Global Markets see a turbulent March and the JSE ends the month lower

Most global markets ended March (and 1Q23) on a positive note (MSCI World +3.2% MoM/+7.9% 1Q23/YTD), showing resilience despite a banking mini-crisis, a cryptocurrency meltdown and persistent concerns that higher interest rates will trigger a global recession. In mid-March, the collapse of a group of mid- and small-cap US banks triggered the first banking crisis since the global financial crisis (GFC) of 2008, sending markets teetering. The loss of confidence in the financial position of two US mid-sized regional banks – Silicon Valley Bank (SVB; the second-biggest bank failure in US history) and Signature Bank – led to customers swiftly withdrawing deposits (i.e., a bank run), resulting in their rapid demise. These events followed the closure, for similar reasons, of a smaller US bank, Silvergate, earlier in the month. Across the Atlantic, Credit Suisse also experienced a renewed loss of confidence due to a series of lapses in risk controls. Nevertheless, towards month-end, most global markets seemed to have largely shrugged off the mini-banking crisis as equities recouped their losses and more, with an especially impressive performance by US tech stock buoying the broader US market.

The US Federal Reserve (Fed) raised interest rates by 0.25% on 23 March, largely in line with expectations. Fed Chair Jerome Powell emphasised that the process of getting US inflation back down to 2% has a long way to go and is likely to be bumpy. He outlined that the Fed is uncertain as to how the recent turmoil in regional banks will play out in the US economy, adding that the US banking system remains sound and that the Fed has provided additional liquidity for the banking system.

On the economic data front, the latest US inflation data were broadly in line with expectations, as annual headline CPI decreased from 6.4% YoY in January to 6.0% YoY in February. Annual core CPI, which excludes the erratic food and energy components, also printed lower – decreasing from January’s 5.6% YoY to 5.5% YoY in February. At the headline level, January retail sales recorded a solid start to the year, rising by c. 3.0% MoM. Still, retail sales came down significantly for February, printing at c. -0.4% MoM (in line with expectations). Personal consumption expenditure (PCE), the Fed’s preferred inflation gauge, rose 0.3% MoM in February – lower than January’s 0.5% increase and beating consensus expectations of a 0.4% rise, indicating that US inflation is slowing.

US equity markets rallied despite the headwinds, with all three major indices ending another volatile month higher. The tech-heavy Nasdaq outperformed and closed March 6.7% up (+16.8% 1Q23/YTD – its best quarterly gain since 4Q20). The blue-chip S&P 500 jumped 3.5% MoM (+7.0% 1Q23/YTD), while the Dow rose 1.9% MoM (+0.4% 1Q23/YTD).

In Europe, Germany’s DAX also ended the month in the green – +1.7% MoM (+12.2% 1Q23/YTD). France’s CAC Index closed March 0.7% higher (+13.1% 1Q23/YTD). February euro area inflation printed at 8.5% YoY vs January’s 8.6%. Germany’s inflation rate remained high in February, at 8.7% YoY (non-harmonised) – unchanged from January. Food and energy prices were significant contributors to the high German inflation print, increasing by 21.8% and 19.1% YoY, respectively. MoM, CPI advanced 0.8%. France’s annual inflation rate slowed in March to 6.6% vs February’s revised 7.3% YoY print. MoM, CPI rose 0.9%. The European Central Bank (ECB) hiked interest rates by 0.5% in March (in line with market expectations), bringing the ECB’s main deposit rate to 3%. However, we note that the ECB is still c. 2% behind the Fed funds target rate of 5.0%, with the ECB’s current cycle starting from a base of negative rates and lagging the start of the US rate-hiking cycle by a few months.

In the UK, the blue-chip FTSE-100 Index declined after two consecutive monthly gains, ending March 3.1% in the red (+2.4% 1Q23/YTD). After easing for three consecutive months, UK inflation surprisingly rose 10.4% YoY in February (vs January’s 10.1% print) as food and energy costs continued to rise, placing further pressure on households. MoM, CPI advanced 1.1% – also higher than the consensus forecast of a 0.6% MoM rise. The higher-than-expected inflation print saw the Bank of England lift interest rates to 4.25% from 4%.

