AVI released mixed FY20 results on 7 September. FY20 revenue growth increased by 0.4% YoY, driven by strong demand for Entyce and Snackworks products, although this was offset by declines in Footwear & Apparel, Ciro, and I&J. The Group’s gross profit declined 2.9% YoY and is reflective of a weaker 2H20 from I&J. The company’s gross margin declined to 39.8% from 41.1% in FY19. AVI managed to protect margins in some segments due to low raw material cost inflation and good cost control. Operating profit declined by 7.5% YoY due to lower gross profit, while basic EPS increased 21.1% YoY, due to I&J selling its interest in a joint venture (JV) with Simplot. AVI realised proceeds amounting to R631.8mn from this sale and the after-tax capital gain stood at R373.7mn. Headline EPS declined by 8.9% YoY to ZAc470.8 from FY19’s ZAc516.6 on the back of lower operating profit and JV earnings. A final dividend of ZAc250/share was announced in 2H20, bringing the total FY20 dividend to ZAc410/share.

Figure 1: Operating profit margins by segment, FY20

Source: Anchor, Company data

We note that these results were mixed because AVI’s business segments were impacted, to varying degrees, by the COVID-19 pandemic and the ensuing lockdowns. Entyce was resilient and Snackworks did extremely well, driven by home consumption patterns during lockdown, while Spitz, Indigo (which sells make-up and fragrances), and Ciro (coffee) were negatively affected by the lockdown restrictions and working-from-home trends. However, I&J’s performance especially was significantly impacted by an earlier build-up of COVID-19 infections. Compliance, isolation, and quarantine protocols reduced the number of people that were available to work, resulting in lower processing capacity and a significant reduction in fishing activity at I&J during AVI’s fourth quarter. These problems were further compounded by export shipment delays at the Cape Town port, which in turn impacted margin recognition in the company’s fourth quarter.

Below we look at the segmental performance of AVI’s various business units in more detail:

Entyce beverages (tea and creamer products were slightly offset by coffee)

- Revenue increased marginally by 0.7% YoY, while operating profit advanced by 1% YoY.

- Tea revenue rose 2.5% YoY due to sales volumes increasing by 4.4% YoY on the back of higher demand during the lockdown period. However, this was slightly offset by lower selling prices in Rooibos as raw material costs declined.

- Coffee revenue was down 9.1% YoY, heavily impacted by lower sales in Ciro’s out-of-home coffee business.

Snackworks

- Revenue rose 12.2% YoY and operating profit jumped by 25.9% YoY, buoyed by good growth from the Biscuits and Snacks segments.

- Biscuit revenue increased by 12.3% and snacks revenue rose 11.7% YoY, with both segments supported by strong sales volumes and higher selling prices.

I&J

- Revenue declined by 7.2% YoY and operating profit fell 41.7% YoY.

- I&J suffered the worst effects of COVID-19 as the company had reduced processing and lower fishing activity in 2H20 due to the pandemic. It was also affected by high infection rates at its processing factories.

- Abalone was negatively impacted by poor export demand and lower selling prices due to lockdown restrictions in key export markets.

- In addition, I&J’s business operations were further impacted by limited airfreight availability due to global flight restrictions.

Personal care

- Indigo’s revenue declined by 10.7% YoY on a LfL basis, while operating profit fell 36.7% YoY. This was driven by lost revenue in AVI’s fourth quarter due to the suspension of cosmetic and fragrance sales under lockdown level-5 restrictions, as well as soft demand from people working from home. AVI is trying to reduce fixed cost nature of the business and Indigo has changed its operating model (Indigo now operates as a licensed distributor rather than an agent and reports the full purchase cost of revenue from Coty products with effect from 1 July 2019)

- Spitz revenue dropped by 15.5% YoY due to lower footwear demand prior to the pandemic-induced lockdown, lower December sales, and a significant loss in revenue from the lockdown. Trading post the lifting of lockdown restrictions has been weak and footfall at major shopping malls remains subdued and weak.

- Green cross revenue decreased by 36.5% YoY due to lower sales volumes, discounting in the mid-price comfort footwear segment, and a significant loss of revenue during the lockdown. However, the gross profit margin was higher following AVI’s conversion to a fully-fledged import model, but these gross profit margin improvements were not enough to offset lower sales volumes.

