In this note, the Anchor investment team highlights a selection of JSE-listed companies that we believe are worth watching in the year ahead (the chosen shares are discussed alphabetically). Please remember that these individual stock ideas may not necessarily be reflected in all client portfolios (as our portfolios have different mandates and risk-return profiles). However, we tried to find stocks that indicate how we pick our shares, which mirror our philosophy in this regard.

After several lean and frustrating years for South African (SA) investors, 2024 was finally a year when the stars aligned somewhat. SA was certainly not the market through which to gain exposure to the theme that gripped investors globally – all things artificial intelligence (AI) – but entering 2024 with valuations close to historic lows relative to history for domestically focused companies in particular, local equities were certainly positioned well for any hint of good news. The pivotal event, of course, was SA’s National and Provincial Elections (NPEs) in May, from which the Government of National Unity (GNU) that emerged was a far better outcome than many had feared. That set off a strong recovery among SA Inc. shares (those companies whose earnings are predominantly linked to the domestic economy and span all sectors).

Among the miners, except for gold shares, which tracked the rising gold price, 2024 has been a decidedly forgettable year thanks mainly to continuing economic challenges facing key commodities consumer, China. Regarding SA’s large component of rand hedge shares geared more to what is happening elsewhere in the world, it was a mixed bag. Rand strength was undoubtedly a headwind for all of them after the GNU’s formation. However, company-specific factors (such as global luxury goods sales having a particularly challenging year, which impacted Richemont) also played a part.

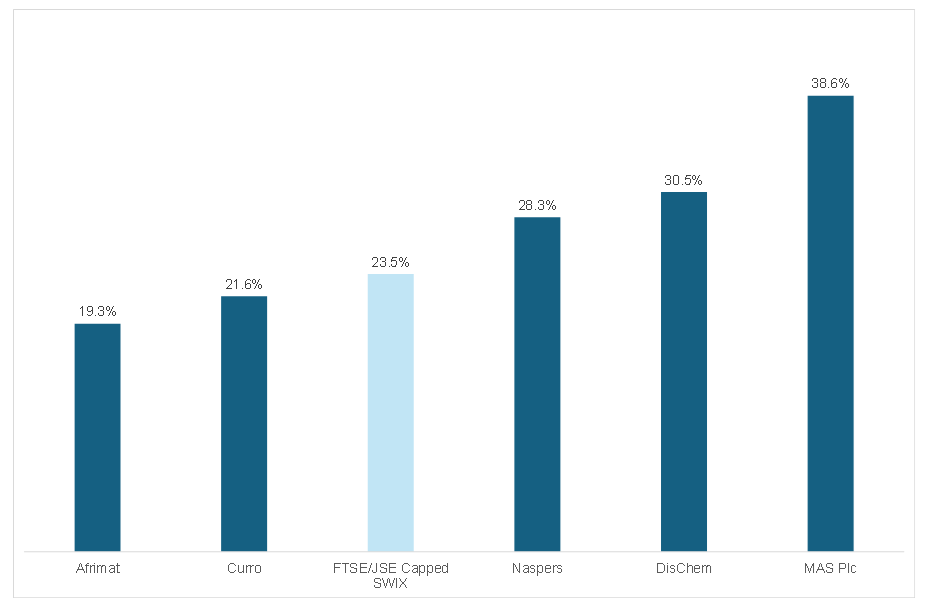

Quoting from what we said last year in our report entitled Anchor’s local stock picks for 2024, dated 12 December 2023, about our picks for 2024: “thus, while we remain vigilant for conditions turning more supportive as 2024 progresses, our stock selections reflect continued caution and bias towards our long-term preference for quality compounders with strong management teams and a company-specific growth thesis that is relatively insensitive to how SA’s macroeconomic prospects unfold”. It was undoubtedly a cautious tone, and, in retrospect, plenty of domestic companies were more geared to what turned out to be a favourable domestic backdrop in 2024. Still, proving that quality prevails in most seasons, an equal weighting in our selection of stocks would have returned 28% – a decent result.

