Bearish sentiment dominated most major global markets (MSCI World -0.9% MoM/+8.8% YTD) in a tumultuous May, with concerns around a US debt default, high inflation and a possible US recession weighing on investor sentiment. While news emerged over the weekend of an agreement between President Joe Biden and US House of Representatives Speaker Kevin McCarthy on the debt ceiling, US markets were down on Wednesday (31 May) as the deal headed for a vote in Congress. In addition, unexpectedly strong US labour market data rattled investors worried that the US Federal Reserve (Fed) might hike interest rates again in June.

Still, Wall Street wrapped the month with an impressive rally in artificial intelligence-related stocks and other tech names, which buoyed the tech-heavy Nasdaq Composite Index to end the month 5.8% higher (+23.6% YTD). Unfortunately, the Dow Jones and the blue-chip S&P 500 indices were less fortunate. The Dow fell 3.5% MoM (-0.7% YTD), while the S&P 500 recorded a small advance (+0.2% MoM) for May (the index is up 8.9% YTD).

In US economic data, April headline CPI showed a decrease to 4.9% YoY from 5.0% in March – coming in below expectations of another 5.0% print. Annual core CPI, excluding the erratic food and energy components, declined to 5.5% YoY in April vs 5.6% in March. MoM headline inflation met consensus expectations, rising to 0.4% in April (vs March’s rate of 0.1% MoM), while core inflation was also in line with expectations and unchanged from March at 0.4% MoM. Following two months of declines, US April retail sales rose 0.4% MoM – a weaker gain than the 0.8% increase consensus forecasts had expected but significantly better than March’s downwardly revised 0.7% drop. Personal consumption expenditure (PCE), the Fed’s preferred inflation measure, rose 0.4% MoM in April vs March’s 0.3% print and consensus expectations of 0.3%. YoY, PCE rose to 4.4% in April from 4.2% in March, higher than the market expected (3.9%).

The US Fed’s Federal Open Market Committee (FOMC) held its latest meeting at the beginning of May, raising rates by 25 bps – in line with expectations. This latest rate hike increases the federal funds rate to the 5%–5.25% range, the highest since 2007, before the global financial crisis. Fed Chair Jerome Powell said that the Fed will not be guiding for further hikes and that decisions will remain data-dependent going forward. However, the possibility of further hikes has not been completely removed.

In Europe, Germany’s DAX ended May down 1.6% MoM (+12.5% YTD), while France’s CAC Index closed 5.2% MoM lower (+9.7% YTD). April euro area annual inflation printed higher at 7.0% YoY vs 6.9% in March. Germany’s economy, the biggest in Europe, entered a technical recession in 1Q23 as data showed a downward revision to its gross domestic product (GDP) – from zero to -0.3% YoY for 1Q23. In 4Q22, Germany recorded a 0.5% YoY contraction. Germany’s annual inflation rate came in at an eight-month low of 7.2% vs March’s 7.4% YoY print. The cost of energy surged 6.8% YoY in April, following a marked slowdown in March (+3.5% YoY), while April also saw an above-average rise in food prices (+17.2% YoY), albeit slowing from the 22.3% YoY hike in March. MoM, CPI advanced 0.4%.

In the UK, the blue-chip FTSE-100 Index fell 5.4% in May (-0.1% YTD). April UK inflation slowed (to 8.7% YoY) vs March’s 10.1% YoY print but still came in higher than expected as food and non-alcoholic drinks prices accelerated by 19.1% YoY. Core inflation, which excludes the volatile food and energy items, surprised the market by rising sharply to 6.8% in April vs 6.2% in March.

Chinese markets were down, with Hong Kong’s Hang Seng Index plummeting 8.3% MoM (-7.8% YTD), while the Shanghai Composite Index fell by 3.6% MoM (+3.7% YTD) as foreign investors continued to sell Chinese shares and expectations were for weak corporate earnings in China. On the economic data front, China’s factory activity shrank for a second straight month in May, with the official manufacturing purchasing managers index (PMI) coming in at 48.8, down from April’s 49.2 print. It was also lower than consensus expectations of a 51.4 print. In addition, the official non-manufacturing PMI, measuring business sentiment in the services and construction sectors, also declined to 54.5 vs April’s 56.4 print. The 50-point mark separates expansion from contraction. The disappointing PMI print has raised questions about a possible economic rebound in the country as weak demand and slowing investment weigh on sentiment.