Chinese markets were mixed, with Hong Kong’s Hang Seng Index jumping 3.1% both MoM and for 1Q23/YTD, while the Shanghai Composite Index lost 0.2% MoM (+5.9% 1Q23/YTD). On the economic data front, China’s March factory activity beat expectations despite being down MoM. The official manufacturing purchasing managers index (PMI) came in at 51.9 in March from 52.6 in February (the highest reading since April 2012). The official non-manufacturing PMI, which measures business sentiment in the services and construction sectors, soared to 58.2 vs February’s 56.3 print. The 50-point mark separates expansion from contraction.

Japan’s benchmark Nikkei rose 2.2% in March (+7.5% 1Q23/YTD). On the inflation front, annual CPI fell to 3.3% YoY in February vs January’s 41-year high of 4.3%, marking the lowest level since September 2022 as transport costs rose the least in c. five months. In addition, the prices of fuel, light, and water charges also declined for the first time since May. As a result, core inflation slowed sharply to 3.1% YoY vs January’s 4.2%, but it remained above the Bank of Japan’s 2% target for an eleventh straight month.

March was a mixed bag for commodity prices, and although oil prices started recovering from their recent lows towards month-end, Brent crude was down 4.9% MoM and ended the quarter down (-7.1% 1Q23/YTD) as March’s banking crisis fuelled fears of prolonged stress in the financial sector and a potential recession. Iron ore rose 4.2% in March (+9.0% 1Q23/YTD), while the gold price staged an impressive recovery – up 7.8% MoM and 8.0% for 1Q23/YTD. Platinum and palladium prices soared – up 4.3% and 3.2% MoM, respectively (down 7.4% and 18.3% for 1Q23/YTD). On the other hand, natural gas prices dropped 19.3% MoM (-50.5% 1Q23/YTD), and thermal coal prices fell 9.5% MoM (-29.6% 1Q23/YTD).

South Africa’s (SA’s) FTSE JSE All Share Index recorded a 2.1% MoM decline but ended 1Q23 4.2% higher, while the FTSE JSE Capped SWIX was down 1.9% MoM (+2.5% 1Q23/YTD). Financial stocks were the biggest drag on performance in March. The Fini-15 dropped by 6.4% MoM (-0.2% 1Q23/YTD) as JSE-listed banking counters felt the contagion amid volatility associated with the banking mini-crisis in the US and the issues with Credit Suisse. The SA Listed Property Index retreated by a further 3.7% in March (-5.3% 1Q23/YTD), while the Indi-25 was down 1.0% MoM but is up 14.0% in 1Q23/YTD. The Resi-10 advanced 0.7% MoM but is down 6.5% for 1Q23/YTD. Looking at the performances of the biggest shares on the JSE by market cap, BHP Group, the largest company on the exchange, gained 4.1% on a total return basis. Anheuser Busch InBev, the third largest listed company, rose 6.1% MoM, followed by Prosus (+3.9% MoM), Richemont (+1.8% MoM), and Naspers (+1.1% MoM). The rand strengthened by 3.2% MoM against the US dollar, with most of this strength coming after the SA Reserve Bank (SARB) raised rates last week. For 1Q23/YTD, the local unit is down 4.3%.

In SA economic data, February headline inflation, as measured by the consumer price index (CPI), rose slightly (its first increase in four months), coming in at 7.0% vs January’s 6.9% print. MoM, CPI rose by 0.7% in February – the biggest monthly increase since July 2022. Food inflation soared 13.6% YoY – the highest level since April 2009. Local retail trade sales shrank for a second consecutive month in January (-0.8% YoY) following December’s downwardly revised 0.5% YoY decline. MoM retail trade rose 1.5% in January, the biggest increase in twelve months, compared to a downwardly revised 0.5% decline in December. SA gross domestic product (GDP) shrank by 1.3% in 4Q22 after rallying to an upwardly revised 1.8% rise in 3Q22. This was the sharpest contraction since 3Q21, following the big surge in loadshedding towards the end of last year. In an unexpectedly hawkish move, and in sharp contrast to market expectations of a 25-bpt hike, the SARB raised the interest rate by 50 bps on 30 March, taking the repo rate to 7.75%.

