Major global markets (MSCI World +3.4% MoM; +19.4% YTD) saw solid gains in July on receding inflation worries, relatively resilient US economic data, and risk appetite globally being buoyed by the prospect that the US Federal Reserve’s (Fed) rate hiking cycle is nearing its end. This comes as personal consumption expenditure (PCE), the Fed’s preferred inflation gauge, cooled in June. The current US earnings season’s strong results have also boosted sentiment, and of the 254 S&P 500 companies that have reported, c. 79% came in above consensus analyst expectations. After pausing its rate-hiking cycle in June, the Federal Open Market Committee (FOMC) increased rates by a quarter-percentage point (as expected) to a range of 5.25% to 5.5% at its July meeting – a 22-year high. Fed Chair Jerome Powell said the Fed would make data-driven decisions on a “meeting-by-meeting” basis in the future.

In US economic data, June headline inflation, as measured by the consumer price index (CPI), slowed sharply to 3.0% YoY (its lowest level since March 2021) vs May’s 4.0%. Core CPI, excluding the erratic food and energy components, declined to 4.8% YoY in June vs 5.3% in May. MoM headline inflation rose 0.2% (vs May’s 0.1%). June retail sales advanced 0.2% MoM (less than expected), while May retail sales data were revised higher (from 0.3% to 0.5% MoM). Retail sales increased 1.5% YoY in June. US 2Q23 GDP grew by a faster-than-expected 2.4% YoY (estimates were for 2% growth) and above 1Q23’s 2.0% YoY print. Growth was buoyed by a resilient labour market which supported consumer spending, businesses boosting investments in equipment and building more factories, and increased government spending. Positively, 2Q23 saw inflation held in check, with the PCE price index up 2.6% vs 1Q23’s 4.1% rise. MoM, PCE dropped to 0.2% in June vs May’s 0.1%. YoY, PCE advanced 3.0% – its lowest annual gain since March 2021 and below May’s 3.8% increase. June core PCE (excluding food and energy) rose 4.1% YoY (its lowest annual increase since September 2021) vs 4.6% in May.

Among the major Wall Street indices, the tech-heavy Nasdaq Composite Index (Nasdaq) and blue-chip S&P 500 posted good gains, up 4.0% (+37.1% YTD) and 3.1% (+19.5% YTD) MoM, respectively. It was both indices’ fifth consecutive positive month. The Dow Jones rose 3.3% MoM and is up 7.3% YTD.

In Europe, Germany’s DAX ended July 1.9% higher (+18.1% YTD), while France’s CAC Index closed 1.3% up MoM (+15.8% YTD). The European Central Bank (ECB) raised rates by 25 bps at its July meeting (the ninth consecutive increase), taking the ECB deposit rate to 3.75%. In a statement, the ECB said, “Inflation continues to decline but is still expected to remain too high for too long,”. In economic data, June euro area inflation was 5.5% YoY, lower than May’s 6.1% print, while EU annual inflation was 6.4% in June vs May’s 7.1%. Germany’s July annual inflation rate fell, coming in at 6.5% vs June’s 6.8% print. Euro area 2Q23 GDP growth accelerated, expanding 0.3% QoQ — higher than the 0.2% consensus forecasts had expected. France and Spain’s economies proved relatively resilient, with the former posting a growth rate of 0.5% and the latter expanding by 0.4%. Germany, however, failed to record any growth, while Italy’s growth was the weakest (-0.3% QoQ). In annual terms, euro area GDP was ahead by 0.6% – down from the 1.1% pace seen in 1Q23.

In the UK, the blue-chip FTSE-100 closed 2.2% higher in July (+3.3% YTD). June UK inflation cooled to 7.9% YoY – below consensus expectations of 8.2% and well below May’s higher-than-expected 8.7%. June core inflation, excluding the volatile food and energy items, remained sticky, at 6.9% vs 7.1% in May (a 31-year high).