Japan’s equity market rallied, with the benchmark Nikkei recording its best performance in c. 30 months, soaring 7.0% in May (+18.4%YTD). Japan’s annual CPI accelerated to 3.5% in April vs March’s 3.2% print, with food prices ticking up and driving the acceleration. Core CPI (which excludes the volatile fresh food category but includes energy costs) rose 3.4% YoY in April vs March’s 3.1% increase. MoM inflation advanced by 0.64%, accelerating from March’s 0.38% MoM rise.

In commodities, Brent crude oil has slumped by c. 16% since peaking at US$86.96 on 12 April following OPEC+’s announcement of production cuts. The decline has come amid concerns around the US debt ceiling, a global recession, and the high interest-rate environment. MoM, Brent crude was down 8.4%, and YTD, the price has dropped by 15.2%. Iron ore prices (-1.6% MoM/-11.1% YTD) were also under pressure amid concerns about unfulfilled expectations for steel consumption in China’s real estate sector during peak season. As the construction season draws to a close and steel demand is lower than expected, along with an uneven performance from the Chinese economy, market commentators believe that China’s iron ore consumption will remain limited. Meanwhile, worries around the US debt ceiling weighed on the price of gold (-1.7% MoM/+7.2% YTD) for most of the month, although we saw a slight rebound in the yellow metal after a deal on the debt ceiling was announced towards month-end. The price of platinum dropped 5.7% MoM (-5.3% YTD) to close May at c. US$998.42/oz, while palladium ended the month 7.3% lower (-22.1% YTD). Natural gas prices fell 4.4% MoM (-48.5% YTD), while thermal coal prices fell 21.1% MoM (-45.2% YTD).

South Africa’s (SA’s) FTSE JSE All Share Index recorded a 4.0% MoM decline (+2.8% YTD) in May, while the FTSE JSE Capped SWIX lost 5.8% MoM (+0.2% YTD) amid a quagmire of bad news locally and volatile global markets. As SA battles loadshedding, its consequences and costs, as well as tepid consumer spending, rampant corruption etc., the government continues to score own goals, with the US ambassador to SA last month accusing the country of supplying arms to Russia. According to the US, arms were loaded on a sanctioned Russian vessel (the Lady R) when it docked in Simonstown in December. The SA government has denied the claim, and President Cyril Ramaphosa has established a judicial commission to investigate. Still, the allegations and the threat of US sanctions have already had dire consequences for the SA economy. The rand plummeted to its weakest-ever level against the US dollar, and bond yields spiked, pushing up the cost of government borrowing and reflecting the negative impact of these allegations on the local economy. SA is the biggest beneficiary of the US Africa Growth and Opportunity Act (AGOA), exporting c. US$15bn of goods and services in terms of that act. One of the conditions for a country to qualify under AGOA is that it is not a threat to US national security interests. If the allegations of supplying arms to Russia prove true, it will leave SA in contravention of that requirement. SA’s free trade agreement with the EU and our trade relations with the UK could also be at risk.

On the JSE, it was red across the board, with the continuing selloff in domestic-orientated counters, the so-called SA Inc. shares, leading the declines as the financial costs of stage-6 loadshedding continued to weigh heavily on sentiment. Financials were hardest hit (Fini-15 -8.2% MoM/-7.2% YTD), followed by the SA Listed Property Index (-6.2% MoM/-7.8% YTD). The Resi-10 also retreated – down 2.2% MoM and 4.7% YTD, although some gold counters shone as the rand gold price soared on the back of a falling rand. The Indi-25 declined by 3.1% MoM but is still up 17.4% YTD. Highlighting the performances of the biggest shares on the JSE by market cap, the largest company on the exchange, BHP Group, advanced by 1.1% MoM, while Prosus (the second biggest listed share) was down 5.4% MoM and Naspers retreated by 8.7% MoM. Anheuser Busch InBev, the third-largest listed company, dropped 11.8% MoM. The rand weakened by 7.8% MoM against the US dollar (-15.8% YTD) as the SA government continues cosying up to Russia despite the country’s supposed “neutral” stance on the war in Ukraine. The local unit weakened dramatically in May, breaching the R19.90/US$1 level and getting close to the psychological R20/US$1 mark.

