chairman to that of executive chairman.

Truworths (+19.9% MoM) was January’s third best-performing share. The apparel retailer’s share price jumped after it said that Group sales rose during the first 26 weeks of FY23. This was despite record loadshedding and increasing pressure on consumers in SA and the UK. In its business and trading update for the 26 weeks ended 1 January 2023, Group retail sales increased 13.7% YoY to R11.3bn. Moreover, the company said that it expects its EPS to be between 11.0% and 14.0% higher as compared to the ZAc452.70 recorded in the corresponding period of the previous year. Truworths also said that it expects its HEPS to be between 8.0% and 11.0% higher vs the ZAc448.60 recorded in the corresponding period of FY22.

Truworths was followed by Naspers, luxury goods firm Richemont and Prosus, with MoM gains of 18.5%, 18.3% and 17.9%, respectively. Improved prospects for tech companies in China drove Naspers and Prosus’ gains. Chinese tech giant Tencent, which continues to push the momentum in Naspers group shares, soared c. 20% in January after the Chinese government signalled that it was softening its stance after a two-year crackdown on tech companies. Meanwhile, in its 3Q23 trading update, Richemont revealed that its sales increased 5.0% YoY at constant currency rates to EUR5.40bn, driven mainly by double-digit growth in Japan (+43% YoY) and Europe (+19% YoY.

In its 1H23 production and sales update, Sasol (+16.3% MoM) revealed that its external sales revenue decreased by 2.0% YoY while its sales volumes declined by 5.0% YoY. The company also signed three power purchase agreements for supplying renewable power to its SA operations, which are subject to certain conditions precedent.

Rounding out January’s ten best-performing shares were Hammerson Plc, Telkom SA and Sirius Real Estate, with MoM gains of 16.2% and 15.8% (both Telkom and Sirius). Telkom’s share price surged after its announcement in January that buyout talks with data-only operator Rain had ended. In an 11 January shareholders update, Telkom said that after initial discussions but before any due diligence, the parties decided that a suitable transaction was not possible at this time. In October 2022, talks of a corporate tie-up between Telkom and MTN also fell through. Hammerson and Sirius were buoyed by a weaker rand and a recovery in international real estate investment trusts (REITs).

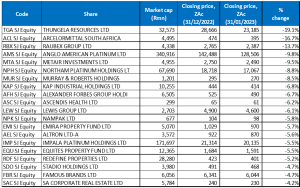

Figure 2: January 2023/YTD 20 worst-performing shares, MoM % change

Source: Bloomberg, Anchor Capital

January’s 20 Worst-Performing Shares

Coal miner Thungela Resources recorded a 19.1% MoM decline in its share price, albeit from an extremely high base and was January’s worst-performing share (we note that EOH Holdings’ share price fell by 30.1% MoM, but the share price decline calculation is complicated by the rights issue it announced last month, and we have therefore excluded it from this month’s commentary and table). Nevertheless, Thungela had a bumper 2022, with the share price soaring 239% for the year as the price of coal jumped following Russia’s invasion of Ukraine. However, Thungela started 2023 on a downbeat note, with the price of coal falling by 16.9% in January as Europe managed to avert an energy crisis by securing enough natural gas supplies, and the European winter turned out to be warmer than initially expected.

Steel producer ArcelorMittal’s (Amsa; -16.7% MoM) share price nosedived on 24 January, falling 22% on the day after the company released its 1H23 trading update, which flagged that its earnings were expected to decline by as much as 63% YoY due to falling steel prices. Amsa said that EPS declined from a R5.94 profit per share for the comparative period to a profit within a range of R2.20-R2.50/share for the current period – a YoY decrease of between 58% and 63%. Headline EPS were also expected to decline from R6.15/share to a headline profit per share within a range of R2.15-R2.45/share for the period – a drop of between 60% and 65% YoY. In its interim results in July, Amsa indicated that the outlook for the coming six months was strongly influenced by intensified economic headwinds, which threatened to affect the trading environment for steel significantly. The steel producer said that globally, steel prices had declined faster than raw materials, leading to negative price cost effects “… with spreads, the difference between steel prices and raw material costs, under significant pressure.”

Amsa was followed by Raubex, in third spot, Anglo American Platinum (Amplats), and automotive components and energy storage products company Metair Investments, which recorded MoM share price declines of 13.7%, 9.8% and 9.5%. After gaining c. 11% in 2022, the platinum price came under pressure in January (down 6.6% MoM), weighing on local platinum producers Amplats and Northam Platinum (-8.8% MoM). In addition, ongoing power woes and logistical issues (Transnet being hamstrung by rail and port limitations) are weighing on the local mining industry.

Construction and engineering Group, Murray & Roberts’ (-8.5% MoM) share price decline continued last month after it plummeted 79.3% in 2022. The Group announced in December that it had entered into a sale and purchase agreement with Intertoll International Holdings BV to dispose of its entire interest in the Bombela Concession Company for R1.38bn, which should provide some relief to its balance sheet by 2H23. Previous restructuring efforts have hit stumbling blocks, with the sale of its Clough business in Australia falling through, which has meant that not only Clough but its holding company, Murray & Roberts Pty Ltd, have been placed in voluntary administration (Clough’s debt of AUD350mn will be ring-fenced in Australia).

Kap Industrial Holdings, Alexander Forbes and health and wellness Group Ascendis Health rounded out January’s ten worst-performing shares, with MoM declines of 6.8%, 6.7%, and 6.2%, respectively.

At Anchor, our clients come first. Our dedicated Anchor team of investment professionals are experts in devising investment strategies and generating financial wealth for our clients by offering a broad range of local and global investment solutions and structures to build your financial portfolio. These investment solutions also include asset management, access to hedge funds, personal share portfolios, unit trusts, and pension fund products. In addition, our skillset provides our clients with access to various local and global investment solutions. Please provide your contact details here, and one of our trusted financial advisors will contact you.