As wealth managers, our clients rely on us to construct and manage their portfolios in a manner that will achieve their investment objectives. Unfortunately, the journey is never one of linear growth, and the concept of market volatility can be emotional at best. While structured products should not replace one’s allocation to equities, they can be used to supplement the portfolio and smooth out returns.

The traditionalist

The key to mitigating the impact of market uncertainty and reducing the potential for losses caused by market volatility is to have a well-diversified portfolio aligned with the investor’s long-term investment objectives.

For many years this was achieved by investing in a range of asset types with exposure to various industries, geographies, and currencies. The outcome was a traditional 60/40 portfolio comprising 60% equities and 40% bonds, with the intention of equities providing capital appreciation and fixed income offering yield and risk mitigation.

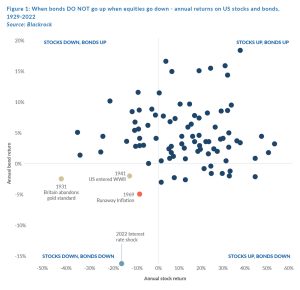

Conventional wisdom suggests that bonds and equities should act complementary in investors’ portfolios (i.e., when equities fare poorly, bonds typically do well and vice versa). But there are certainly environments where that is not the case, and investors will have fresh memories of the 2022 market sell-off when equities had a very tough year, and bonds had one of their worst years on record. This is a good reminder of alternative assets’ value and their essential role in investors’ portfolios when traditional assets may struggle.

Alternative diversification

So how do we generate returns in an economic environment unsuitable to conventional investment categories and strategies? We would require an investment that can mitigate the impact of market volatility while generating returns uncorrelated to the broader market. Look no further than alternative investments.

In a recent report by One Goldman Sachs Family Office Initiative, entitled Eye on the Horizon: Family Office Investment Insights, Goldman Sachs set out to interview 166 family office decision-makers around the globe to determine how these offices were allocating client assets. While 72% of the family offices’ managed assets were over US$1bn, what caught our attention was the outsized allocation to alternative assets, which equated to an average of 44%!

Alternative investments take many forms, including private equity, venture capital, private debt, hedge funds and structured products. Structured products are designed to provide capital protection and predefined outcomes. One key benefit of structured products is that they can deliver pre-agreed returns in flat or declining market conditions while ensuring a client’s capital is partially or fully safeguarded over the long term.

What is a structured product?

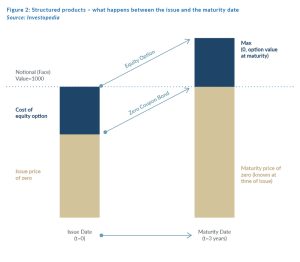

Simply put, structured products can be considered a hybrid between an equity-linked deposit and a fixed-deposit savings account. This hybrid is achieved by taking traditional securities, such as an investment-grade bond and replacing the usual payment features (periodic coupons and final principal) with non-traditional payoffs derived from the underlying asset or index performance as opposed to the bond’s cash flow. Through this mechanism, investors can safeguard their capital while having the ability to gain from market-linked returns.

Without going down the rabbit hole, there are many factors to consider when selecting a structured product. These include the reference asset, investment term, initial investment amount, desired returns, and the level of capital protection. Below we outline the basic notions that affect an investor’s payoff profile – returns and capital protection.

Without going down the rabbit hole, there are many factors to consider when selecting a structured product. These include the reference asset, investment term, initial investment amount, desired returns, and the level of capital protection. Below we outline the basic notions that affect an investor’s payoff profile – returns and capital protection.

One of the benefits of using a structured product lies in the optionality to structure the product to achieve the investor’s return objective. Traditionally, investors would select an asset class to derive a specified goal (i.e., fixed income to generate yield, equities for growth and property for a mix of growth and income). The other appealing aspect of structured products is the ability to introduce features that protect the investor from capital losses.

Capital protection

The certainty investors obtain around protecting their capital when investing in a fixed deposit at the bank can be matched to investing in some structured products. Although the capital protection feature in structured products is subject to the creditworthiness of the issuing entity, investors should exercise care when selecting at which bank they place their fixed deposit. Thus, investors should exercise care when selecting the bank that issues their choice of structured products.

Capital protection features in structured products can be broken down into two main categories:

- Hard capital protection: The issuer guarantees 100% of the original investment amount.

- Soft capital protection: The capital guarantee is subject to specific pre-defined criteria being met, e.g., the investor’s capital is protected provided the reference asset has not fallen by more than 30% at the maturity of the structured product. In this instance, if the reference asset has fallen by 35% at maturity of the structured product, the investor will bear the full 35% capital loss.

Pre-defined return outcomes

The pre-defined return outcomes for a structured product can be broadly split into fixed or variable return outcomes.

Fixed return outcomes

- Reference asset: The performance depends on the reference asset’s return, which can be an equity index or a basket of individual equities/bonds.

- Pre-defined return: The investor earns a pre-defined return on the structured product if the reference asset meets specific pre-defined criteria (e.g., a 12% p.a. return, provided that the equity index has not fallen by more than 30% when the structured product reaches maturity).

- Capital protection: This original capital invested is protected provided that the reference asset does not fall by more than a pre-defined amount over the term of the asset (e.g., if the referenced equity index has dropped by more than 30% at the maturity of the product, the investor is exposed to the full loss, in all other instances the capital is guaranteed).

Variable return outcomes

- Reference asset: The performance depends on the returns of the exposure selected – typically equity (e.g., an equity index or basket of individual equities).