In economic data, April SA headline inflation, as measured by the consumer price index (CPI), slowed to 6.8% YoY (its lowest reading since May 2022) from 7.1% in March. MoM, CPI advanced by 0.4% in April vs March’s 1.0% print. Inflation eased mainly due to the expected decline in fuel inflation to 5.0% YoY in April from 8.1% in March and partly due to an unexpected softening in food and non-alcoholic beverages inflation to 13.9% from 14.0% YoY. Nonetheless, core inflation (excluding the volatile energy and food price categories) rose 0.1 pp to 5.3% YoY in April, as headline price pressures continue to filter through to the rest of the economy. Unusually, this latest rise in core inflation was driven by services instead of goods.

Against this backdrop, and in line with expectations, the SARB’s Monetary Policy Committee (MPC) increased the repo rate for the tenth time in 18 months by 50 bps. The repo rate now stands at 8.25% (its highest level in 14 years), with prime at 11.75%. Elsewhere, local retail trade sales shrank for a fourth consecutive month in March (-1.6% YoY) following February’s upwardly revised drop of 0.7% YoY. MoM retail trade sales declined 0.7% in March, compared to a 0.1% MoM decrease in February. In some positive news, due to favourable weather conditions, the Crop Estimates Committee (CEC) increased its 2022/2023 maize production estimate for SA by 2% to 16.1mn tonnes. This is a 5% YoY increase and the third-largest harvest on record.

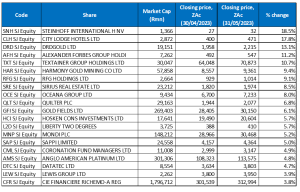

Figure 1: May 2023 20 best-performing shares, MoM % change

Source: Anchor, Bloomberg

Steinhoff International’s share price rose 18.5% MoM – the best-performing share on the JSE in May, albeit from an extremely low base. However, to contextualise the share price performance, we note that Steinhoff’s share price increase is largely irrelevant as it is trading at less than 1% of its high. Thus, the share price movement is, in effect, just a bet on whether there is any value left in the company – the end outcome could well be zero value. Nevertheless, in an update to shareholders earlier this week, Steinhoff said that its financial creditors had accepted a three-year debt repayment holiday in exchange for over 80% and 100% of the Group’s equity. In terms of the new plan, Steinhoff will delist from the JSE and the Frankfurt stock exchange. According to Steinhoff, the three classes of creditors had backed the restructuring plan, despite the Group’s shareholders voting against it. Steinhoff will be approaching a Dutch court, where it is registered, to confirm the deal.

Hotel chain City Lodge was May’s second best-performing share, gaining 17.8% MoM. Last week, in a disclosure to shareholders, City Lodge said that HSS Investments and Entertainment Holdings (two of Tsogo Sun Gaming’s subsidiaries) had increased their collective interest in the company to 10.0%. This means that Tsogo Sun Gaming, Africa’s largest casino operator, is now one of City Lodge’s top-five investors.

JSE-listed gold miners performed well in May as the significant rand weakness and sustained dollar gold price strength saw the rand gold price trade at around R1.3mn/kilogramme (kg). DRDGold, one of the world’s largest gold tailings retreatment companies, was May’s third best-performing share, gaining 13.1%. Last month, DRDGold also reported a production increase of 4% to 1,329kg in the three months to end-March as the yield increased to 0.030g/tonne from 0.255g/tonne, which lowered the cash operating costs per kg slightly to R691,061/kg. The company said it had generated strong third-quarter cash due to increased gold prices. In addition, a higher yield per tonne of gold reclaimed from its Ergo plant on the East Rand and its Far West Gold Recoveries lifted production and helped to offset an increase in costs per tonne treated. As a result, its cash and equivalents increased by R160.2mn, taking its cash on hand as of 31 March 2023 to R2.55bn. DRDGold said that “a portion of the cash would be put towards capital projects …” but it remains in a “favourable” position to pay a final dividend in August (its year-end is 30 June).

