January was a volatile month for world markets (MSCI World Index -5.3% MoM – its worst start to the year since 2016, according to Reuters) as concerns over spiralling inflation, higher interest rates, and geopolitical tensions (the standoff over Ukraine and the potential of an escalating military conflict between Russia and NATO) weighed on sentiment. Although US markets recovered somewhat during the last few trading days of the month, January saw Wall Street suffering its worst start to the year since the global financial crisis (GFC). The blue-chip S&P 500 gauge plummeted by 5.9% in January – its biggest MoM drop since the start of the pandemic, while the Dow Jones ended the month 4.0% lower and the tech-heavy Nasdaq fell by 10.1% MoM.

Following January’s US Federal Reserve (Fed) meeting, the Fed’s statement and subsequent Q&A session were also more hawkish than investors were hoping for, and it was all but confirmed that the first rate hike will be at the Fed’s next meeting on 16 March. The Fed also reaffirmed its plans to end bond purchases in March before launching a significant reduction in its asset holdings.

In terms of US economic data, inflation came in at a c. 39-year high of 7.0% YoY – the third straight month in which inflation came in above 6%. Excluding food and energy prices, core CPI rose 5.5% YoY – its sharpest increase since February 1991, according to CNBC. This as disruptions to global supply chains due to COVID-19 continue to cause shortages, driving up the prices of goods. US 4Q21 GDP growth came in stronger-than-expected, at an annualised rate of 6.9% – well above the 2.3% growth recorded in 3Q21.

The UK’s blue-chip FTSE 100 ended 1.1% higher MoM. In January, data from the Office of National Statistics (ONS) showed that UK GDP surpassed pre-COVID levels for the first time in November, expanding 0.9% MoM. Meanwhile, December UK inflation hit its highest level (of 5.4%) in c. 30 years.

In Europe’s largest economy, Germany, the DAX closed January 3.4% down, while the eurozone’s second-biggest economy, France’s CAC Index fell by 3.0% MoM. On a QoQ basis, preliminary seasonally adjusted eurozone GDP advanced 0.3% in 4Q21 (in line with market expectations), while YoY, seasonally adjusted GDP climbed 4.6% in 4Q21 after a 3.9% YoY gain in 3Q21.

In Asia, Hong Kong’s Hang Seng Index was up 2.3% MoM, while the Shanghai Composite Index sank by 7.6% MoM. On the economic data front, China’s official manufacturing purchasing managers index (PMI) fell to 50.1 in January vs December’s 50.3 print. China’s official non-manufacturing PMI, which measures business sentiment in the services and construction sectors, declined to 51.1 in January vs 52.7 in December. The 50-point mark separates expansion from contraction. China’s 4Q21 GDP rose 4% YoY, according to that country’s National Bureau of Statistics and, for 2021, China’s economy grew by 8.1% (its fastest growth in c. a decade) as industrial production advanced steadily through the end of the year and offset a drop off in retail sales, according to official data. Elsewhere, Japan’s benchmark Nikkei closed January 6.2% lower.

Among commodities, the Brent crude oil price soared 17.3% MoM in January, ending the month at US$91.21/bbl, buoyed by concerns around political tensions in Europe and supply shortages. After rising 3.1% in December, the gold price fell 1.8% in January, while platinum and palladium prices gained 5.5% and 23.7% MoM, respectively. The iron ore price also recorded a good showing – jumping by 11.6% MoM on the back of expectations of strong construction activity in China over the coming months as the country works to stimulate the economy to meet growth targets.

Following a 4.6% MoM gain in December, South Africa’s (SA’s) FTSE JSE All Share Index rose by a lacklustre 0.8% in January – still in positive territory compared to many major markets. Financials and commodities counters were the outperformers on the JSE in January with the Fini-15 rising by 3.4% MoM and the Resi-10 gaining 3.9% MoM. The Indi-25 and the SA Listed Property Index were the laggards – down 2.0% and 2.9% MoM, respectively. Highlighting January’s best-performing shares by market capitalisation, the large-cap commodities companies outperformed, with Sasol rocketing 33.2% MoM, Kumba Iron Ore (Kumba) jumping 17.5% MoM, Impala Platinum (Implats) rising by 4.1% MoM, and Anglo American up 4.0% MoM. British American Tobacco leapt 12.7% and MTN Group bounced by 12.5% MoM. Prosus, the biggest share on the JSE, and Naspers disappointed – down 3.4% and 0.4% MoM, respectively. The rand closed the month 3.7% firmer against the US dollar.

