Background

In this article, we look at the events surrounding the recent demise of three banks in the US and the crisis of confidence in the Swiss bank Credit Suisse.

In the past week, a loss of confidence in the financial position of two midsized regional banks – Silicon Valley Bank (SVB) and Signature Bank – led to customers rapidly withdrawing deposits (i.e., a bank run), resulting in their rapid demise. These events followed the closure, for similar reasons, of a smaller bank, Silvergate, earlier last week. Across the Atlantic, Credit Suisse has experienced a renewed loss of confidence due to a series of lapses in risk controls. The Swiss National Bank (SNB) has undertaken to provide copious liquidity to Credit Suisse to prevent a similar fate for the once venerable Swiss bank.

We ask whether this crisis is something to worry about (as was the case during the global financial crisis [GFC] and what impact it will have on those large-diversified US banks we invest in).

What happened in the US?

As highlighted in our article entitled There are more banks than bankers: A perspective on the US banking mini-crisis, dated 13 March, recently a group of midsized US banks triggered the first US banking crisis since the GFC in 2007/2008.

To date, the impact of higher interest rates on bank shares has been mostly positive. This is understandable because banks earn more money when rates increase – bad loans become a problem later. The exception has been a bank like Credit Suisse, the Swiss lender, which has displayed poor risk controls over recent years.

However, over the past week, a more adverse impact of higher interest rates on the US banking industry has become more evident. Higher rates have withdrawn liquidity from the economy, and asset prices have been severely impacted. This has raised doubts about the fortitude of some midsized banks in the US and potentially elsewhere.

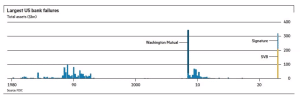

The collapse of SVB impacted US$175bn in deposits and US$209bn in assets – becoming the second-largest bank failure in US history after Washington Mutual in 2008. Signature Bank was to follow – becoming the third-largest bank casualty in US history. Earlier, a smaller bank, Silvergate Capital, which was highly exposed to the crypto sector, announced the closure of its operations and that it would return assets to depositors. After the collapse of SVB and Signature, US authorities, including the Federal Reserve (Fed), moved quickly to prevent further contagion in the banking industry by guaranteeing the deposits of all clients at the institutions under threat.

The ramifications of these events are far-reaching. Until recently, US Fed Chair Jerome Powell had been clear on the Fed’s intentions to continue hiking interest rates until US inflation returned to typical 2% levels. But with SVB having collapsed and bank share prices under some pressure, pundits suggest that there should be either a pause in further rate hikes or a hike of only 25 bps. Moreover, the latest producer price inflation numbers would also point to a lower hike than seemed likely only last week.

Figure 1: Historic US banking crises

Source: FT.com, FDIC

Who are the culprits this time around?

- The crypto and niche banks such as Silvergate, Signature, and SVB.

- Those banks that did not sensibly prepare for rising interest rates. SVB was at fault here.

- The banks with recurring lapses in risk controls. As mentioned earlier, Credit Suisse has been a serial offender on this front.

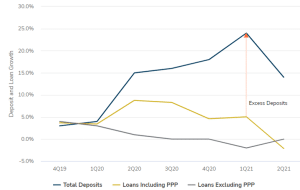

Figure 2: Deposit growth took off during the pandemic, with deposits outpacing loans

Source: Reports of condition and income

What has driven the latest crisis?