DRDGold was followed by financial services Group, Alexander Forbes, rand-hedge Textainer Group and Harmony Gold, which recorded MoM gains of 11.2%, 10.7% and 9.4%, respectively. In its FY22 trading update, Alexander Forbes indicated that it expects its headline EPS to be between 42.0% and 47.0% higher than the ZAc33.2 recorded in FY21. The company also announced that it had acquired a majority stake in local group risk insurance administration services company TSA Administration for an undisclosed amount. The cash deal is subject to approval and will see it acquire a 60% stake in TSA Administration via its indirect wholly-owned subsidiary Alexander Forbes Financial Services, with the option of obtaining the remaining 40% over the next five years. It will be financed by drawing down on its existing term loan facility. In Harmony’s operating update for the nine months ended 31 March 2023, the Group reported a 49% YoY rise in operating cash flow to R3.2bn and also said it was on track to achieve its FY23 guidance of 1,400,000 to 1,500,000 ounces in total product. The gold miner said that its high-grade Mponeng mine made the largest single contribution (39% towards total Group operating free cash flow) of its surface and underground mines.

Rounding out May’s best-performing shares were food company RFG Holdings, Sirius Real Estate, Oceana Group, and Quilter Plc, with MoM gains of 9.1%, 8.5%, 8.0% and 6.8%, respectively. RFG Holdings’ share price soared after it reported better-than-expected results for the six months ended 2 April 2023. The Group, which owns brands such as Rhodes, Bull Brand, Squish, Bisto etc., reported a 36.7% YoY profit increase to R218mn after group revenue improved by 10.2% YoY to R3.8bn. Its diluted EPS increased by 36.9% YoY to ZAc83.1. The company said that growth was driven by price inflation of 14.8% and strong trading performances from its regional and, in particular, its international business in March.

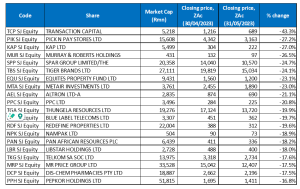

Figure 2: May 2023 20 worst-performing shares, MoM % change

Source: Bloomberg, Anchor

Transaction Capital (-43.3% MoM) was May’s worst-performing share. Last month, the company said it was discussing new funding with lenders as its taxi-lending business faces a cash crunch. The share price extended its losses on 9 May, dropping by more than 35% after the company reported a R1.86bn loss for the six months to end March, vs a R615mn profit in the prior year’s comparative period. The huge loss meant that the Group did not issue a dividend. The share closed 35.07% lower on the day at R7.11 – it had hit a high of R47.71 in the past 12 months. YTD, the share price has plummeted c. 79.2%. This after the company warned in March of structural problems at SA Taxi (once its biggest business) and an earnings drop of up to 50% YoY. However, its losses exceeded what the market had expected, with Transaction Capital reporting a continuing operations loss of R1.3bn vs a profit in the previous half year of R518mn. Part of its planned restructuring of SA Taxi includes reducing the number of vehicles to be refurbished and refinanced, finding other channels to sell repossessed vehicles, cutting staff, and resizing its cost base.