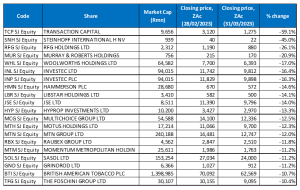

Figure 1: March 2023 20 best-performing shares, MoM % change

Source: Bloomberg, Anchor

Gold counters featured prominently among March’s best-performing shares, buoyed by a higher gold price (+7.8% MoM), which was boosted by a weaker greenback on the back of shifting expectations on interest rates in the US. In addition, positive announcements and earnings from JSE-listed gold counters also positively impacted these counters’ share prices. Gold Fields was March’s best-performing share, recording an impressive 42.1% MoM gain. It was followed closely by AngloGold Ashanti, which saw its share price jump 39.1% MoM. The two gold producers’ share prices were buoyed by the announcement of a joint venture (JV) in Ghana and the stronger gold price. The JV will bring together Gold Fields’s Tarkwa Mine and AngloGold’s Iduapriem Mine, located near Tarkwa in western Ghana. The JV will create Africa’s largest gold mine (and one of the biggest in the world) with an estimated life of 18 years. However, the companies did say that they were not considering a full-scale merger. The Tarkwa mine is 90% held by Gold Fields, with the government of Ghana (GoG) holding a 10% stake, while the Iduapriem Mine is 100%-owned by AngloGold. If the JV goes ahead, Gold Fields and AngloGold will own 60% and 30% of the joint operation, respectively, and the GoG will hold 10%.

Another gold miner, Harmony, was March’s third best-performing share with a 31.1% MoM gain. Harmony reported 1H23 results in early March, with its revenue increasing 6% YoY to R23.3bn, while headline earnings per share (EPS) rose 18% YoY to ZAc293. No interim dividend was declared as Harmony opted to allocate capital towards copper projects instead. The company said that its results were driven by a combination of higher gold prices and strong operational performances across its mines. Harmony is focused on transforming into a global gold and copper producer as the global just energy transition takes momentum, and it recently acquired a copper mine in Australia for c. R3bn.

Harmony was followed by real estate investment trust (REIT), Accelerate Property Fund Limited, Aspen Pharmacare and Sun International with MoM gains of 30.1%, 29.1% and 27.3%, respectively. Aspen reported half-year results in March, which saw the company’s revenue decreasing by 1% YoY to R19.5bn, while normalised earnings before interest, taxes, depreciation, and amortisation (EBITDA) fell 11% to R5.1bn. Normalised headline EPS also fell by 17% YoY to ZAc679.6. However, Aspen’s share price jumped after the company lifted its outlook for the second half of the year, saying that it expected its 2H23 financial report to exceed its 1H23 and 2H22 results. In addition, Aspen indicated that it expected a strong 2H performance from its commercial pharmaceuticals and manufacturing divisions. Sun International also reported FY22 results in Mach, which showed that its income advanced YoY to R11.30bn. At the same time, its adjusted headline earnings improved from R110mn to earnings of R1.1bn, with adjusted headline EPS growing from ZAc44 in FY21 to ZAc439. The hotel and leisure Group also resumed dividend payments, declaring a record dividend of ZAc329/share for the year – a dividend payout of 75% of adjusted HEPS.

DRD Gold and mid-tier gold producer Pan African Resources recorded MoM share price gains of 27.0% and 21.1%, respectively. Pan African Resources said in March that it had secured a R400mn loan from Rand Merchant Bank, which forms part of the R2.5bn funding package for the construction of the Mintails project. Under the terms of the deal, Pan African will receive R400mn upfront and sell back 4,846oz of gold per month at the fixed price of R1.125m/kg for 24 months starting in March and representing c. 30% of the Group’s annual production.