Figure 1: Anchor’s 2024 domestic stock picks – total return (rand)

Source: Anchor, Bloomberg

Turning our attention to 2025, we enter the year with valuations of domestic companies closer to their long-term average in many cases after the post-GNU rally. Investors have bid up shares in anticipation that an end to loadshedding (for the time being), greater confidence in the future post the GNU formation, and lower interest rates will be among the factors combining to deliver some much-needed tailwinds for these companies. So far, confirmation that this has begun to materialise in the commentary from companies that have reported over recent weeks has been decidedly patchy. Still, outlooks, by and large, remain cautiously optimistic.

Given the large composition of globally sensitive companies listed, what happens offshore from a market perspective has and will remain a critical driver of our market. The strong rally in US equities post the strong mandate that the popular vote has handed President-elect Donald Trump in the US elections suggests investors have grabbed onto the good bits of what his return represents (less regulation, tax cuts, lower energy prices) while assuming the bad bits will turn out to be bluster – time will tell!

Our picks for 2025 include some of our old favourites with which we are sticking (Afrimat and Naspers/Prosus), lean into the improving domestic consumer outlook expected (Southern Sun and ADvTECH), while our call that 2025 will finally be the year that Renergen delivers on its long-delayed promises will no doubt raise a few eyebrows.

ADvTECH: Educating for Growth

By Stephan Erasmus, CFA, CGMA, Investment Analyst

ADvTECH has positioned itself as one of SA’s more compelling private education providers, gaining recognition and investor confidence. Its share price advances this year reflect growing trust in the company’s strategy and its ability to deliver steady improvement in both academic outcomes and financial returns.

The company focuses on expanding its student base while keeping tuition affordable. This approach has helped fill classrooms and lecture halls, reinforcing the company’s credibility as a provider of accessible quality education. Given SA’s harsh prevailing economic conditions, more families seek better schooling but remain mindful of cost. ADvTECH also employs technology to track student performance and teacher effectiveness, ensuring that rising enrolments do not come at the expense of academic standards.

Geographic expansion has added another dimension to its growth story. In Kenya and Botswana, ADvTECH’s ability to adapt to local conditions and offer recognised curricula has resonated with parents and students. Building on these successes, it plans to open a new university campus in Ghana next year. This venture will combine local support with digital resources, allowing ADvTECH to reach new markets without excessive capital expenditure.

It’s most promising prospects may now lie in higher education. With SA’s public universities under strain, private operators are filling the gap. ADvTECH’s tertiary institutions have earned respect for producing graduates who find work more quickly than many public education counterparts. The company is also progressing towards full university accreditation, a milestone that would bolster its reputation, potentially draw more students and broaden its academic offerings.

A recent acquisition underlines its ambitions. ADvTECH purchased a former training and conference centre in Sandton. By 2026, it plans to offer two tertiary brands, Varsity College Sandton and Vega Bordeaux, on this 47,000-square-metre site. The new campus will be capable of hosting about 9,000 students, roughly doubling the current capacity. Distance learning is another growth avenue for students who prefer online study, further enhancing ADvTECH’s offering.

The Group has navigated a challenging domestic economic environment with a measured approach, securing trust from parents, students, and investors. As the spotlight shifts towards mid-sized opportunities on the Johannesburg Stock Exchange, ADvTECH’s proven ability to adapt to demand, invest in quality, and expand thoughtfully makes it an education stock worth watching in 2025.

Afrimat: Significant headwinds but share price resilient

By Mike Gresty, CA(SA), CFA, Fund Management

Afrimat has been a long-term favourite of ours, frequently featuring among our local stock picks, including for 2024. Although the share did reasonably in absolute terms, it did not stand out in what was a good year for SA equities. While our high regard for this management team as superior capital allocators, with the ability to navigate the challenging domestic operating environment better than most, is unchanged, 2024 proved to be a year in which the challenges Afrimat faced overshadowed the progress it made in its strategy to secure future growth.

Among the headwinds that mean this financial year’s earnings (to end-February 2025) will fall well below what was initially expected are:

- The much-delayed Competition Commission approval of Afrimat’s acquisition of Lafarge resulted in the latter being in worse shape by the time Afrimat finally got its hands on it.