In our view, the following has contributed to the current crisis:

- Excess deposits from the COVID-19 period put pressure on banks as a wall of cash (fiscal stimulus etc.) entered the banking system. What would they do with it? As reported in the Financial Times (via data from the FDIC), from April 2020 and peaking two years later, around US$4.2trn of deposits poured into US banks. Banks deployed only c. 10% into loans leaving vast excess deposits, which they partially invested into securities (c. US$2trn), resulting in a 50% increase from pre-COVID levels (banks were already holding c. US$4trn before COVID-19). Banks took on interest rate risk by investing in bonds in part because the return on cash was so low, but this also meant that the overall risk in the banking industry rose shortly before a wave of high inflation was to hit. Note that higher interest rates have been very positive for bank income statements – net interest income (NII) has grown strongly since 2020/2021 – while credit conditions have remained benign. As a result, bottom-line earnings for banks like Bank of America and JP Morgan (JPM) have been very strong. In effect, US banks have been over-earning in recent periods due to higher rates and low credit costs (credit losses are likely to normalise going forward). So banks have been over-earning on the income statement, but risks have been building, for many, on the balance sheet.

- Transitory inflation has become sticky. Like the Fed, many market pundits and corporates believed that the so-called transitory high inflation of 2021 would soon revert to normal levels as the Covid supply-chain disruptions dissipated. SVB, for example, took this line and did not hedge interest rate risks. And so, as transitory inflation became sticky, forcing the Fed to hike interest rates, the bond market took fright, and asset prices adjusted accordingly. For this reason, 2022 was the worst year for financial markets (equities and bonds) since 2008. For banks with large bond securities portfolios, higher yields led to lower bond prices and rising paper losses on their books.

- Regulations (2010 Dodd-Frank Act) were rolled back in 2018. Under the Trump administration, there was much support for rolling back some of the banking regulations passed after the GFC, making life easier for mid-sized banks. Under Dodd-Frank, larger banks had to follow stricter rules than smaller banks (the legislation drew the line at US$50bn in assets), leaving c. 40 of the 5,670 US banks above this limit. The Trump administration effectively increased the threshold to US$250bn in assets, leaving only 12 banks facing mandatory annual stress-tests (the Fed could still decide to impose rules on those banks with assets below US$250bn). Were it not for these changes to regulations, both Signature Bank and SVB would have been subject to stricter measures. The rest is history!

By the end of 2022, following a very poor year in the bond market, banks had racked up losses (mostly unrealised) of some US$600bn on their investment securities (largely bonds). For a bank like SVB, which had invested c. 60% of its earning assets in securities, the consequences were catastrophic. The bank now had unrealised losses of c. US$15bn, similar to the equity recorded on SVB’s balance sheet. SVB needed to raise capital – fast. But with Silvergate now in the cross-hairs of a bank run, customers in Silicon Valley turned their eyes to their very own regional bank, SVB, and decided to panic. The key in any bank run is to panic first. And this they did – rapidly withdrawing deposits (US$42bn on a Thursday), draining all liquidity in the bank. By Friday, the Fed decided to step in. The next culprit was New York-based Signature Bank. Other mid-sized banks like First Republic Bank have also come under extreme pressure. JPM and the Fed have offered support to keep this bank afloat.

In a banking crisis, once you have established the viability of the bank’s balance sheet, the next vital statistic is knowing whether your deposit will be covered by the FDIC deposit insurance of up to US$250,000 per account. Anything above this may be lost in a bank-run. At SVB, this was problem number 2. The vast majority of deposits (>90%) were >US$250,000, which added to the panic and the speed of withdrawals. Signature Bank had a similar problem. However, with the Fed having now guaranteed all deposits at these institutions, this risk has now fallen away, and all clients of the banks concerned will be able to withdraw their funds.

Which banks are the survivors of this mini-crisis?

- Larger banks are subject to stricter regulations (annual stress tests).

- More conservative management teams. JPM has been the most conservative, recording losses of c. US$50bn on its securities portfolio. Bank of America (BAC), with losses of c. US$110bn has fared less well, which is reflected in the relative share price performances of JPM and BAC.

- More diversified banks. If a niche bank, i.e., only in crypto or a tech start-up bank, then clients will be more concerned.

- More clients covered by federal deposit insurance – before the Fed stepped in (it has now insured all deposits).

- Those who did not reach for yield by investing too heavily in longer-duration securities.