May’s second worst-performing share was Pick n Pay Stores, with a MoM decline of 27.2% as its share price reached levels last seen c. ten years ago. This after the retailer released FY22 results that showed a 16.3% YoY drop in headline EPS and warned that the following year’s results might be similar. Pick n Pay’s adjusted headline EPS fell by 16.3% YoY to R2.42, down from R2.89, while profit before tax, excluding an insurance payout, dropped 15.1% YoY to R1.6bn. Revenue rose to R109.3bn from R100.9bn posted in FY21. The Group said that the high cost of diesel to keep its generators powered caused a significant dent in profit, as it spent R522mn in total on diesel and a net amount of R430mn when its electricity savings initiatives are considered. CEO Pieter Boone said that loadshedding has had “a material impact on our results, particularly through massive increases in diesel costs,” adding that “It is going to be another tough year, but I have every confidence in our plan and in the ability of our teams to deliver it.”

In a trading update for the first ten months to 30 April 2023, Kap Ltd, May’s third worst-performing share (-27.0% MoM), revealed that its HEPS is expected to be between ZAc22.3 and ZAc52.1, as compared with ZAc74.4 reported in the previous year – at least 30% lower YoY if current trading conditions persist. Kap said that the operating environment in SA was demanding, with the impact of loadshedding worse than anticipated.

Kap was followed by specialist engineering Group Murray & Roberts (-26.5% MoM), Spar Group (-24.7% MoM), and Tiger Brands (-24.1% MoM). Spar released a weak trading update for the six months ended 31 March 2023 (1H23). The Group said that its turnover increased 7.9% YoY to R72.90bn. However, it expects diluted EPS to come in at the midpoint of guidance – at ZAc448.8 vs ZAc604.1 recorded in 1H22. Spar said it had to put through cost increases leading to lower-than-expected sales across all its regions (it operates as a wholesaler, supplying independent stores in SA, Ireland, Switzerland and Poland).

Meanwhile, Tiger Brands’ share price plummeted after it delivered interim results below market expectations. The company also flagged loadshedding costs and operational headwinds. In its 1H23 results, Tiger Brands (SA’s biggest food producer) said that despite solid revenue growth, its performance for the reported period was impacted by a challenging operating environment due to prolonged periods of loadshedding. It added that high inflation levels and lower disposable income adversely affected consumer behaviour in terms of volumes and basket mix. On 30 May, the share price hit an intraday low of R153.88 but closed the day 16.8% down at R157.82. YTD, Tiger Brands is down 28.4%.

Tiger Brands was followed by Equites Property Fund, energy storage and automotive component specialist Metair Investments, information technology company Altron and PPC Ltd with MoM declines of 23.1%, 23.0%, 21.1% and 20.8%, respectively. At the beginning of May, another board member resigned at Metair, bringing the total of directors that have quit the company’s board this year to three and stoking fears around a leadership vacuum. Meanwhile, Altron reported FY23 results, which showed that revenue from continuing operations rose 19.3% YoY to R9.5bn. However, it reported an 8% YoY decline in continuing headline EPS. The results were negatively affected by certain non-cash adjustments related to exposure to a broadband contract in Pretoria and excess inventory related to another network in Johannesburg. These provisions negatively impacted HEPS but adjusted HEPS was up 19% YoY. EBITDA experienced a 4% decline to R1,053mn while operating income (before capital items) fell by 21% YoY to R346mn.

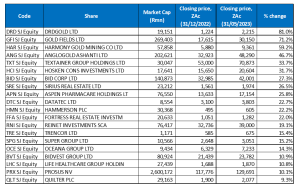

Figure 3: Top-20 best-performing shares, YTD

Source: Anchor, Bloomberg

Fourteen out of April’s top-20 YTD best-performing shares were once again among the top-20 best performers for the year to the end of May, and with most gold shares recording good gains in May, the four top-performing shares were all gold counters. Sirius Real Estate, Trencor, Oceana Group, Bidvest, Prosus and Quilter Plc were the new entrants among the best YTD performers, bumping PPC, Spar, Pan African Resources, Wilson Bayly Holmes Ovcon, Attaq and Sun International from the list.

