At the end of March, Naspers announced that it plans to list a company (called NewCo for now) on the Euronext Exchange in Amsterdam which will hold all of Naspers’s non-South African investments. We will have to wait for the prospectus to confirm the details but, in the meantime, we provide our thoughts on how Naspers’ plan might play out for you.

Naspers will make a “capitalisation award” to its shareholders of an instrument that shareholders can elect to exchange either for shares in NewCo or for more shares in Naspers. While Naspers hopes that this will narrow the discount at which the group trades to the value of its net assets, we think it will lead to a potentially unappealing choice for tax-sensitive retail investors. Electing to take up shares in NewCo will trigger a capital gain. Alternatively, electing to take up further Naspers shares avoids triggering a capital gain, but investors may find this vehicle trades at a larger discount than it did before.

What will the Naspers structure look like once this transaction is complete?

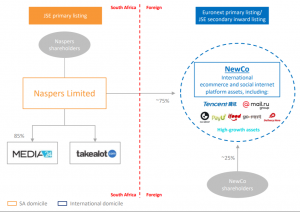

Naspers anticipates that, once the transaction is complete, around 25% of NewCo will be owned directly by its shareholders, leaving Naspers with a 75% stake in NewCo, as well as its South African assets (immaterial). The new structure is explained in Figure 1 below.

Figure 1: Naspers structure following proposed transaction

Source: Company presentation

As far as timing is concerned, at this stage, Naspers has said that it will take place no sooner than the second half of 2019.

Why is Naspers doing this?

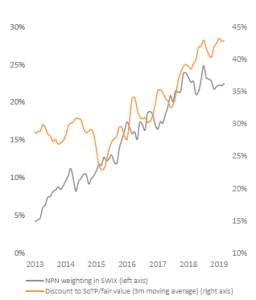

Naspers hopes that the listing of NewCo on the Euronext exchange will be a step towards narrowing the discount at which it trades, relative to its net asset value. In the South African equity market there are few topics that have been debated more extensively than the reasons for, and likely direction of, the Naspers discount. This discount has widened in recent years and one of the important contributory factors believed to be responsible is that its outperformance of the rest of the market (thanks largely to the stellar performance of its main asset – Tencent) has led to it becoming too large for the SA market. As Figure 2 below shows, since 2013 its weighting in the JSE All Share SWIX Index has risen from just 5% to >20%. As the size of Naspers has grown, it has increasingly bumped up against the single stock concentration risk limits of institutional funds, making them forced sellers as the share continues to rise. Certainly, Figure 2 suggests this has at least been a contributory factor to the widening discount.

Figure 2: The size of Naspers on the JSE All Share SWIX

Source: Bloomberg

By listing NewCo on Euronext where: (1) its size will not be a constraint; (2) it will be eligible for inclusion in more indices, thus attracting passive index-linked buyers; and (3) developed market funds that could not buy Naspers/Tencent before, due to limitations on their mandate, will be able to invest for the first time. NewCo, it is hoped, will trade at a lower discount to its net asset value than Naspers has done historically.

So, will Naspers’ plan work?

Eliminating the size constraint and opening up NewCo to new pools of capital that had not previously had the opportunity to invest is certainly a compelling argument as to why NewCo will trade at a smaller discount to its net asset value than has been the case for Naspers. However, what is less clear is what happens to the discount in Naspers itself after the creation of NewCo. Although, admittedly, Figure 2 above reveals the discount is already extremely large and close to its historic high, we think there are a number of reasons the discount in Naspers may actually widen further post the creation of NewCo:

- The creation of NewCo introduces a new investment holding company between Naspers and the underlying investments. This introduces the possibility of a double holding company discount being applied by investors.

- Shifting 25% of Naspers’s market capitalisation into NewCo will not reduce its size by enough to prevent it from hitting concentration limits in SA. Many funds may continue to see Naspers and NewCo as a single entity anyway since they are essentially exposed to the same assets.

- Institutions that do not trigger a capital gain by trading may seek to switch out of Naspers and into NewCo post the listing of NewCo, placing further selling pressure on Naspers.

- A possible lack of appeal of South African assets that remain in Naspers (albeit not very material) and value leakage resulting from existing long-term management incentives linked to Naspers shares.