Chinese equities closed July on a cheery note, despite the month’s disappointing economic data releases. There was optimism around the government’s top economic planning agency, the National Development and Reform Commission (NDRC), releasing a policy document on 31 July containing measures to restore and expand consumption and covering a wide range of industries, including automobile, real estate, electronic products, and the services industry. MoM, Chinese markets recorded gains, with Hong Kong’s Hang Seng Index up 6.1% (+1.5% YTD), while the Shanghai Composite Index rose 2.8% (+6.5% YTD). China’s factory activity posted a fourth straight monthly contraction in July, with the official manufacturing purchasing managers index (PMI) coming in at 49.3, slightly better than the expected 49.2 but down from June’s 49.0 print. The official non-manufacturing PMI, measuring business sentiment in the services and construction sectors, slowed to 51.5 (its weakest level this year and a fourth straight monthly decline) vs June’s 53.2 print. The 50-point mark separates expansion from contraction. The National Bureau of Statistics said extreme weather conditions negatively impacted construction activity (-4.5 ppts).

Japan’s equity market performance disappointed, with the benchmark Nikkei declining after two consecutive positive MoM performances as it retreated by 0.1% in July (+27.1%YTD). Core CPI (excluding the volatile fresh food category but including energy costs) rose 3.3% YoY in June vs May’s 3.2% gain, matching expectations. The so-called “core-core” inflation rate, which excludes fresh food and energy prices, slowed to 4.2% in June vs May’s 4.3% print. Last week the Bank of Japan opted to keep its benchmark interest rate at -0.1% but said it would fine-tune its bond purchases to allow greater flexibility given the “high uncertainties” for the economy and prices.

In commodities, Brent crude oil rose 14.2% MoM (-0.4% YTD) – its second consecutive MoM gain following OPEC+ production cuts and renewed optimism around the Chinese demand and global growth outlook. Iron ore prices rose 2.0% MoM but are down 1.1% YTD. Meanwhile, the gold price rose 2.4% MoM (+7.7% YTD). The platinum price jumped 5.3% MoM (-11.2% YTD), while palladium ended the month 4.6% higher (-28.2% YTD). Natural gas prices fell by 5.9% MoM (-41.1% YTD), while thermal coal prices retreated by 0.9% MoM (-43.3% YTD).

South Africa’s (SA’s) FTSE JSE All Share Index rose by a solid 3.9% in July (+8.1% YTD), while the FTSE JSE Capped SWIX rose by 4.1% MoM (+7.9% YTD). Financials were by far the best-performing segment of the market (Fini-15 +7.9% MoM; +11.6% YTD), followed by resources (Resi-10 +3.7% MoM; -9.2% YTD), as higher commodity prices, especially platinum group metal (PGM) prices and gold buoyed the index. Industrial counters (Indi-25 +2.5% MoM; +20.8% YTD) and property (the SA Listed Property Index +2.1% MoM; -5.5% YTD) also recorded good gains. Highlighting the performances of the biggest JSE-listed shares by market cap, the largest company on the exchange, BHP Group, disappointed, falling 1.4% MoM, while Anheuser Busch InBev, the third-largest listed company, declined by 3.7% MoM and Richemont was down 10.1% MoM. However, the JSE was buoyed by the performances of Prosus (the second-biggest listed counter) and Naspers (the fifth-largest by market cap), up 2.9% and 3.4% MoM, respectively. Glencore, Anglo-American, FirstRand and Standard Bank were four other large caps that posted impressive MoM gains of 1.9%, 2.1%, 6.3% and 7.6% MoM, respectively. The rand recorded another strong performance in July, firming by 5.6% MoM (-4.5% YTD), ending July below the psychological R18.00/US$1 level at R17.85/US$1. Slowing SA inflation and the SA Reserve Bank’s (SARB) decision to leave the interest rate on hold spurred buying of government bonds, helping the local unit’s strong performance in July.

In economic data, SA’s June headline CPI slowed for a third consecutive month to 5.4% YoY (the lowest reading since October 2021) vs May’s 6.3%. Declines in food and fuel inflation largely drove this cooling in inflation. Annual inflation for food and non-alcoholic beverages slowed for a third month, cooling to 11.0% from a high of 14.0% in March, primarily due to the continued decline in global food prices and partly reflecting some base effects. Similarly, the combination of fuel price cuts in June and base effects likely pushed fuel inflation up by 8.3% YoY in June. Core inflation (excluding the volatile categories of food and energy costs) surprised on the downside, at 5% YoY vs 5.2% in May, indicating that the broadening in price pressures has been relatively limited over recent months. May retail sales data (released in July) fell for a fifth consecutive month, with data showing that retail trade declined by 1.4% YoY, following a revised 1.8% YoY drop in April. YTD, every month has seen a decline in retail sales data.