- Several months during which operational problems at Afrimat’s sole domestic iron ore customer – ArcelorMittal – resulted in it buying almost no iron ore from Afrimat.

- Challenging geological conditions encountered in the underground operations of Afrimat’s anthracite mine, Nkomati.

- A generally disappointing performance from Transnet on the export iron ore line, which has exacerbated the impact of lower realised iron ore prices this year.

Considering the extent of the headwinds Afrimat faced in 2024, its share price resilience likely reflects investor recognition that these frustrations should prove relatively temporary and the portfolio of assets that Afrimat now has positions the Group well for the years ahead – sentiments that we agree with. In this regard:

- Lafarge, of which Afrimat finally got control and began consolidating in May 2024, will be an important test of the operational execution capability of the Afrimat team. Early signs are positive, with the particularly problematic, on account of severe neglect, cement operations reaching a breakeven position in October. Although management has interesting plans for the cement operations (potentially focusing on supplying a grade of cement aimed at the lower end of the market where demand is strongest), it was clear from the outset that cement represented a free option in the deal. The real attraction lies in Lafarge’s high-quality portfolio of quarries. Should the improvement in business sentiment post the establishment of the GNU begin to translate into a more tangible acceleration in investment activity, the timing of this acquisition will prove particularly serendipitous for Afrimat.

- While the single customer risk for domestic iron ore supply remains, a new take-or-pay agreement that has been put in place with ArcelorMittal provides far greater assurance around prospective results from the Jenkins mine, which was established for this purpose. Pleasingly, the volumes in this agreement are at the top end of what this mine was projected to produce annually.

- Regarding the export of iron ore, Transnet remains the binding constraint. However, increased spending on maintenance recently and more encouraging news that new management in Transnet is far more receptive to private sector engagement on steps required to reverse the deterioration in performance provide glimmers of hope. Resolving the consequences of years of mismanagement of the export iron ore line by Transnet will not happen overnight, and management has warned that the necessary work may well disrupt volumes in the short term. Still, finally, there are signs of progress.

Afrimat’s 2H25 performance should show sequential improvement from 1H, thanks to progress on turning around the Lafarge operations and far better performance from domestic iron ore post its new agreement with ArcelorMittal. However, as the current projections in the table below reveal, this is not likely to be a great year for the company. With Lafarge’s turnaround in full swing and a low base for most of its other operations, Afrimat is well set for strong growth in years to come.

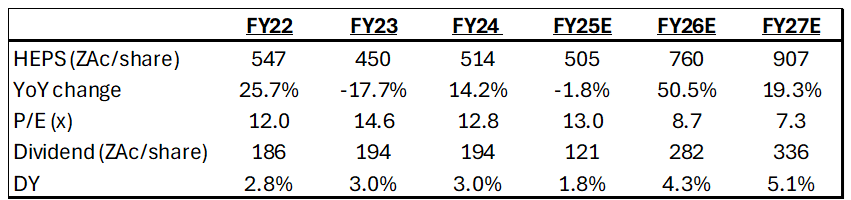

Figure 1: Afrimat projections (year-end February)

Source: Bloomberg consensus.

Naspers/Prosus: More of the same, please

By Mike Gresty, CA(SA), CFA, Fund Management

Another stock pick from last year that we have decided to stick with for 2025 is Naspers/Prosus. The various pillars that supported our investment thesis then are essentially unchanged, except that we have a further year of execution, which we think may start to get noticed by investors who, until now, have primarily seen Naspers/Prosus as a ‘poor man’s’ Tencent. This uncharitable view arose because Tencent accounts for >75% of the Naspers/Prosus net asset value (NAV). At the same time, the balance of the investment portfolio continued to lose money and burn cash. This has led to Naspers/Prosus’s investment performance routinely underperforming that of Tencent (by a wide margin). Considering each aspect of the investment case, we think there is a growing case for this perception to change:

