Every month a minimum debit order comes off your bank account to slowly whittle down your mortgage, and if you are diligent and do not access the bond, you should typically pay it off after 20 years. However, many ask what to do with savings available after all expenses have been met. Should you invest these savings into the stock market or try to pay down your debt quicker? This article explores how your wealth would have changed over the past 20 years had you implemented various strategies.

It is June 2002, and you decide to buy a house for R1.1mn; you put down a deposit of R100,000 and get a bond for R1mn from your favourite bank at a rate of prime less 1%. The average prime rate was 15.75% for your first year, thus, your rate was 14.75%, and your starting net asset value (NAV; assets less liabilities) would have been R100,000. Your first-year payment to the bank would have been R157,000 or R13,000 per month. Almost all of that amount would have gone to servicing interest, and thus very little capital would have been paid back. You have also been disciplined that year, and you were able to save R1,000 per month or R12,000 for the year, and you now have a choice to pay back your loan or invest it in the stock market. In this analysis, your options are either the FTSE JSE All Share Index or the US S&P 500 Index. Let us also assume that you were able to increase that saving each year by inflation, therefore, R12,000 in the first year and R12,144 in the second year and so on.

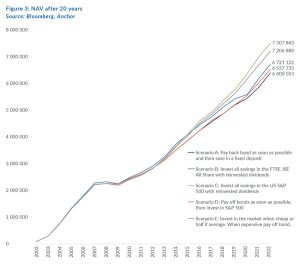

So, let us look at various scenarios and how they would have impacted your wealth 20 years later.

Scenario A: Pay off your bond as quickly as possible, and after paying down the debt, you invest in a fixed deposit.

This is the most conservative approach as you put all your savings into your bond and shy away from markets. Remember, you are not investing in anything; you pay down your debt a little more each year. But you also save all the future interest on that amount paid back, which compounds in your favour. You were charged a whopping R147,000 interest in your first year, and your loan closes at only R990,000 – a measly R10,000 less than how you started that year. You now take your hard-earned R12,000 savings to reduce your debt to R978,000. So, you are chipping away at your debt as best you can. Fortunately, your property has increased in value to R1.17mn, and thus your NAV is now R192,000.

If you continue putting your inflation-growing savings into the loan, you will pay off your loan in 15.5 years instead of 20, which sounds fantastic. Now that you have paid off your debt, you decide, being very conservative, to save all the funds that you would have paid into the bond (monthly bond payments + extra savings) into a fixed deposit. Thus 4.5 years later, after 20 years, you would have a house worth R5.5mn, a fixed deposit of R866,000, no debt and a NAV of R6.4mn. Pretty good going, but could you have done better?

Scenario B: Do not pay down your bond at all but rather invest in the JSE.

Instead of paying off your bond as soon as possible, you decide to put your savings into the FTSE JSE All Share Index and all the dividends are reinvested in that portfolio over time. Therefore, your bond will last the full 20-year term, and you will pay the maximum possible interest on this debt. However, after 20 years, you will have an equity portfolio worth R1.1mn and a paid-off house. Thus, your ending wealth would be R6.7mn.

Scenario C: Do not pay down your bond but rather invest in the US S&P 500 Index

This scenario is similar to Scenario B, where you do not pay off your bond but instead decide to invest the money in the US S&P 500 as you believe better returns will be generated offshore. In rand terms, you would have had a very similar investment path until about year 15, when you would have begun to pull ahead as the SA market underperformed the US. At the end of 20 years, you would have an offshore equity portfolio worth R1.9mn, giving you a total NAV of about R7.5mn.

So far, investing in the stock market was a better decision than paying off your debt. But let us explore two more variations to the above.

Scenario D: Pay down your debt as soon as possible and then invest offshore in the US S&P 500

This is similar to Scenario A, where you try and pay off your debt as soon as possible, but instead of investing in a fixed deposit after you have paid off your bond, you invest in the S&P 500. In this scenario, you will also pay off your debt after 15.5 years, but you would only have invested in the stock market for the past 4.5 years. Thus, you have not received the benefit of time and compounding in the stock market, but you would have at least beaten Scenario A and ended with a NAV of R6.53mn.

Scenario E: Investing in the US S&P 500 when cheap or paying off your debt when expensive.

This is the most interesting scenario where you put a little more thought into what you do. In this scenario, you invest in the market when it is cheap or pay back your loan when it is expensive. Then, if the market is about average, you split your savings between the two.

Note that the market is expensive above the red line or cheap under the blue line.

In this scenario, you would have invested your savings into the market for six of the 20 years. You would have paid off your bond in four of the 20 years and split your savings the rest of the time. In Scenario E, you would have paid back your loan after 17.5 years, and after it is paid off, you then put all your proceeds into the S&P 500. After 20 years, you would have an equity portfolio of R1.6mn, giving you a closing NAV of about R7.mn or second place after Scenario C.

Conclusion

The best scenario is C, investing as much as possible in the S&P 500 and allowing for compound growth over the long term. Unfortunately, Scenario A has the worst outcome. The interest saved on paying off your bond and the interest earned afterwards is not as good as being invested in the market. And, if we deduct income tax on that interest you earned, the final NAV would be even worse.

Intuitively you would think that Scenario E is the best strategy as it uses a lot more brain power, but it does not beat Scenario C because of the times you split your savings between bond payments and the market. This is because the market can be averagely valued, but because the earnings of the underlying companies continue to rise, it ends up beating the interest rate on your bond over time.

For those who have read this far and love the numbers, we have included a slight variation to Scenario C in Scenario F (see table in Figure 2 above), where we continually invest in the stock market unless it is expensive. Now we are saying that we are long-term investors all the time except when the market is expensive but what is crazy is that we still do not beat Scenario C! So, it is quite clear that trying to time the market around cheap or expensive is not a successful long-term strategy. You would be much better off putting a debit order in your bank account to invest in the market no matter what and allow for long-term compounding over and above the interest paid or earned.

At Anchor, our clients come first. Our dedicated Anchor team of investment professionals are experts in devising investment strategies and generating financial wealth for our clients by offering a broad range of local and global investment solutions and structures to build your financial portfolio. These investment solutions also include asset management, access to hedge funds, personal share portfolios, unit trusts, and pension fund products. In addition, our skillset provides our clients with access to various local and global investment solutions. Please provide your contact details here, and one of our trusted financial advisors will contact you.