Against this latest positive inflation print, the SARB’s Monetary Policy Committee (MPC) voted to keep interest rates at current levels at its 20 July meeting. Thus, the repo rate remains at 8.25% and the prime lending rate at 11.75% – which will help offer some temporary relief to strained local consumers.

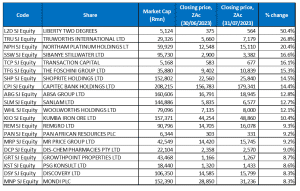

Figure 1: July 2023 20 best-performing shares, MoM % change

Source: Bloomberg, Anchor

Real estate investment trust (REIT), Liberty Two Degrees (L2D), was July’s best-performing share, soaring by 50.4% MoM. This follows the announcement last week that Liberty Group (which owns c. 61% of L2D’s shares) intends to buy out L2D’s minority shareholders and de-list the Group. On the day of the announcement, L2D’s share price jumped, gaining 41.8% on 27 July. Liberty Group is offering minority shareholders a price of R5.55/share. The offer price is c. 35% below the last reported net asset value (NAV) of R7.51, as at 31 December 2022. However, it represents a 46.4% premium to the volume-weighted average price at which L2D has traded over the past 30 days. Liberty Group was de-listed and merged into Standard Bank after the bank bought out the minority interest. If the deal goes ahead, it will consolidate Liberty’s real estate assets, and L2D will also delist from the JSE. L2D’s R8.2bn property portfolio includes the Sandton City Complex, Midlands Mall, Nelson Mandela Square, Melrose Arch and Sandton Sun Hotel.

In its FY23 trading update released last week, clothing retailer Truworths (+26.8% MoM) revealed that its retail sales jumped 11.4% YoY to R20.6bn (or by 13.2% YoY adjusted since FY22 and FY23 are difficult to compare because of 53 weeks in FY22 and 52 in FY23). Moreover, retail sales in Truworths’ Africa segment increased 9.1% YoY to R15.0bn, while like-for-like store retail sales rose 4.4% YoY. The company is set to release its FY23 results on 31 August. In the UK, Truworths’ shoe chain Office saw retail sales grow 16.9% (or 18.8% on a 52-week base). Due to the weaker rand, UK retail sales increased by 23.9% YoY to R5.6bn.

In third place, platinum miner Northam’s share price rose 20.4% MoM, reacting positively to the announcement in July that Northam will sell its 34.5% stake in Royal Bafokeng Platinum (RBPlats) to Impala Platinum (Implats). Although it is an about-face after Northam’s vigorous pursuit of RBPlats, the move does help protect Northam’s balance sheet at a time when PGM prices are under pressure. This is also a significant sale for Northam as it represents c. 22% of its market cap and should put Northam’s balance sheet firmly in a net cash position. CEO Paul Dunne said that Northam is exploring using the cash from the sale of its RBPlats stake to pay a maiden dividend or embark on a share buyback. The other option is to reduce debt.

Northam was followed by Sibanye Stillwater, Transaction Capital, and The Foschini Group, which recorded MoM share price gains of 16.6%, 16.1% and 15.3%. After a hair-raising decline of 79.5% YTD, Transaction Capital recorded a double-digit gain in its share price in July, albeit from an extremely low base.

Meanwhile, Capitec Bank was up 14.4% in July, while Absa Group rose by 12.8%. Absa released a 1H23 voluntary trading update last month, stating that its results were likely to align with its prior guidance. The Group said this was despite SA’s weaker economic growth and high-interest rate environment. The trading update highlighted a solid operational performance, with Absa guiding for low-teens, first-half revenue growth, driven by substantial mid-teens net interest income growth, reflecting low double-digit growth in customer loans and deposits, combined with interest margin expansion due to higher interest rates. Absa also expects high single-digit non-interest income growth with strong growth in its Africa Regions segment and insurance revenue.

In the tenth spot, Sanlam’s share price recorded a 12.7% gain in July.