- Enhanced/geared returns: Returns are geared to the index (e.g., 2.5 times the index’s performance).

- Return capped: The investor’s returns are capped at a certain level (e.g., a maximum return of 25% even if the enhanced return of the reference asset is higher than that at the maturity of the structured product).

- Capital protection: It is usually subject to conditions (e.g., the reference index has not fallen by more than 30% at maturity). If capital protection is unconditional, this usually reduces the amount of enhancement or gearing the investor participates in on the upside or reduces the cap.

Ultimately, the reference asset and note structure selected will provide the investor with a means of achieving their investment outcome, provided the reference asset has performed within the pre-defined parameters selected by the investor. Thus, investors should understand how the performance of these reference assets affects the return on their investment and remember that past performance does not necessarily indicate future performance.

A conducive environment for structured products

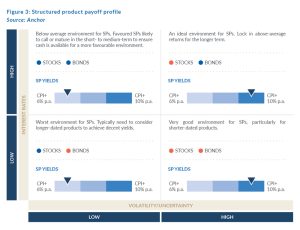

Most asset classes have an environment that is highly conducive to their optimal performance. Equities generally perform best in periods of low uncertainty (volatility) and low or decreasing interest rates. At the same time, bonds fare better when uncertainty is high, and rates are high or decreasing but fare poorly when rates increase. Structured products can function as a good alternative, particularly to equity, when uncertainty is high. High uncertainty (volatility) typically results in very attractive pricing for fixed-return structured products, mainly when rates are high and rising (an environment which is not good for bonds, which investors would typically turn to when uncertainty is heightened). That said, the fact that structured products can be tailored to the prevailing environment makes them appealing in a portfolio most of the time.

Depending on what stage in the interest rate cycle we find ourselves in and the prevailing market volatility experienced, these two factors determine the effectiveness of structured products and the preferred type of product to use in the correlating environment.

As expected, high interest rates and high levels of market uncertainty are the ideal environment for most structured products. They should favour longer-dated, fixed-return products to enable investors to lock in above-average returns. When interest rates are low, but market uncertainty is high, this still provides a good environment for structured products, with a preference towards shorter-dated products.

When volatility begins to subside, we find the environment sub-optimal for structured products. All-in-all, by changing the characteristics of the structured products, one can obtain exposure to a predictable long-term outcome regardless of the investment environment.

Alternative ways to invest in structured products

So, why have structured products not been more prevalent in traditional investor portfolios? Structured products are bespoke and complex products issued by banks. They are crafted using derivatives which can be complicated to understand. They are typically unlisted and usually have very high minimum investment levels. Structured products have long investment terms, and while they can typically be unwound reasonably easily, this can impact capital protection. The complexity, high minimums and liquidity considerations have often been enough to deter investors.

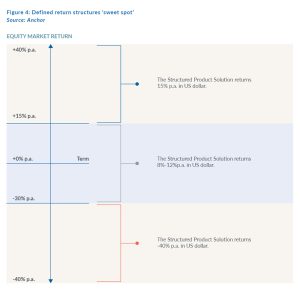

At Anchor, we pride ourselves on innovation and thinking outside the box to bring our clients solutions that enable them to meet their investment objectives. As a testament to this, the Anchor investment team has recently launched a bespoke, actively managed, structured product solution. This solution aims to deliver a return profile to investors which is consistent and predictable by building a portfolio of structured products. The return objective is to generate a US dollar-denominated return of 8%-12% over any three-year rolling period (net of fees).

The strategy and objective

From a strategic perspective, the solution uses a blend of shorter and longer-dated defined return structures to balance market risks and deliver a consistent and predictable return profile to investors. Depending on current market conditions, the solution may be fully invested in shorter or longer-dated defined return structures to optimise returns at prevailing market conditions. Staggered liquidity events (maturities, expiries and Autocalls) allow the asset managers to take advantage of attractive product opportunities when they arise, adding flexibility and liquidity in the solution not found in purchasing direct structured products in a client portfolio.

The four main advantages of investing in the solution as opposed to holding individual structured products directly are as follows:

- Diversification: The solution allows investors to invest in a diversified basket of structured products instead of concentrated exposure in one or two structured products. Thereby reducing single-product exposure risk.

- Lower minimum investment: The solution is ideal for investors with smaller amounts to invest, as the minimum investment amount for investing directly into individual structured products can be prohibitive for many investors.

- Active management: The bespoke solution is run by professionals who can efficiently shoulder the administrative and managerial aspects inherent in direct structured product investments – particularly managing the reinvestment of cash received from coupons and maturities.

Overall, this bespoke, actively managed structured product solution is a unique alternative for investors who want to gain exposure to equity markets but may be hesitant to do so, given the recent market volatility.

Alternative assets are becoming more popular amongst retail investors, and the use of structured products as a complement to traditional investment portfolios will play a more significant role in modern portfolio management. A bespoke structured product solution should create more conviction inside client portfolios which will most certainly surprise on the upside. As with all asset classes, seek advice from your wealth or portfolio manager to maintain a balance in your portfolio for growth, income, and asset protection.

At Anchor, our clients come first. Our dedicated Anchor team of investment professionals are experts in devising investment strategies and generating financial wealth for our clients by offering a broad range of local and global investment solutions and structures to build your financial portfolio. These investment solutions also include asset management, access to hedge funds, personal share portfolios, unit trusts, and pension fund products. In addition, our skillset provides our clients with access to various local and global investment solutions. Please provide your contact details here, and one of our trusted financial advisors will contact you.