Only time will tell how Mr. Market decides to treat the discounts in Naspers and NewCo. However, the fact that Naspers soon reversed the initial rally in its share price on release of the announcement could be interpreted to mean that the market anticipates a smaller discount on NewCo and a slightly wider discount on Naspers equals no material change in the overall discount from before!

The Hobson’s choice facing retail investors

If the market’s response so far suggests Naspers’ creation of NewCo is much ado about nothing, it is important to realise this does not necessarily apply to retail investors who hold Naspers directly. As such, for retail investors who hold Naspers shares in a tax-sensitive form, we think they will face the choice to either:

- opt to exchange the instruments that Naspers issues for NewCo shares and, in so doing, trigger a capital gain on around 25% of their Naspers investment; or

- opt to exchange the instruments that Naspers issues for more Naspers shares. This will avoid triggering a capital gain but runs the risk that the value of their Naspers investment falls because Mr. Market begins to apply a larger discount to Naspers for the reasons discussed above.

Is there anything that can be done to avoid facing this Hobson’s choice?

For investors that have a particularly large weighting of Naspers in their portfolios, this transaction presents an opportunity to consider whether now might be a good time to restructure one’s portfolio:

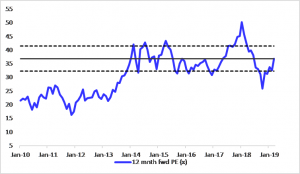

Is this a good time from a valuation point of view to restructure? Investors may well have avoided this over the last year due to the belief that Naspers’ valuation was at particularly depressed levels. In Figure 3 below, we show the share price as a multiple of expected earnings for Tencent, which accounts for >90% of Naspers’s net asset value today. In 2018, Tencent’s share price declined 47% from its January high, initially as part of a broad-based China Inc. selloff in response to the US-initiated trade war with China, and subsequently due to a freeze on new online game approvals by Chinese regulators. This price decline resulted in Tencent’s valuation falling from what was admittedly a lofty 50x projected earnings to 25x projected earnings. The latter appears cheap when considered against Tencent’s historic valuation range. Subsequently, as mobile gaming approvals have resumed and there has been growing optimism regarding a US/China trade deal, Tencent has recovered strongly and with it, Tencent’s valuation. Now valued at 36x expected earnings, this is around the average based on the last 5 years.

Figure 3: Naspers share price as multiple for expected Tencent earnings

Source: Bloomberg, Anchor

Why would you not want a large concentration of exposure in Naspers in your portfolio? Within the South African market, Naspers has been almost the only listed investment via which investors could play the technology growth theme, as well as having been a solid rand hedge. Its superior past investment performance notwithstanding, a nagging concern to consider – Naspers’ overexposure to a single stock in a single market (Tencent in China), which accounts for >90% of Naspers’ net asset value. As incredibly successful as Tencent has been, and still with compelling growth prospects ahead, the ban on new game approvals last year was a timely reminder of the risks posed by a heavy-handed regulatory environment in which Tencent operates. It suffices to say the first thought that runs through Chinese regulators’ minds when they reach the office each day is not the interests of investors (particularly foreign ones). Such left-field risks can be mitigated by controlling the size of one’s position in Naspers.

Are there viable alternatives? A further concern that may have prevented investors from considering restructuring their Naspers investment into a fund has likely been that their exposure to the technology theme would be significantly diluted and thus risk underperforming Naspers going forward. Anchor has set up a dedicated global technology unit trust, which is expected to launch in June this year. This may be a worthwhile alternative to consider. This should be better balanced across more companies and countries.

When done for portfolio restructuring purposes, Section 42 of the Tax Act allows for rollover relief and no capital gains will be triggered because of the transfer of shares into a non-tax-sensitive fund. The current base cost will be rolled over and capital gains will only be realised on selling units in the fund.

In summary

Naspers’s decision to list on Euronext may inadvertently have placed tax-sensitive retail investors with a set of rather unappealing choices. With Naspers’ valuation no longer so cheap thanks to the strong recovery in Tencent, for those that might have been considering restructuring their portfolios anyway, it may be a worthwhile time to consider a Section-42 transfer to avoid being placed in this position, as well as to address single-stock/country exposure that one has through Naspers.