Rounding out March’s top-10 performers were investment company Brimstone Investments (+13.8% MoM) and Datatec (+11.1% MoM). In its FY22 results, Brimstone reported a revenue increase of 22.9% YoY to R6.21bn, while its diluted EPS stood at ZAc75.7, compared with ZAc291.7 recorded in FY21. The company’s CEO Mustaq Brey said that in a challenging year (loadshedding, higher fuel costs, interest rate increases, a steep rise in international freight costs etc.), Brimstone counted itself as fortunate to report a profit and pay a dividend – ZAc33/share vs ZAc30/share in FY21. Finally, in a trading update for the year ended 28 February 2023, information and communications technology company, Datatec, said that Group revenue for the current year is expected to increase by c. 13% YoY to US$5.16bn (c. R94bn) from US$4.55bn. Datatec will release its FY23 results in May.

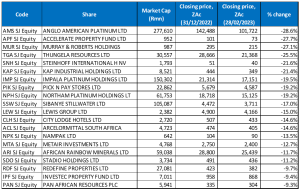

Figure 2: March 2023 20 worst-performing shares, MoM % change

Source: Bloomberg, Anchor

Transaction Capital was March’s worst-performing share, plummeting 59.1% MoM. On 14 March, the company’s exposure to SA’s embattled taxi industry, which has been hard hit by high interest rates, loadshedding and fuel prices, saw its share price plunge c. 40%. The company painted a troubling picture of its SA Taxi division in a trading update in which it flagged problems with its taxi finance business and used vehicle operation, saying that it expected half-year earnings to drop by over 20% YoY as a result of pressure on margins at WeBuyCars (in which it has a 75% stake). The Group added that SA Taxi was unlikely to recover to pre-COVID-19 levels in the short to medium term, leading to a restructuring of the unit. By the end of the week of 13 March, the share had lost 59.1% of its value (R10bn of its market cap). However, the decline appeared to have halted as the counter regained some lost ground, rising 31% on 17 March to close at R11.50. The share price was also pummeled by reports that CEO David Hurwitz had sold shares worth millions in December and would have known about the state of the company. This was a claim the company defended, saying Hurwitz had advised its chair and company secretary that the family trust that owned his shares was in breach of certain covenants relating to the debt it held with banks against its Transaction Capital shares and that it had asked permission to sell 1.6mn shares to reduce debt. Management has restructured the business and established a new platform, Mobalyz, which will house, among other things, its credit, insurance, data sets and technologies to support SA Taxi.

Steinhoff was March’s second worst-performing share – declining by 45.0%. The share dropped by as much as 25% on 29 March following the news that the company will ask its creditors to approve a restructuring plan that leaves shareholders with nothing. Steinhoff’s debt, including EUR10.2bn due at the end of June, exceeds the value of its assets, essentially meaning that it is bankrupt. On 28 March, Steinhoff said it had drawn up a new restructuring plan to avoid creditors taking over in June. The plan is similar to the one announced in December 2022, except shareholders will walk away with nothing. The December plan gave creditors 80% of the company in exchange for extending Steinhoff’s debt repayment date to June 2026. Shareholders would have received 20% of an unlisted company with no guarantee that the holding would have any value, but at the AGM, 60%-plus of shareholders voted against the plan. Now, the Steinhoff board has voted to enter a restructuring process under Dutch law. If successful, it will see debt repayment dates extended for three years, with two optional year-long extensions. If lenders and the Dutch court agree to the new plan, Steinhoff shareholders will have no financial interest in the company, losing their entire investment.

Rhodes Foods Group (RFG Holdings) was last month’s third-worst-performing share. In a voluntary trading update for the 21 weeks ended 26 February 2023, RFG revealed that its revenue increased by 7.4% YoY, with revenue in its regional and international segments rising by 8.7% and 0.7% YoY. However, the share price fell after RFG warned that its margins had come under pressure due to the high increases in input costs, including tin plate used in cans, global commodities, and raw materials such as meat and fats. In addition, RFG said that loadshedding and related water supply interruptions continue to impact some of its facilities in Gauteng, resulting in lower output, higher manufacturing costs and “ultimately lost sales”.