In local economic data, December’s annual headline inflation, as measured by the consumer price index (CPI), accelerated to its highest level since March 2017, coming in at 5.9% YoY vs 5.5% in November. Stats SA said this latest release was driven by higher prices in the food and non-alcoholic beverages, housing and utilities, and fuel sub-sectors. Notably, transport prices jumped by a significant 16.8% YoY, fuelled by rising petrol and diesel prices. Notably, for 2021, headline inflation now averages out at 4.5% YoY – still in the middle of the SA Reserve Bank’s (SARB’s) target band of 3%-6%. At its January meeting, the SA Reserve Bank’s (SARB’s) Monetary Policy Committee (MPC) raised rates by a further 25 bpts, with the repo rate now at 4% p.a.

On the pandemic front, as at 31 January, Department of Health data show that 29.89mn vaccines have been administered to date (vs 27.95mn as at 31 December), while the total number of confirmed COVID-19 cases in SA since the start of the pandemic stood at 3.61mn vs 3.17mn on 31 December.

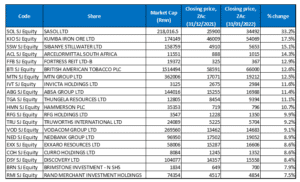

Figure 1: January 2022/YTD 20 best-performing shares, % change

Source: Bloomberg, Anchor

Sasol (+33.2% MoM) was January’s best-performing share by far. A higher oil price, refining margins and a demand recovery in the chemicals market, propelled by the easing of COVID-19 lockdown regulations, contributed to a 31% YoY revenue jump in Sasol’s chemicals business. According to the company, 1H22 revenue for this business came in at US$4.86bn -significantly above 1H21’s US$3.7bn.

Sasol was followed by Kumba in the second spot, with a MoM share price gain of 17.5%. Last week, Kumba said that it expects full-year profit to jump by up to 52% YoY, as it benefits from higher average iron ore prices. In an operational update, Kumba indicated that headline earnings per share (EPS) was expected to surge by R97.43-R107.80 in the year to end-December, despite only a slight increase in sales and production volumes. Total production for the year rose by 9% to 40.9mn tonnes. However, sales were flat at R40.2mn which, according to a Business Day report, reflected the difficulties experienced by Transnet in linking Kumba’s mines in the Northern Cape to the port of Saldanha from where the steelmaking ingredient is exported to China and other countries (the local mining industry relies on Transnet’s rail network to transport minerals to various ports).

Sibanye Stillwater (+15.1% MoM) was January’s third best-performing share. Last month, Sibanye cancelled its US$1bn acquisition of nickel and copper mines in Brazil following what the company termed an adverse “geotechnical event” at the Santa Rita nickel mine, although the sellers disputed the severity of the event and have threatened legal action. Sibanye also announced in January that it had entered into an agreement with Rustenburg Platinum Mines Ltd, a subsidiary of Anglo American Platinum Ltd (Amplats), through its subsidiary, Sibanye Rustenburg Platinum Mines Ltd, which will result in the Rustenburg operation assuming full ownership of the low-cost, mechanised Kroondal operation. This will see the life of the Kroondal operation being extended to 2029 and “ensure significant value creation for stakeholders.”

Sibanye was followed by steel manufacturer, ArcelorMittal SA, Fortress Reit Ltd -B-, and British American Tobacco with MoM gains of 14.3%, 12.9%, and 12.6%, respectively. In its FY21 trading statement, Arcelor said that its EPS was expected to improve from a loss of R1.80/share for the comparative period in 2020 to a profit within a range of R5.80-R6.10/share for FY21.

MTN Group (+12.5% MoM) recorded a share price jump after it reported that its largest operation, MTN Nigeria Communications had recorded a strong set of FY21 results, with a 45.5% YoY jump in profit and margin improvement across the board. The strong numbers were despite a 10.6% YoY drop in the Nigerian company’s mobile subscriber base which was negatively affected by regulatory restrictions on new SIM sales and activations. MTN Nigeria’s Service segment revenue grew by 23.3% YoY, driven by voice, data and fintech services. In other MTN news, the company has been added to a top sustainable investment index as its ratings on environmental, social and governance (ESG) performance have gone up recently.

In early January, investment holding company, Invicta Holdings (+11.6% MoM) announced that it and its subsidiary, Invicta Global Plc (IVTG) had entered into an agreement with International Holdings and Investments SA and Chen Chin Linn to purchase all the shares of KMP Holdings Ltd (KMP supplies aftermarket heavy-duty diesel engine parts for industrial and agricultural machinery). In terms of the agreement, IVTG has acquired 100% of the issued share capital of, and shareholders loans payable by, KMP from the sellers. The purchase price for the acquisition is GBP12.5mn (c. R269.4mn).