- Those with stronger risk controls, i.e., unlike Credit Suisse.

Find out more about the banking mini-crisis here.

Credit Suisse: A self-inflicted crisis created by an extended period of poor execution unrelated to the challenges experienced by US banks

On 15 March, Credit Suisse’s share price plummeted more than 20% after the chairman of the Group’s largest backer, Saudi National Bank, said it would not be interested in providing Credit Suisse with further financial support. However, after markets closed on 15 March, the SNB and the Swiss Financial Market Supervisory Authority (FINMA) also released a joint statement of support for Credit Suisse in which they asserted that the problems of certain banks in the US do not pose a direct risk of contagion for the Swiss financial markets. They added that the strict capital and liquidity requirements applicable to Swiss financial institutions ensure their stability, and Credit Suisse meets the stringent capital and liquidity requirements imposed on systemically important global banks.

In this section, we look at the events surrounding Credit Suisse (we note that at the market open on 16 March, Credit Suisse’s share price rose over 30% after the bank said that it would borrow up to US$54bn from the SNB).

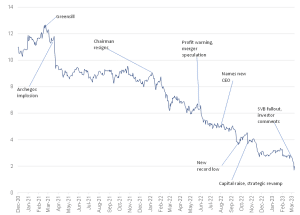

Credit Suisse has been involved in several missteps in the past few years, including the collapse of the supply-chain lender, Greensill Capital and hedge fund, Archegos Capital, Mozambique’s “tuna bonds” loan bribery scandal, and the forced resignation of two CEOs since 2020. Adding to the market’s already-negative sentiment toward the bank, it recently released dismal FY22 results. Credit Suisse reported its fifth consecutive quarterly loss, bringing the full-year losses for 2022 to US$8bn. Credit Suisse further indicated that more losses are expected in 1Q23 as it forecasts ongoing struggles for the wealth management unit and the investment bank.

Below we highlight a timeline of events leading up to the share price drop.

- February 2021: Credit Suisse was forced to suspend US$10bn of investor funds after the collapse of the supply-chain lender Greensill Capital, whose loans were packaged and sold to Credit Suisse clients.

- March 2021: US Hedge Fund Archegos Capital’s collapse costs Credit Suisse US$5bn.

- October 2021: Regulators fined Credit Suisse GBP350mn for the bank’s role in the long-running Mozambique “tuna bonds” loan bribery scandal that pushed the country into a financial crisis in 2016.

- January 2022: Credit Suisse Chairman Antonio Horta-Osorio resigns after admitting to breaking COVID-19 quarantine rules.

- November 2022: The bank raises US$4bn of additional capital with a share sale to Saudi National Bank, which took a 10% equity stake.

- February 2023: Credit Suisse reports its fifth consecutive quarterly loss (and forecasts continued struggles for wealth management and investment bank), bringing its FY22 losses to US$8bn. The bank also announces plans to spin out the US investment bank.

- 9 March 2023: Credit Suisse delays the release of its annual report to address a request by the US Securities and Exchange Commission (SEC) for more info on cash flow revisions in 2019/2020.

- 14 March 2023: The bank releases its annual results, including a statement that reads: “management has identified certain material weaknesses in our internal control over financial reporting”. Management tries to restore confidence, with CEO Ulrich Koerner saying that business is starting to improve, while chairman Axel Lehman says government assistance “isn’t a topic for discussion now”.

- 15 March 2023: Saudi National Bank Chairman, Anmar Al Khudairy, said they would “absolutely not” be open to further cash injections “for many reasons outside of the simplest reason, which is regulatory and statutory”. Credit Suisse approaches SNB and FINMA, and they release a joint statement to try and calm the market, confirming that the bank has adequate liquidity and is ready to provide more if required.

