Climate change and Investing

In this article, we explore the significance of energy and the impact of climate change on investors. We will begin by discussing the current state of climate change and why it is a pressing issue. Next, we will examine the steps being taken to address this problem. Finally, we analyse why energy and climate change will likely be critical areas for investors to pay attention to in the future.

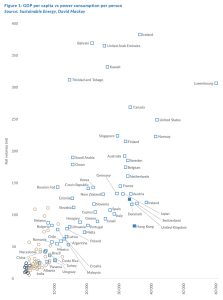

The world currently emits 51bn tons of greenhouse gases per year. That figure is measured in carbon dioxide equivalents (CO2e). There are several greenhouse gases, such as carbon dioxide, methane and nitrous oxide, but the most common is carbon dioxide. Part of the challenge is that their energy use naturally grows as economies grow. As a result, there is a strong relationship between GDP per capita and power consumption per person.

The problem with the world continuing to emit c. 50bn tons of greenhouse gases every year is that these greenhouse gas emissions increase global temperatures. Higher global temperatures can lead to huge weather, health and economic challenges. Increases of 1 or 2 degrees Celsius in average global temperatures may sound small but can significantly impact the world. As a globe, we may experience more intense storms, wildfires, heatwaves, erratic crops and higher sea levels. There is still a lot that scientists do not know, but the majority (97%) believe that human behaviour is indeed impacting the climate. That is important because scientific consensus is a driver in global policy. It has contributed, for example, to the Paris Agreement. The Paris Agreement, which includes over 190 countries as signatories, aims to keep the rise in the world’s average temperature below 2 degrees Celsius compared to pre-industrial levels.

The aim is to get annual emissions to net zero (i.e., we remove as many greenhouse gases as we put in the atmosphere). This is a mammoth task for the world. To put the size of the challenge ahead of us into context, consider the COVID-19 pandemic. In 2020, the world emitted 48bn-49bn tons of CO2e, yet, global emissions fell by only c. 5% in 2020. That is astonishing when you consider the change in behaviour required for us to get there – large parts of the world were “locked down” at home, air travel was suspended, and much economic activity was stopped as we dealt with the pandemic. Clearly, getting to net zero will require a fundamental re-working of our economy rather than a mere reduction of activity in certain areas.

Climate change is likely to create significant opportunities for investors going forward. One reason is that the transition to a greener economy may have to occur much quicker than previous energy transitions. Historically, energy transitions have taken place over decades. It took coal 60 years to go from 0% to 45% of the world’s energy supply. It took oil 60 years to go from 0% to just under 40% of the world’s energy supply. Natural gas has only become 20% of the global energy supply over the past 60 years. This transition may need to happen over a much shorter period because of the urgency to reduce emissions, and the economic implications of such a transition could be unprecedented.

Climate change will also likely create significant opportunities for investors because it affects many parts of the global economy (see Figure 3 below).

From the clothes we wear to the fertilisers used for the foods we eat to the plastic in so many of the household items we use, fossil fuels are a fundamental part of modern life. It is natural to think of climate change as just a problem of burning fossil fuels to generate electricity, but it is much more pervasive. As the table above shows, manufacturing (especially cement, steel and plastic) is an even larger contributor to climate change than electricity generation. This is a challenge not only for the energy sector (for example, thermal coal or oil companies) but for the whole economy – iron ore and steel producers, clothing manufacturers, the automotive industry, agricultural companies, etc.

The third reason why climate change is likely to create significant opportunities for investors is that climate change policies can create supply shortages for fossil fuels. Globally, governments and corporations generally want to use less fossil fuels over time. There is public pressure on banks to provide less funding to fossil fuel companies. As a result, less capital is generally spent on maintaining these fuels’ output levels. The irony, therefore, is that sharp increases in energy demand can lead to dramatic price increases. We have seen this since the global economy began to recover from the COVID-19 pandemic. The dramatic recovery in global GDP and the subsequent Russian invasion of Ukraine created severe supply tightness for oil, natural gas and thermal coal. As international policy becomes more stringent on fossil fuels and capital markets become increasingly less willing to fund these companies, investors may be presented with severe demand-supply mismatches at certain times.

In conclusion, climate change is an important issue for investors. The current annual emissions rate of 51bn tons of CO2e can have major weather, health and economic impacts. To prevent this, the global policy aims to minimise the increase in the world’s average temperature vs pre-industrial times. As a result of that minimisation, climate change will likely present opportunities for investors for three reasons, these include:

- The transition to a low-carbon economy may have to occur much faster than previous energy transitions.

- The transition is likely to be pervasive across all facets of the economy.

- Finally, the transition may, at times, create severe supply shortages for fossil fuels.

At Anchor, our clients come first. Our dedicated Anchor team of investment professionals are experts in devising investment strategies and generating financial wealth for our clients by offering a broad range of local and global investment solutions and structures to build your financial portfolio. These investment solutions also include asset management, access to hedge funds, personal share portfolios, unit trusts, and pension fund products. In addition, our skillset provides our clients with access to various local and global investment solutions. Please provide your contact details here, and one of our trusted financial advisors will contact you.