ABSA Group and Thungela Resources rounded out the top-10 performers for January, recording MoM gains of 11.4% and 11.1%, respectively. Thungela has been buoyed by global coal prices soaring in January due to an escalation of tensions between Russia and western countries around Ukraine and the fear that it will see Russia cutting gas supplies to Europe. This has resulted in European utilities increasing their coal imports, further exacerbating the impact of the Indonesia coal ban (Indonesia is the world’s biggest thermal coal exporter) that started on 1 January (although it has since been eased).

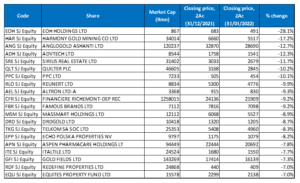

Figure 2: January 2022/YTD 20 worst-performing shares, % change

Source: Bloomberg, Anchor

EOH Holdings, down 28.1% MoM, was January’s worst-performing share. Shares in EOH, which has been working to regain its reputation, fell after the company said that its board was considering at a possible rights issue to raise extra cash to whittle down its debt and improve liquidity. In a pre-closing trading update to shareholders, EOH said that it will also consider selling more assets to deal with its debt issues and the introduction of mezzanine debt. It said that a R1.5bn bridge debt facility maturing in October 2022 would be partially repaid using proceeds from asset disposals, and the board was considering options to settle the remaining R750mn, as well as raise liquidity to pursue growth opportunities.

Harmony Gold (-17.2% MoM) was January’s second-worst performing share. The company released its production update as at the end of December 2021 and cut its forecast for annual gold production by 4%. It made a similar increase to its cost guidance due to operational challenges at its Papua New Guinea mine (Hidden Valley). Harmony said that 1H22 gold production from SA operations remained steady at 718,726oz vs the 708,310oz produced during the previous six-month period ended 30 June 2021. However, its gold production at Hidden Valley declined 26.0% YoY to 60,153oz because of geotechnical issues which prevented the effective mining of stage-6 of the open pit, resulting in more lower-grade stockpiles being processed.

Another gold miner was January’s third worst-performing share – AngloGold Ashanti with a 12.7% MoM decline. In a trading update, the company said that it expects FY21 headline EPS of between USc137 and USc153 – a decrease of 36%-42% YoY. AngloGold described FY21 as a “challenging” year, adding that lower grades, a decline in production and retrenchment costs of US$18mn would result in basic earnings being as much as 38% weaker YoY.

AngloGold was followed by ADvTECH with a 12.3% MoM decline, Sirius Real Estate with an 11.7% MoM share price drop and Quilter Plc, born out of Old Mutual’s restructuring and corporate break-up, which was down 10.2% MoM. Quilter released a 4Q21 trading update in January which showed that its assets under management and administration (AuMA) had increased by 13% YoY, while average AuMA for the year was 17% higher YoY. There were net inflows of GBP4bn, representing 4% growth on opening AuMA (a significant increase on the GBP1.5bn in the prior year). Nevertheless, the market was disappointed, likely expecting higher growth, resulting in the share price coming under pressure.

Business Day reported that analysts believed the drop in the PPC (-10.1% MoM) share price was “precipitated by significant stock sales by some of the company’s senior executives …”. The recent share price wobble was blamed on stock exchange filings showing that senior executives had sold a combined R240.5mn in PPC shares between 19 and 21 January. The cement manufacturer, which was significantly restructured in the past two years to reduce its debt and recover into a financially healthier position, also recently announced that the Public Investment Corporation had doubled its shareholding in the Group (from 5.37% to 10.25%).

Reunert (9.9% MoM), Altron Ltd -A- (-9.3% MoM), and Richemont (-9.2% MoM) rounded out January’s ten worst-performing counters. In mid-January, Altron said that its Group CEO, Mteto Nyati, will step down from his role at the end of June 2022. Nyati led Altron’s transition from a family-controlled business to an independent corporate entity and contributed significantly to achieving several strategic initiatives at Altron. This included being instrumental in finalising several bolt-on acquisitions during his tenure as well as establishing and growing Altron’s core ICT portfolio and transforming the business from a diversified technology Group into a trusted information technology services company.

Finally, Richemont ended the month in the red, negatively impacted in January along with other highly rated growth stocks. The company released an incredibly strong 3Q22 trading update (for the quarter ended 31 December 2021) on 19 January. Sales jumped by 35% YoY – a solid beat vs Bloomberg consensus analysts’ expectations of 18% YoY revenue growth. Growth was strong across the board, but the standout performance continued to come from its Jewellery Maisons business, especially in China and the US. Importantly, for profitability, the fastest growth is happening in its direct retail channel (i.e., its own stores), with sales in Richemont’s own stores now accounting for 60% of overall sales (vs 53% pre-COVID).