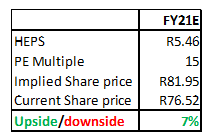

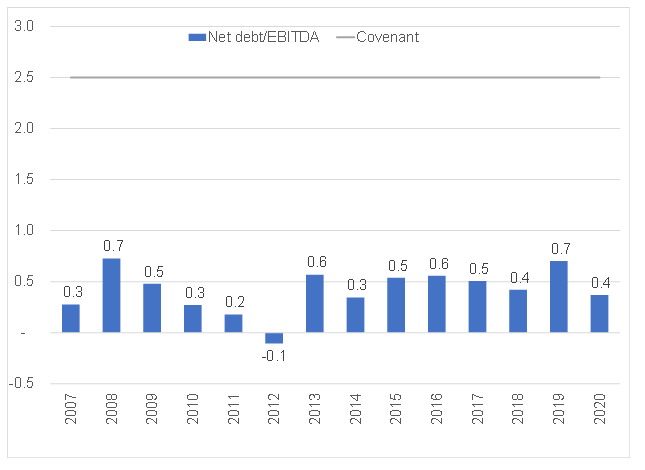

AVI’s valuation and sensitivity analysis

Figure 2: AVI PE valuation

Figure 3: AVI valuation sensitivity analysis

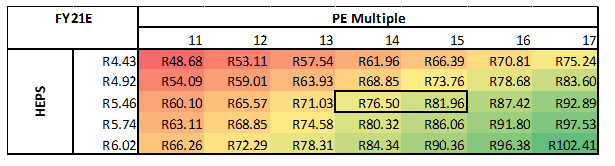

In our view AVI’s good cash flow generation and balance sheet capacity indicate a special dividend and/or share buy-back programme is highly possible in FY21. Management also said that there is appetite for acquisitions. However, they will only consider credible brands that can add value.

Figure 4: Cashflow conversion

Source: Anchor, Company data

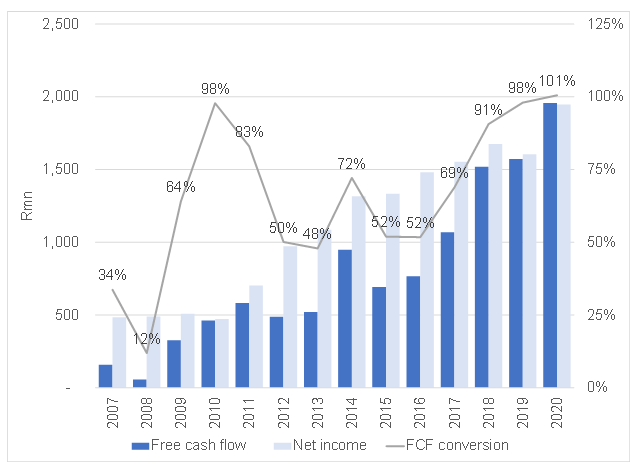

Figure 5: Net debt/EBITDA ratio

Source: Anchor, Company data

Outlook

Management highlighted that AVI will endeavor to protect Entyce and Snackworks profits and improve Personal Care’s profit in the current tough operating environment. Footwear and Apparel is expected to recover slowly as demand starts to normalise when footfall returns to the major shopping malls. Management also expects to sustain its return on capital employed (ROCE) and maintain its dividend payout ratio of 80%.

We believe that AVI’s earnings growth driver for FY21E will be I&J’s performance, which stands to benefit from the lower oil price and increased export sales into Europe. Nevertheless, despite these positive contributors for I&J, we are concerned about Abalone’s near-term prospects and new shipping fuel regulations that could negate the lower fuel operating costs. As a result, we are cautious on the prospect of I&J reaching record margins. So, while we believe that I&J will be an earnings driver for AVI, we caution against extreme bullish sentiments regarding its margin expansion.

In addition, while we think that Entyce and Snackworks will remain resilient into FY21, in our view AVI’s retail segment will continue to recover slowly. Overall, we believe that AVI is one of the better food producers in the sector, with a credible management team that has a solid track record. The company had good cash generation and continues to have excellent balance sheet capacity. We are also encouraged by management’s comments on returning cash to shareholders in the near term. If playing the SA recovery story, AVI would be our preferred stock within the food producers’ space.