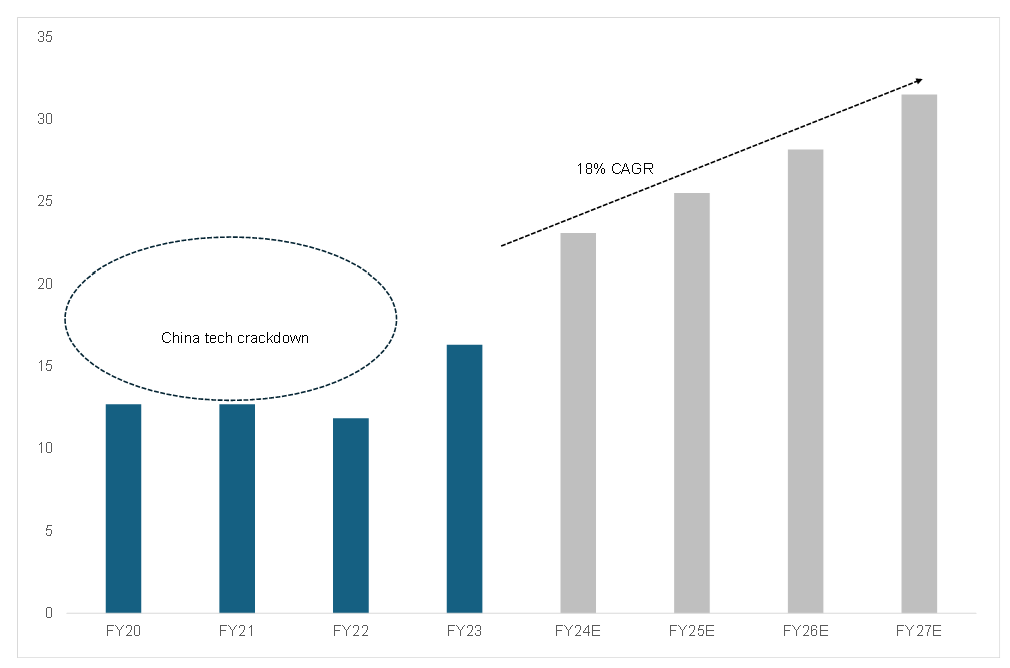

- Tencent – delivering solid profit growth despite China’s macro headwinds: The dramatic derating that Tencent (along with the broader Chinese tech sector) suffered during the 30-month big-tech crackdown that began in November 2020 with the last-minute cancellation of Ant Group’s IPO, likely reflects a structural reassessment of the investment risk in China. The past 18 months post this regulatory reset have seen a notable pivot by Tencent away from pursuing revenue growth for growth’s sake to driving improved profitability and a shift towards greater returns to shareholders through share buybacks and dividends. Currently valued at just 14x projected earnings, even without assuming any re-rating, the solid earnings growth in prospect as Tencent continues focusing on profitability and returns should deliver a more than respectable investment performance.

