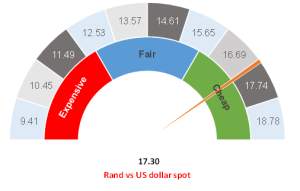

Figure 1: Rand vs US dollar

Source: Anchor

US October consumer price index (CPI) data, released on 10 November, rose less than expected, with inflation increasing by 7.7% YoY after rising 8.2% in September. MoM, CPI gained 0.4%. Core inflation, which excludes the volatile food and energy components, was up 6.3% YoY and 0.3% MoM, respectively. The market reaction to the CPI print has been violent and positive for risk assets. We note that this was a single market-supportive economic data print after a series of disappointments for much of 2022 (it was the first annual inflation increase below 8% in eight months). While one swallow does not make a summer, the direction of the tide is turning. Both US core and headline inflation came in lower than expected. Partly this reflected further gains in reopening supply chains and rebuilding inventory levels as used car (and other goods) prices are becoming deflationary. Partly this reflected lower-than-expected inflation for the shelter component, indicating that softer housing markets are starting to feed through to weaker rental prices. We are seeing increasing evidence that the tight US labour market is also slowing down. Fed officials, however, have been pointing out that the Fed has more to do as inflation remains well ahead of its target level of 2%. There are more rate hikes to come, both in South Africa (SA) and the US.

For us, the main benefit of the latest US CPI data was to take the risk of 6% or 7% interest rates in the US off the table. It seems that peak rates will now likely be in the low-5% range. For the US, markets have responded by reducing future Fed rate hike expectations towards 0.5% in December, with rate hikes of 0.25% after that. It seems to us that the 0.75% rate hikes are now a thing of the past. Similarly, in SA, the market has reacted by lowering consensus expectations for our SA Reserve Bank Monetary Policy Committee (MPC) meeting on 24 November to an expected hike of 0.50%. SA is pricing in that we have 1% of rate hikes left in the current cycle and that we will be at peak local rates toward the end of 1Q23.

As the Fed has been hiking rates, there has been only one currency in town, with the US dollar pushing ever stronger. The realisation that we will see a slower rate-hiking environment with peak rates early next year has tempered investors’ appetite for US dollars. Many long dollar positions were closed out in the last few days, with the dollar giving up some of its gains. This has allowed the rand to recover back toward R17.25 against the greenback. Option volatility prices have also been declining, meaning that financial markets are expecting a more stable environment going forward.

We previously stated in our report entitled The Navigator – Anchor’s Strategy and Asset Allocation, 4Q22 and dated 17 October 2022, that we think the rand will recover towards R16.50/US$1 over the course of next year and that this will be a gradual recovery. We maintain that view, and the recent CPI print increases our conviction of a gradually weakening US dollar in 2023. In the short term, it is plausible that the euphoria following the latest US inflation print has seen the market move too high, and we might see some of the recent gains reversed. However, over a longer timeframe, our view that we are moving into an environment that will be supportive of risk assets is reinforced.

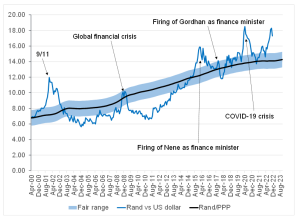

Looking at our purchasing power parity (PPP) chart in Figure 2, it is clear the rand remains overly weak against the US dollar, which supports our view of a gradual rand recovery. The recovery will, however, not be in a straight line, and some bumps are to be expected along the way. We have sold some US dollar holdings in our portfolios while the rand was above R18.00/US$1, and we are now patiently waiting for markets to settle after the positive surprises of the past week.

Figure 2: Actual rand/US$ vs rand PPP model

Source: Thomson Reuters, Anchor

At Anchor, our clients come first. Our dedicated Anchor team of investment professionals are experts in devising investment strategies and generating financial wealth for our clients by offering a broad range of local and global investment solutions and structures to build your financial portfolio. These investment solutions also include asset management, access to hedge funds, personal share portfolios, unit trusts, and pension fund products. In addition, our skillset provides our clients with access to various local and global investment solutions. Please provide your contact details here, and one of our trusted financial advisors will contact you.