RFG was followed by Murray & Roberts, Woolworths, Investec Ltd and Investec Plc with MoM losses of 20.9%, 17.0%, 16.4% and 16.3%, respectively. In its 1H23 results, Murray & Roberts posted a 40.7% YoY revenue increase to R5.90bn, while it also reported a diluted loss per share of ZAc627, compared with EPS of ZAc14 recorded in 1H22. Last month, Murray & Roberts also revealed that it could soon regain control of parts of its Australian businesses after entering an agreement on how to repay its debt and continue operating. Meanwhile, Woolworths’ share price was down MoM despite the company posting a 15% YoY rise in 1H23 turnover, a c. 75% jump in diluted EPS (ZAc289.3 vs ZAc165.5 recorded in 1H22) and a near doubling of its interim dividend. The company’s comment in the results that SA’s energy crisis has “reduced its domestic adjusted operating profit by an estimated R15mn per month” likely weighed on its share price performance. Banking and wealth management company Investec was weighed down by contagion fears in the financial sector following the banking mini-crises in the US and the issues at Credit Suisse.

Hammerson Plc (-14.6% MoM), Libstar Holdings (-14.1% MoM), and JSE Ltd (-14.0% MoM) rounded out March’s ten worst-performing shares. Libstar, the owner of the Denny, Lancewood and Goldcrest brands, reported disappointing FY22 results last month. Although price hikes helped it deliver 10.7% YoY revenue growth to R11.7bn, its normalised headline EPS from continuing operations fell 11.8% YoY to ZAc65.3 from ZAc74 in FY21. Its gross profit margin also dropped to 20.7% from 22.2%, prompting the Group to cut its dividend by ZAc3 to ZAc22. The company also posted a 46% decline in its annual operating profit. During the period, the Group had to contend with higher costs, increased loadshedding, elevated inflation and a fire at one of its mushroom farms.

Figure 3: Top-20 best-performing shares, 1Q23/YTD

Source: Anchor, Bloomberg

Nine out of February’s top-20 YTD best-performing shares remained among the top-20 best performers for the year to the end of March (1Q23). DRD Gold, Gold Fields, Aspen, AngloGold Ashanti, Brimstone, African Rainbow Capital Investments (ARC Investments), Harmony Gold, Sun International, Datatec, Bidvest and Prosus are the new entrants.

A bumper March performance from DRD Gold (+39.3% YTD/1Q23) saw it emerge as the 1Q23/YTD best-performing share, pushing PPC out of the top spot it had occupied in January and February. DRD Gold was followed by another gold producer Gold Fields (+34.5% in 1Q23/YTD, discussed earlier), and Aspen (+34.4% in 1Q23/YTD, discussed earlier) in third place.

Aspen was followed by PPC Ltd (+33.9% in 1Q23/YTD), AngloGold Ashanti (+31.0% 1Q23/YTD), and Hosken Consolidated Investments (HCI; +28.4% in 1Q23/YTD). Cement company PPC’s share price declined by 7.9% in March after its FY23 operational update revealed that it expected cement sales volumes in SA and Botswana to fall by 4.0% to 7.0% YoY. Moreover, PPC said that the price increases in 2H23 have not kept pace with cost inflation, and it expects the margins for its SA and Botswana Cement business to decline by 9.0% and 11.0%, respectively, for the full year, from 14.5% reported for FY22.

Brimstone Investments, Swiss luxury goods manufacturer Richemont, and ARC Investments recorded 1Q23/YTD gains of 27.2%, 27.0% and 25.0%, respectively. Last month, Richemont announced plans to simplify its corporate structure as it relates to the SA listing of its A-shares by opening a secondary share listing in SA, replacing its depository receipt programme in a bid to reduce complexity and streamline trading. If approved by shareholders and the relevant regulatory authorities, the change will be effective on 19 April 2023. The ‘A’ shares will then trade via a secondary listing on the JSE, and Richemont will end its existing SA depository-receipt programme with one ‘A’ share exchanged for every ten depository receipts held.