Figure 1: Tencent adjusted EPS projections, HKD

Source: Bloomberg, Anchor

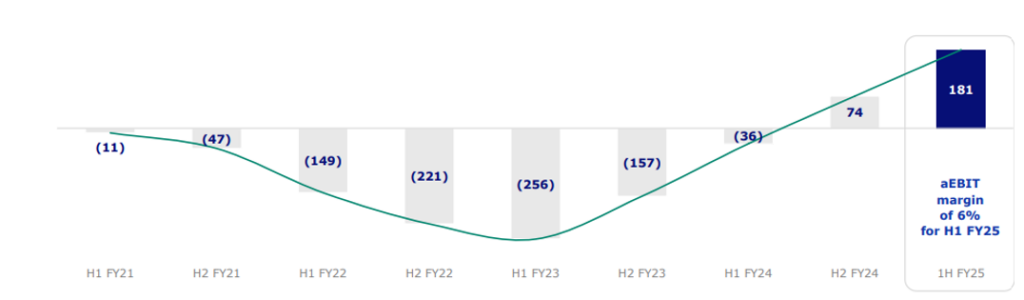

- Prosus Ecommerce Division – growing confidence in profitable growth being sustained: The abrupt departure of Prosus CEO Bob van Dijk in September 2023 came as a surprise to us, bringing the curtain down on a tenure that can probably best be summed up as a lot more profitable for him personally than it was for Prosus shareholders. The market was initially somewhat underwhelmed that, following a supposedly exhaustive search for the best possible replacement, it settled on an insider – Fabricio Bloisi (founder of the Latin American food delivery business iFood, which Prosus owns). Although it is relatively early days since his appointment in May 2024, we have been positively surprised by what we see. He has been given the target of doubling the NAV (adding c. US$100bn, in other words) over the next 3.5 years, for which he stands to be well paid if he achieves it. At least this time, shareholders stand to benefit too! His entrepreneurial background is already driving a much-needed shake-up of the culture – a much greater focus on the ecosystem that the portfolio of businesses represents, a greater sharing of best practices and a harder-edged focus on the turnaround of underperforming businesses. This mindset extends to how the team thinks about investing in existing and new businesses – another area that, frankly, comprised too many mistakes under van Dijk’s tenure. Importantly, what has stayed is the firm commitment to driving improved profitability in the Ecommerce division.

Figure 2: Prosus Ecommerce division operating profit trend, US$mn

Source: Prosus

- Share buybacks should eventually begin to further narrow the discount to NAV: Since the open-ended share buyback began in 2022, c. 25% and 22% of the Prosus and Naspers free float, respectively, has been repurchased (the most significant proportion globally within the tech universe, according to management), while the programme has boosted NAV by c. 11%. The amount by which NAV has been boosted is less than initially expected, mainly because there is a regulatory limit on the number of shares it can buy back based on the volume of shares traded. Maybe this has contributed to the fact that the discount at which the shares trade relative to NAV – currently 35% for Prosus and 38% for Naspers – has remained relatively range-bound over the past year. On top of the gradual NAV accretion that the buyback is driving, eventually, this ongoing share buyback will likely start running out of willing sellers from which to buy shares at the prevailing discount, which should begin to narrow the discount. Admittedly, of the three likely drivers of performance over the next year we have discussed here, this will likely be the least material, but its impact over time should not be underestimated.

As for a relative preference between Naspers and Prosus at this point, it is important to see this in the context of Naspers having materially outperformed Prosus since the open-ended share buyback began, leading to a material narrowing in the discount to NAV between the two. Possible contributory factors behind this include: (1) Naspers is selling down its Prosus stake to fund its share buybacks, partially negating the impact of Prosus’s buying; (2) the prospect of material corporate action outside of the share buyback to reduce the discount seems to receded for the time being; and (3) with China as an investment theme for European investors since Prosus listed in Amsterdam having been akin to a red-headed stepchild, Prosus has attracted little interest from this new investor base.

There is limited fundamental justification for the discount gap to narrow further, in our view, but one needs to keep in mind that the selling of Prosus shares by Naspers to raise cash for its buybacks will continue. What could change going forward, particularly if our thesis that Prosus’s Ecommerce division will increasingly decouple the investment case from that of Tencent, should begin to attract the interest of European investors. This would be an important source of new demand for Prosus shares, which we have not seen before. Thus, if we were forced to choose only one of the two, it would be Prosus, but we would rather own both until there is clearer evidence of European demand for Prosus.

Renergen: Fortune favours the bold

By Stephan Erasmus, CFA, CGMA, Investment Analyst

Renergen, a name that may not yet be well-known in the global energy landscape, is positioning itself to play an essential role in two key areas: liquefied natural gas (LNG) and helium. With unique assets and ambitious plans, Renergen may well thrive as the world increasingly moves to cleaner energy solutions and grapples with helium shortages. Despite this potential, the company must overcome immediate challenges that require careful management.

Renergen’s most valuable asset is helium, with 13.6bn cubic feet (BCF) of reserves, making it one of the richest producers in the world. These reserves come from only 14% of its licensed production area of 1,870 square kilometres, so significant potential exists in untapped areas. The global helium market is very tight. Helium is essential for many industries, like medical imaging and aerospace, and there is a constant gap between supply and demand. In 2018, the US government called helium a strategic resource, reflecting its importance to national security.

