One universal truth regarding investing is that to earn returns, one must take risks. You cannot beat inflation and grow your wealth in real terms without taking on risk. The right amount of risk depends on your investment objectives, but getting the mix even approximately right can have a profoundly positive impact on your long-term investing outcome.

Once an investor has determined the right level of risk to build into their portfolio (something your wealth manager should be helping you with!), the next most important step is to optimise the potential returns of your portfolio given your “risk budget”. There is no point in taking on additional risk if it does not result in concomitantly higher returns. Conversely, one should target a required return while taking on the lowest possible level of risk.

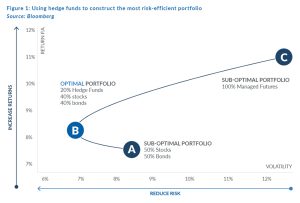

Modern investment theory illustrates this principle graphically with a concept called the “efficient frontier” – a relatively simple chart which plots portfolio returns against portfolio risk (see Figure 1). You do not need to be a professional investor to find the optimal portfolio in this example (Portfolio B), as this portfolio clearly earns the highest return per unit of risk.

The fundamental difference between Portfolio A, a classic mix of stocks and bonds, and Portfolio B (the optimum portfolio) is that Portfolio B includes an allocation to hedge funds – a highly effective and yet often overlooked asset class that will enhance the risk-adjusted performance of most investors’ portfolios given an appropriate allocation.

Notes to Figure 1:

- Empirical study spanned the 20-year period between 1987–2008.

- Managed futures portfolio: CASAM CISDM CTA Equal Weighted.

- Stocks: MSCI World.

- Bonds: JP Morgan Government Bond Global (Source: Bloomberg).

Using hedge funds to build the optimum portfolio

So how do we go about building the optimum portfolio? Fortunately, we have a century of market data to lean on to help us.

While the exact optimal allocation to each asset class will vary per study, depending on the timeframe and asset class indices that are referenced – the conclusion is always the same: a modest allocation to hedge funds in a well-diversified portfolio materially reduces risk (or portfolio volatility) while resulting in a higher compound return through time (an important by-product of lower volatility).

This axiom is particularly relevant in the context of the South African equity market, which, when measured in US dollar terms, has produced underwhelming returns – despite the elevated level of volatility.

Figure 2 compares the cumulative US dollar return of the FTSE JSE All Share Index to the cumulative US dollar return of one of Anchor’s best-performing South African long/short hedge fund strategies over the last five years.

The numbers speak for themselves. The ability of a hedge fund to capitalise on the JSE’s volatility means that real hard currency returns are possible (42% in US dollar terms over five years in this instance), even in an environment where the FTSE JSE All Share Index has essentially been flat (in US dollar terms). Both asset managers and their regulator (the Financial Services Conduct Authority [FSCA]) have worked together in recent years to make hedge funds more accessible to South African investors for this reason, and we encourage our clients to reassess their asset allocation accordingly.

Reevaluating the benefits of active hedge fund strategies

Despite the overwhelming empirical evidence of portfolio enhancement achieved through the inclusion of hedge funds, the asset class continues to be one of the most underutilised tools in the retail investment landscape.

This is partly a consequence of historical accessibility issues (which are no longer a factor). Still, a general lack of comfort around hedge funds and their perceived complexity and riskiness is also one of the more prominent issues.

Although the term “hedge fund” can describe a broad range of investment strategies, ranging from relatively low-risk to very high-risk funds, it is important to understand some of the more fundamental reasons that active hedge fund strategies are so effective. These include:

- They can benefit from the long and the short side of the marketHedge funds are in the fortunate position to be able to take a long position on the market (i.e., to make a profit when stock prices go up) as well as a short position (i.e. to make a profit when stock prices go down).

You will notice that hedge funds often outperform long-only funds when market conditions are poor, primarily due to their ability to go short.

- They often take less risk than the marketGiven their ability to go both long and short, the volatility of hedge funds’ returns is usually lower than the broader equity market as their net exposure (i.e. total percentage long positions – total percentage short positions) is less than 100%.Most South African hedge funds take a modest level of directional exposure, which results in an asymmetrical return profile: i.e., investors capture much of the upside, but less of the downside, of the broader equity market.

- Hedge funds have a more diverse toolkitIn addition to the ability to go short, hedge funds can use a more diverse range of instruments to enhance returns and protect against downside risk.Options structures are often overlayed on top of long positions to limit losses in a market downturn, and exchange rate risk can be mitigated through currency futures.

- Managers are remunerated on performanceAlthough the fees charged by hedge funds are considerably higher than those levied by more passive strategies (such as conventual equity funds or passive exchange-traded funds [ETFs]), a large proportion of these fees are performance-based.Hedge fund managers’ incentives are directly aligned with their investors’ best interests, which is a meaningful contributing factor to the superior risk-adjusted performance of this asset class.

Consider a multi-strategy or multi-manager approach

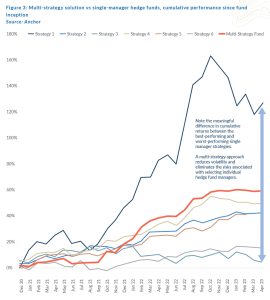

Given that hedge funds target absolute returns rather than benchmark-relative returns, the performance of various individual hedge fund strategies is highly divergent, making selecting a hedge fund manager challenging.

Although a manager’s capability can be judged against a meaningful track record, past performance is certainly no guarantee of future returns – and strategies that have worked well in the past can perform poorly when market conditions change.

To mitigate manager selection error (i.e., choosing a manager who will underperform), allocate across several hedge fund managers and preferably across managers who demonstrate complementary styles. This will ensure less volatile overall returns.

We strongly encourage allocating to a multi-strategy hedge fund, or a fund of hedge funds, where several different managers or funds have been selected and incorporated into a blended strategy. The primary advantage of a blended solution is that managers have been selected not only on merit but also on the basis that their strategies are complementary.

The chart below compares the cumulative return of one of Anchor’s multi-strategy hedge fund solutions with the cumulative return of each underlying individual fund or strategy. It demonstrates the benefits of a multi-strategy approach. Not only does the multi-strategy fund demonstrate less volatility than the constituent funds, but it also mitigates the risk of selecting a single-manager fund that may underperform.

Anchor runs several multi-strategy hedge funds with very competitive risk-adjusted track records, available across most major investment platforms and featuring very low investment minimums (from R1,000). South African Regulation 28-compliant retirement portfolios are now also able to allocate up to 2.5% to a single manager hedge fund, up to 5% to a fund of hedge funds, and up to 10% to hedge funds in aggregate – which means most South African investors can now benefit from an allocation to hedge funds.

Our wealth managers are equipped to help you select the most appropriate hedge fund solution in light of your investment objectives, with the primary objective being to optimise the risk-adjusted performance of your overall portfolio.

At Anchor, our clients come first. Our dedicated Anchor team of investment professionals are experts in devising investment strategies and generating financial wealth for our clients by offering a broad range of local and global investment solutions and structures to build your financial portfolio. These investment solutions also include asset management, access to hedge funds, personal share portfolios, unit trusts, and pension fund products. In addition, our skillset provides our clients with access to various local and global investment solutions. Please provide your contact details here, and one of our trusted financial advisors will contact you.