Raubex released its FY21 results on 10 May. These results were a tale of two halves, with Raubex’s operations being severely impacted by COVID-19 restrictions across all its segments during 1H21 (the six months ended 31 August 2020). However, in 2H21, the company’s operations recovered extremely well and some of its segments even reverted to normalised levels of operational efficiency, which we expect to continue into the new financial year (FY22).

From the results presentation we also highlight the Group’s outstanding order book growth and, consequently, given Raubex’s increased order book growth, we expect capacity to be more constrained over the near term. Management have said that the company will consider increasing capacity and it will seek to bid/tender on select projects at better margins. We therefore expect a better margin performance from Raubex within the next 2-3 years as the South African (SA) construction sector gathers momentum.

Key takeaways

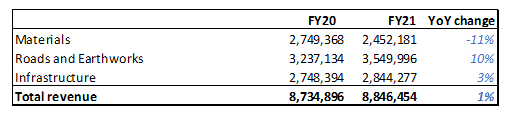

- Revenue increased by 1.3% YoY to R8.85bn.

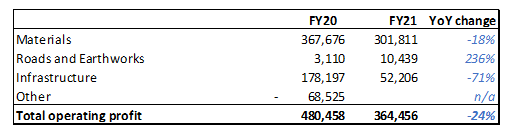

- Operating profit decreased by 24.1% YoY to R364.5mn. This decline was driven by COVID-19 restrictions negatively impacting the Group’s operations in 1H21.

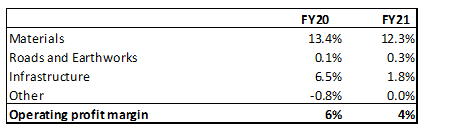

- Raubex’s operating profit margin declined to 4.1% in FY21 vs 5.5% in FY20.

- Profit before tax fell by 23.4% YoY to R341.6mn.

- The effective tax rate rose from 32.5% to 40.6%.

- This increase was driven by certain tax losses incurred, for which deferred tax assets had not been recognised.

- In addition, dividend withholding taxes (DWT), payable on declared dividends by its subsidiaries in Namibia and Botswana, drove the effective tax rate higher during the period under review.

- EPS declined 37.1% YoY to ZAc87.4, from ZAc139 in FY20.

- HEPS fell 49.4% YoY to ZAc81.9 from ZAc161.7 in FY20.

- A final cash dividend of ZAc29/share was declared but management have indicated that the company will revert to 3x dividend cover for FY22E.

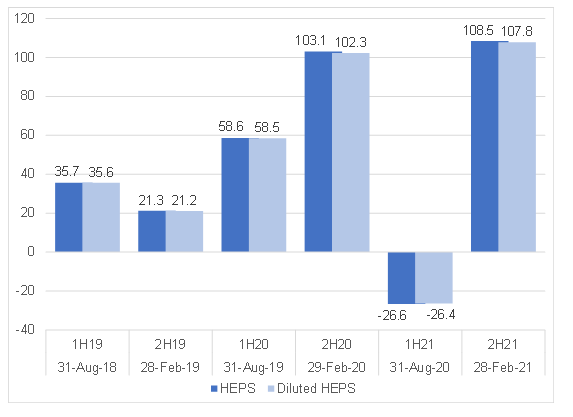

Figure 1: Raubex historic six-month EPS performance, 1H19 to 2H21 (ZAc)

Source: Company reports, Anchor

Segmental overview

Materials division

1H21 was negatively affected by COVID-19 induced lockdown restrictions but this segment has recovered well since the easing of these restrictions. The recovery in 2H21 was driven by strong demand for aggregates, and improved materials handling within the mining sector. However, contract crushing demand remained subdued during the period under review.

Road and earthworks

The easing of pandemic restrictions led to an operational improvement in 2H21. However, the operating environment for its bitumen and asphalt operations remained challenging in FY21. Management expect the asphalt and bitumen operations to improve in 2H22. Still, Raubex won major contracts for this segment in 2H21 and this has placed it in good stead over the medium term. Raubex will also be looking out for higher-margin project opportunities going forward as the segment reaches its capacity.

Infrastructure

The Infrastructure segment was also severely impacted by COVID-19 restrictions. Although its operations in SA and Western Australia bounced back nicely in 2H21, the project losses from the Douala Grand Mall project drove operating profit lower as the project experienced extreme logistical challenges at a critical stage of its completion. Going forward, project losses from Doula Grand Mall will no longer feature in Raubex’s operational performance and we expect a normalised operational performance from this segment going forward.

Figure 2: Raubex segmental revenue, FY20 vs FY21 (R’000)

Source: Company reports, Anchor

Figure 3: Raubex segmental operating profit FY20 vs FY21, (R’000)

Source: Company reports, Anchor

Figure 4: Raubex segmental operating margins, FY20 vs FY21

Source: Company reports, Anchor

Order book

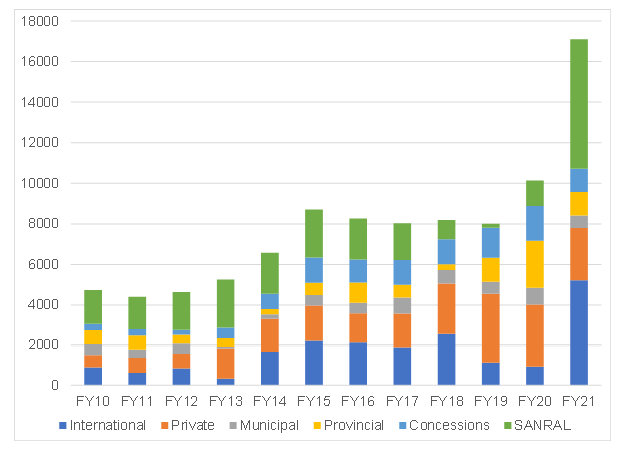

- Raubex’s secured order book increased by 68.9% YoY from R10.14bn in FY20 to R17.12bn in FY21. Management’s comment on the order book’s outlook was also very positive.

- Looking at the order book history, we note that FY21’s secured order book is the highest it has been over the past decade (see Figure 5).

- In addition, management have tendered for c. R20bn in projects that are awaiting adjudication. If Raubex is successful in securing even some of these projects, we expect earnings upgrades for the share.

Figure 5: Raubex order book, FY10 to FY21, Rmn

Source: Company reports, Anchor

Outlook

The general tone from management in the earnings call was extremely positive on the local construction sector. CEO Rudolf Fourie has been quoted as saying that tender activity levels within the SA construction industry are at an all-time high. On margin expansion, management were of the view that most construction companies need to grow their order books to enable increased contract pricing within the industry. We can expect better project pricing from construction companies as the industry starts to take off soon. Overall, we believe that the SA construction industry is starting to gather momentum as the country’s Economic and Reconstruction and Recovery Plan, which includes a substantial infrastructure build programme, rolls out and, in our view, Raubex is extremely well placed to benefit from this going forward.

Conclusion

To date, as evidenced from the Group’s earnings call, developments within the construction sector continue to point towards tailwind effects for Raubex and for the industry as a whole. We think that the South African National Roads Agency (SANRAL) and government infrastructure build programmes offer compelling prospects for Raubex in the short-to medium-term and possibly even in the long term. The overall general outlook and operational momentum for Raubex thus remains positive and we believe that the combination of these factors will support its share price performance in the near-term. Raubex is currently trading on a 12M FWD PE of 10.6x, which is higher than its historical average of 8.4x. We think that the share will continue to trade at a higher multiple relative to history, given the general positive newsflow within the construction industry.