It operates a unique facility in Virginia, SA, producing LNG and helium. This facility is the first helium plant in SA and the fifteenth of its kind worldwide. The Phase-1 plant is operating below its full capacity, utilising only 45% of its gas intake capacity and 40% of its output capacity. The company must add wells to reach the Phase-1 nameplate capacity.

Figure 1: Aerial view of the Renergen helium plant in Virginia, SA

Source: Renergen

The Company needs to secure funding to complete Phase-1 of its project. It is considering different options, including issuing convertible debt related to its upcoming Nasdaq listing or seeking more private equity investment. The latter has worked well for the company in the past. In early 2024, Renergen raised R550mn by selling a 5.5% stake in its operating subsidiary, Tetra4, to a SA private equity group. The implied value was c.R68/share, considerably higher than the current share price of c. R8/share. Renergen plans to list on Nasdaq in 1Q25, aiming to raise funds for the initial part of its Phase-2 development. However, Renergen must demonstrate consistent and reliable performance from Phase-1 to build market confidence.

The Group has a market value of R1.2bn, which arguably does not reflect the true worth of its assets. For example, in 2024, the US Bureau of Land Management (BLM) sold 2 BCF of helium reserves for about R8bn. Renergen has 7.2 BCF of proven (1P) helium reserves, which can be economically recovered with a high degree of certainty. This shows that Renergen is arguably undervalued, especially considering that it is SA’s only LNG producer and is 73 km from Sasol’s gas pipeline. This positions the company well to help meet the country’s potential gas shortages.

The delay in operating at full production on Phase-1 has worried some investors, and the company’s dependence on shareholder funds due to a stretched balance sheet raises concerns. However, the long-term outlook suggests that Renergen can overcome these difficulties. The company has interesting potential, with both LNG and helium production making it a unique player in the global energy market. For investors willing to take a risk, Renergen is an interesting option. Significant upcoming events, like the completion of Phase-1 production and a potential Nasdaq listing, mean it deserves attention in 2025. This small company could soon achieve more than expected.

Southern Sun: A great addition to your Christmas wish list

By Liam Hechter, CA(SA), CFA, Fund Management

Fewer industries were harder hit by the COVID-19 pandemic than travel and leisure, and for Southern African hotel operator Southern Sun (SSU), the timing could not have been worse. Having entered the pandemic fresh off the demerger between itself and local gaming operator Tsogo Sun Holdings in 2019, the newly consolidated balance sheet was vulnerable to a cyclical downturn, let alone a full-scale government-mandated shutdown of its operations with no apparent end in sight. But if ever there was an example of a management team making the best of a tricky (actually horrendous) situation, it would be the example set at SSU under the leadership of CEO Marcel von Aulock.

Showing true South African grit and determination, the SSU management team quickly set out to right-size the operations. It embarked on a maintenance capex programme that would have been very difficult to perform under normal circumstances without materially disrupting operations. They used the downtime productively, ensuring that the operating leverage would be explosive when (/if) the business returned to normal operating capacity. And that is exactly what we believe we are experiencing at the moment. While some of the SSU assets might still be operating well below a satisfactory level (which we calculate to be in the region of 65%), there are pockets of strength (like the Cape-based hotels) that are benefitting from a strong rebound in foreign tourism.

Tourist numbers remain well below the peak of 2018, underpinning our view that Cape Town hotels have more room to increase capacity or adjust prices higher to meet demand. That, coupled with the added optionality of a recovery in Sandton-based business travel over the next year (the G20 summit being one example that should contribute nicely). We expect Group-wide occupancy to increase to above 62% next year from 58% a year ago, with each additional 1% of occupancy adding c. R100mn to SSU’s operating free cash flow.

Trading on a trailing 15x P/E and, on our estimates, a 12-month forward 11.5x P/E (implying 30% growth in earnings), the Group will also likely be debt-free and ready to pay out healthy dividends in one year. We believe SSU shares would be a good addition to this year’s Christmas stocking.