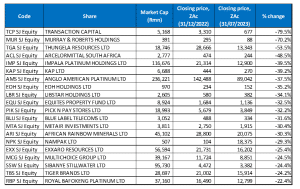

Figure 2: July 2023 20 worst-performing shares, MoM % change

Source: Bloomberg, Anchor

ArcelorMittal (Amsa) was July’s worst-performing share, with its share price plummeting 31.7% after SA’s largest steelmaker warned that its earnings for the six months to end-June would drop by between 111% and 114% YoY. The company said that headline EPS was likely to fall from R2.71 to a headline loss of ZAc38-ZAc46c for the period, and it expected a “substantially weaker financial performance”. Amsa continues to face weaker demand and higher input costs, made worse by loadshedding and disruptions to Transnet’s rail networks. In a trading statement, Amsa said that local conditions had deteriorated due to “the burden of loadshedding, high inflation and interest rates, and negative growth in key steel-consuming sectors such as manufacturing, autos, mining and construction”. It added that the “… unprecedented severity of the electricity loadshedding in the last six months was very much underestimated,”.

Amsa was followed by Richemont, which was down 10.1% MoM. Richemont released a 1Q24 (1 April to 30 June) trading update last month, which showed that its top-line sales missed expectations by 1%, with actual YoY sales coming in at 19% YoY compared to the 20% YoY estimate. The Americas region (its third-largest) was the worst-performing for the quarter and the only region showing negative YoY growth – actual sales were down 2% YoY, while consensus analyst forecasts had expected a 1% YoY rise. This weighed on the share price despite Japan and the Middle East & Africa regions outperforming expectations, and APAC, which includes China, Richemont’s most significant region, showing robust growth (in line with expectations) – up 40% YoY. Richemont was followed by the information and communication technology (ICT) solutions and services group Datatec, which lost 10.0% MoM.

Datatec was followed by Thungela Resources (-9.8% MoM), specialist engineering group Murray & Roberts’ (MUR; -8.3% MoM) and Sirius Real Estate (also down 8.3% MoM). Last month, Australia’s Federal Court granted MUR’s holding company administrators, MRPL, an extension to convene a second creditors meeting by the end of August, buying MUR time to regain control of the Australian business. MUR stumbled in its quest to regain control of its Australian asset, RUC Cementation Mining Contractors, after failing to ensure that certain conditions precedent in the deed of company arrangement proposal to creditors were met on time. Also in July, MUR shareholders approved a special resolution to grant financial assistance to its subsidiary OptiPower Projects, bringing relief to the company that recently lost a bid to recoup R25mn from a client. The Johannesburg High Court dismissed OptiPower’s R25mn claim for non-payment of a wind farm built in the Eastern Cape.

Alexander Forbes was down 8.1% in July, while both EOH Holdings and Multichoice Group’s share prices were down 7.3% MoM. Pay-TV company MultiChoice’s share price plunged c. 13% on 4 July after JP Morgan Chase & Co downgraded its recommendation on the share. According to Reuters, JP Morgan adjusted Multichoice’s rating down from “neutral” to “underweight” – basically recommending investors sell their shares in the company.

Finally, Telkom SA’s share price lost 7.2% MoM. On 7 July, Telkom said it had rejected an offer led by its former CEO to buy a majority stake in the company. This saw its share price drop by 7% on the day. In June, Telkom confirmed it had received an unsolicited offer led by former CEO Sipho Maseko and the Government Employees Pension Fund to buy a substantial stake in the telecoms Group which is partly government owned. On Monday (31 July), Telkom released its 1Q23 trading update, which showed that Group revenue increased by 3.8% YoY to R10.69bn, driven by continued uptake of its new generation network (NGN) products by customers as well as increased data traffic. Its mobile revenue advanced 5.2% YoY to R5.45bn, primarily driven by the continued provision of value-compelling propositions, effectively stimulating data consumption. Mobile data traffic and subscribers rose by 25.1% and 6.9% YoY to 329 petabytes and 18.5mn subscribers, respectively.

Figure 3: Top-20 best-performing shares, YTD

Source: Anchor, Bloomberg

Fifteen out of June’s top-20 YTD best-performing shares were again among the top-20 best performers for the year to the end of July. The two top-performing shares were once again gold miners – unchanged from June. Sanlam, Truworths, Discovery, Old Mutual and Wilson Bayly Holmes-Ovcon (WBHO) were the new entrants among the best YTD performers, bumping Sirius Real Estate, Datatec, Afrimat, Hammerson Plc and AngloGold Ashanti from the list.

