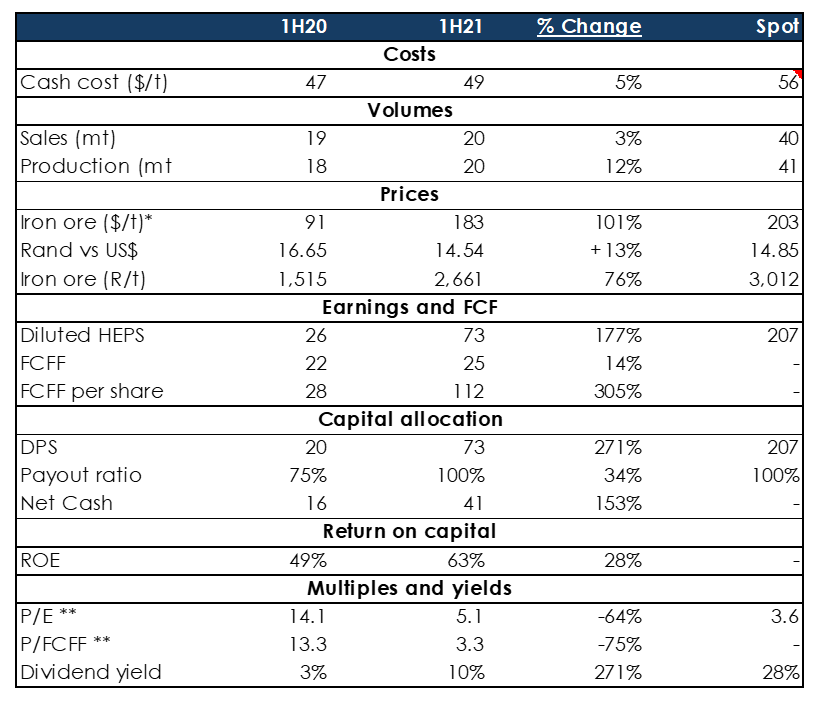

Kumba Iron Ore (Kumba) reported results for the six months ended 30 June 2021 (1H21) on 27 July. Operationally, these results were good with cash costs on our forecasts rising by 5% YoY in US dollar terms. Production volumes rose by 12% YoY, recovering well from a COVID-19 impacted 1H20 period. The Group’s 1H21 earnings were incredibly strong thanks to high iron ore prices. In rand terms, the price of iron ore was 76% higher for the six-month period under review. In addition, Kumba benefits from higher-quality products, so it realises higher prices than the iron ore prices we highlight in Figure 1 below.

Diluted HEPS nearly tripled to R73/share, while free cash flow (FCF) was also much stronger vs 1H20, at R112/share. Kumba’s formal dividend policy is to pay out 50% to 75% of earnings but, since the end of 2016, Kumba has paid out 92% of earnings via dividends. That trend continued in these results and Kumba declared a dividend (R72.60/share) equal to 100% of record HEPS. As at 31 December 2020, Kumba had R23bn or c. R71/share of net cash on its balance sheet. The combination of excess cash and strong cash generation makes it likely that close to 100% of its earnings will continue to be paid out via dividends going forward.

Anglo American owns 70% of Kumba and we note that Anglo’s 80%-owned Anglo American Platinum (Amplats) also announced record 1H21 earnings on the back of high palladium and rhodium prices, on 26 July (see our report entitled Amplats posts record 1H21 earnings on higher PGM prices, dated 27 July 2021).

Figure 1: Kumba 1H21 results overview, Rbn unless otherwise indicated

Source: Anchor, Bloomberg

*Kumba’s realised pricing is higher due to its higher-quality product. **calculated by annualising half-year earnings and FCF per share.

The share is currently trading on a P/E multiple of between 3.6x and 5.1x, depending on the estimate used, or an earnings yield of 20%-28%. Given Kumba’s high dividend payout ratio, that 20%-28% earnings yield is a good proxy for the company’s current dividend yield (assuming iron ore prices remain at these levels). However, we do not expect iron ore to stay above $200/t over the long term (although, to be fair, we also did not foresee it getting there in the first place).

Nevertheless, we do believe that the JSE-listed miners with iron ore exposure are generating large amounts of FCF (FCF yields are around the 15%-25% range) and, in many instances, a large proportion of that cash will be returned to shareholders via dividends and share buybacks. Kumba is not widely owned across our mandates, but we do have exposure to it via Anglo American, which will report its results on 29 July. We currently prefer to have iron ore exposure via diversified miners, which are not as wholly dependent on iron ore as Kumba is.