Elsewhere, ARC released results for the six months ended 31 December 2022. The company said its diverse investment portfolio had shown remarkable resilience in what were challenging macroeconomic conditions for all the firms in which it is invested. ARC’s intrinsic investment value in the African Rainbow Capital Fund (ARC Fund) rose by 0.2% from R13.24bn as at 30 June 2022 to R13.27bn at 31 December 2022, indicating stability. ARC aims to further narrow the discount between its listed valuation and its intrinsic net asset value (INAV). Its share price on 31 March of R7.76 is c. 27% below its INAV/share, which was estimated at R9.88 at the end of December 2022 (a substantial improvement on the 45% discount to INAV the Group was trading at in early September 2022). In an interview with Business Day, ARC’s co-CEO said the plan is to narrow that discount further to 10%-20%. “… over the next year or so …”.

Harmony (+24.5% in 1Q23/YTD, discussed earlier) rounded out the top-ten YTD performers.

Figure 4: Bottom-20 worst-performing shares, 1Q23/YTD

Source: Anchor, Bloomberg

Among the 1Q23/YTD worst-performing shares, 13 of the 20 shares for the year to end-March were also among the 20 worst-performers for the year to the end of February. Transaction Capital (down 61.5% in 1Q23/YTD, discussed earlier), RFG Holdings (-29.6% in 1Q23/YTD), EOH Holdings (-25.8% in 1Q23/YTD), Liberty Two Degrees (-17.9% in 1Q23/YTD), SA Corporate Real Estate (-14.6% in 1Q23/YTD), Blue Label Telecoms (-14.3% in 1Q23/YTD), and Exxaro Resources (-14.2% in 1Q23/YTD), were the new entrants.

With its huge share price drop in March, Transaction Capital (-59.1% MoM) also emerged as the worst-performing share in 1Q23/YTD, bumping Anglo American Platinum (-33.0% in 1Q23/YTD) from the top spot and into fourth position. Transaction Capital was followed by Steinhoff (also the second worst performing share for March), with Murray & Roberts (-42.4% in 1Q23/YTD) in the third spot.

RFG Holdings (discussed earlier), Thungela Resources, Kap Industrial, and EOH Holdings recorded 1Q23/YTD declines in their share prices of 29.6%, 29.5%, 28.4%, and 25.8%, respectively. Coal exporter Thungela’s share price declined by 5.4% in March, despite the Group declaring a FY22 final cash dividend of R40/share – more than double the R18 it declared in FY21 and bringing its total FY22 dividend to R100/share. The company also recorded a 143% YoY rise in headline EPS to R130.82 and a profit of R18.2bn vs R6.9bn the prior year, as European demand for coal soared following Russia’s invasion of Ukraine. However, Thungela noted that because of Transnet Freight Rail’s deteriorating performance since 2021 and its poor performance in 2022, it had to review its FY23 production outlook.

Meanwhile, EOH (+10.8% MoM) said in a trading statement for the six months ended 31 January 2023 that revenue from continuing operations is expected to be between 5% to 10% higher YoY, with solid growth expected in its iOCO Digital and International operations. EOH also expects operating profit to be between R100mn and R120mn vs an operating profit from continuing operations of R100mn in the prior year.

Pick n Pay (-25.6%), and Impala Platinum (Implats; -23.1%) rounded out the worst performers for 1Q23/YTD. In March, Implats (-4.5% MoM) extended its already drawn-out takeover offer for Royal Bafokeng Platinum by another month (to 28 April 2023) while it awaits a takeover compliance certificate from the mergers & acquisition watchdog.

At Anchor, our clients come first. Our dedicated Anchor team of investment professionals are experts in devising investment strategies and generating financial wealth for our clients by offering a broad range of local and global investment solutions and structures to build your financial portfolio. These investment solutions also include asset management, access to hedge funds, personal share portfolios, unit trusts, and pension fund products. In addition, our skillset provides our clients with access to various local and global investment solutions. Please provide your contact details here, and one of our trusted financial advisors will contact you.