Although DRDGold’s share price was down 2.4% MoM in July, the share remained at the top spot YTD with an impressive gain of 58.8%. In addition, Gold Fields (+56.1% YTD) maintained its second position after recording a 5.1% MoM advance in July. Textainer, the year to June’s third best-performing share, was bumped to the sixth spot with a YTD gain of 34.0%, with Hosken Consolidated Investments (HCI) taking the third position with a 46.6% YTD gain.

Aspen Pharmacare, Sanlam and Textainer followed HCI with YTD gains of 40.7%, 35.0% and 34.0%. Aspen said earlier this week that it would buy the Latin American commercial rights and intellectual property for a portfolio of Viatris’ branded products in a c. R5bn deal. According to Aspen CEO Stephen Saad, Aspen’s Latin American business accounts for over one-tenth of its turnover, and the region offers strong growth opportunities. Earlier this year (in May), Aspen also secured the rights to market, distribute and sell US biotech pioneer Amgen’s products in SA for an initial five-year term, which Aspen expects to be renewed.

Textainer was followed by Reinet Investments (+32.3% YTD), Harmony Gold (+30.9% YTD), Truworths (+30.5% YTD) and logistics and mobility solutions company, Super Group (+29.6% YTD). In its annual report released last month, Reinet said it had received EUR122mn in dividends from British American Tobacco (BAT) in the year to end March. Despite significantly reducing BAT’s share of its asset base over the past ten years, Reinet said that BAT continued to be a “fortress”, giving it liquidity to pursue other opportunities. Most of Reinet’s portfolio is unlisted and includes exposure to various specialist private equity funds. Reinet records its assets and liabilities in euro and said its NAV stood at EUR5.7bn at the end of March.

In July, Super Group said that for the 12 months ended 30 June, it expects headline EPS to be between ZAc456.8/share to ZAc483.5/share – c. 20%-27% higher YoY. The company said it had delivered a strong FY23 performance despite the volatile macroeconomic environment.

Figure 4: Bottom-20 worst-performing shares, YTD

Source: Anchor, Bloomberg

Among the YTD worst-performing shares, eighteen of the twenty shares for the year to end of June again featured among the twenty worst-performers for the year to the end of July. The new entrants were Multichoice (-24.5% YTD) and Tiger Brands (-24.2% YTD).

Despite its 16.1% share price gain in July, investment holding company Transaction Capital (discussed earlier) was the worst-performing share YTD with a 79.5% share price drop. Transaction Capital was again followed by MUR (-70.2% YTD) in second spot, with thermal coal miner Thungela Resources coming in third (-53.5% YTD).

Thungela’s share price has been under pressure this year as the price of coal plummeted to an average price of US$112/tonne for 5M23 (from a high of US$300/tonne in SA following Russia’s invasion of Ukraine). In addition, Thungela had to contend with Transnet’s poor performance, which, before two derailments in May, was averaging 48mn tonnes in coal to its ports, compared with less than 40mn tonnes in January. Thungela has indicated that it must achieve 53mn tonnes in 2H23 to meet 2022’s 50mn tonnes in deliveries. Thungela lost 300,000 tonnes in coal exports in the first five months of this year.

Thungela was followed by ArcelorMittal, Implats, KAP Ltd and Anglo American Platinum, which recorded YTD share price declines of 48.5%, 39.5%, 39.2% and 37.5%, respectively. Last month, Northam said it would sell its 34.5% stake in RBPlat to Implats in a R13bn transaction after Northam ended its quest to acquire RBPlat. Implats will delist RBPlat after acquiring c. 98% of the business in a cash and shares takeover. Northam’s divestment from RBPlats means that Implats can more easily extract operational synergies between RBPlat’s newer shafts and Implats’ adjacent older Rustenburg operations.

Finally, EOH (-35.2%), Libstar Holdings (-34.1%) and Equites Property Fund (-32.5%) rounded out the ten worst-performers YTD.

At Anchor, our clients come first. Our dedicated Anchor team of investment professionals are experts in devising investment strategies and generating financial wealth for our clients by offering a broad range of local and global investment solutions and structures to build your financial portfolio. These investment solutions also include asset management, access to hedge funds, personal share portfolios, unit trusts, and pension fund products. In addition, our skillset provides our clients with access to various local and global investment solutions. Please provide your contact details here, and one of our trusted financial advisors will contact you.