A bumper May performance from DRDGold (discussed earlier) saw it take the coveted top spot from Gold Fields with an impressive YTD gain of 81.0%, pushing Gold Fields (+71.2% YTD) into second position. In its 1Q23 operational update, released last month, Gold Fields said it remained on track to deliver its FY23 production and cost guidance provided in February. However, the gold miner revealed that its attributable equivalent gold production dropped 4.0% QoQ to 577.00 Koz. For FY23, the company expects attributable equivalent gold production (excluding its Asanko mine in Ghana) to be between 2.25Moz to 2.30Moz. Harmony (discussed earlier) was the third best-performing share, with a YTD gain of 59.2%.

Harmony was followed by yet another gold producer AngloGold Ashanti (+46.7% YTD), Textainer (+33.7% YTD) and Hosken Consolidated Investments (HCI; +31.7% YTD) in sixth place. AngloGold Ashanti was down 1.3% MoM in May. Last month, the company said it would move its primary listing to New York from the JSE as part of a corporate restructuring to access a larger pool of capital and reduce the risks associated with SA. The move is estimated to cost c. 5% of its market capitalisation, primarily to cover its SA tax obligations. The gold miner also said its gold production and adjusted EBITDA declined YoY in 1Q. Gold production totalled 584,000 oz for the quarter, down from 588,000 oz. As a result, ANG’s adjusted EBITDA declined from US$438mn to US$320mn. Nevertheless, AngloGold maintained its gold production guidance for 2023 at 2.45mn oz to 2.61mn oz.

HCI was followed by Bid Corp, Sirius Real Estate, Aspen Pharmacare and Datatec, which recorded share price gains of 27.3%, 26.5%, 25.8% and 22.7% YTD, respectively.

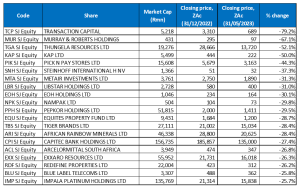

Figure 4: Bottom-20 worst-performing shares, YTD

Source: Anchor, Bloomberg

Among the YTD worst-performing shares, eleven of the twenty shares for the year to end May were also among the twenty worst-performers for the year to the end of April. Metair Investments (-31.1% YTD), Nampak (-29.8% YTD), Pepkor (-29.5% YTD), Equites Property Fund (-28.7% YTD), Tiger Brands (-28.4% YTD), Capitec (-27.4% YTD), Exxaro (-26.3% YTD), Redefine Properties (-26.2%) and Blue Label Telecoms (-25.8% YTD) were the new entrants.

Following a further 43.3% drop in May, Transaction Capital (discussed earlier) remained the worst-performing share YTD, with its share price now down a massive 79.2%. Transaction Capital was again followed by Murray & Roberts (-67.1% YTD) in the second spot, and coal exporter Thungela Resources (-52.1% YTD), which moved into third place after recording a MoM loss of 19.9% in May.

Kap Ltd, Pick n Pay Stores, Steinhoff International, Metair Investments, and Libstar recorded YTD share price declines of 50.0%, 44.3%, 37.3%, 31.3% and 31.0%, respectively.

EOH (-30.1%) and Nampak (-29.8%) rounded out the worst performers YTD. Nampak’s share price plunged after the debt-laden company released a profit warning in May. In its 1H23 trading update, the packaging company said it expects a headline loss per share (LPS) of between ZAc53 and ZAc58 compared to a HEPS of ZAc35.6 recorded in the previous year. In addition, it expects LPS to be between ZAc380 and ZAc420 compared to an EPS of ZAc34.9 recorded in the previous year. Nampak also announced a reduced rights offer last week of up to R1bn to help raise capital to pay off the R6bn debt it incurred after an unfortunate expansion into Africa. Nampak’s debt far outweighs its R455mn market value. Shareholders rejected a previous R1.5bn rights offer in January, but the company said it is confident that shareholders will back the proposed capital raise.

At Anchor, our clients come first. Our dedicated Anchor team of investment professionals are experts in devising investment strategies and generating financial wealth for our clients by offering a broad range of local and global investment solutions and structures to build your financial portfolio. These investment solutions also include asset management, access to hedge funds, personal share portfolios, unit trusts, and pension fund products. In addition, our skillset provides our clients with access to various local and global investment solutions. Please provide your contact details here, and one of our trusted financial advisors will contact you.