Figure 3: A series of missteps and poor execution has driven the Credit Suisse share price down by c. 85%

Source: Bloomberg

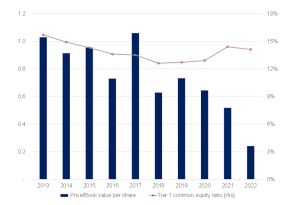

Figure 4: Credit Suisse remains well-capitalised, but investors have driven the share price to only a fraction of the bank’s book value

Source: Bloomberg, Anchor Capital

Profitability is the problem, not liquidity

Despite a significant recent withdrawal of deposits, unlike the US banks, which recently experienced challenges related to the withdrawal of deposits, Credit Suisse remains well-placed to meet any further deposit withdrawals.

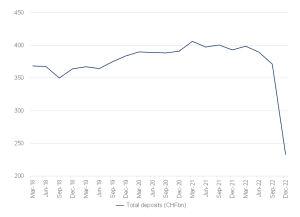

Figure 5: Credit Suisse has seen significant outflows of deposits recently

Source: Bloomberg, Anchor Capital

The latest reported results show that Credit Suisse has CHF118bn in liquid assets (including CHF62bn of cash held with central banks) against CHF233bn of deposits and CHF12bn of interbank loans. Credit Suisse is also less sensitive to interest rate moves relative to some of the distressed US lenders, with its recent stress test suggesting a CHF1.8 bn loss in a parallel shift in the yield curve, i.e., 3.6% of its capital base (regulators start getting concerned if that number is at 15% or higher).

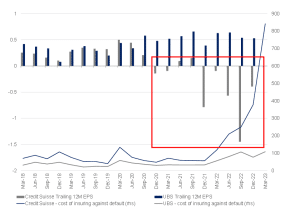

Figure 6: A sequence of poor operating results (in an environment where its Swiss banking rival, UBS, has managed to deliver solid results) has led investors to price in an increasingly high probability of a collapse of Credit Suisse

Source: Anchor Capital, Bloomberg

With the latest crisis pushing Credit Suisse bond yields into the teens, the challenge of returning the bank to profitability has become incrementally harder as it will struggle to turn a profit while borrowing at an interest rate in the teens and attempting to lend those funds to customers at a higher rate. So, the bank has its work cut out, and while the SNB announcement has averted an immediate crisis, there remains a high probability that the bank will need to be broken up and/or acquired.

Conclusion

Our approach at Anchor has been to invest in the larger, well-diversified, and, therefore, the most heavily regulated banks. JPM is one such bank that has been a core investment for our clients. JPM is well-capitalised and is subject to regular stress tests by the US Fed. These tests show how JPM would handle sharp rises in interest rates etc. – the smaller banks do not face the same level of scrutiny. JPM has also been extremely conservative in managing its balance sheet in this rate cycle. Jamie Dimon, the CEO, has stated how wary they are of taking on duration on their balance sheet, and it is no surprise that JPM has avoided the types of capital losses that have slayed a bank like SVB. In our view, many large US banks, like JPM, Citigroup, BAC etc., are in a group apart from the smaller banks mentioned above. They are heavily regulated, well diversified, and well managed. Therefore, we recommend retaining our investments in the sector and, where appropriate, consider taking advantage of these depressed share prices.

We do not believe this banking crisis – arguably a mini-crisis – will spread to the well-run giants. If anything, depositors are likely to shift their funds to the larger banks – a flight to safety.

Confidence will remain frayed until this period passes. However, the US Fed has responded promptly to guarantee customers’ deposits at SVB and others – beyond the typical US$250,000 level.

At Anchor, our clients come first. Our dedicated Anchor team of investment professionals are experts in devising investment strategies and generating financial wealth for our clients by offering a broad range of local and global investment solutions and structures to build your financial portfolio. These investment solutions also include asset management, access to hedge funds, personal share portfolios, unit trusts, and pension fund products. In addition, our skillset provides our clients with access to various local and global investment solutions. Please provide your contact details here, and one of our trusted financial advisors will contact you.